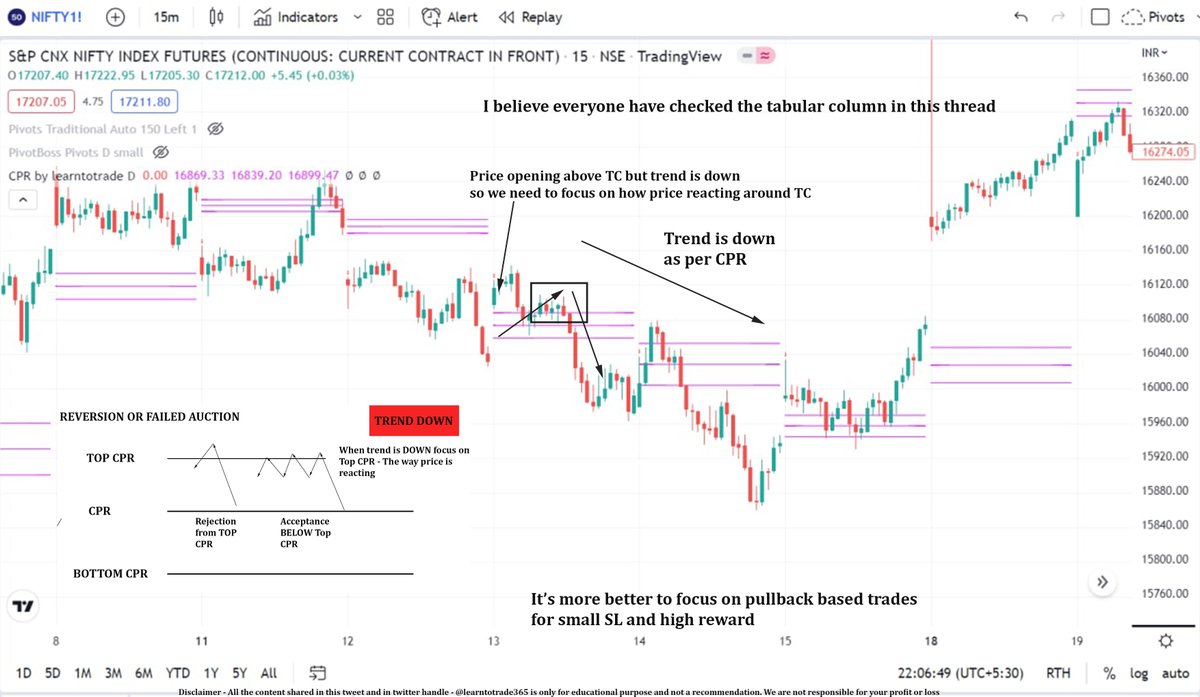

Retailers late sellers who place sl at visual reference levels are thrown out. Avoid placing sl at same location were retailers place stoploss https://t.co/qctgpFYLnK

This is the reason for retailers stoploss. Check it out \U0001f447 https://t.co/fnHPgzCCVn pic.twitter.com/njvqgM9PI3

— Learn to Trade (@learntotrade365) July 28, 2021

More from Learn to Trade

2 hours of non-stop Twitter space by @kapildhama

Topic - Data Points to check as a Option seller

Mega Thread 🧵 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop

#StockMarketindia

1/18 https://t.co/m0NXToSU1p

2/18

-Make your own trading system

- First identify what suits you ?

Trend Following

Directional or Non-directional option selling

9:20straddle

Naked option buying/selling

-Never take more than 1% loss in intraday

-There is no specific trick in market only important is process

3/18

-Chart & Data plays a important role ( Understand to combine to identify trades/direction )

-In all trades knowing exit point is very important

Simple target for Kapil sir in straddle is 100 points in a week on BNF & Loss exit point is 50 points after adjustment (R:R 1:2)

4/18

- Simple target for Kapil sir in straddle is 50 points in a week on NF & Loss exit point is 25 points after adjustment (R:R 1:2)

Check data after 3:00 p.m Chart + Data ?

