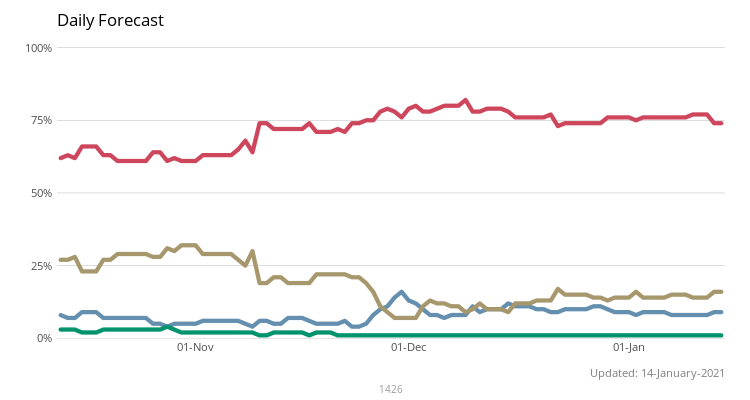

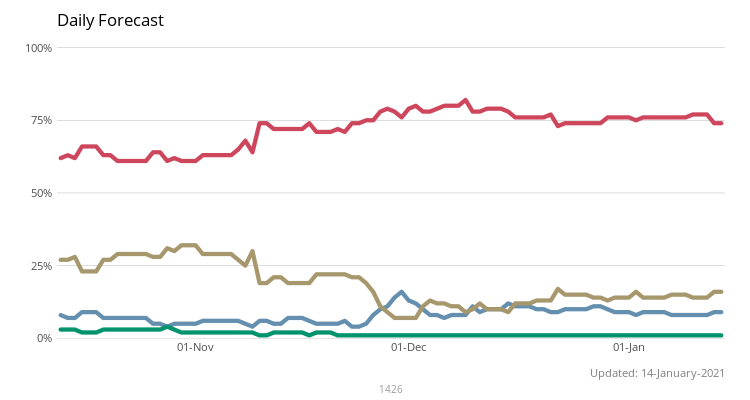

What % of working adults in the UK will 'work from home exclusively' in July 2021?

About 75% of this group of #superforecasters say more than 10% but less than 20% (the red line in the graph below)

@superforecaster Thread (2/10)

https://t.co/3fhFR1lXFy

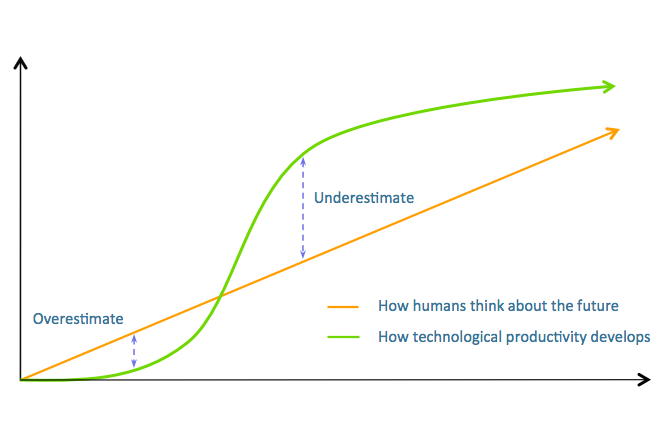

“We tend to overestimate the effect of the technology in the short run and underestimate for the long run”

Roy Amara

Our predictions tend to be made through foggy Zoom goggles and constrained by the Gregorian calendar.

Thread (3/10)

Remote Work Isn’t New

In Britain from the 1600s to the mid-19th century work did not take place in factories but in people’s houses.

Workers made dresses, shoes, and matchboxes in their kitchens or bedrooms.

Thread (4/10)

https://t.co/1A52zT4kiP

Some predictions from people in 1921 who were asked

“what will happen in 2021?”

📺 streaming entertainment into our homes

🚗 electricity powers our wheels

📚 books will read to us

Thread (5/10)

https://t.co/JYY5fXcBTT

No Meetings, No Deadlines, No Full-Time Employees

From the history of remote work, to a future of work scenario for some.

from

@shl at

@gumroad No Sweat...

Thread (6/10)

https://t.co/KicHWzHGaj

The Blockchain Workforce is coming

From a blockchain version of Upwork

to freelancer platforms paying #crypto

@LaborXNews Thread (7/10)

https://t.co/szlj5tJJ3Z

How do we manage our workforce?

From improving innovation in virtual teams using network analysis to better sales productivity.

Best People Analytics Resources of 2020 from

@david_green_uk Thread (8/10)

https://t.co/gx546FSHwO

'Scribe Spotlight' in this newsletter is on

@Vitolae Recommended reading for Workforce Futurists

"The future of work, with a feminist perspective"

Thread (9/10)

https://t.co/ScbCIXV5Vg

Please subscribe, share and contribute to the

Workforce Futurist Newsletter

for regular essays, update articles (like this)

on #Orgdev, technology, #HR, #HRTech, demographics and more…

Thread (10/10)

https://t.co/774xNODMBz

@thereaderapp my dear, loyal and reliable friend, please unroll Many thanks!

@threadreaderapp how could I mistake you for someone else! please unroll Merci!