In this Video I have discussed about Mean Reversion Intraday Trading Strategy

More from JayneshKasliwal

Detailed Study of Stocks that became 5X in past 2 Years

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

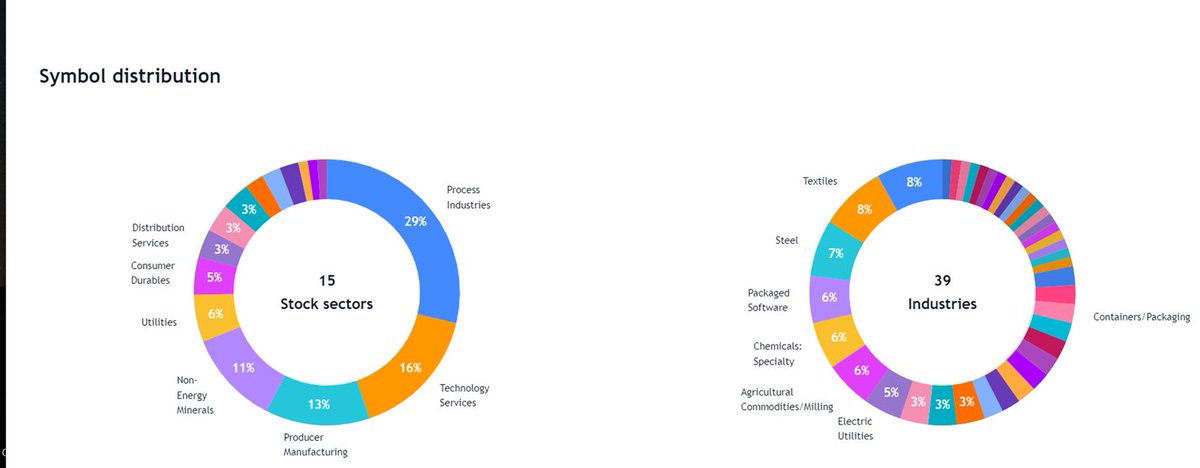

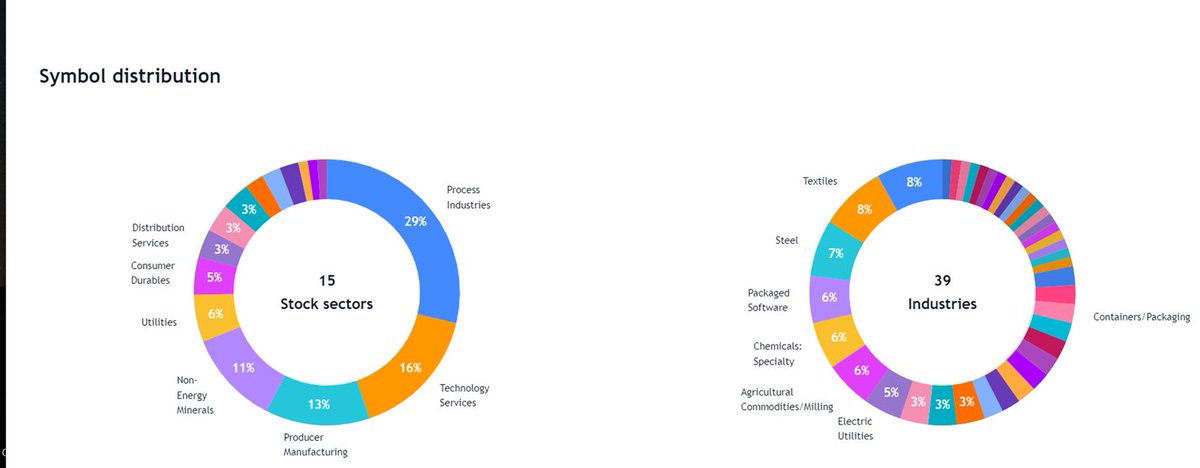

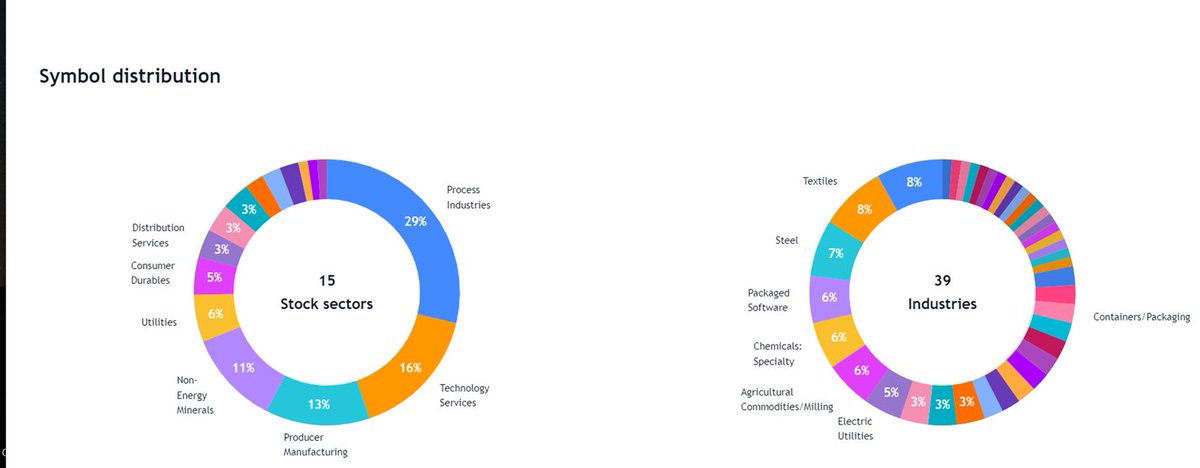

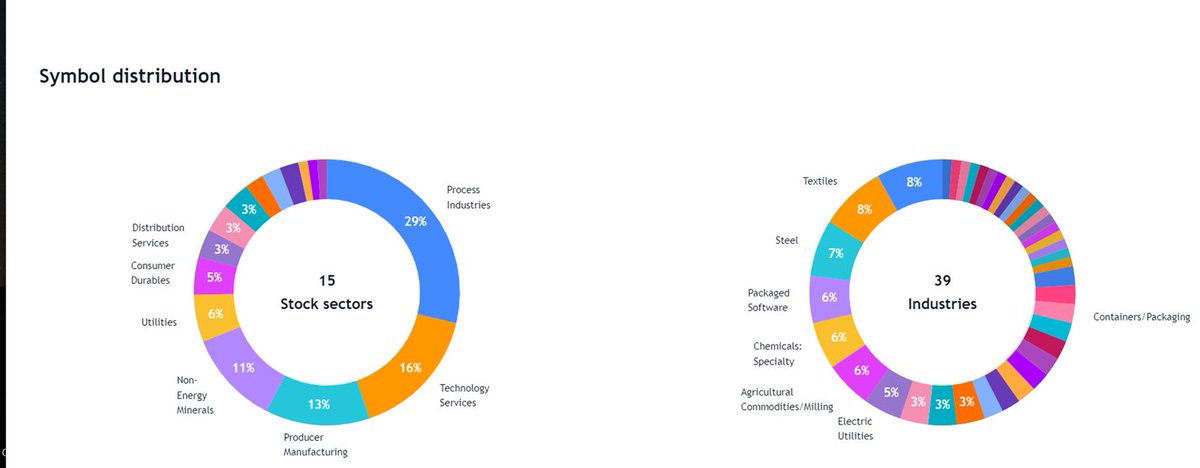

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5

1/n

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5

1/n

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

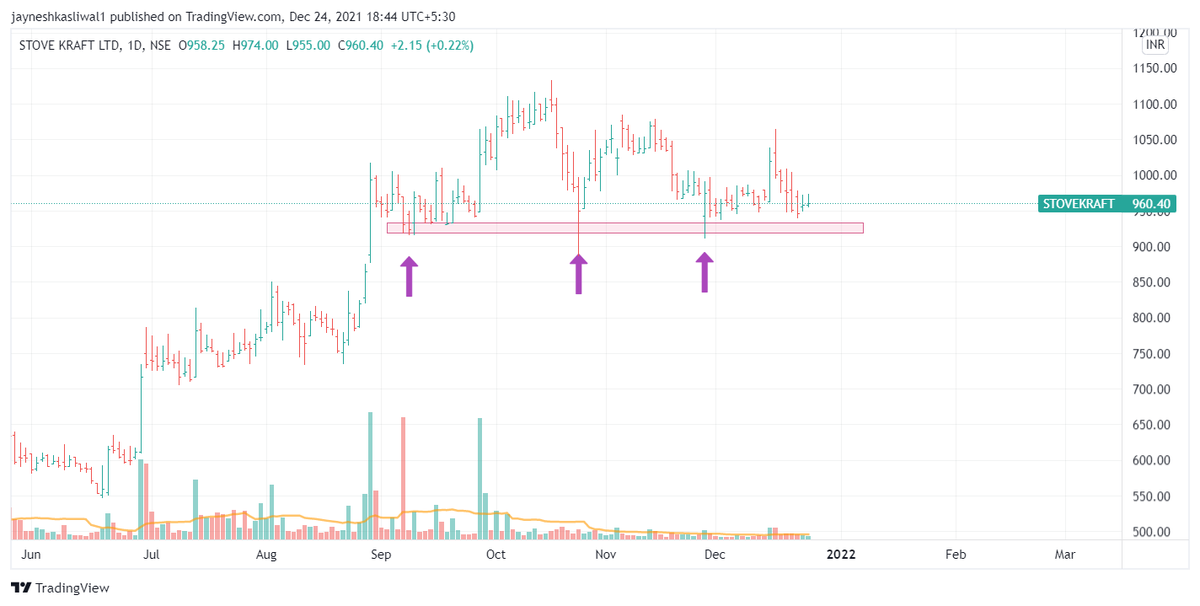

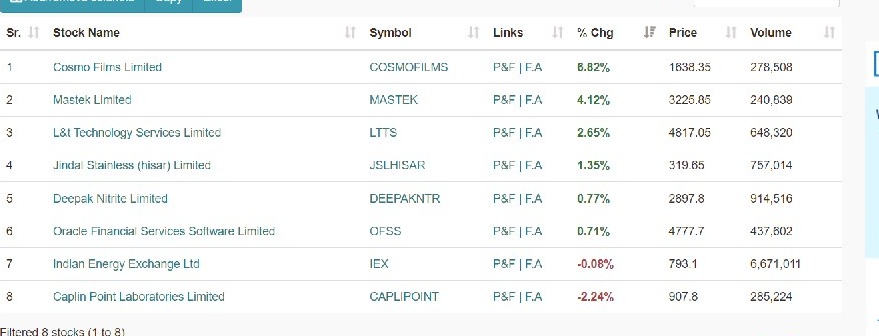

Im sharing A stock Screener+Swing Strategy

Criteria

Screener to Find Swing Stocks.

1. 15% Range of Near 52 week high

2. Avg Volume > 1 lakh

3. Market Cap > 2000 Cr

4. Roe Roce > 20%

5. Eps Increasing Qtr on Qtr

6. Above 50 ema

1/

How to use This Screener

1. Basically we are screening Fundamentally strong stock

2. These are Technically Strong also as stocks are near 52 week high and above 50 ema

