Rule : Rising channels can be traded in 2 ways

1. Buy at lower end of the channel and book profit at top of the channel (Never buy breakout from the Rising channel / Buy near top of the channel)

2. Sell only the breakdown from raising channel below previous low

My Learnings

Many asked me on Rain Industries.

— Shivaji Vitthalrao\U0001f1ee\U0001f1f3 (@shivaji_1983) June 16, 2021

Rule : I never Buy near Top of the Raising channel or the breakout from the raising channel.

Why? do some back testing. We may miss the move if it breaks out channel but chances are 20% but getting caught 80% is brutal.

My learnings. pic.twitter.com/Kfok8z6V3U

More from Shivaji Vitthalrao🇮🇳

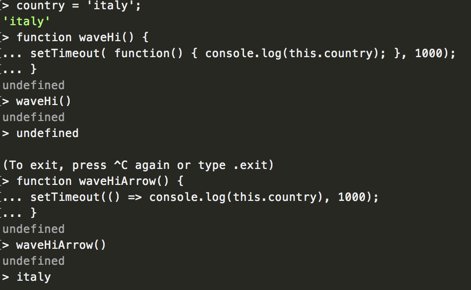

Quiz Answer

Copper break below 4.43 qualify as bearish Flag and pole

HINDCOPPER break below 157 qualify as bearish Flag n pole.

Impact copper can test 4.28-4.20

HINDCOPPER can test 150-141 as per pattern targets.

165-166 Lakshman Rekha.

Copper break below 4.43 qualify as bearish Flag and pole

HINDCOPPER break below 157 qualify as bearish Flag n pole.

Impact copper can test 4.28-4.20

HINDCOPPER can test 150-141 as per pattern targets.

165-166 Lakshman Rekha.

Quiz - Hindcopper

— Shivaji Vitthalrao\U0001f1ee\U0001f1f3 (@shivaji_1983) June 9, 2021

What pattern do you see?

whats the confirmation level and impact ?

Both are interlinked. https://t.co/0gVaRXd4pS pic.twitter.com/Bbs1rdaOWf