Check how is the closing ( Location of closing - Near Day high or Day low or mid of the day )

5/18

Example:

-If market is near high ( Check in data whether Near ATM PE has more writing & in CE writing whether is less at higher strike price) - It is a Probability

Once Data is bullish along with the close he choose

Strangle- Rs.70 PE & Rs.40 CE or scroll down

Topic - Data Points to check as a Option seller

Mega Thread 🧵 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop

#StockMarketindia

1/18 https://t.co/m0NXToSU1p

\U0001f50a Twitter Space with @kapildhama for the first time

— Learn to Trade (@learntotrade365) January 15, 2022

Topic - Data points to check as a option seller

Sunday ( 16/01/22 ) evening 06:00 p.m

Link - https://t.co/XMaoRfOWp4

Click on the link and set reminder #stockmarkets #trading #StockMarketindia pic.twitter.com/HRPEooa5H2

2/18

-Make your own trading system

- First identify what suits you ?

Trend Following

Directional or Non-directional option selling

9:20straddle

Naked option buying/selling

-Never take more than 1% loss in intraday

-There is no specific trick in market only important is process

3/18

-Chart & Data plays a important role ( Understand to combine to identify trades/direction )

-In all trades knowing exit point is very important

Simple target for Kapil sir in straddle is 100 points in a week on BNF & Loss exit point is 50 points after adjustment (R:R 1:2)

4/18

- Simple target for Kapil sir in straddle is 50 points in a week on NF & Loss exit point is 25 points after adjustment (R:R 1:2)

Check data after 3:00 p.m Chart + Data ?

Check how is the closing ( Location of closing - Near Day high or Day low or mid of the day )

5/18

Example:

-If market is near high ( Check in data whether Near ATM PE has more writing & in CE writing whether is less at higher strike price) - It is a Probability

Once Data is bullish along with the close he choose

Strangle- Rs.70 PE & Rs.40 CE or scroll down

Whether OI works for intraday trading ?

Whether OI useful ?

No one has a exact answer. But one effective way to make use OI in a very different perspective - OUT OF THE BOX from Traditional method

Read the full thread 🧵

Kindly RETWEET & share so it can reach many traders

I do Live Market session every Monday to Friday by 09:00 a.m to 01:00 pm . Also i share important support /resistance levels of Banknifty & Nifty on the Telegram Channel. FOLLOW US @learntotrade365

