My swing cash strategy ☢️

(In simple language)

1⃣ #stock selection process - always choose that stock which are consolidating near all time high

(Because whenever stock will give all time high breakout then it will easily give 20/30% return in 1/2 months

And, your 3/4 stocks must be from different strong sectors.

If you hold 3 stocks out of them 2 will give 40% then ur portfolio impact is 25%

(Here time period is 1/3 months)

If any stocks is out of nifty sector then u can open stock scanner website and check their peer charts.If out of 5 ,3 are strong then u can select that company

https://t.co/v4YXcWTS9R

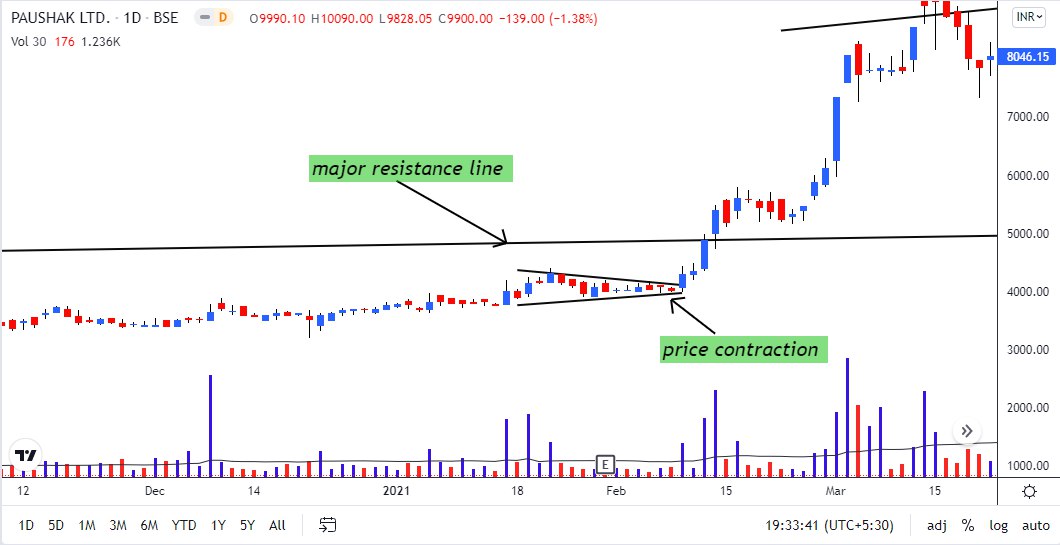

If stock making good contraction of price near major/minor demand & supply then only enter that trade 👇l

Ex - #paushak /// #tatapower

➡️sl rule - don't risk more then 4/6% in your one trade. ( u have to exit at sl anyhow)

And your cash and fno account must be different .

Which I m planning to take.....

#manaksia steels

#indiancard cloth.

you can check my ▶️ video 🎥👇👇

https://t.co/3p0OjFrXCT

If you learn something don't forget to show your love ❣️#like #retweet

More from Vikrant

The cash strategy 👇☢️👇

1⃣ #stock selection process - always choose that stock which are consolidating near all time high.

(Because whenever stock will give all time high breakout then it will easily give 20/30% return in 1/2 months

U can use trading view scanner for that.

