In one sentence showing RS means outperforming other stocks both during market uptrends and downtrends.

What is Relative Strength (RS) and how to identify it (Thread)

In one sentence showing RS means outperforming other stocks both during market uptrends and downtrends.

If you want to outperform the indexes, logic says you have to be invested in stocks doing the same.

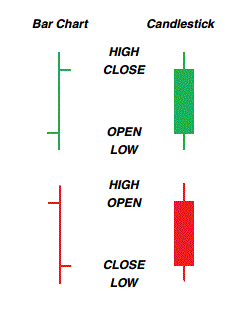

RS Rating: @IBDinvestors Proprietary measure of RS scored 1-99. Stocks with an RS rating of 80 have outperformed 80% of stocks over the past year.

RS Line: The Line plotted by dividing each day’s stock price/ price of the SPX.

-Note RSI (Relative strength index) is something completely unrelated to the concept of this thread.

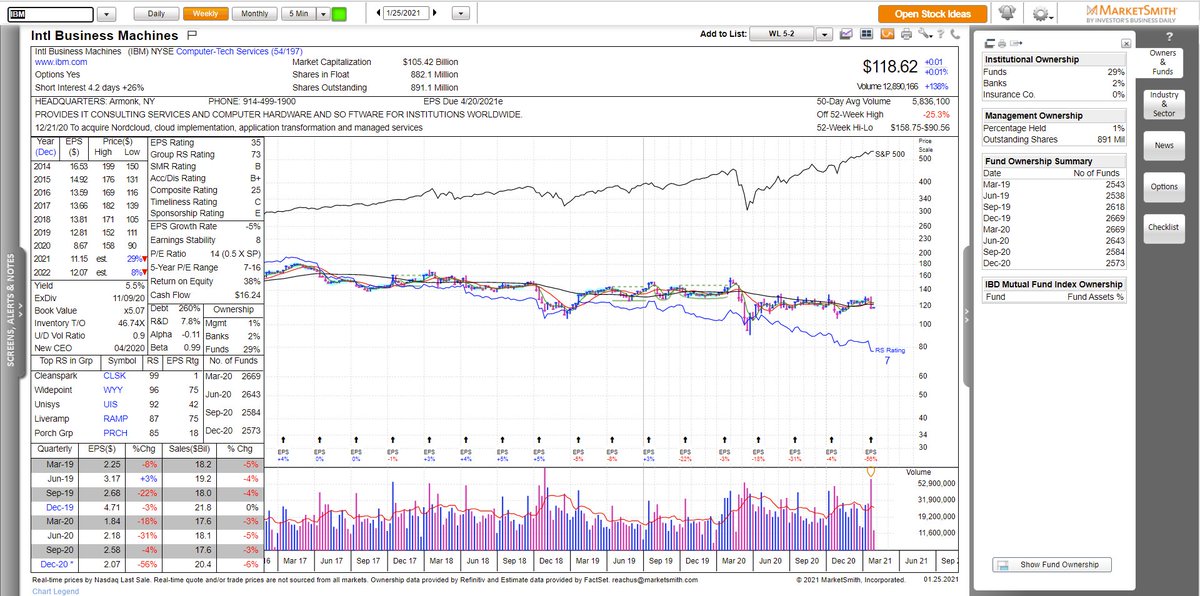

RS rating: 7, decreasing RS line

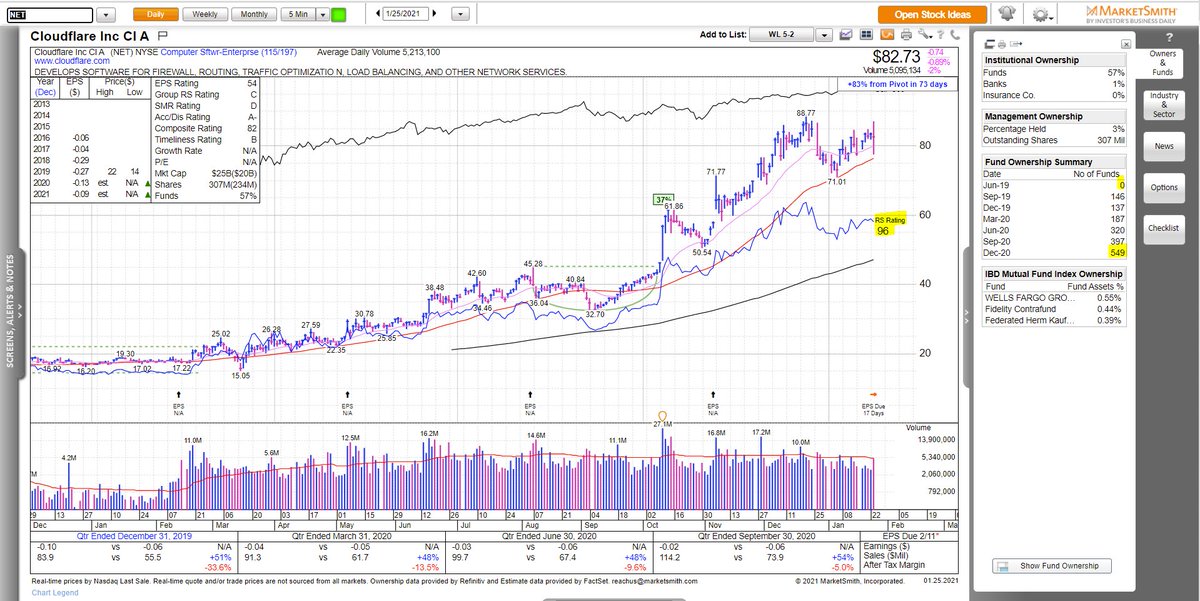

NET is an example

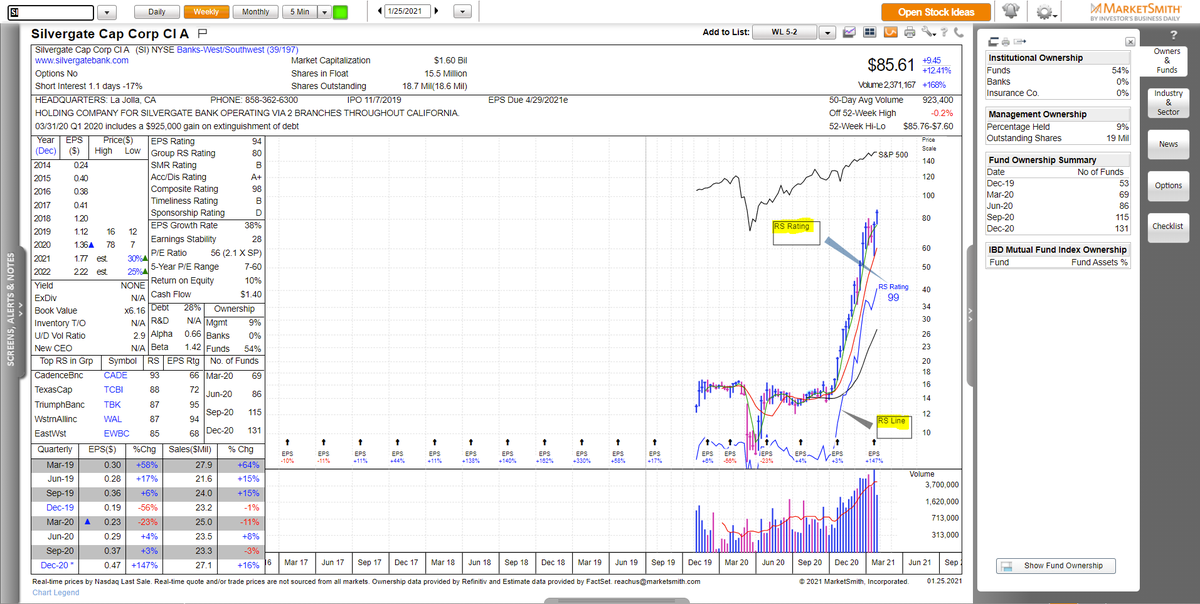

RS rating of 98, ⬆️ RS line and # of funds.