Join the Telegram Channel - https://t.co/VU0bCGAX9s

Scroll down 👇

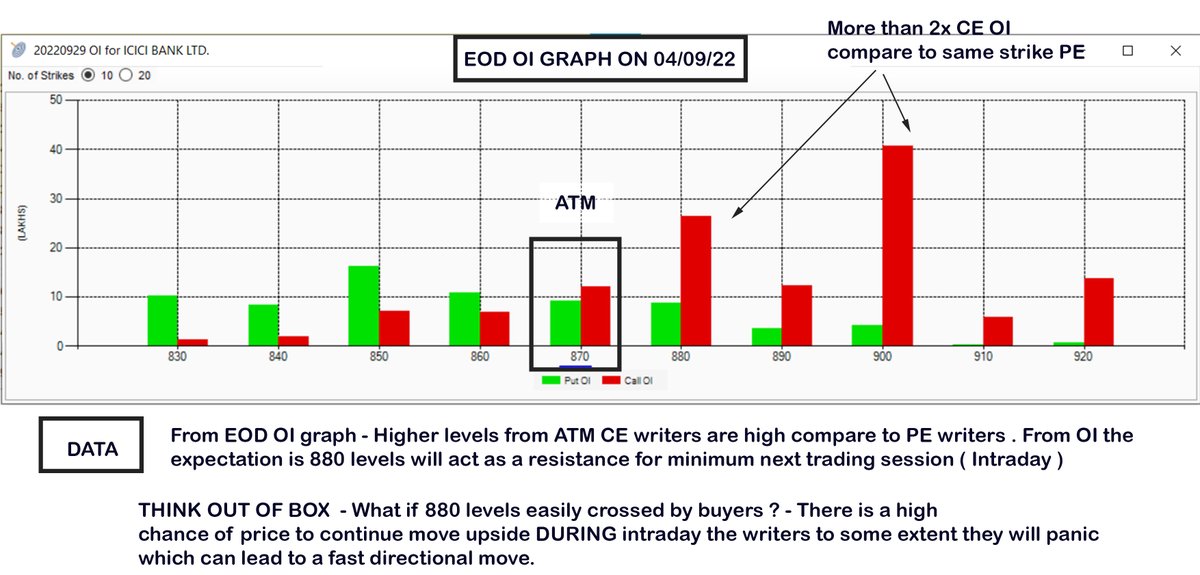

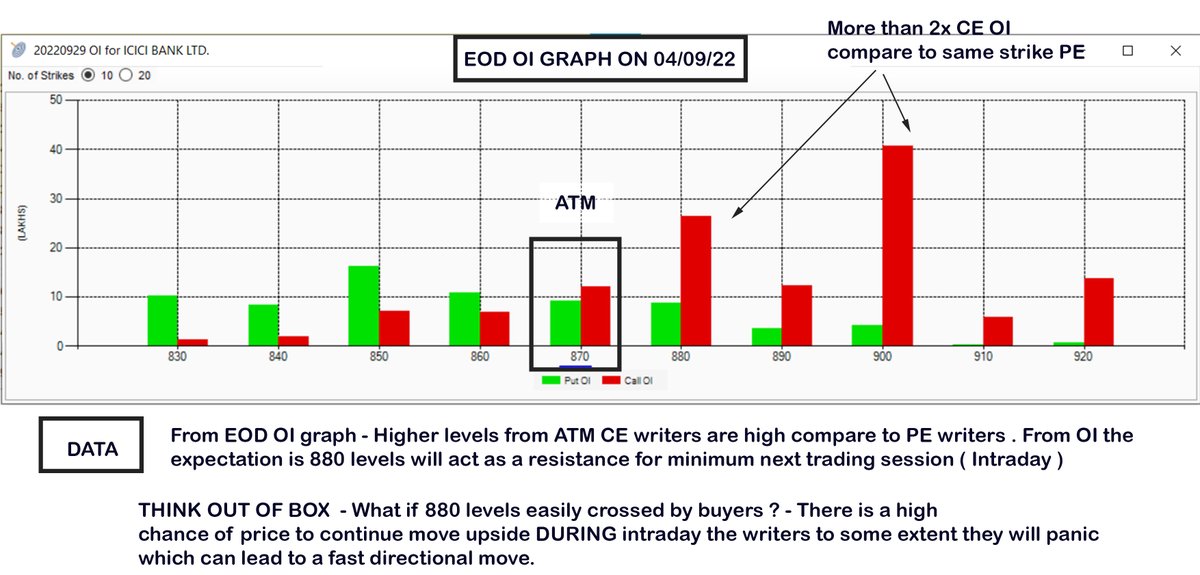

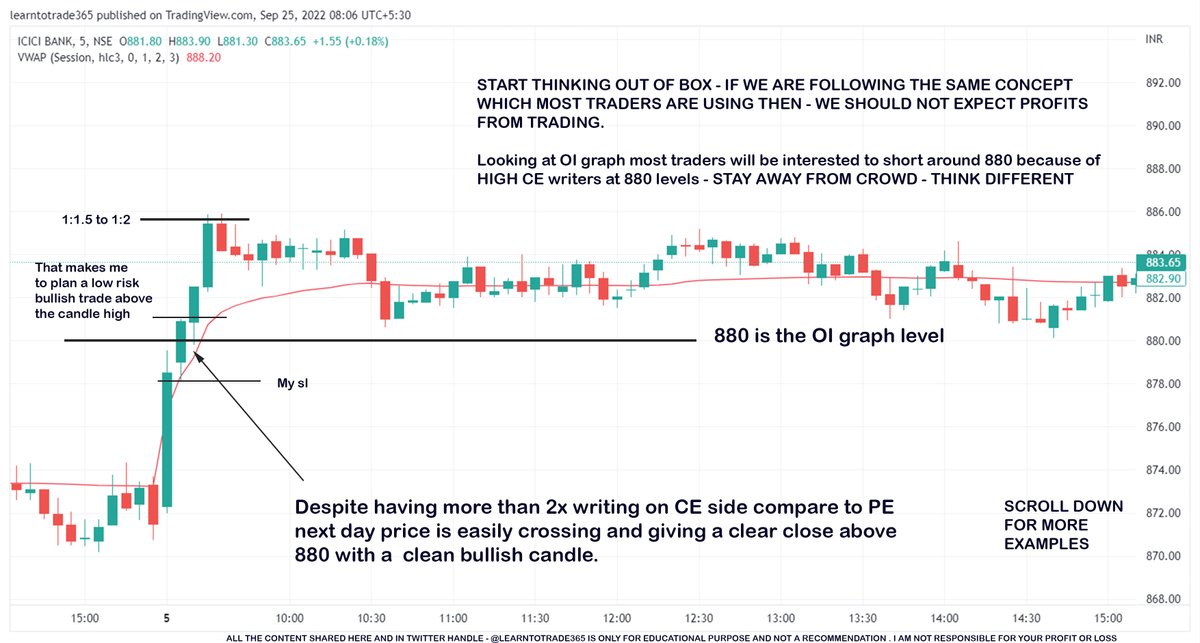

This is a EOD OI graph of ICICIBANK. Here i am trying to focus on strike price which has more than 2x OI comparing CE vs PE of individual strikes.

