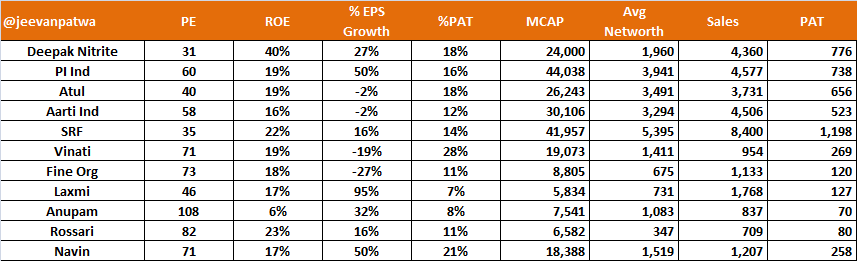

Imagine what you want in a company, codify it in the form of filters, create a screen. Example below:

A lot of people ask: how do you find companies to invest in? very good question.

How did you find RACL, Pix?

Creating this ad-hoc thread to share my process.

if you like it, please RT to benefit maximum investors. 🙏

Imagine what you want in a company, codify it in the form of filters, create a screen. Example below:

AND

Market Capitalization < 3000

AND

((Average return on capital employed 5Years > 25 AND

Price to Earning < 20) OR

(Average return on capital employed 5Years > 15 AND

Price to Earning < 10))

AND

Sales growth 5Years > 10

AND

...

Operating cash flow 5years /5 < Operating cash flow 3years /3

AND

Operating cash flow 7years /7 < Operating cash flow 3years /3"

smallcaps with a min mcap,

which have a bare minimum average ROCE & valuation accordance to the unit economics

which are also growing topline

and where operating cash flows are also increasing, on an average basis

One first needs to have a thought about what one is looking for, then one can codify it in screener. Another type of cos i look for are turn-arounds.

AND

(short term sales growth > 7 OR medium term sales growth > 7)

AND

(short term opm growth > 10 OR medium term opm growth > 10)

AND

Market Capitalization < 2000

AND

medium term ocf profit ratio > 0.3

AND

ROIC > 12

2. looking through PF of & tracking super-investors.

For funds/people with sizable PF sizes like @LuckyInvest_AK sir & @SunilBSinghania sir

I track trendlyne portfolios to generate ideas.

1. Study https://t.co/3jeqlXO0QH thread for the company

2. Study company's conference calls, investor presentations

3. Study industry structure through industry reports, webinars on YT

4. Study company's annual report

6. Estimate future growth rates for industry and company's competitive positioning

7. Assign a fair value range for the company

(i) there is significant discount to fair value

& (ii) significant sales & profit growth visibility & triggers

& (iii) Sources of durable competitive advantages which act as the 'moat' around the profit growth and market shares.

