Price Action pattern for intraday trading

A small thread

Traders show your support by like & retweet to benefit maximum traders

@Puretechnicals9 @AnandableAnand @Abhishekkar_ @ProdigalTrader @nakulvibhor @RajarshitaS @Rishikesh_ADX @Stockstudy8 @vivbajaj

More from Learn to Trade

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

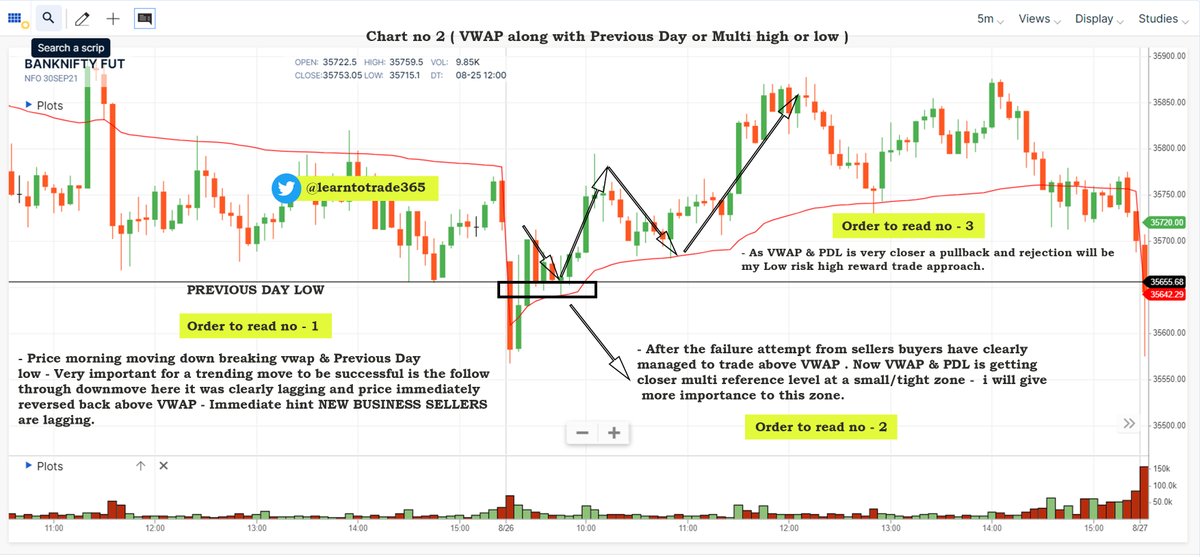

Chart 1

Chart 2

Chart 3

Chart 4

After more than 8 years of market experience i am sharing these effective intraday strategies.

