Lockpicking Floppies!

That's not the type of drive it's supposed to be used in, as you can see from the box.

This is basically just made for things like "we have a computer in the church office, and we're tired of bored kids installing videogames"

More from foone

So I got out some CF cards and noticed something odd about this one. Do you see the weirdness?

How the fuck is a CF card "USB Enabled"?

So CF cards are a weird beast that act as either a PCMCIA card or an ATA/IDE card depending on a mode pin.

They're definitely not USB.

And it's not like that weird SanDisk card I have which you can fold in half and plug it in as a USB device.

It turns out the reason for "USB Enabled" is because it's a Lexar drive from the jumpSHOT era.

This is a normal CF card in most cases, you can use it in normal CF card readers and such

How the fuck is a CF card "USB Enabled"?

So CF cards are a weird beast that act as either a PCMCIA card or an ATA/IDE card depending on a mode pin.

They're definitely not USB.

And it's not like that weird SanDisk card I have which you can fold in half and plug it in as a USB device.

Flip it over, bend it in half, and now you can plug your SD card right into a USB port pic.twitter.com/jeBefP2xU1

— foone (@Foone) May 2, 2020

It turns out the reason for "USB Enabled" is because it's a Lexar drive from the jumpSHOT era.

This is a normal CF card in most cases, you can use it in normal CF card readers and such

More from Tech

You May Also Like

I’m torn on how to approach the idea of luck. I’m the first to admit that I am one of the luckiest people on the planet. To be born into a prosperous American family in 1960 with smart parents is to start life on third base. The odds against my very existence are astronomical.

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.

