We don't know for how long the market will be choppy - could be a few days, 2 months, 6 months or a year. (2/18)

While trading in stocks, how do you survive in a choppy market and make profits? Here's how I do it 🧵

Choppy markets are difficult to trade. When there's an uptrend like it was in mid-2020 and 2021, it's easy to find out stocks in different ways. (1/18)

We don't know for how long the market will be choppy - could be a few days, 2 months, 6 months or a year. (2/18)

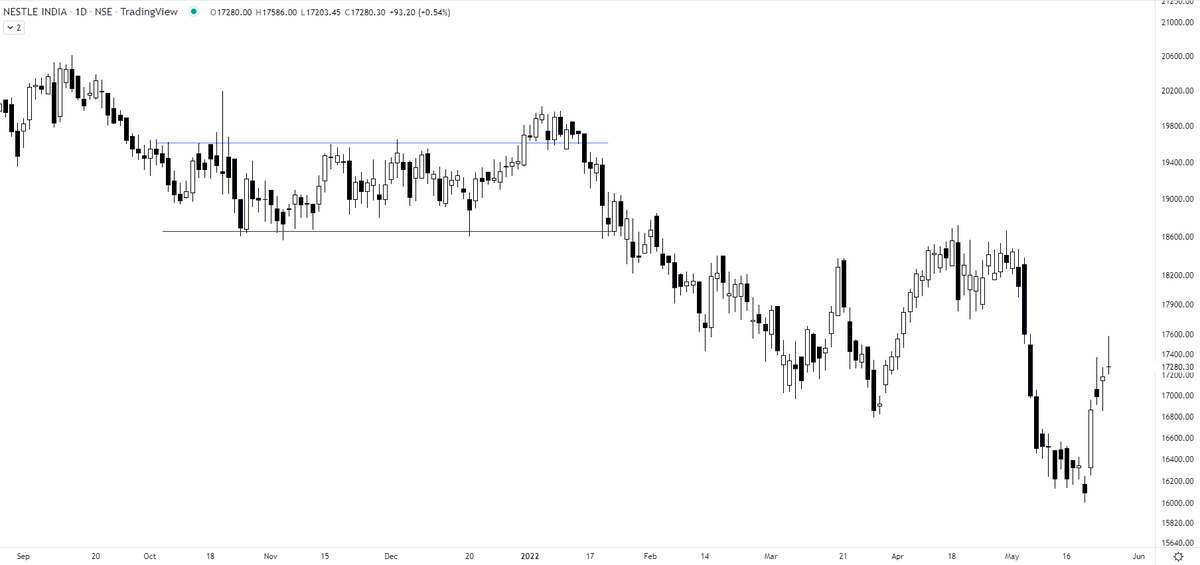

After a clear uptrend, market changes the trend and sometimes goes sideways/consolidate for the time being. (3/18)

Method One:

When Nifty and small-cap/midcap Index comes at major support keep a watchlist ready. (4/18)

(Read prev. Swing Trading thread)(6/18)

(Have written about it in the previous thread and my personal favourite)

If there is any major reason behind changing trend or the sudden fall, we have to figure out what sector can benefit from that reason. (7/18)

This time, Russia Ukraine war had directly affected 2-3 sectors - Metals, Chemicals and Energy. (8/18)