Below 880 strike CE vs PE in which 880 CE has 2x more OI (more writers) compare to 880 pe.

Read the message in the image

Scroll 👇

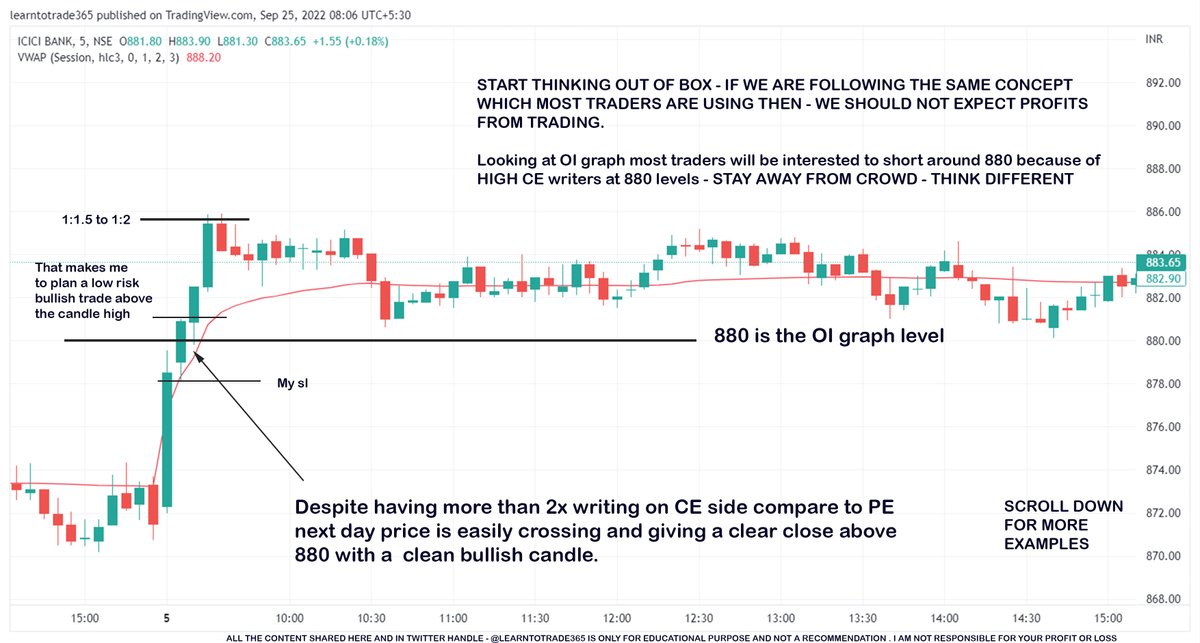

From the above OI graph of EOD 04/09 NOW refer the chart below of the same ICICIBANK for 05 sep

Main focus is not to take 880 levels as resistance just because of more CE OI. My focus if 880 is easily crossing and closing above it to open a bullish opportunity