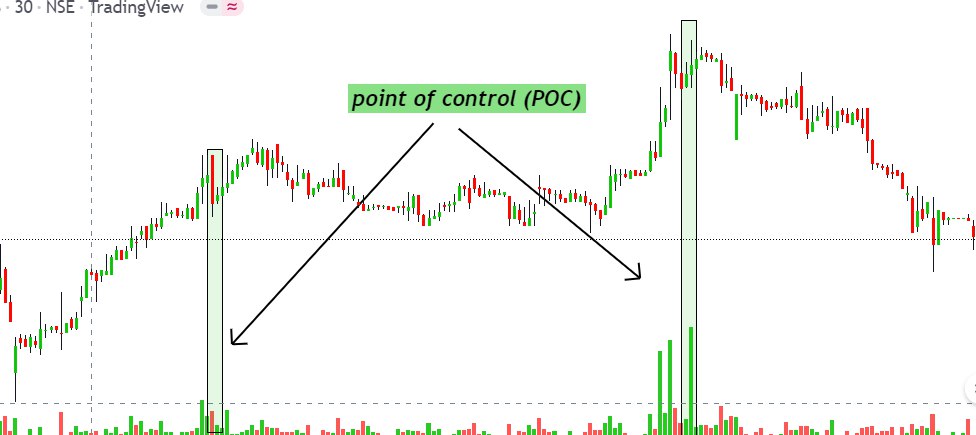

2⃣volume analysis - In that consolidating period volume should be high of up move days then down move days. And last 3/4 month volume of accumulation is much higher.

3️⃣ fund diversification - always deploy your capital in 3/4 stocks, not more then that or not less then 3.

And, your 3/4 stocks must be from different different sectors.

4⃣comunding magic - If you hold 10 stocks then if 2 stocks will give 100% return then portfolio impact is 20% only. (here time period is 8/15 months)

If you hold 3 stocks out of them 2 will give 40% then ur portfolio impact is 25%

(Here time period is 1/3 months)

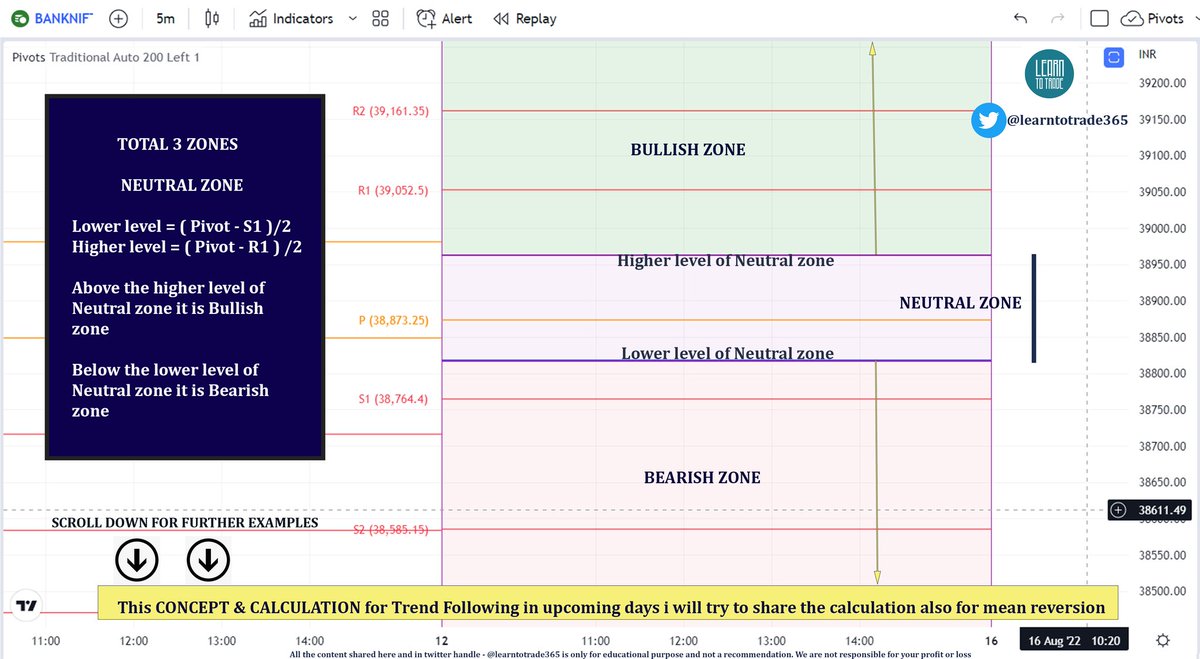

5⃣sectors analysis - always choose that sector stocks which are near support or breakout stage.