There are many different ways summarized extremely well by @duckman1717 in the document below and I will expand on a couple of these concepts.

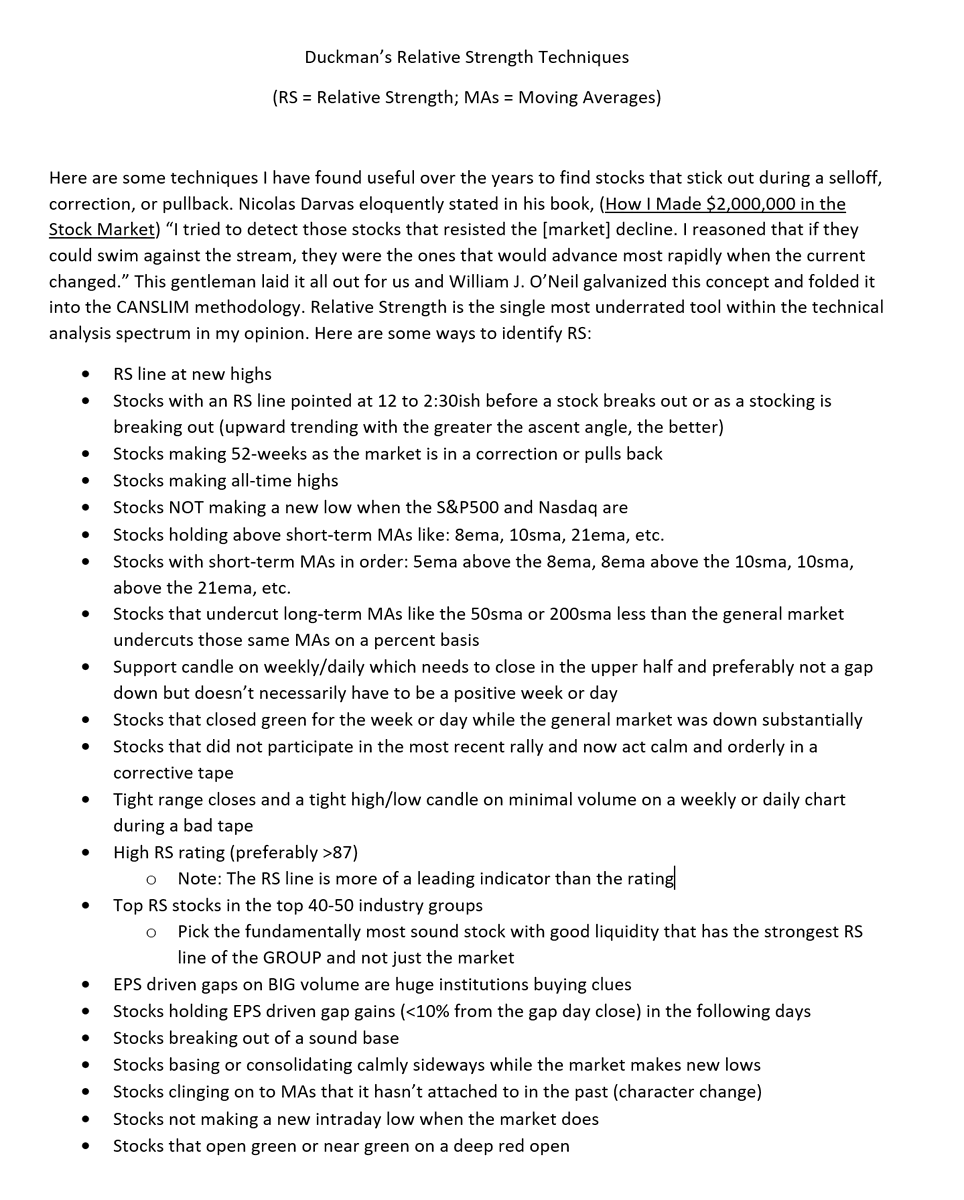

Makes a higher Low when the SPX makes a lower one

