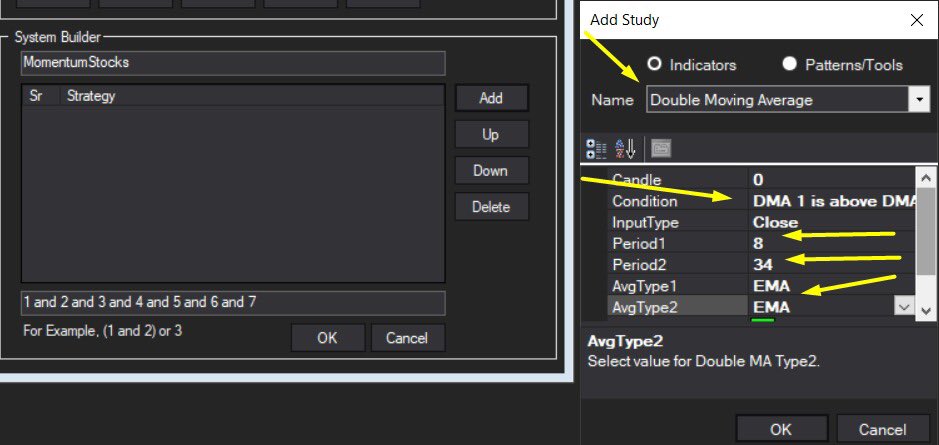

5 Moving Averages Use Cases

Moving avarages rules pic.twitter.com/jgaCEzFOxw

— True market leader (@TmarketL) May 6, 2022

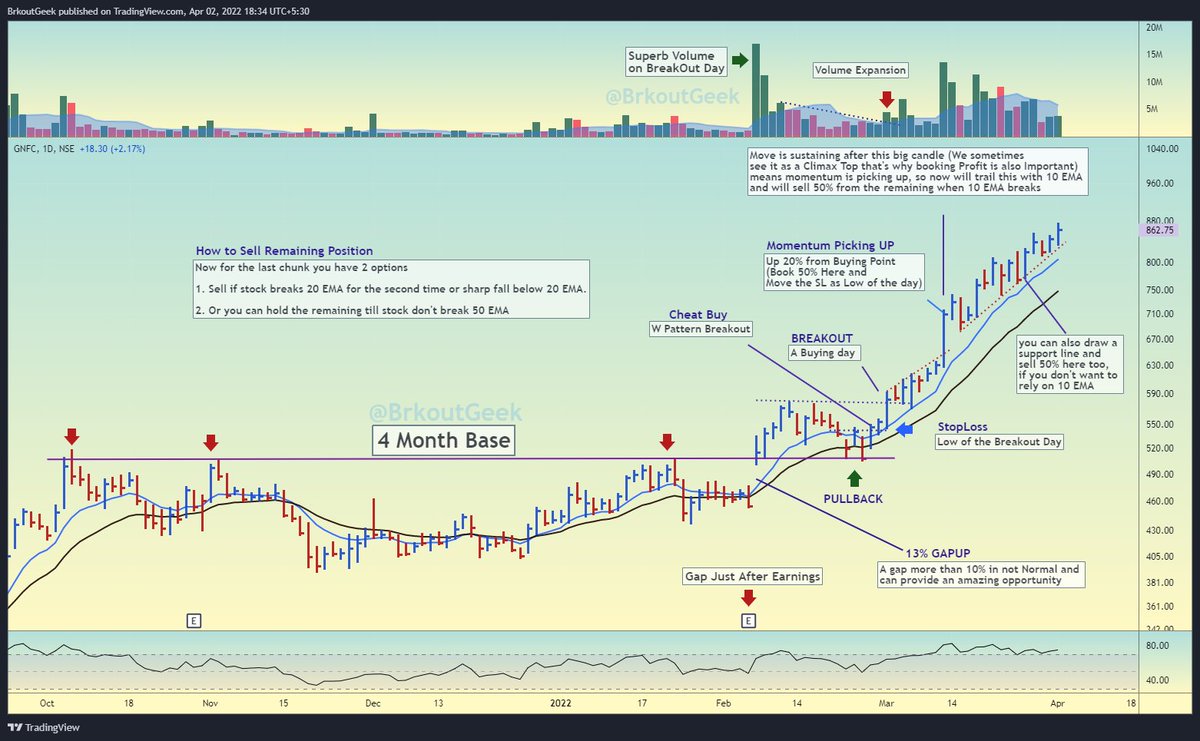

More from 𝙱𝚛𝚔𝚘𝚞𝚝𝙶𝚎𝚎𝚔📈

More from Screeners

Most of the indices are entering oversold territories

Take small cap index for example

Whenever Monthly RSI is below or around 40, the index bottoms out

We are getting there.

If I had 50% cash, I would have deployed some in beaten down stocks where earnings growth is intact. https://t.co/t5WwgH1V5o

Take small cap index for example

Whenever Monthly RSI is below or around 40, the index bottoms out

We are getting there.

If I had 50% cash, I would have deployed some in beaten down stocks where earnings growth is intact. https://t.co/t5WwgH1V5o

I have more than 50% cash but still worried if this is a good time. Will invest 20% by EoY

— Tamil Metaverse (@TamilMetaverse) June 21, 2022