More from Sahil Sharma

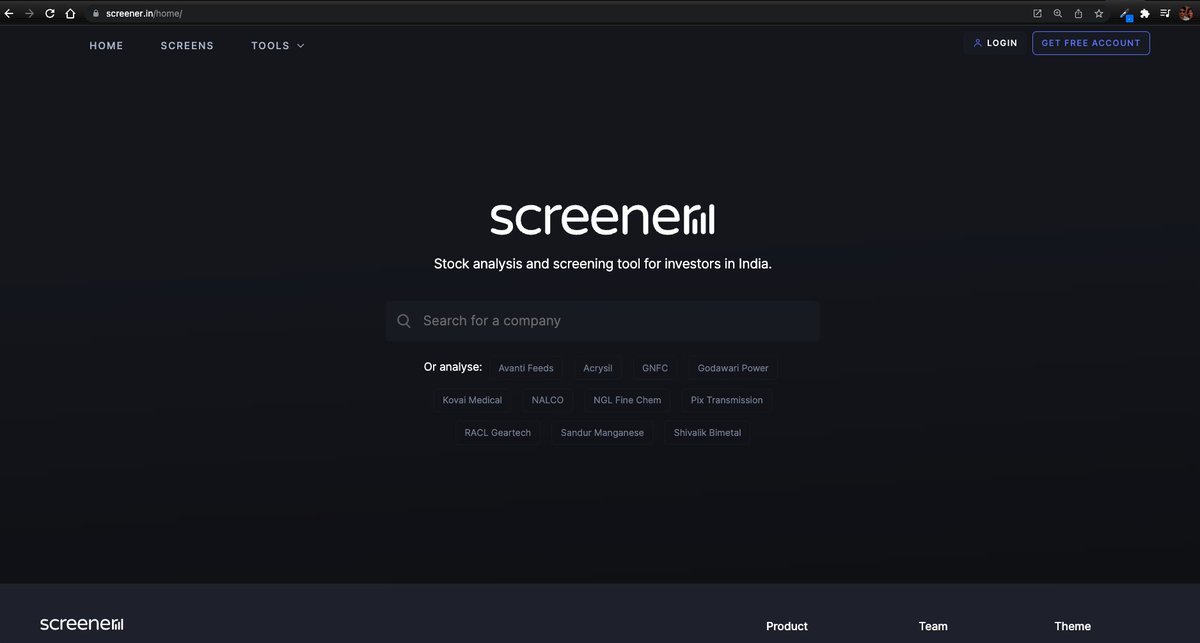

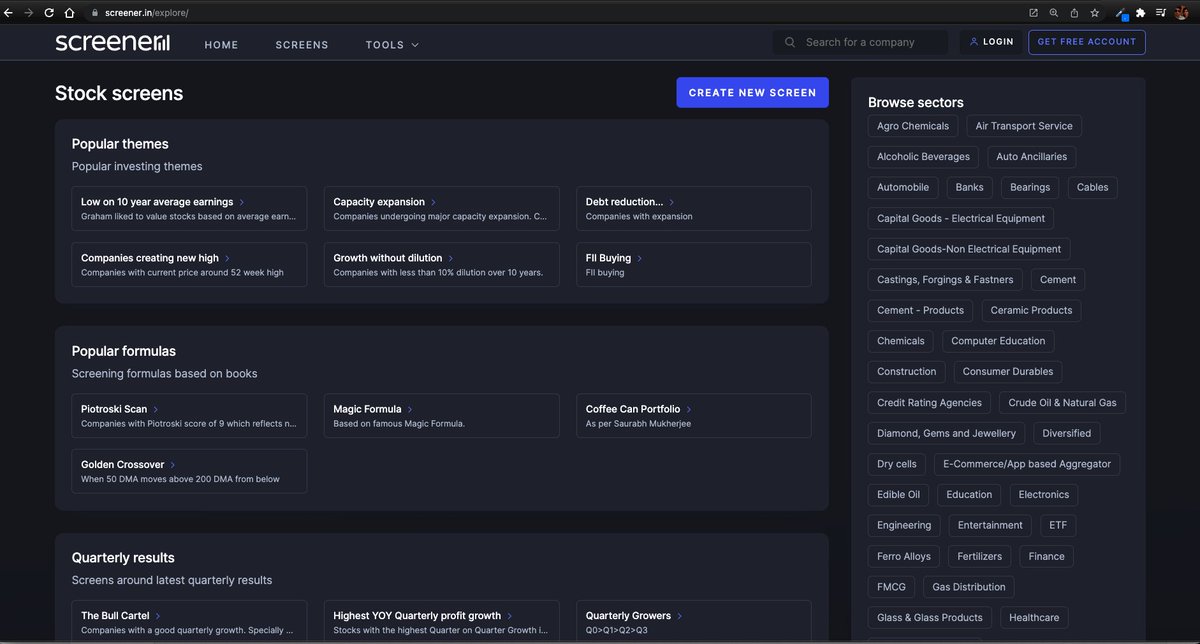

Step-by-step: how to use (the free) @screener_in to generate investment ideas.

Do retweet if you find it useful to benefit max investors. 🙏🙏

Ready or not, 🧵🧵⤵️

I will use the free screener version so that everyone can follow along.

Outline

1. Stepwise Guide

2. Practical Example: CoffeeCan Companies

3. Practical Example: Smallcap Consistent compounders

4. Practical Example: Smallcap turnaround

5. Key Takeaway

1. Stepwise Guide

Step1

Go to https://t.co/jtOL2Bpoys

Step2

Go to "SCREENS" tab

Step3

Go to "CREATE NEW SCREEN"

At this point you need to register. No charges. I did that with my brother's email id. This is what you see after that.

More from Stocks

Prashant Sir has a spectacular ability to simplify complex topics and put them in Twitter threads.

📊 This is a must-read for every trader.

I scraped his entire tweet library - here are some of my faves.

THREAD 🧵 👇

1/7

Bollinger

Thread: Bollinger Bands

— Prashant Shah (@Prashantshah267) August 22, 2020

Bollinger Bands\xae is a wonderful invention of John Bollinger. #Bollingerbands #Indicators #Definedge pic.twitter.com/UREE7eedxh

2/7

Donchian

Thread: Donchian Channels

— Prashant Shah (@Prashantshah267) August 8, 2020

Donchian channels were invented by Richard Donchian. He is known as a father of trend following trading. He was founder of world\u2019s first managed fund in 1949. #donchianchannels #indicators #definedge pic.twitter.com/IaTcGedIbR

3/7

Darvas

Thread: Darvas Box Theory#Darvas #knowledgesharing #Definedge pic.twitter.com/xYRrlkjDrm

— Prashant Shah (@Prashantshah267) July 17, 2020

4/7

Money Flow Index or

Thread: MFI Indicator

— Prashant Shah (@Prashantshah267) July 24, 2020

Created by Gene Quong and Avrum Soudack, MFI stands for Money Flow Index. #MFI #Indicators #Definedge pic.twitter.com/zZPU4SUuEu

You May Also Like

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