Scroll👇

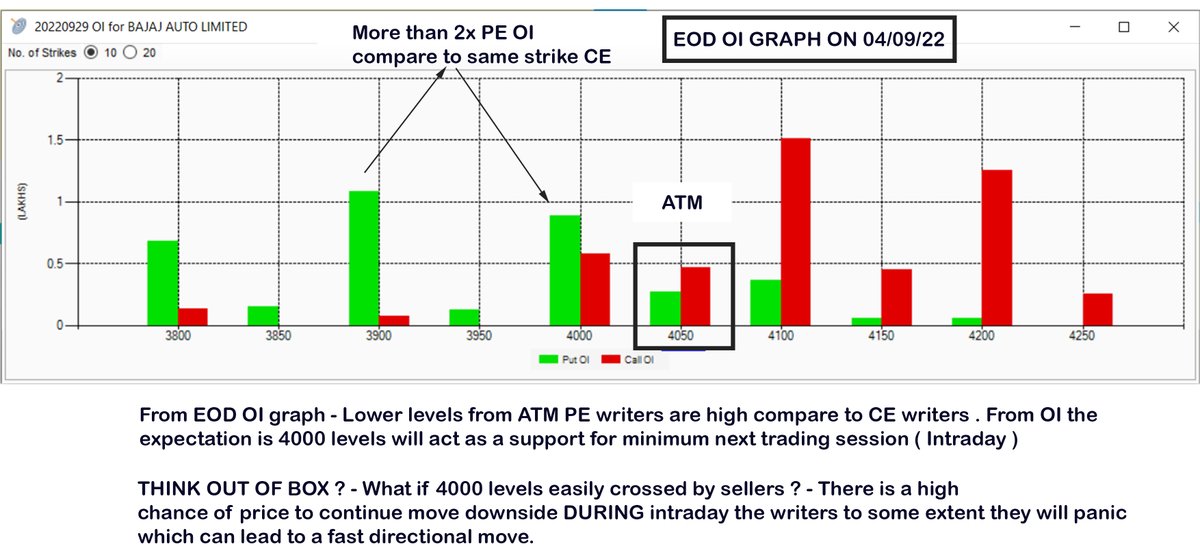

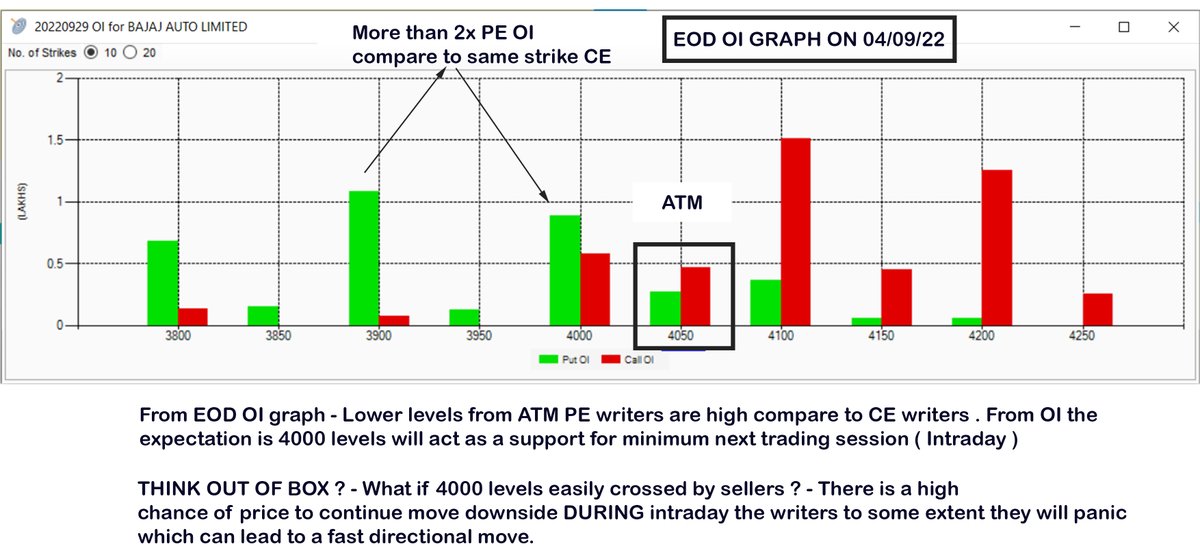

EOD OI graph of Bajaj Auto. Here i am trying to focus on strike price which has more than or equal 2x OI comparing CE vs PE of individual strikes.

Below 4000 strike CE vs PE in which 4000 PE has 2x more OI compare to 4000 CE.

Read the content in the below image

Scroll👇

Whether OI useful ?

No one has a exact answer. But one effective way to make use OI in a very different perspective - OUT OF THE BOX from Traditional method

Read the full thread 🧵

Kindly RETWEET & share so it can reach many traders

I do Live Market session every Monday to Friday by 09:00 a.m to 01:00 pm . Also i share important support /resistance levels of Banknifty & Nifty on the Telegram Channel. FOLLOW US @learntotrade365

Join the Telegram Channel - https://t.co/VU0bCGAX9s

Scroll down 👇

This is a EOD OI graph of ICICIBANK. Here i am trying to focus on strike price which has more than 2x OI comparing CE vs PE of individual strikes.

Below 880 strike CE vs PE in which 880 CE has 2x more OI (more writers) compare to 880 pe.

