https://t.co/4eauUKUp5N

2/

Today, @EFF published "Privacy Without Monopoly: Data Protection and Interoperability," a major new paper by Bennett Cyphers and me. https://t.co/Ma2FE2vZ9u

— Cory Doctorow #BLM (@doctorow) February 13, 2021

1/ pic.twitter.com/RzCkQdQRxy

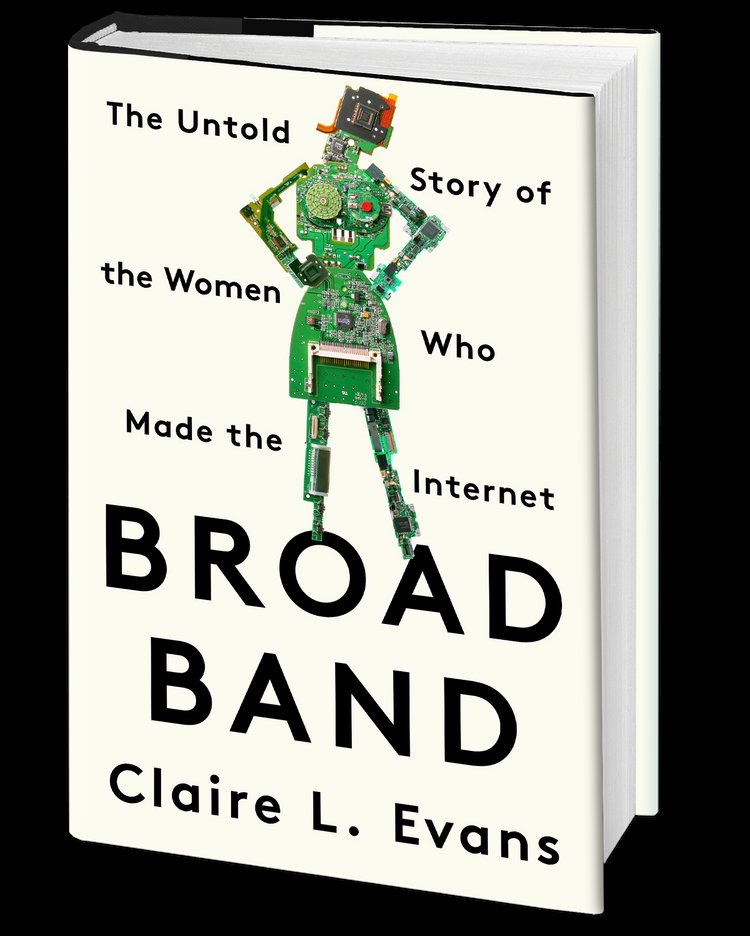

One of the most Monkey's Paw things about my life is my relationship to books. When I was a teenager, I read all the way through the school and public libraries, spent everything I had on books, and still couldn't get enough and dreamt of more.

— Cory Doctorow #BLM (@doctorow) February 13, 2021

1/ pic.twitter.com/Lgkdk5a7YA

Inequality requires narrative stabilizers. When you have too little and someone else has more than they can possibly use, simple logic dictates that you should take what they have.

— Cory Doctorow #BLM (@doctorow) February 13, 2021

1/ pic.twitter.com/BUFyq9H2n4

One thing I've been noticing about responses to today's column is that many people still don't get how strong the forces behind regional divergence are, and how hard to reverse 1/ https://t.co/Ft2aH1NcQt

— Paul Krugman (@paulkrugman) November 20, 2018

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

1/\u201cWhat would need to be true for you to\u2026.X\u201d

— Erik Torenberg (@eriktorenberg) December 4, 2018

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody: https://t.co/Yo6jHbSit9