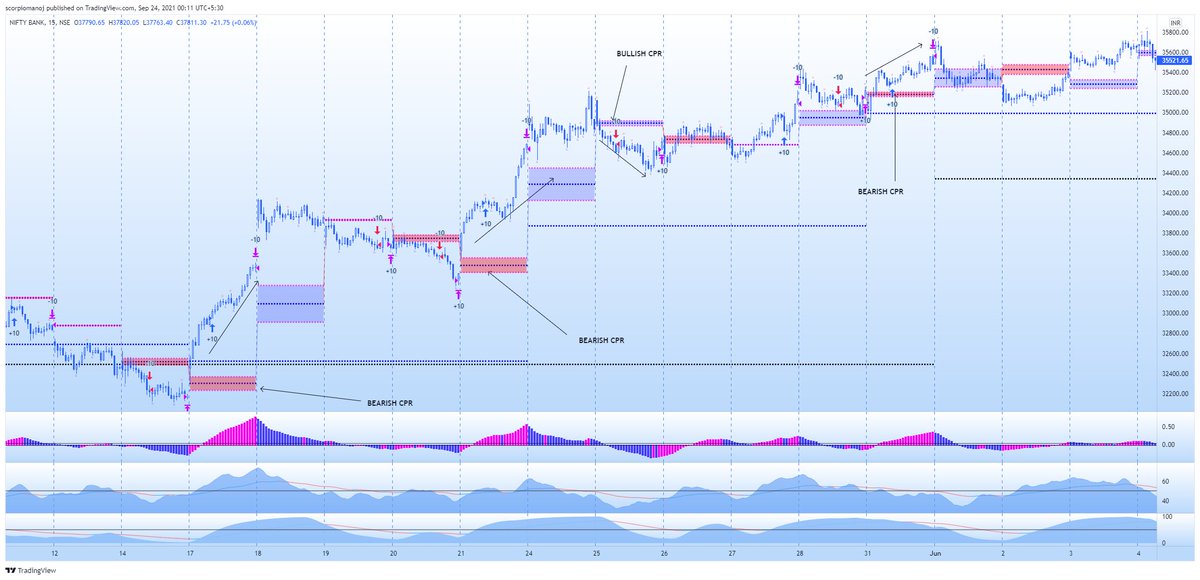

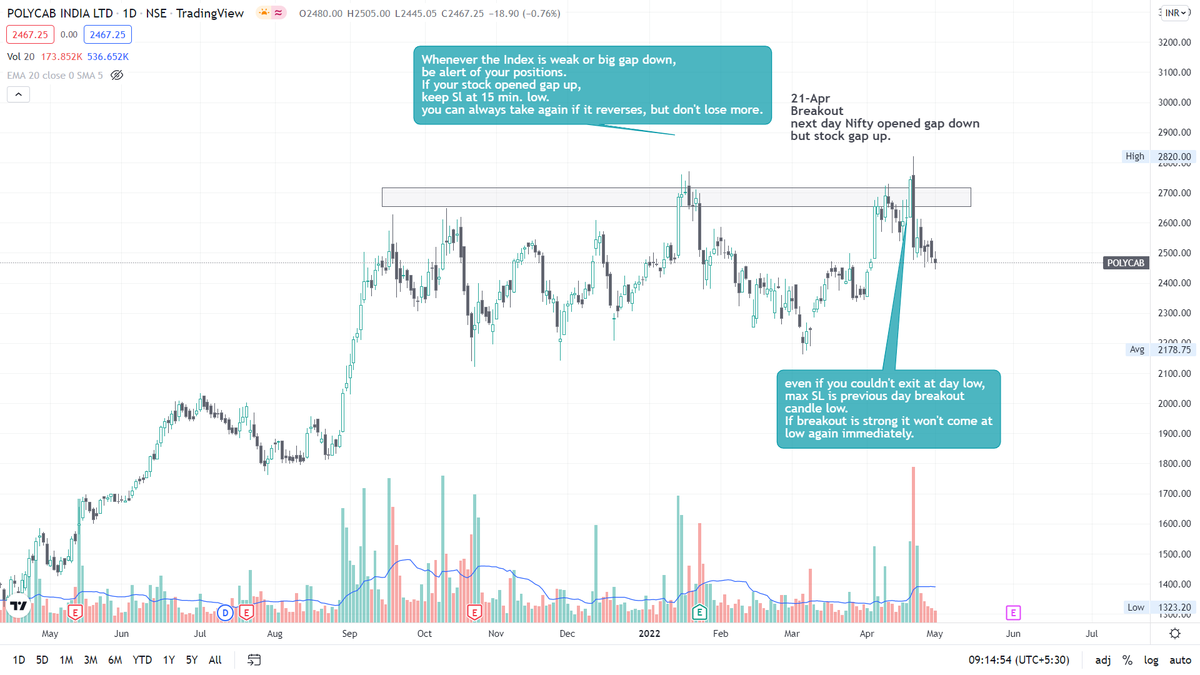

Alertness is important in a choppy market. (12/18)

Check the charts for more understanding: (14/18)

More from Sheetal Rijhwani

#AffleIndia updated chart

Target - 6400+

Stop loss - 4650 https://t.co/DD6pFtSvMI

Target - 6400+

Stop loss - 4650 https://t.co/DD6pFtSvMI

#AffleIndia

— Sheetal Rijhwani (@RijhwaniSheetal) August 8, 2021

It's at retest of weekly breakout level.. we can get a good entry with favourable risk/reward. Have a look at chart! #stockmarket #stockstowatch pic.twitter.com/cS9EOIoWJl

If you are new to F&O, you can start with Vertical Spreads (Debit and Credit spreads) instead of buying options in Stocks and Indices.

