Categories Screeners

Simple: When 13 moves above 21 in "15 Minute t/f for Intraday only", BUY

When 13 moves below 21 in "15 Minute t/f for Intraday only", SELL as in a SAR system

Master just one doubt about the re-entry part

— Sunny Singh (@SurendraSinghJi) February 10, 2022

You mentioned to re-enter at 17430 levels.

How to initiate the trade at the lowest point when the candle is in the formation mode.

Is it that when the price touches 21ma we should entry longs till 13ma is above 21ma.

Show path \U0001f64f

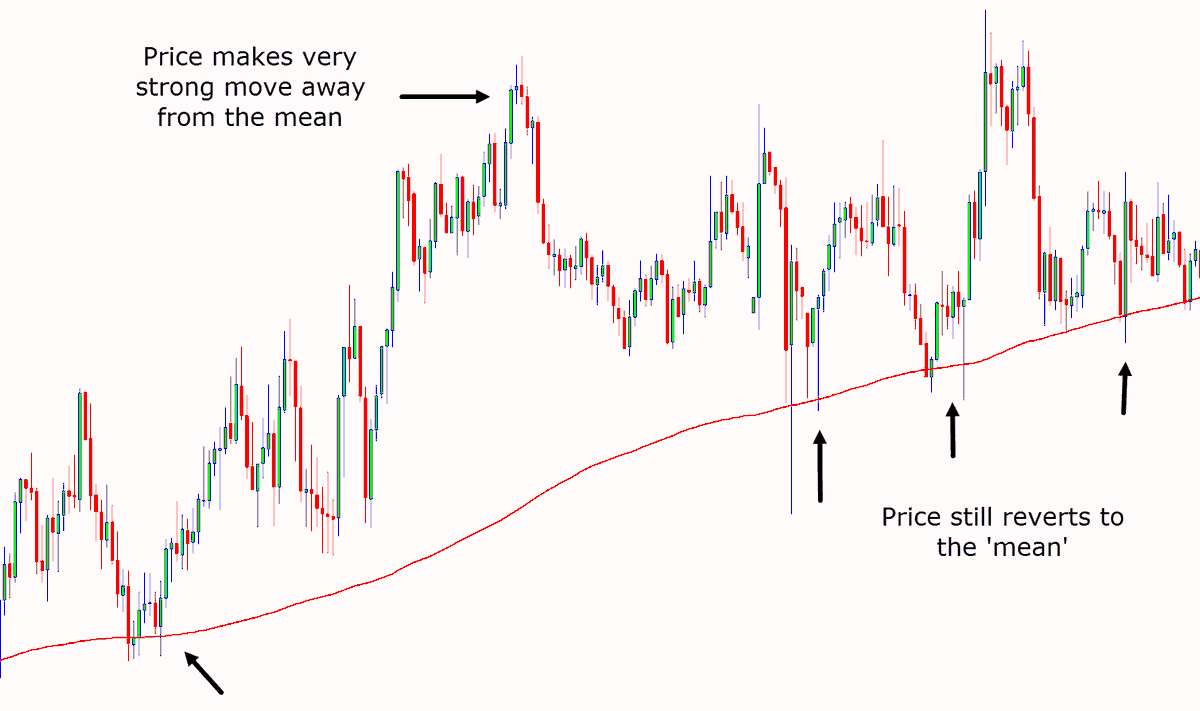

Addl.strategy: When prices move far from MA, say 150 to 200 pts, "Part book" & re-enter when prices pull back to MA

Choose to do this way 1 or 2 times only for intraday

Idea is "Mean Reversion" - Prices tend to move back to MA IF they move far away from MA in a trending phase.🙏

This is Nifty's chart from 2004 to 2006. Back then also US interest rates had gone up. Markets had corrected well before Fed had hiked rates for first time in 2004, from then it hiked rates 17 times by 4.25% over next 2 yrs and yet market kept making new highs. @shivaji_1983 pic.twitter.com/EAFhske9EE

— Sandeep Kulkarni (@moneyworks4u_fa) February 11, 2022

See Large OIl buildup kin strikes par hai and in between strikes data kaise move ho raha hai.

Thumb Rule:

Calls Reduction + Puts addition = Upthrust

Calls Addition + Put Reduction = Down move

Higher the Delta OI velocity, faster is the move.

For Nifty Intraday Traders: As of now, this seems to be a buy on dip market and looks like there won't be any juicy trades on short side. Will update if data changes. https://t.co/PCIyyPld4A pic.twitter.com/ES3o4z60rY

— Professor (@DillikiBiili) March 11, 2022

0/ Tomorrow I am posting a thread on how you can make such a weekly trading plan for yourself.

Will be using this thread as an example at the end of that thread tomorrow.

Anyways, let's begin!

1/ October 2nd Week

#BANKNIFTY

— Nikita Poojary (@niki_poojary) October 10, 2021

Outlook for the week Oct 11 - Oct 14, 2021

Compiled here\U0001f447

2/ October 3rd

#BANKNIFTY

— Nikita Poojary (@niki_poojary) October 17, 2021

Outlook for the week Oct 18 - Oct 21, 2021

Clear BO on the Weekly TF

1/4 pic.twitter.com/oh7F1AEsH7

3/ November 1st

#BANKNIFTY

— Nikita Poojary (@niki_poojary) October 31, 2021

Outlook for the truncated week Nov 1- Nov 3, 2021

On a higher TF structure has changed to -ve, bounces would be utilized as a selling opportunity

However this is the first selling so first pullback can be expected

Detailed explanation on the charts pic.twitter.com/7UxQBZ3QFq

A Simple 8 pager guide!

Retweet to get the guide in DM

Learn

What is VWAP

How to use Vwap for trading.

VWAP Patters.

How to use VWAP on Options Chart

How to use Vwap on Straddle Chart

Retweet and i will send you link in DM

@yogeshnanda1

Here is pdf in case someone doesn't want to Retweet

The Simple Guide to Volume Weighted Average Price

Click here to download :

https://t.co/3Plrm2duyY

Share with friends if you like it.

Retweet

OR, it just moves between 13 & 21 & move higher

Channel bottom comes around "17300"- no guarantee that every time it touches the channel bottom

Patience pays

IF you miss a trade, wait for the next

They always come🙂🙏 https://t.co/CfVFhgbFxl

Is it better to buy when price below ema 21 ?\u2026 as SL will be less

— TaksJ (@TaksJoh) February 16, 2022

Use 3Bar High on weekly candle to invest with stop at 3Bar Low.. 👇

One of the fairly easy and convenient method for investing is 3 Bar High/Low method on weekly candles.

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) March 26, 2021

Buy when stock price goes above High of previous 3 bars, continue till trend continues week after week, and sell out when Price goes below Low of previous 3 bars. pic.twitter.com/nnVCbMi84C

I posts chart when some set up is formed completely and is tradable.

My prefered entry method is to go long abv previous day high,

SL preferably below (considering volatility) recent swing low

&

Target is Resistance levels or 5X/7X/10X

It's great that you provide such analyses free of cost but please also be clear about what should be next course of action - not advice or recommendation but just your own view. Your views on entry, sl and possible targets. That would make an amazing post

— Preeti (@PreetiStock1988) November 16, 2021