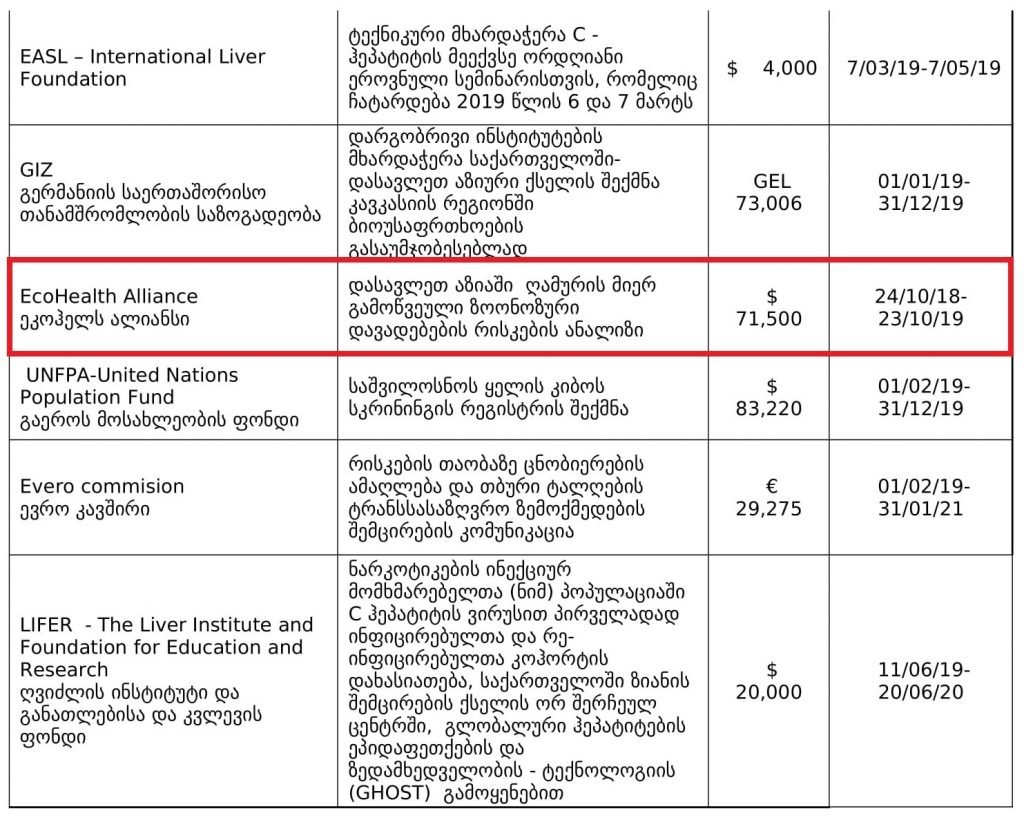

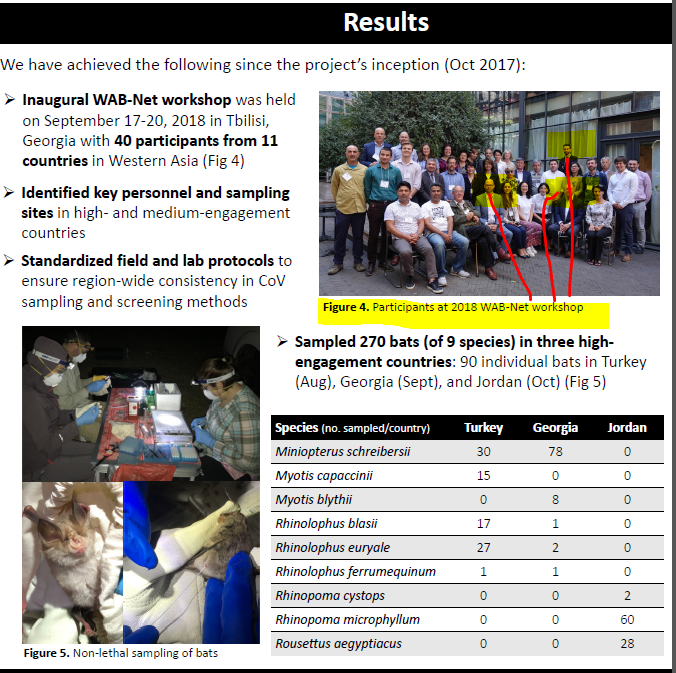

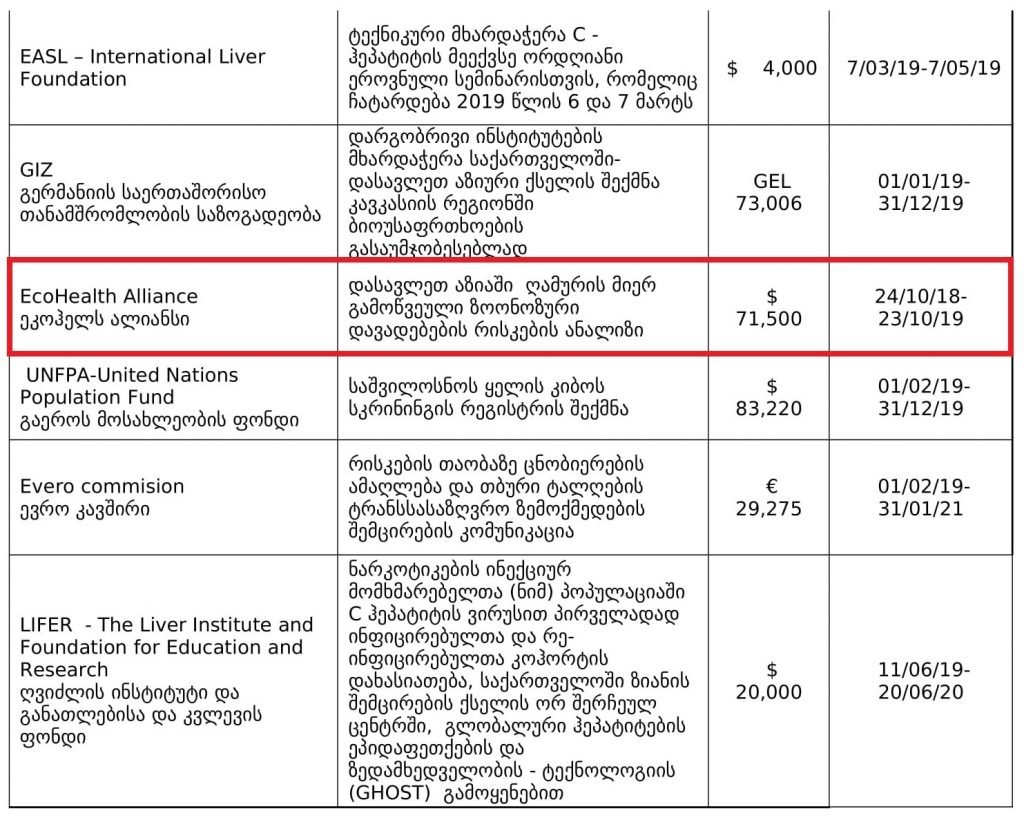

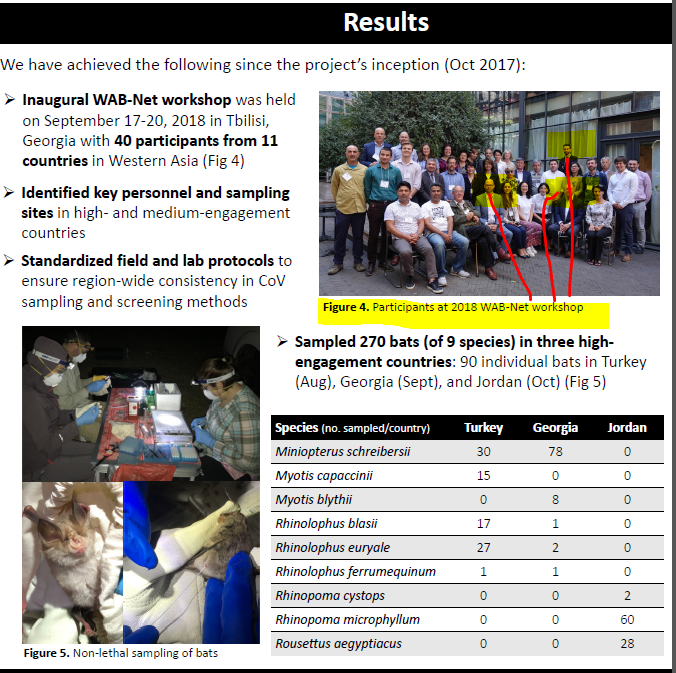

1. Project 1742 (EcoHealth/DTRA)