Here are some ways how you can do it, when you can do it and the right position sizing for doing it... 🧵 (1/25)

Traders who are trading in cash and want to explore options generally start with options buying without much knowledge. They buy OTM strikes and trade with wrong position sizing. With no idea about the perfect entry, they end up feeling that F&O is risky. (2/25)

After losses in F&O buying, this is how I approached it and it rewarded me pretty well in initial phase. I find this strategy easy to start things off. And then, you can explore other strategies too and find what works for you. (3/25)

Vertical spread is a directional, defined risk options trading strategy:

1. Bull call spread (Debit spread)

2. Bull put spread (Credit spread)

3. Bear call spread (Credit spread)

4. Bear put spread (Debit spread)

Read about these strategies in the below articles. (4/25)

https://t.co/KQvYOsu9kv

While going through these strategies, you must have thought you have to wait till expiry for profits/loss. (5/25)

Here are some ways how you can do it, when you can do it and the right position sizing for doing it... 🧵 (1/25)

Traders who are trading in cash and want to explore options generally start with options buying without much knowledge. They buy OTM strikes and trade with wrong position sizing. With no idea about the perfect entry, they end up feeling that F&O is risky. (2/25)

After losses in F&O buying, this is how I approached it and it rewarded me pretty well in initial phase. I find this strategy easy to start things off. And then, you can explore other strategies too and find what works for you. (3/25)

Vertical spread is a directional, defined risk options trading strategy:

1. Bull call spread (Debit spread)

2. Bull put spread (Credit spread)

3. Bear call spread (Credit spread)

4. Bear put spread (Debit spread)

Read about these strategies in the below articles. (4/25)

https://t.co/KQvYOsu9kv

While going through these strategies, you must have thought you have to wait till expiry for profits/loss. (5/25)

If you're a swing/positional/trend follower, then this thread is for you. In this one, I will be covering how to filter stocks, how to take entry and the exit plans. 🧵 (1/21)

