2/4

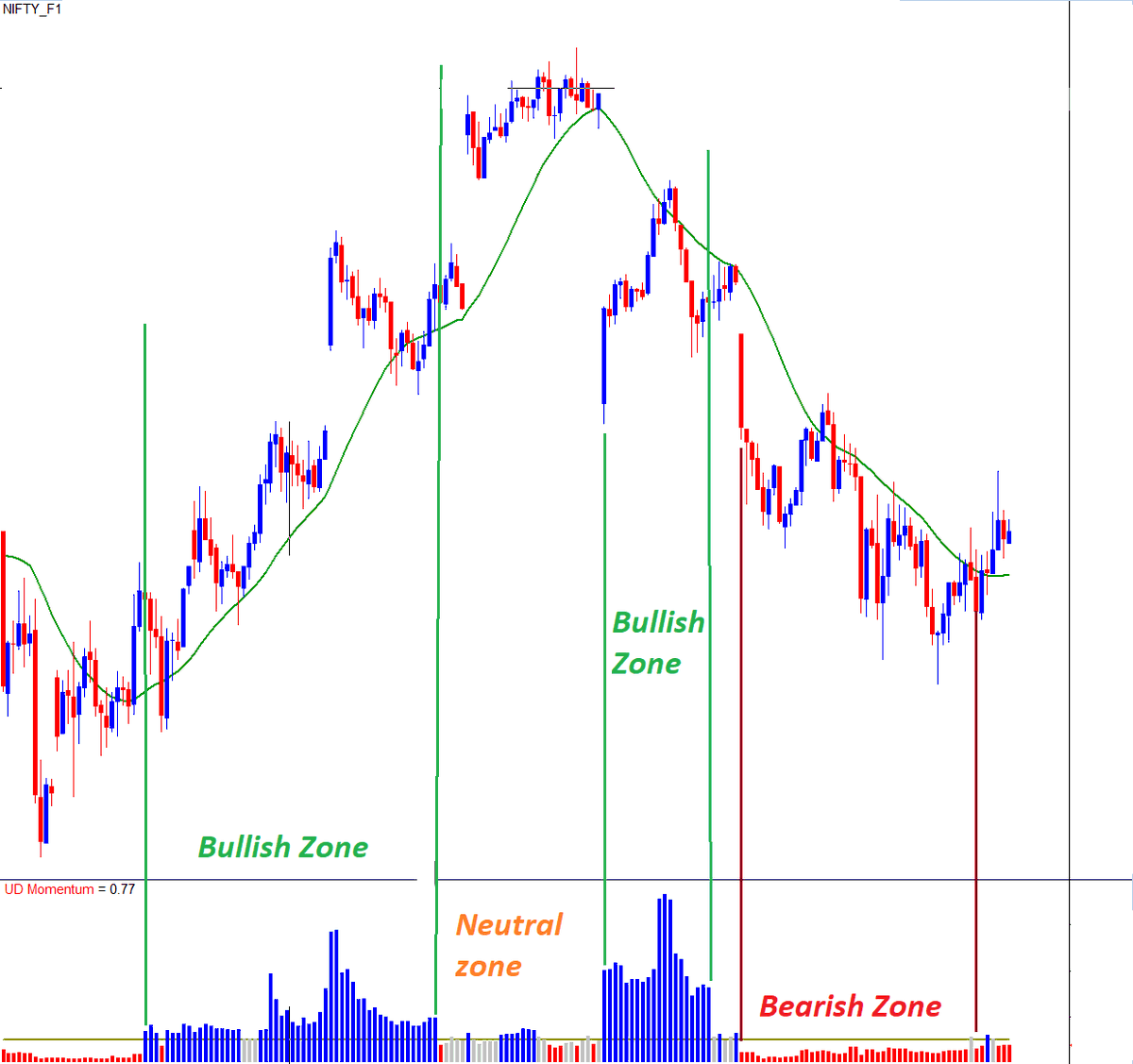

Before making ur trade entry or even before making a bias of trend as either bullish or bearish, do u use any objective measures to define the trend based on price, volume and momentum?

Price will always go back and forth move no matter how strong the trend is.