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

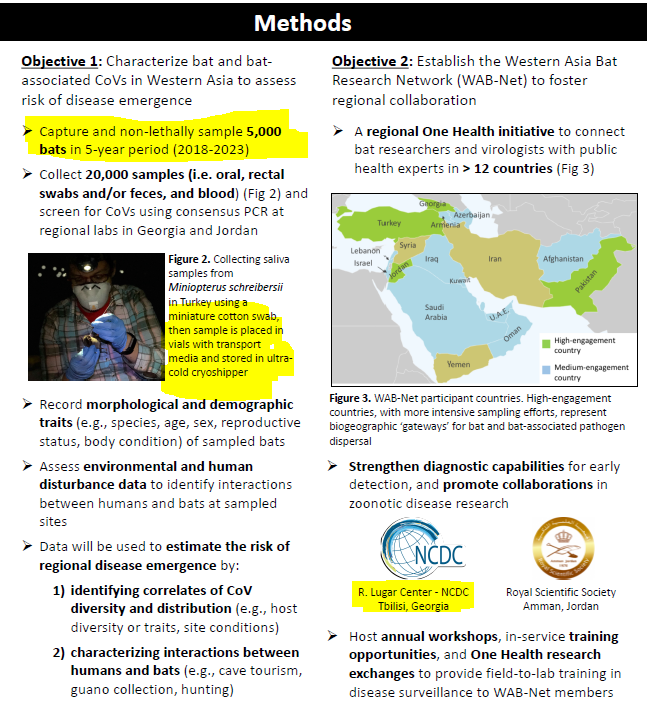

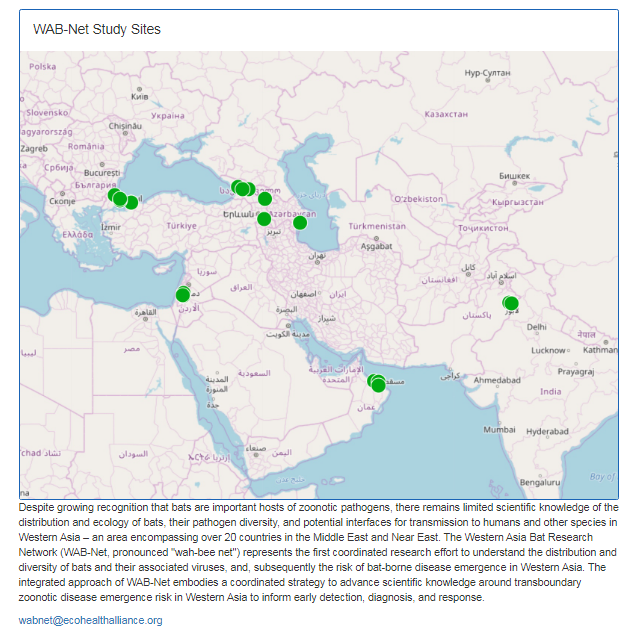

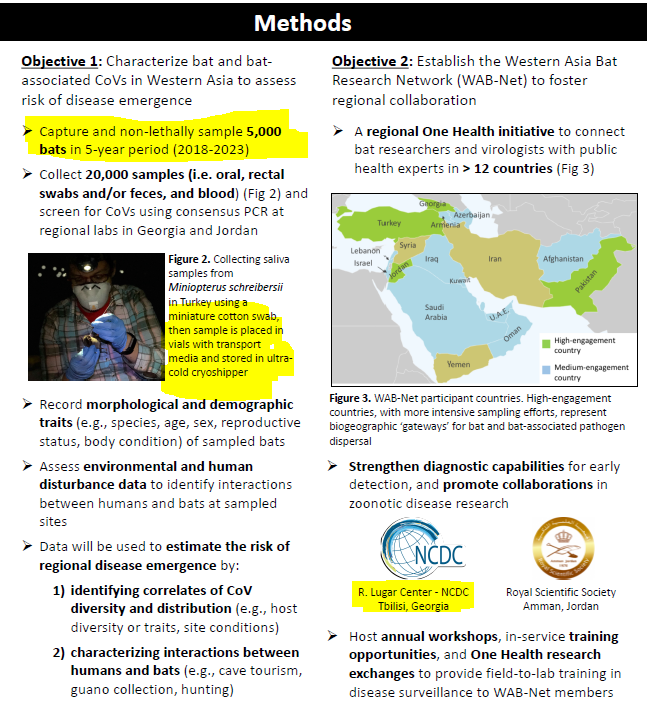