Read the message in the image

Scroll 👇

From the above OI graph of EOD 04/09 NOW refer the chart below of the same ICICIBANK for 05 sep

Main focus is not to take 880 levels as resistance just because of more CE OI. My focus if 880 is easily crossing and closing above it to open a bullish opportunity

Scroll👇

EOD OI graph of Bajaj Auto. Here i am trying to focus on strike price which has more than or equal 2x OI comparing CE vs PE of individual strikes.

Below 4000 strike CE vs PE in which 4000 PE has 2x more OI compare to 4000 CE.

Read the content in the below image

Scroll👇

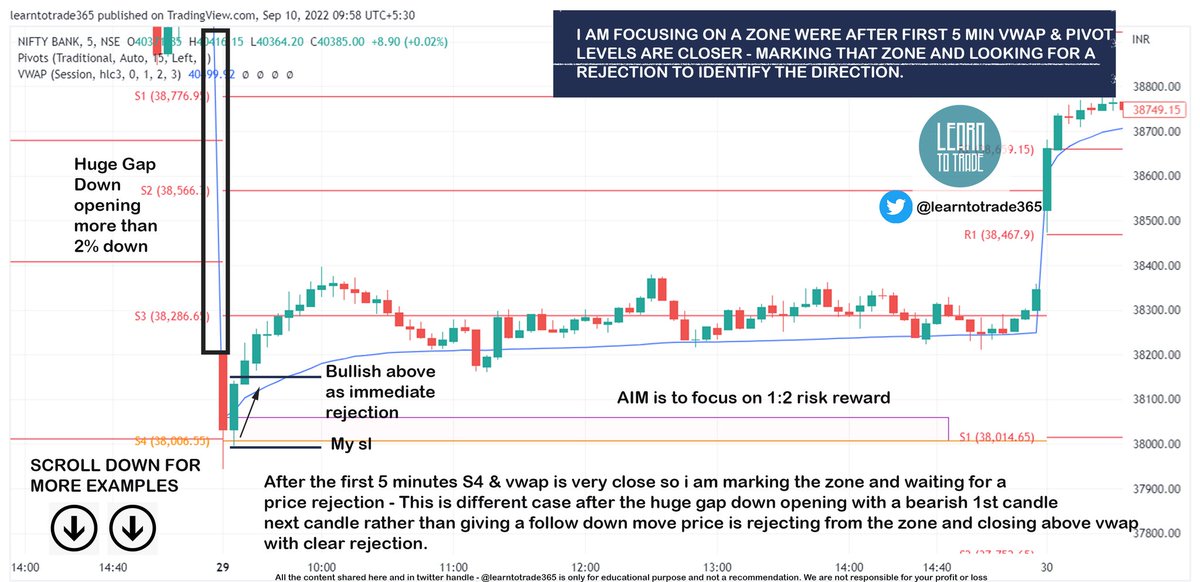

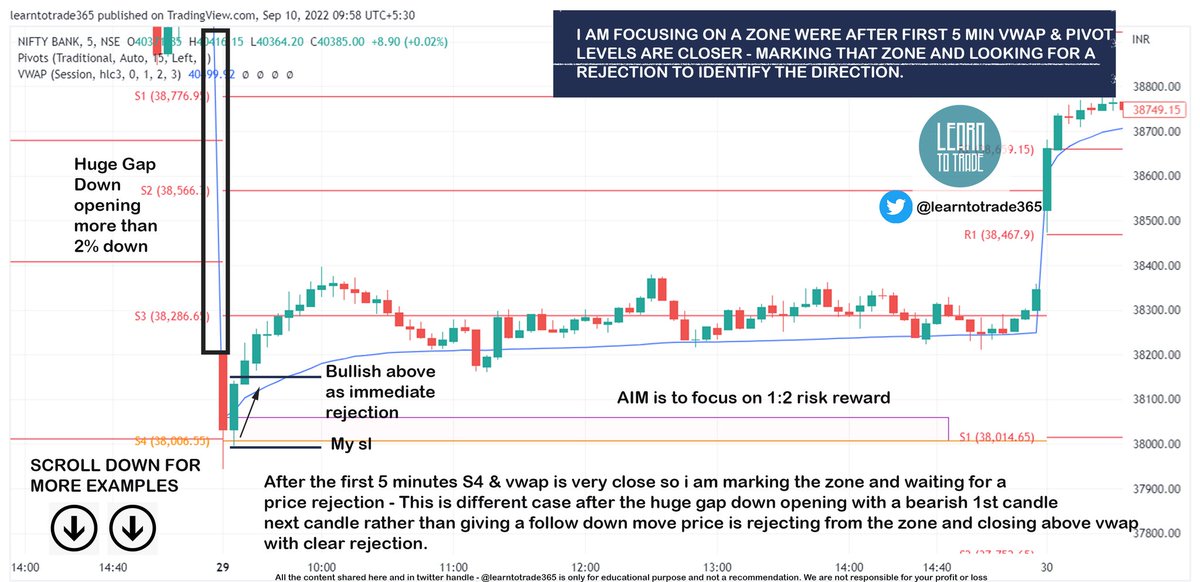

Vwap & Pivot Points - Trading Zones for intraday directional traders

Intraday Trading strategy for Trend followers 🧵

Support us by RETWEET this tweet to reach and benefit most traders so it can help them to gain knowledge

Scroll down 👇

I also do All Trading day Live Market session during Market hours from morning 9:00 a.m to 01:00 p.m - Follow me @learntotrade365

Join the Telegram channel for Live Market updates and live session immediate notification

https://t.co/VU0bCGjU7s

Scroll down for chart examples 👇

Make your Trading system very simple so your main aim is to focus on the price not on various indicators.

Scroll down for more examples 👇

Rather than chasing the price looking at candle colours start trading in a perspective of risk to reward based approach

Scroll down for more examples 👇

Try to understand what retail traders will do. Even in this below example after looking at more than 2% gap down many traders will not much think to plan a bullish trade but chart is showing Sellers are not making a Follow through downmove

Scroll down for more examples 👇

Intraday Trading strategy for Trend followers 🧵

Support us by RETWEET this tweet to reach and benefit most traders so it can help them to gain knowledge

Scroll down 👇

I also do All Trading day Live Market session during Market hours from morning 9:00 a.m to 01:00 p.m - Follow me @learntotrade365

Join the Telegram channel for Live Market updates and live session immediate notification

https://t.co/VU0bCGjU7s

Scroll down for chart examples 👇

Make your Trading system very simple so your main aim is to focus on the price not on various indicators.

Scroll down for more examples 👇

Rather than chasing the price looking at candle colours start trading in a perspective of risk to reward based approach

Scroll down for more examples 👇