If any stocks is out of nifty sector then u can open stock scanner website and check their peer charts. If out of 5 , 3 are strong then u can select that company.

1⃣ #stock selection process - always choose that stock which are consolidating near all time high.

(Because whenever stock will give all time high breakout then it will easily give 20/30% return in 1/2 months

U can use trading view scanner for that.

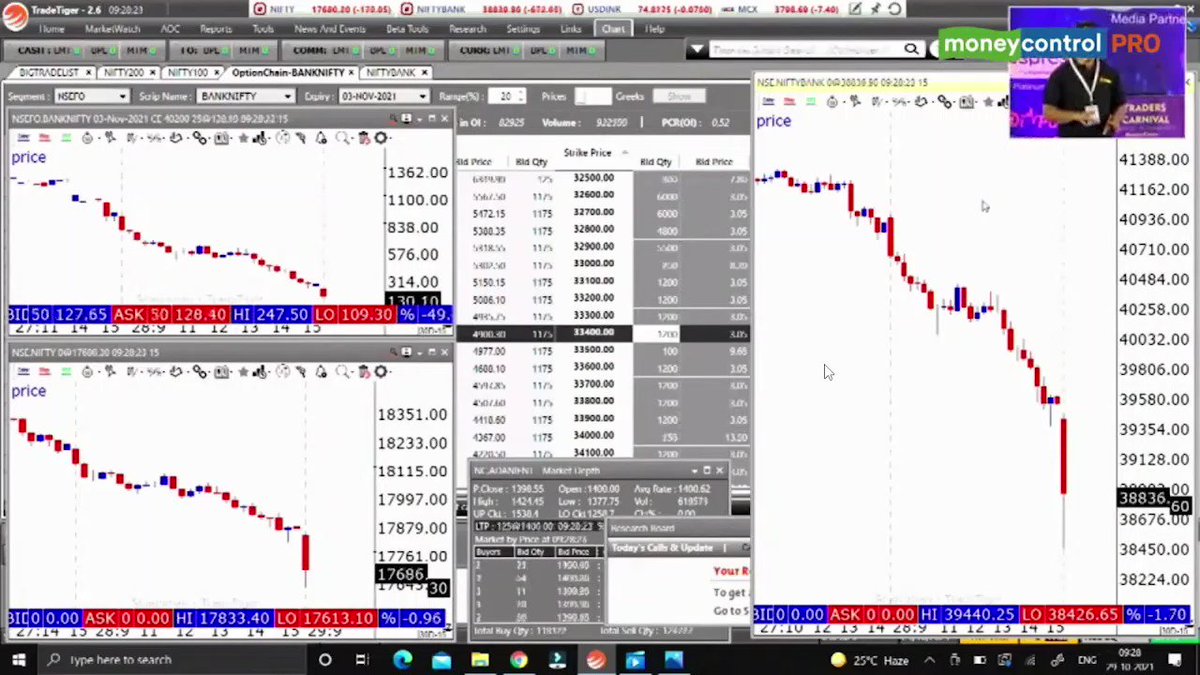

How I turned 7lac account to 33lac in just 1 year only by cash trading.

— Vikrant (@Trading0secrets) October 14, 2021

Soon going to make full thread about my strategy of cash by which this happened.

And for cash hedging I started option selling in different a/c.

How many of u intrested for that thread? \U0001f499\U0001f49b\U0001f499 pic.twitter.com/wIyfE8fwfw

2⃣volume analysis - In that consolidating period volume should be high of up move days then down move days. And last 3/4 month volume of accumulation is much higher.

3️⃣ fund diversification - always deploy your capital in 3/4 stocks, not more then that or not less then 3.

And, your 3/4 stocks must be from different different sectors.

4⃣comunding magic - If you hold 10 stocks then if 2 stocks will give 100% return then portfolio impact is 20% only. (here time period is 8/15 months)

If you hold 3 stocks out of them 2 will give 40% then ur portfolio impact is 25%

(Here time period is 1/3 months)

5⃣sectors analysis - always choose that sector stocks which are near support or breakout stage.