1/4

2/4

3/4

More from Aneesh Philomina Antony

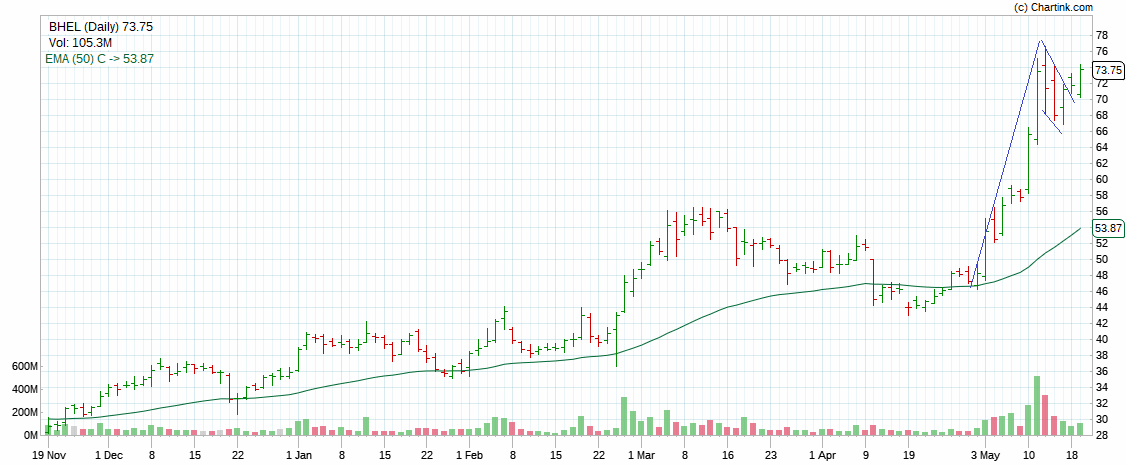

Parameters

1.Price structure - higher swing highs & swing lows

2. Momentum - doubled in last 250 days & trade close to recent highs

3. Demand - Higher volume on green bars

4. Volatility - Bigger bars on upside & shorter on downside

5. Relative strength - Outperforming market

1.Price structure - higher swing highs & swing lows

2. Momentum - doubled in last 250 days & trade close to recent highs

3. Demand - Higher volume on green bars

4. Volatility - Bigger bars on upside & shorter on downside

5. Relative strength - Outperforming market

Hello Aneesh, (1) apart from the volume supported HH-HL formation in ATH or 52 weeks high stocks, what other data point u see to shortlist scrip? (2) How do u estimate the holding period for the scrip? Plz guide

— Rohit Khanna\U0001f1ee\U0001f1f3 (@Rohit_MktWale) March 26, 2022

More from Stockslearnings

Crisp and wonderfully explained. Urge EVERYONE to read this 🙏🏻

Friends,

— Pankaj DP (@voPAtrader) May 8, 2021

I am planning to write Stock mkt related thread (/writeup) on..

WHY STUFF WORK?

E.g. Why prior Support acts as Resistance?

If u have such questions related to Data/ TA, DM me. If possible, I shall incorporate reasoning for that as well.....#learning #stocks

You May Also Like

“We don’t negotiate salaries” is a negotiation tactic.

Always. No, your company is not an exception.

A tactic I don’t appreciate at all because of how unfairly it penalizes low-leverage, junior employees, and those loyal enough not to question it, but that’s negotiation for you after all. Weaponized information asymmetry.

Listen to Aditya

And by the way, you should never be worried that an offer would be withdrawn if you politely negotiate.

I have seen this happen *extremely* rarely, mostly to women, and anyway is a giant red flag. It suggests you probably didn’t want to work there.

You wish there was no negotiating so it would all be more fair? I feel you, but it’s not happening.

Instead, negotiate hard, use your privilege, and then go and share numbers with your underrepresented and underpaid colleagues. […]

Always. No, your company is not an exception.

A tactic I don’t appreciate at all because of how unfairly it penalizes low-leverage, junior employees, and those loyal enough not to question it, but that’s negotiation for you after all. Weaponized information asymmetry.

Listen to Aditya

"we don't negotiate salaries" really means "we'd prefer to negotiate massive signing bonuses and equity grants, but we'll negotiate salary if you REALLY insist" https://t.co/80k7nWAMoK

— Aditya Mukerjee, the Otterrific \U0001f3f3\ufe0f\u200d\U0001f308 (@chimeracoder) December 4, 2018

And by the way, you should never be worried that an offer would be withdrawn if you politely negotiate.

I have seen this happen *extremely* rarely, mostly to women, and anyway is a giant red flag. It suggests you probably didn’t want to work there.

You wish there was no negotiating so it would all be more fair? I feel you, but it’s not happening.

Instead, negotiate hard, use your privilege, and then go and share numbers with your underrepresented and underpaid colleagues. […]