Stays above 200day SMA while SPX undercuts by 28%

The Leaders often bottom before the indexes

$TSLA increased 800% from this point in 9 months

Higher Low again

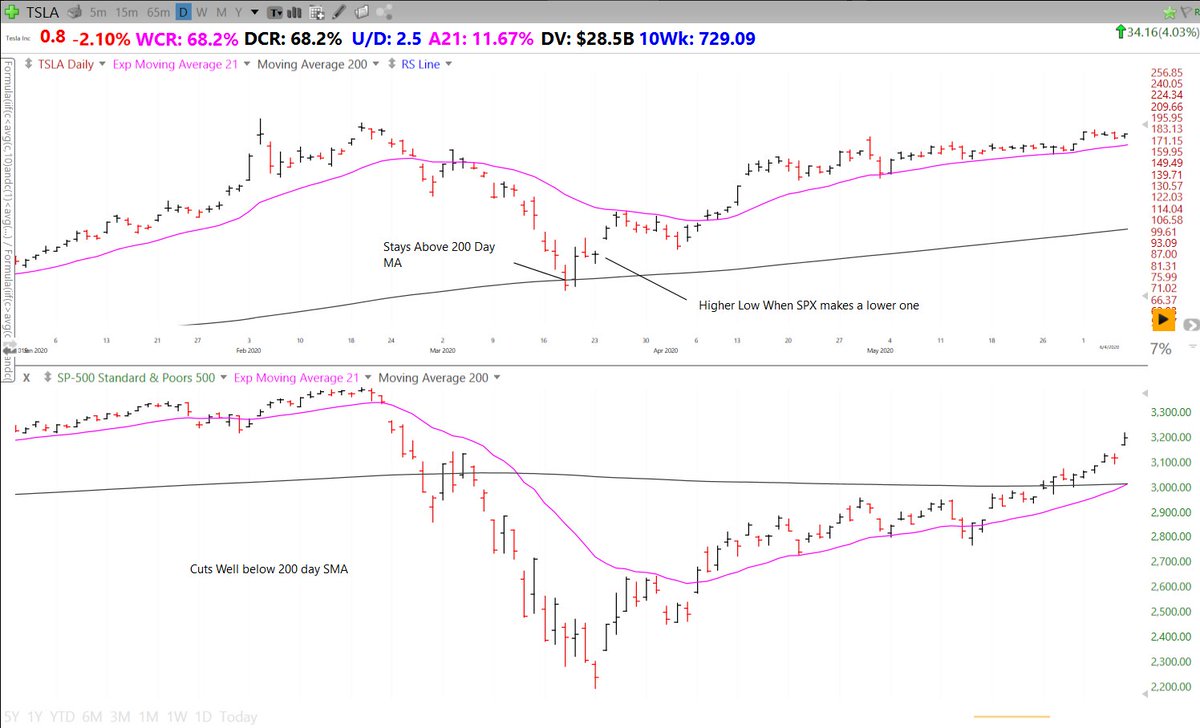

RS Line hitting new all time highs during correction