Spend few minutes of your time to understand

Thread 🧵 RT for wider reach

Scroll down👇

1/8

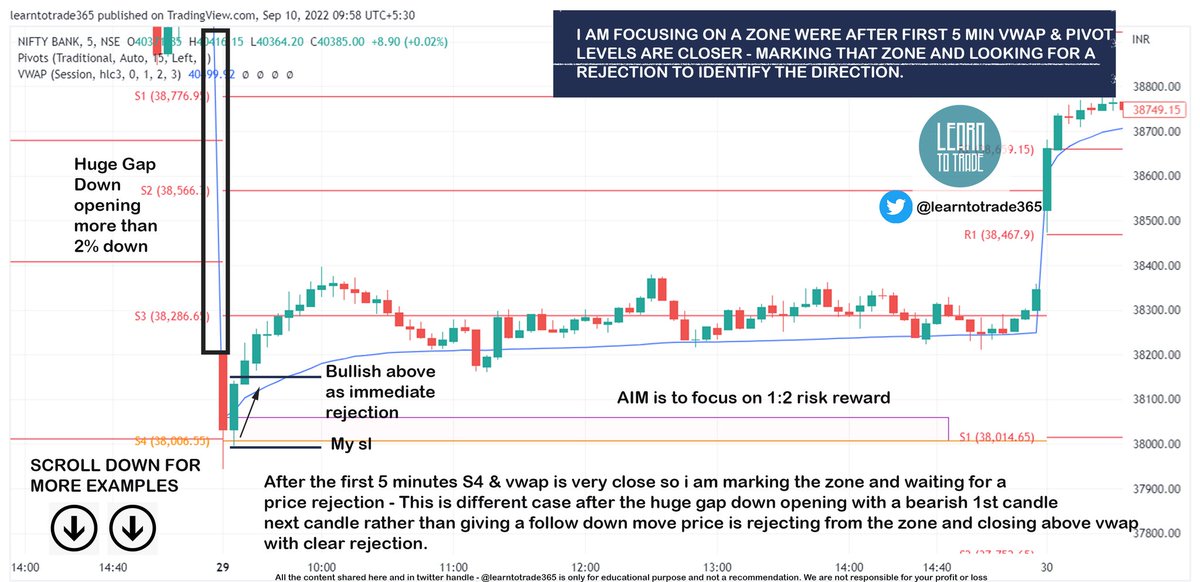

Intraday Strategy 1 - VWAP & Pivot Based

Vwap & Pivot Points - Trading Zones for intraday directional traders

— Learn to Trade (@learntotrade365) September 10, 2022

Intraday Trading strategy for Trend followers \U0001f9f5

Support us by RETWEET this tweet to reach and benefit most traders so it can help them to gain knowledge

Scroll down \U0001f447 pic.twitter.com/L6HHsXQZpV

Intraday Strategy 2 - Price Action strategy without

Price Action Trading ( Without Indicators)

— Learn to Trade (@learntotrade365) August 20, 2022

Intraday Trading strategy for all Directional traders.

Intraday Trading Strategy Thread \U0001f9f5

Support us by RETWEET to reach and benefit maximum traders

Scroll down \U0001f447 pic.twitter.com/AVsKmWroMc

Intraday Strategy 3 - Price Based

Highly effective Trading strategy which can help to follow the trend & ride the direction in BANKNIFTY ( Without Indicators)

— Learn to Trade (@learntotrade365) October 1, 2022

For Option Buyers, Option Sellers & all Directional traders

Simple strategy help to make more profits

Retweet this thread \U0001f9f5 to reach many traders pic.twitter.com/dKxVmgntz3

Intraday Strategy 4 - Open Interest based

Whether OI works for intraday trading ?

— Learn to Trade (@learntotrade365) September 25, 2022

Whether OI useful ?

No one has a exact answer. But one effective way to make use OI in a very different perspective - OUT OF THE BOX from Traditional method

Read the full thread \U0001f9f5

Kindly RETWEET & share so it can reach many traders pic.twitter.com/IFx13oISRW

Topic - Data Points to check as a Option seller

Mega Thread 🧵 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop

#StockMarketindia

1/18 https://t.co/m0NXToSU1p

\U0001f50a Twitter Space with @kapildhama for the first time

— Learn to Trade (@learntotrade365) January 15, 2022

Topic - Data points to check as a option seller

Sunday ( 16/01/22 ) evening 06:00 p.m

Link - https://t.co/XMaoRfOWp4

Click on the link and set reminder #stockmarkets #trading #StockMarketindia pic.twitter.com/HRPEooa5H2

2/18

-Make your own trading system

- First identify what suits you ?

Trend Following

Directional or Non-directional option selling

9:20straddle

Naked option buying/selling

-Never take more than 1% loss in intraday

-There is no specific trick in market only important is process

3/18

-Chart & Data plays a important role ( Understand to combine to identify trades/direction )

-In all trades knowing exit point is very important

Simple target for Kapil sir in straddle is 100 points in a week on BNF & Loss exit point is 50 points after adjustment (R:R 1:2)

4/18

- Simple target for Kapil sir in straddle is 50 points in a week on NF & Loss exit point is 25 points after adjustment (R:R 1:2)

Check data after 3:00 p.m Chart + Data ?

Check how is the closing ( Location of closing - Near Day high or Day low or mid of the day )

5/18

Example:

-If market is near high ( Check in data whether Near ATM PE has more writing & in CE writing whether is less at higher strike price) - It is a Probability

Once Data is bullish along with the close he choose

Strangle- Rs.70 PE & Rs.40 CE or scroll down

Intraday Trading strategy for Trend followers 🧵

Support us by RETWEET this tweet to reach and benefit most traders so it can help them to gain knowledge

Scroll down 👇

I also do All Trading day Live Market session during Market hours from morning 9:00 a.m to 01:00 p.m - Follow me @learntotrade365

Join the Telegram channel for Live Market updates and live session immediate notification

https://t.co/VU0bCGjU7s

Scroll down for chart examples 👇

Make your Trading system very simple so your main aim is to focus on the price not on various indicators.