If any stocks is out of nifty sector then u can open stock scanner website and check their peer charts. If out of 5 , 3 are strong then u can select that company.

Trading view scanner process & how to add 1000 stocks in watchlist in just 5 min. by simply copy & paste 👇

1⃣Open trading view in your browser and login trading view by ur mail I'd & select stock scanner in left corner down side .

2⃣ touch the percentage% gain change ( and u can see higest gainer of yesterday)

3️⃣ Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4⃣ Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5⃣ U can also select those stocks which are going to give range breakout of few year or months

6⃣If in 15 min chart📊 any stock sustaining near BO zone or after BO then select it on your watchlist

Now this is my 1000 stocks list you have to copy paste them in your trading view account.

https://t.co/jWBH98aKME

Full process is explained in my YouTube video (how to add 1000 stock)

1⃣Open trading view in your browser and login trading view by ur mail I'd & select stock scanner in left corner down side .

2⃣ touch the percentage% gain change ( and u can see higest gainer of yesterday)

3️⃣ Then, start with 6% gainer to 20% gainer and look charts of everyone in daily Timeframe . (For fno selection u can choose 1% to 4% )

4⃣ Then manually select the stocks which are going to give all time high BO or 52 high BO or already given.

5⃣ U can also select those stocks which are going to give range breakout of few year or months

6⃣If in 15 min chart📊 any stock sustaining near BO zone or after BO then select it on your watchlist

Now this is my 1000 stocks list you have to copy paste them in your trading view account.

https://t.co/jWBH98aKME

Full process is explained in my YouTube video (how to add 1000 stock)

More from Trading strategies

You May Also Like

Funny, before the election I recall lefties muttering the caravan must have been a Trump setup because it made the open borders crowd look so bad. Why would the pro-migrant crowd engineer a crisis that played into Trump's hands? THIS is why. THESE are the "optics" they wanted.

This media manipulation effort was inspired by the success of the "kids in cages" freakout, a 100% Stalinist propaganda drive that required people to forget about Obama putting migrant children in cells. It worked, so now they want pics of Trump "gassing children on the border."

There's a heavy air of Pallywood around the whole thing as well. If the Palestinians can stage huge theatrical performances of victimhood with the willing cooperation of Western media, why shouldn't the migrant caravan organizers expect the same?

It's business as usual for Anarchy, Inc. - the worldwide shredding of national sovereignty to increase the power of transnational organizations and left-wing ideology. Many in the media are true believers. Others just cannot resist the narrative of "change" and "social justice."

The product sold by Anarchy, Inc. is victimhood. It always boils down to the same formula: once the existing order can be painted as oppressors and children as their victims, chaos wins and order loses. Look at the lefties shrieking in unison about "Trump gassing children" today.

Funny there are those who think these migrant caravans were a FANTASTIC idea that's going to take the immigration issue away from you.

— Brian Cates (@drawandstrike) November 26, 2018

Like several weeks watching a rampaging horde storm the fences & throw rocks at our border patrol agents & getting gassed = great optics!

This media manipulation effort was inspired by the success of the "kids in cages" freakout, a 100% Stalinist propaganda drive that required people to forget about Obama putting migrant children in cells. It worked, so now they want pics of Trump "gassing children on the border."

There's a heavy air of Pallywood around the whole thing as well. If the Palestinians can stage huge theatrical performances of victimhood with the willing cooperation of Western media, why shouldn't the migrant caravan organizers expect the same?

It's business as usual for Anarchy, Inc. - the worldwide shredding of national sovereignty to increase the power of transnational organizations and left-wing ideology. Many in the media are true believers. Others just cannot resist the narrative of "change" and "social justice."

The product sold by Anarchy, Inc. is victimhood. It always boils down to the same formula: once the existing order can be painted as oppressors and children as their victims, chaos wins and order loses. Look at the lefties shrieking in unison about "Trump gassing children" today.