Strong bounce once market pressure lifts

Broke out to new all time highs shortly after correction

$DOCU increased 120% in 3 months

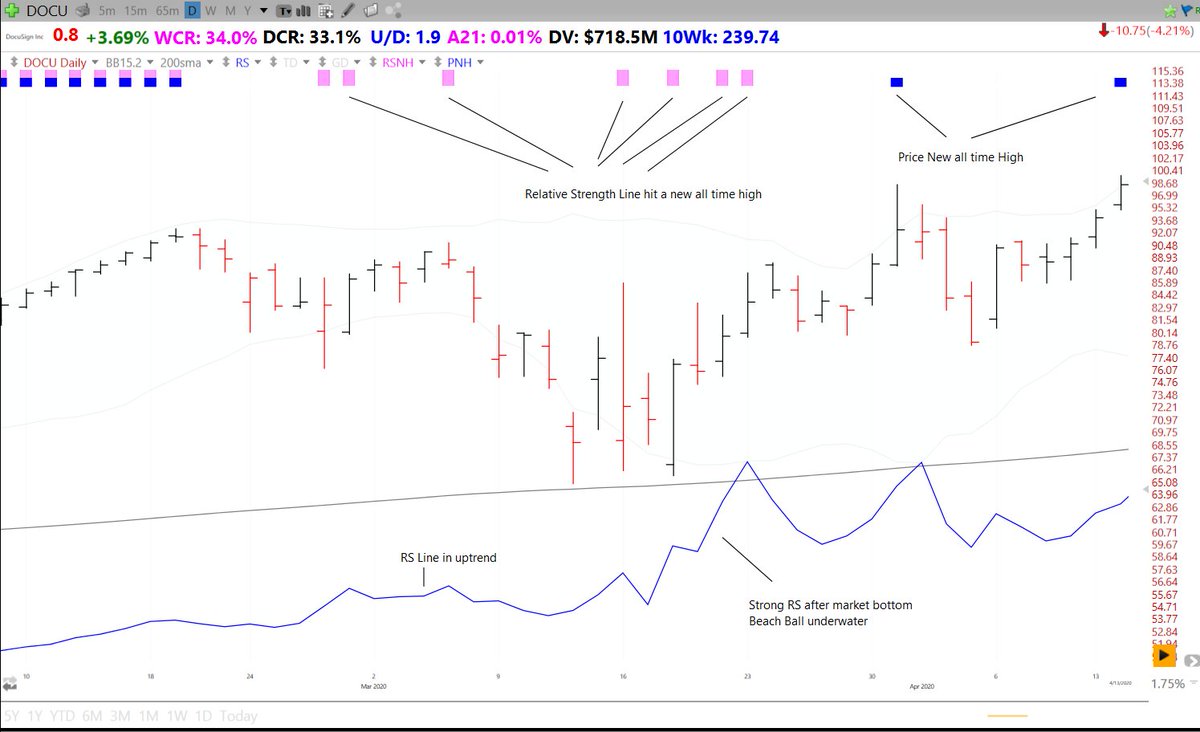

Trends above all Key Moving Averages

RS Line in Uptrend

Forms Tight Price areas then breaks out.

