Spend a couple of hours on this 👇!

The bet is on Mr. Yugal Sikri turning the trajectory of the business completely, what a legend he's been in the domestic pharma industry!

https://t.co/HDarniLCTH

More from Saket Reddy

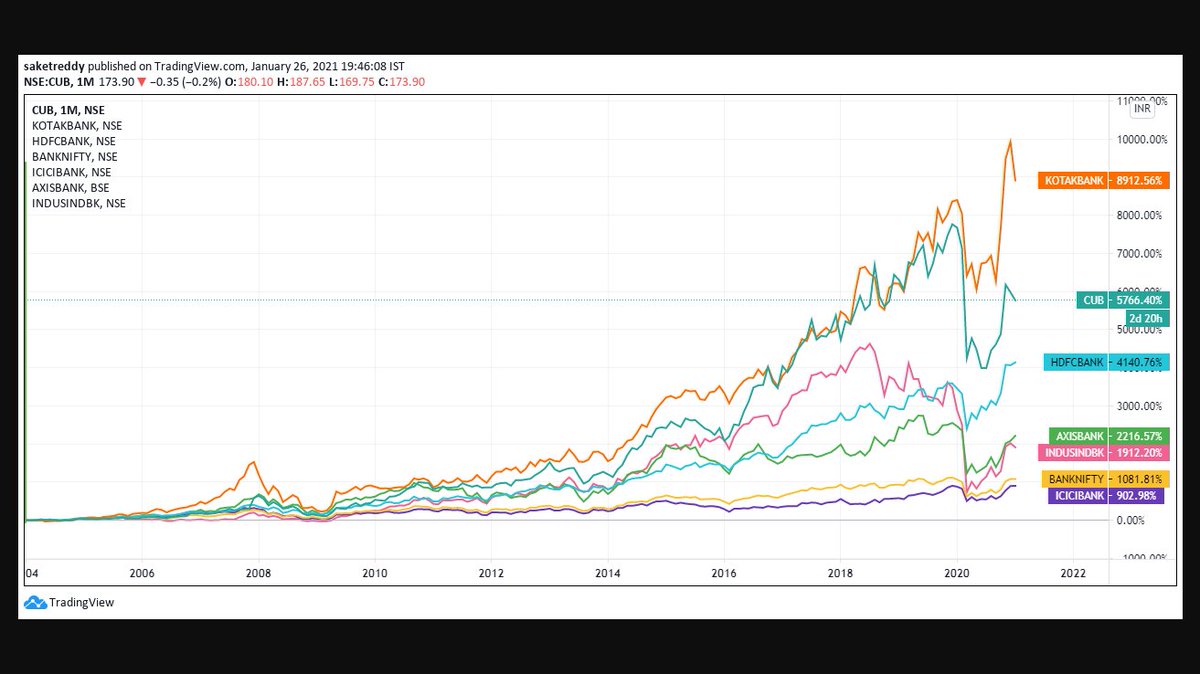

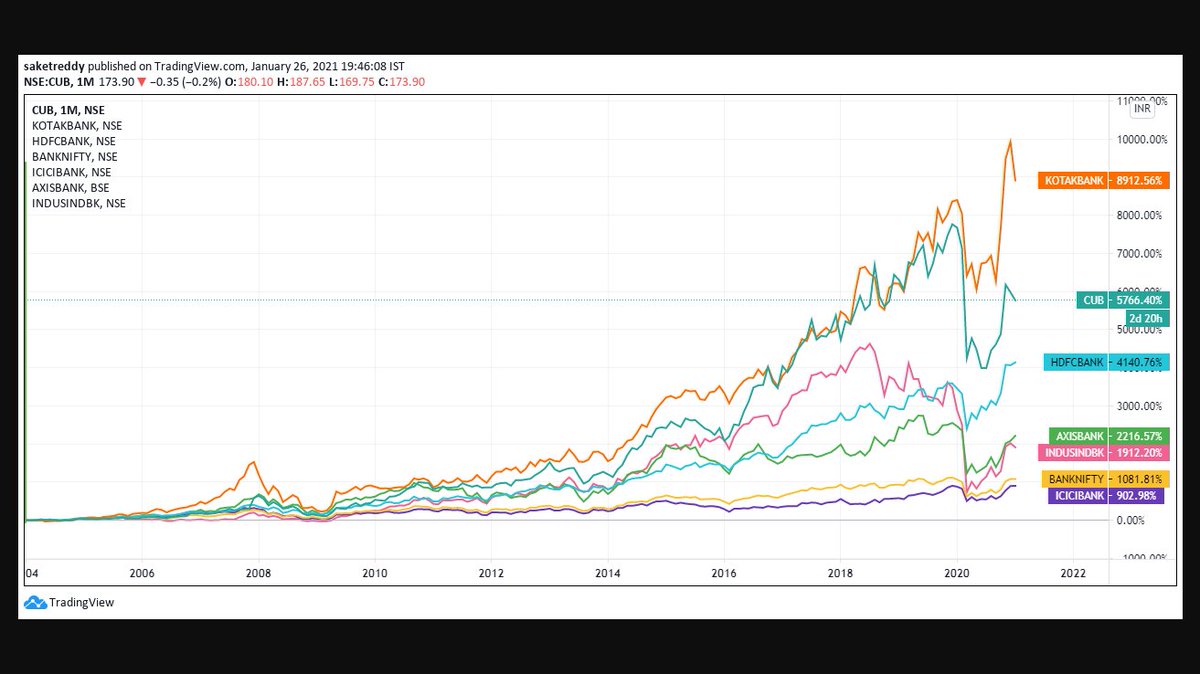

While people were debating figuring out which is the best in ICICI/AXIS & INDUSINDBNK, look what the top 3 high quality banks (HDFCBANK, KOTAKBANK & CUB) have done over the last 5, 10 & 17 years.

They are the real compounders, they've created massive wealth compared to others! https://t.co/PluVwU5OXG

They are the real compounders, they've created massive wealth compared to others! https://t.co/PluVwU5OXG

Hope Everyone saw BANDHANBNK Numbers. I feel many such banks will go through a massive NPA Cycle followed by depleted Tier 1.

— Saket Reddy (@saketreddy) January 24, 2021

Hence, stay with the Top 3 banks :-

HDFCBANK

KOTAKBANK

CUB

They've low cost of funding, well provisioned Moratorium book, high ROEs & high Tier 1 CAR.

Domestic MDF market size is pegged at 2500Cr currently & is

expected to grow at 15% CAGR over the next 3 years (organised players to grow even faster).

The industry further has potential to capture incremental opportunity of 4500-5000Cr low-end plywood market. https://t.co/Cre3xVUNqu

GREENPANEL had 1,400 dealers (retail business) as of FY21 and added 250 dealers in 6MFY22. Target to

increase this to 2,200 by FY23.

The industry further has potential to capture incremental opportunity of 4500-5000Cr low-end plywood market. https://t.co/Cre3xVUNqu

GREENPANEL would grow earnings at 15-20% CAGR over the next 3-5 years with ROCE & Margin expansion once they commision the de-bottlenecked capacity in FY22 and the brownfield AP CAPEX in FY23/FY24.

— Saket Reddy (@saketreddy) October 14, 2021

Huge runway for growth, industry structure (both MDF & RE) turned for the good! https://t.co/jFTZCwhNMS

GREENPANEL had 1,400 dealers (retail business) as of FY21 and added 250 dealers in 6MFY22. Target to

increase this to 2,200 by FY23.