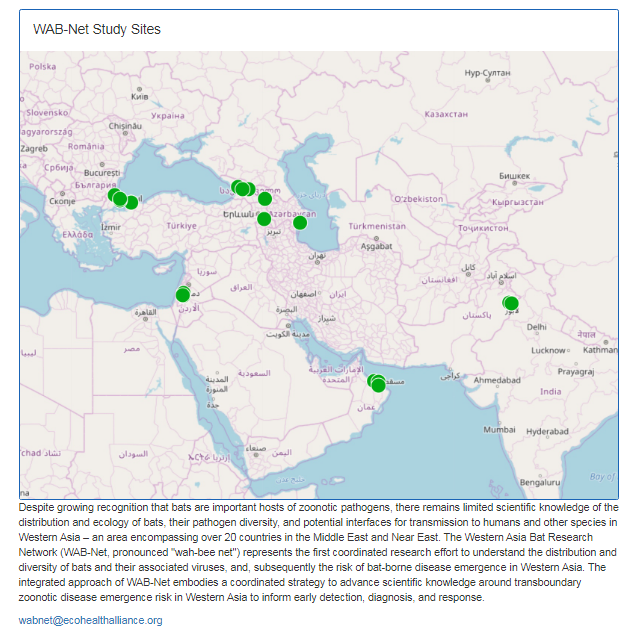

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

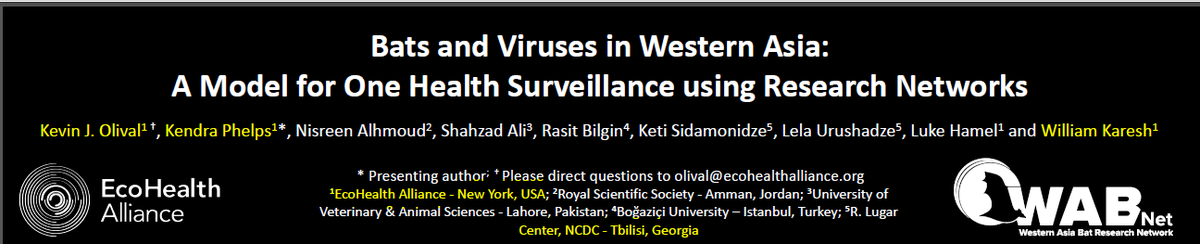

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)