Scroll down for more examples 👇

Rather than chasing the price looking at candle colours start trading in a perspective of risk to reward based approach

Scroll down for more examples 👇

Try to understand what retail traders will do. Even in this below example after looking at more than 2% gap down many traders will not much think to plan a bullish trade but chart is showing Sellers are not making a Follow through downmove

Scroll down for more examples 👇

More from Ta

💎SECRET INFO inside

🧠Great for both beginners & advanced traders

▪️ What are they?

▪️ Types of MAs

▪️ Why are they such a powerful tool?

▪️ How to properly use them?

▪️ My best SECRET EMA value?

▪️ Which Timeframe to use?

▪️ Advanced EMA technique?

1/20

▪️ What are they?

Moving average is nothing more than an average price of the last (value) of candles.

If we are gonna use an example of MA(50) it is gonna be the mean price of the last 50 candles

General rule:

Price above = Bullish 🐂

Price below = Bearish 🐻

2/20

▪️ Types of Moving Averages

1) Simple Moving Average - SMA

2) Exponential Moving Average - EMA

3) Smoothed Moving Average - SMMA

4) Volume Weighted Average Price - VWAP

There are a few more but these are the most important in my opinion.

3/20

I won't be going that much into detail about each of them in this thread but more so covering MAs in general.

The important takeaway is there are many methods of calculations and each offers bit different pros & cons

I'll leave experimenting with each of them up to you

4/20

▪️ Why are they such a powerful tool?

Because they help everyone, even newbies, that are just starting out, to easily & visually clearly identify trends without understanding the advanced Market Structure techniques.

Price above = 🐂

5/20

https://t.co/g5SneLNPh5

Market Structure (MS)

— J A C K I S (@jackis_trader) July 6, 2020

Understanding MS is the most important thing in TA

It rules above everything. TL's, MA's, Indicators. Everything.

While it's nothing more than looking at swings and seeing Higher Highs (HH), Highers Lows (HL), Lower Highs (LH), and Lower Lows (LL). pic.twitter.com/QbgOSHGkBr

All my threads will be listed under here

Need help getting better entries ?

Here is your thread

Thread on Finding Entries.

— James Lefaith aka Jimmy Momo (@JamesLefaith) June 15, 2021

Firstly you have to be able to identify and area of value for an add.

NEVER BLINDLY BUY\u203c\ufe0f

ALWAYS BUY AT A KEY LEVEL OF SUPPORT, CONFIRMATION & OR IN SOME INSTANCES EVEN AT A BREAK OF A RESISTANCE LEVEL

\u203c\ufe0fThis is how you do that

This is How you can be green on every trade via risk management

RISK MANAGEMENT THREAD

— James Lefaith aka Jimmy Momo (@JamesLefaith) June 17, 2021

Bookmark this; it\u2019s important.

This thread will help you exit (Mostly) EVERY TRADE GREEN but MOST IMPORTANTLY will help you mitigate risk.

HERE is some proof. pic.twitter.com/RNFJtOqJ9C

Thread on high profitability support and resistance setups & trigger points.

\U0001f90dThread on My Support & Resistance System\U0001f90d

— James Lefaith aka Jimmy Momo (@JamesLefaith) June 19, 2021

This Thread Will Help you guys identify favorable, highly profitable, quick and smart money decision areas to add for your entries.

This Thread was requested by my good friends @DevTrades21 and @jessasecond1. Give Them a Follow

Here’s the Jimmy Momo Script, hope you all love it

EVERYONE Here\u2019s the moment we\u2019ve been waiting for, Here is the TOS study based on my candle system.

— James Lefaith aka Jimmy Momo (@JamesLefaith) September 12, 2021

Script created by @richard_the_red everyone give him a follow & thank him for putting in the time. We really hope you all enjoy it & put it to good use https://t.co/0hzRfQ3uGg

You May Also Like

Those who exited at 1500 needed money. They can always come back near 969. Those who exited at 230 also needed money. They can come back near 95.

Those who sold L @ 660 can always come back at 360. Those who sold S last week can be back @ 301

Sir, Log yahan.. 13 days patience nhi rakh sakte aur aap 2013 ki baat kar rahe ho. Even Aap Ready made portfolio banakar bhi de do to bhi wo 1 month me hi EXIT kar denge \U0001f602

— BhavinKhengarSuratGujarat (@IntradayWithBRK) September 19, 2021

Neuland 2700 se 1500 & Sequent 330 to 230 kya huwa.. 99% retailers/investors twitter par charcha n EXIT\U0001f602