Pullbacks are on lower volume than advances

Increased 1000% in 6 months while trending with the 21ema

Breakout on large volume to all time highs

Many up days in a row

Upside reversals near the bottom of price consolidations

Tight price action during correction and right before BO

Increased 100% in 1.5 months from the breakout

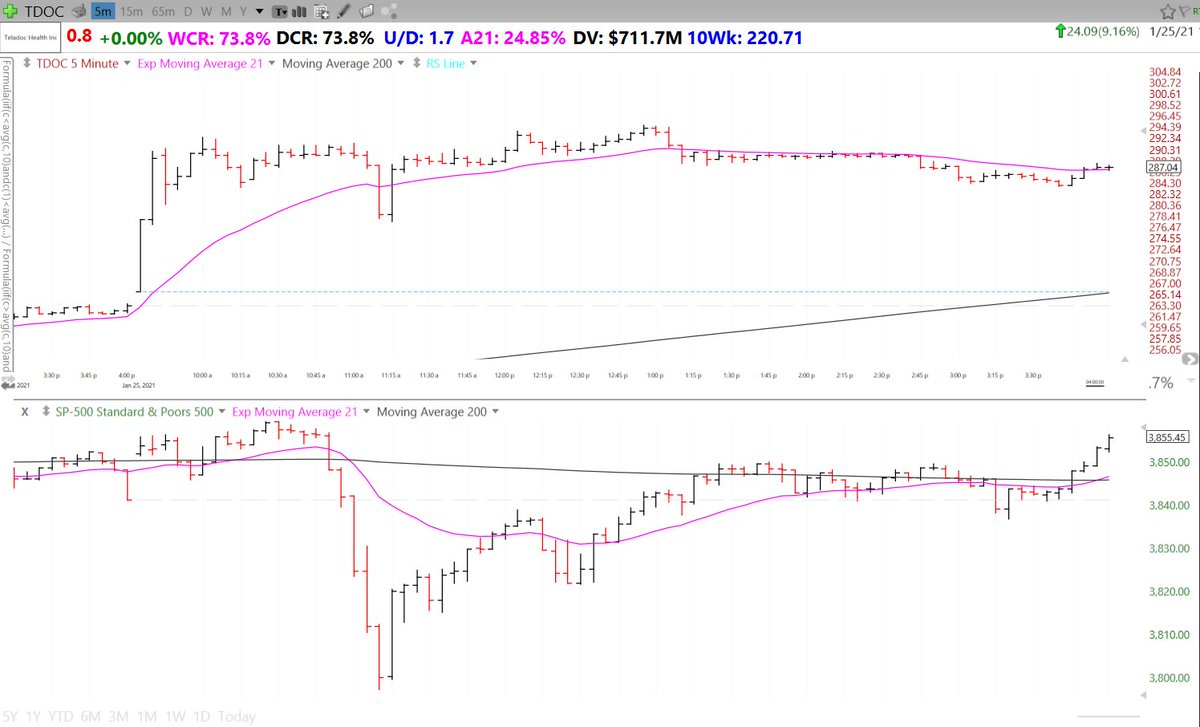

Red to green move on a gap down day

Upside reversal

Prior Uptrend and Volume Contraction within base

5 minute chart with SPX comparison

For instance:

- Earnings gap ups from Bases on large volume

- Newfound respect for a key moving average

Avoid

- Gap downs on large volume

- Breaking previously respected KMAs

- Red to green moves

- Green on Red days

- High DCR +WCR compared to $SPX

- Closing well off lows

- Tight price action compared to $SPX

- RS line ⬆️

- Pullbacks are on low vol

- Pick stocks with increasing RS Lines + other Signs of RS

- On red days track what is showing RS

- During corrections cut weak stocks first

- During Bear Markets track RS signs- Future Leaders

https://t.co/gCwio1qYWX

What is Relative Strength (RS) and how to identify it (Thread)

— Richard Moglen \U0001f4fd\ufe0f\U0001f981\U0001f6a2 (@RichardMoglen) January 25, 2021

What is an Optimal Buy Point? (thread)

— Richard Moglen \U0001f4fd\ufe0f\U0001f981\U0001f6a2 (@RichardMoglen) August 29, 2020

What is a True Market Leader / TML (Thread)

— Richard Moglen \U0001f4fd\ufe0f\U0001f981\U0001f6a2 (@RichardMoglen) November 6, 2020

(And how to find them)

An Introduction to Price and Volume Action (thread)

— Richard Moglen \U0001f4fd\ufe0f\U0001f981\U0001f6a2 (@RichardMoglen) December 4, 2020

More from Richard Moglen 📽️🦁🚢

How to time the market (thread)