Try to understand what retail traders will do. Even in this below example after looking at more than 2% gap down many traders will not much think to plan a bullish trade but chart is showing Sellers are not making a Follow through downmove

Scroll down for more examples 👇

More from Stoploss

Forgot to mention one point. How to trail profits in Breakout trades.

One of the best way that I know is ATR based trailing.

Here is an example https://t.co/BTATx5fyW6

One of the best way that I know is ATR based trailing.

Here is an example https://t.co/BTATx5fyW6

An example of ATR based TSL.

— Professor (@DillikiBiili) April 9, 2021

SL for coming candle is Low of the just completed candle - ATR of previous candle. Chart is self explanatory. https://t.co/D95iv4t5j6 pic.twitter.com/e8BkO2j5rn

You May Also Like

fascinated by this man, mario cortellucci, and his outsized influence on ontario and GTA politics. cortellucci, who lives in vaughan and ran as a far-right candidate for the italian senate back in 2018 - is a major ford donor...

his name might sound familiar because the new cortellucci vaughan hospital at mackenzie health, the one doug ford has been touting lately as a covid-centric facility, is named after him and his family

but his name also pops up in a LOT of other ford projects. for instance - he controls the long term lease on big parts of toronto's portlands... where doug ford once proposed building an nfl stadium and monorail... https://t.co/weOMJ51bVF

cortellucci, who is a developer, also owns a large chunk of the greenbelt. doug ford's desire to develop the greenbelt has been

and late last year he rolled back the mandate of conservation authorities there, prompting the resignations of several members of the greenbelt advisory

his name might sound familiar because the new cortellucci vaughan hospital at mackenzie health, the one doug ford has been touting lately as a covid-centric facility, is named after him and his family

but his name also pops up in a LOT of other ford projects. for instance - he controls the long term lease on big parts of toronto's portlands... where doug ford once proposed building an nfl stadium and monorail... https://t.co/weOMJ51bVF

cortellucci, who is a developer, also owns a large chunk of the greenbelt. doug ford's desire to develop the greenbelt has been

and late last year he rolled back the mandate of conservation authorities there, prompting the resignations of several members of the greenbelt advisory