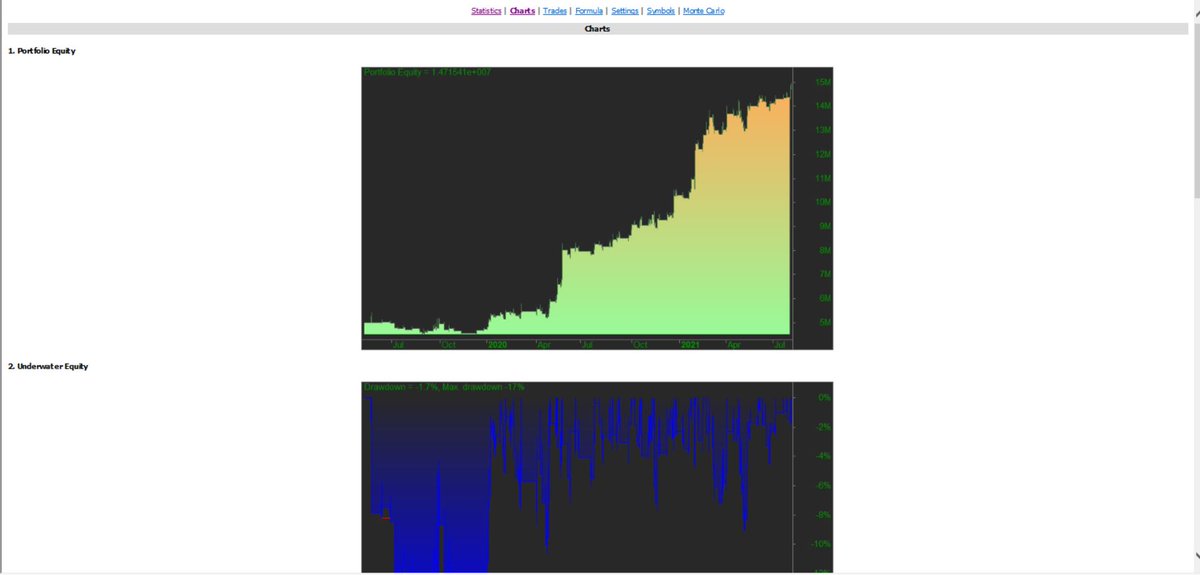

What is #Trendindicator ?

Technical Analysis with "Macd"

Do back test on index & stocks in #Tradingview chart using MACD, how your trading positions would have been on the right side!

https://t.co/I2n6qX4TL2

Spend just 15-30 minutes to learn a skill

with 100% focus & attention

More from Van Ilango (JustNifty)

Read about "#Bollingerbandstartegy" here.

Read again till you understand the logic fully of a "Moving avg (13Sma) & its upper & lower band" mechanism and then,

Apply on charts of your short listed stocks and understand how the trades/ investments would have worked -back testing

Read again till you understand the logic fully of a "Moving avg (13Sma) & its upper & lower band" mechanism and then,

Apply on charts of your short listed stocks and understand how the trades/ investments would have worked -back testing

Bollinger band has been a trusted guide with the settings of 13sma & 2 std deviation. Add to it 5 & 8 smas and it works in all time frames.

— Van Ilango (JustNifty) (@JustNifty) September 29, 2020

Start from week & Day for investments; Hour & 5 minute for intraday.

Experiment initially; you'll still need other tools to read the mkt\U0001f600\U0001f64f pic.twitter.com/yEkHiDHiha

When trending, especially above #movingaverage, ignore this behaviour of #MACD .

I use MACD for reversal points only.

Do not follow it at every 5 minute.

I use MACD for reversal points only.

Do not follow it at every 5 minute.

Yesterday and today both we had MACD divergence . Yet market was just continuing in the opposite direction . Can you please what to do in such case ? . For eg - today I was unable to go long because there was divergence . Same case was for yesterday . Can you please guide .\U0001f64f pic.twitter.com/vfqy8dRAU2

— Mehul (@MehulGarodia9) May 20, 2022