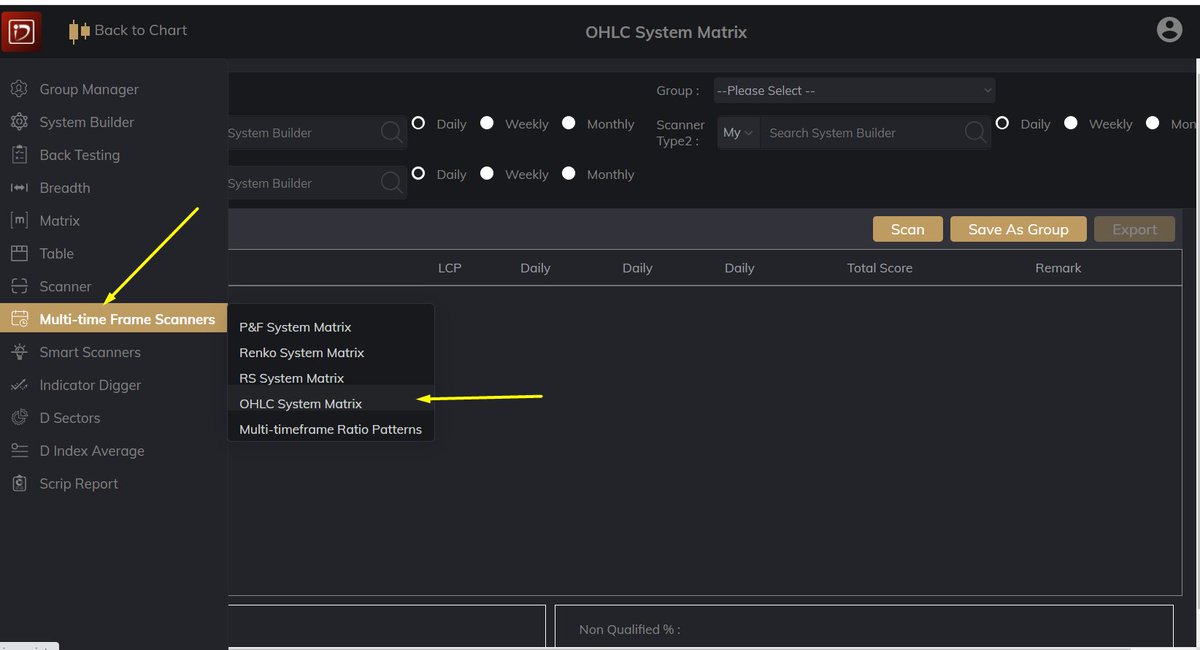

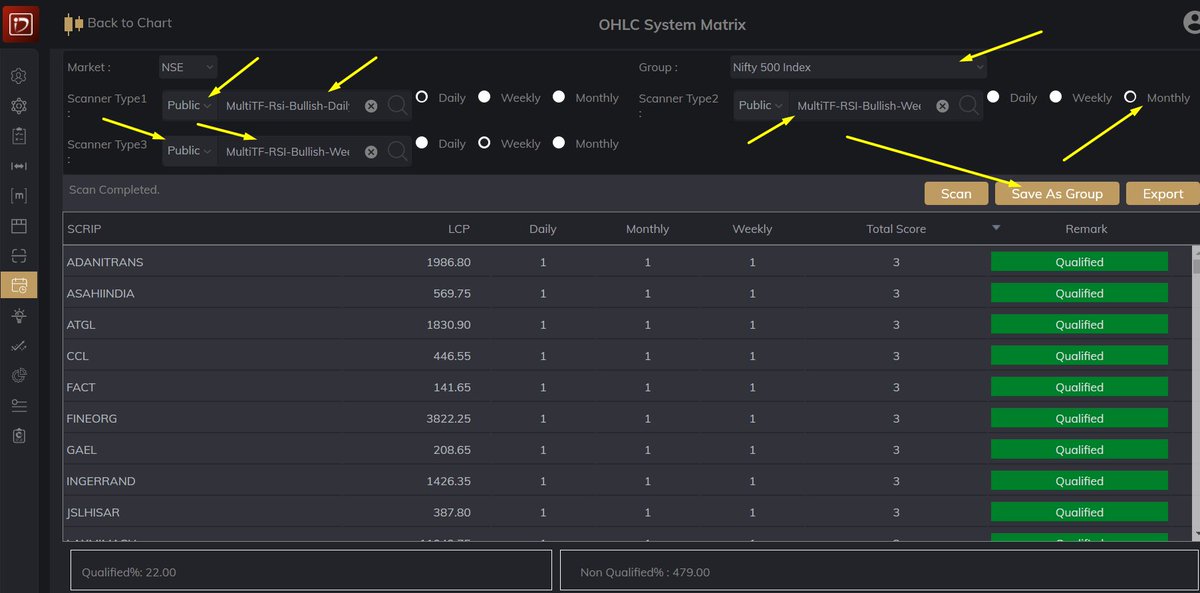

It's practically impossible to check all charts. However, you can use multiple scanners as per your setups to make things easy.

In trending market, even junk stocks give a good move. But in sideways and falling markets, you have to be very selective. (2/21)

One imp. filter for me is trading in strong fundamental stocks. Every quarter, I check results of companies and filter the list. I keep checking the charts and set an alert on the levels. Many good handles on Twitter post good results lists, you can save that as well. (3/21)

This time, I did the same on my telegram channel.

https://t.co/C3eS9PSncG

Second filter for me is Current Performing Sectors/Themes. Keep your eyes and ears open. Being a good observer helps you big time. Make good use of news in your analysis. (4/21)

For Eg: Textiles are performing well for a while now. It has strong consumer interest due to many global retailers, diversifying their outsourcing and reducing their dependence on China. Order booking from India has increased rapidly. (5/21)

It's practically impossible to check all charts. However, you can use multiple scanners as per your setups to make things easy.

In trending market, even junk stocks give a good move. But in sideways and falling markets, you have to be very selective. (2/21)

One imp. filter for me is trading in strong fundamental stocks. Every quarter, I check results of companies and filter the list. I keep checking the charts and set an alert on the levels. Many good handles on Twitter post good results lists, you can save that as well. (3/21)

This time, I did the same on my telegram channel.

https://t.co/C3eS9PSncG

Second filter for me is Current Performing Sectors/Themes. Keep your eyes and ears open. Being a good observer helps you big time. Make good use of news in your analysis. (4/21)

For Eg: Textiles are performing well for a while now. It has strong consumer interest due to many global retailers, diversifying their outsourcing and reducing their dependence on China. Order booking from India has increased rapidly. (5/21)

More from Screeners

How was the trap set in USA Small-Cap index

Russell 2000

It is better if you spend considerable time learning these concepts. https://t.co/caBHOO4Owa

Russell 2000

It is better if you spend considerable time learning these concepts. https://t.co/caBHOO4Owa

TRAPS? In a false breakout, the price breaks out of the range & comes back within the range. A trap is one step ahead, price not only comes back within the range but breaks down in the opposite direction. It traps the initial longs who didn't close their positions

— The_Chartist \U0001f4c8 (@charts_zone) January 22, 2022

Russell 2000 pic.twitter.com/txzjdnStzc

You May Also Like

THREAD PART 1.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.