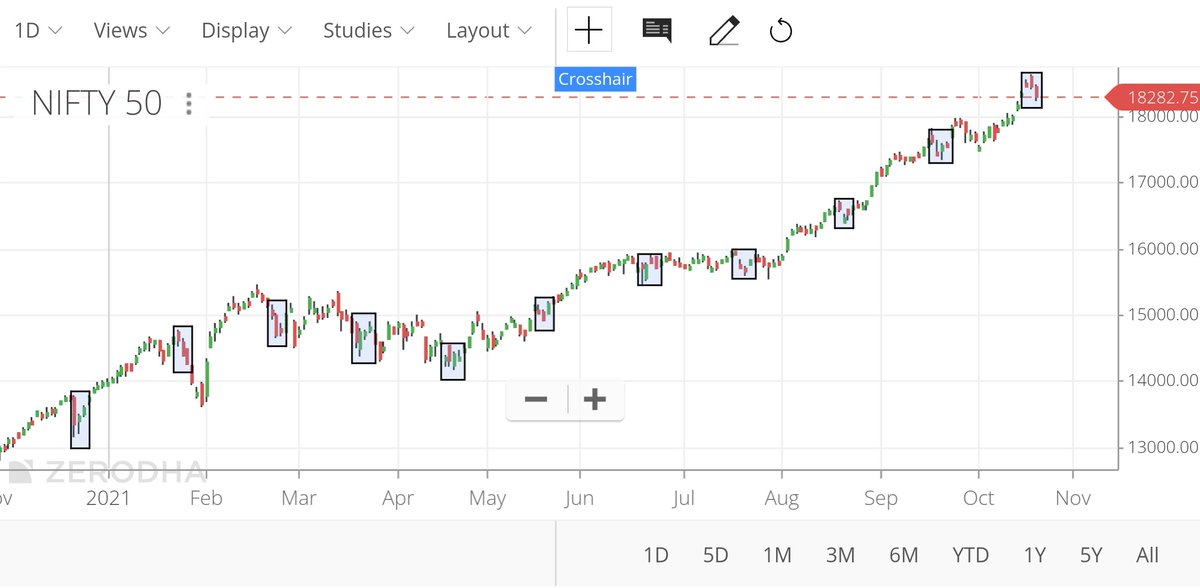

Same pattern was in #Tisco.

Chart pattern & trades taken attached.

This is how i approach trades when i trade directional through option sell. https://t.co/HaMtxbHmOm

Filter stocks which hits 52 week high/ATH after 1-2 months of consolidation.

— Pathik (@Pathik_Trader) April 1, 2021

More from Pathik

More from Stocklearnings

An inverse occurrence is about to witness failure, awaiting for its impact .

#CandleTrading tag would help you understand more of some of these ancient yet effective techniques...

#CandleTrading : #Bullish #Belthold#Pattern #Psychology :Pattern importance could be traced back to the traditional #Japanese sport of \u2018Sumo #wrestling'. The importance of \u2018Mawashi ( Wrestlers Belt) \u2019 & its tactical move for gripping the opponent to throwing him off the ring. pic.twitter.com/lN60xad6Ma

— Sacchitanand Uttekar (@Sacchitananad) August 16, 2020

Have compiled his:

1. Expiry day trading.

2. Trade logics.

3. Multiple Charts analysis.

3. BTST criteria for stocks.

Share if you find it helpful so that everyone can benefit.

A pdf of his moneycontrol article where you can read about his journey and how he trades.

— Harsh (@HarshAsserts) September 11, 2020

Advice on how to not let your mood influence your decisions.

When trading,moods will want to influence ur decisions

— Banknifty Addict (Gaurav) (@BankniftyA) December 29, 2019

How to minimize:

-Have a backtested plan/system

-Know yourself(emotion and panic levels)

So trade size is important to keep ur emotions in check

-dont focus too much on pnl

-have a back up plan ready

& last stay positive!!

Expiry day Trading:

How to become better?

When I had spoken to him on phone he advised me to backtest all expiries and rigorously practice them again and again to develop conviction. Superb advice!

Backtest the complete expiry and practice again and again till u develop conviction

— Banknifty Addict (Gaurav) (@BankniftyA) November 5, 2020

Acts based on support and resistance levels from charts

Support and resistance levels based on technical charts on various time frames.

— Banknifty Addict (Gaurav) (@BankniftyA) December 19, 2019

Breaking any of the above, leads to a direction

and then only directional play.