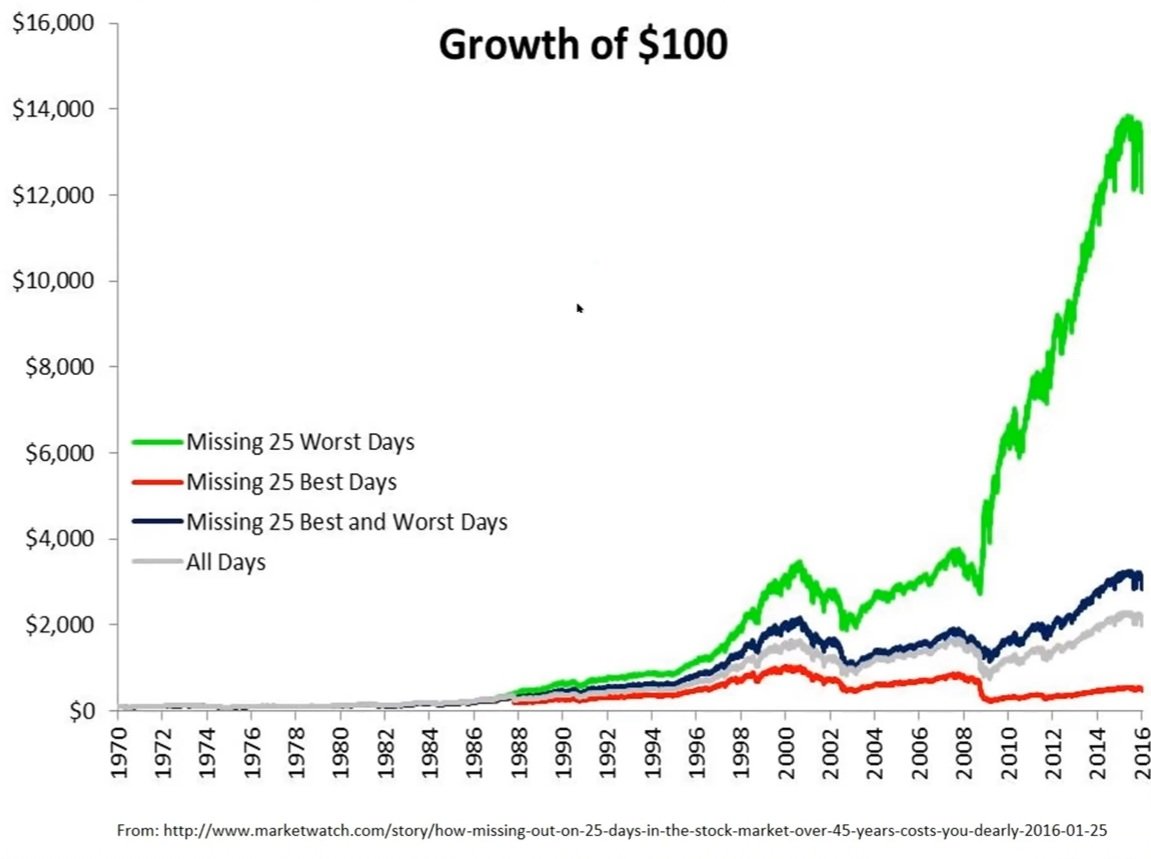

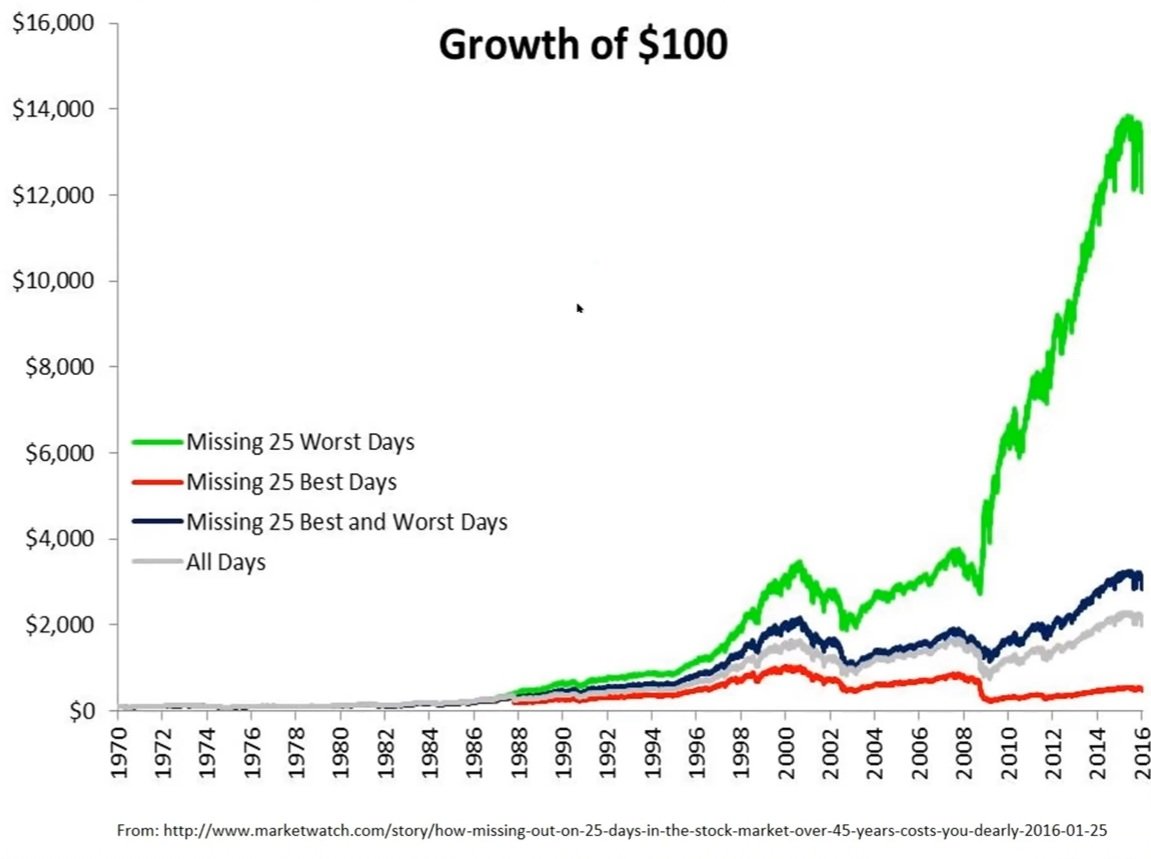

There is the old saying that “Time in the market beats timing the market” The chart below from Dr. Wish’s @WishingWealth presentation at the @TraderLion_ conference shows that to be false.

Full presentation: https://t.co/o2f21GBXci

The green line is unattainable realistically, however, missing volatile times during corrections yields better performance than buy and hold and we can aim for the green line.

Investors usually only show the gray and red results.

More

There are many strategies for investing/trading in the stock market operating within different timeframes and with different objectives.

That is of course what creates a market and opportunity. Timing the market may not be what works for you or what fits your goals/lifestyle.

However, everyone involved in the market is here to make money over time and corrections can cause huge drawdowns in the high alpha names negating incredible performance during strong market uptrends.

There is the old saying that “Time in the market beats timing the market” The chart below from Dr. Wish’s @WishingWealth presentation at the @TraderLion_ conference shows that to be false.

Full presentation: https://t.co/o2f21GBXci

The green line is unattainable realistically, however, missing volatile times during corrections yields better performance than buy and hold and we can aim for the green line.

Investors usually only show the gray and red results.

More

There are many strategies for investing/trading in the stock market operating within different timeframes and with different objectives.

That is of course what creates a market and opportunity. Timing the market may not be what works for you or what fits your goals/lifestyle.

However, everyone involved in the market is here to make money over time and corrections can cause huge drawdowns in the high alpha names negating incredible performance during strong market uptrends.