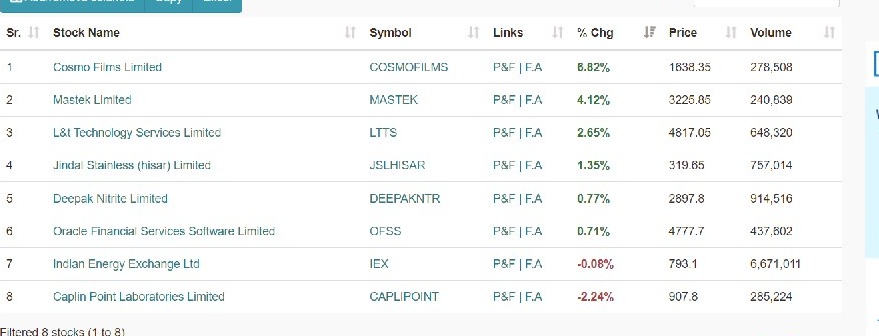

3. Below is the list For the screened Stocks.

4. Target should be on RR

@StocksNerd @MarketScientist

2/

When to Enter

1. When 52 week High is Broken

2. Filter Stocks Select Stock With High Relative Strength

Example : #CosmoFilms , #Mastek

3. Keep Sl Below 21 ema

4. Keep Trailing Using 21 ema

5. Enter stocks on high volume breakout

6.Look for Price Range Contraction

3.

Your Most work is done by the screener

The most important task is filtering out manually and that's where your Returns will differ

As we are screening TechnoFunda stocks these can used for momentum investing

Join telegram https://t.co/b4N4oPAto9

@AmitabhJha3 @chartians

Criteria

Screener to Find Swing Stocks.

1. 15% Range of Near 52 week high

2. Avg Volume > 1 lakh

3. Market Cap > 2000 Cr

4. Roe Roce > 20%

5. Eps Increasing Qtr on Qtr

6. Above 50 ema

1/

How to use This Screener

1. Basically we are screening Fundamentally strong stock

2. These are Technically Strong also as stocks are near 52 week high and above 50 ema

3. Below is the list For the screened Stocks.

4. Target should be on RR

@StocksNerd @MarketScientist

2/

When to Enter

1. When 52 week High is Broken

2. Filter Stocks Select Stock With High Relative Strength

Example : #CosmoFilms , #Mastek

3. Keep Sl Below 21 ema

4. Keep Trailing Using 21 ema

5. Enter stocks on high volume breakout

6.Look for Price Range Contraction

3.

Your Most work is done by the screener

The most important task is filtering out manually and that's where your Returns will differ

As we are screening TechnoFunda stocks these can used for momentum investing

Join telegram https://t.co/b4N4oPAto9

@AmitabhJha3 @chartians

More from Trading strategies

Detailed Study of Stocks that became 5X in past 2 Years

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5

1/n

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5

1/n

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

You May Also Like

Department List of UCAS-China PROFESSORs for ANSO, CSC and UCAS (fully or partial) Scholarship Acceptance

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research