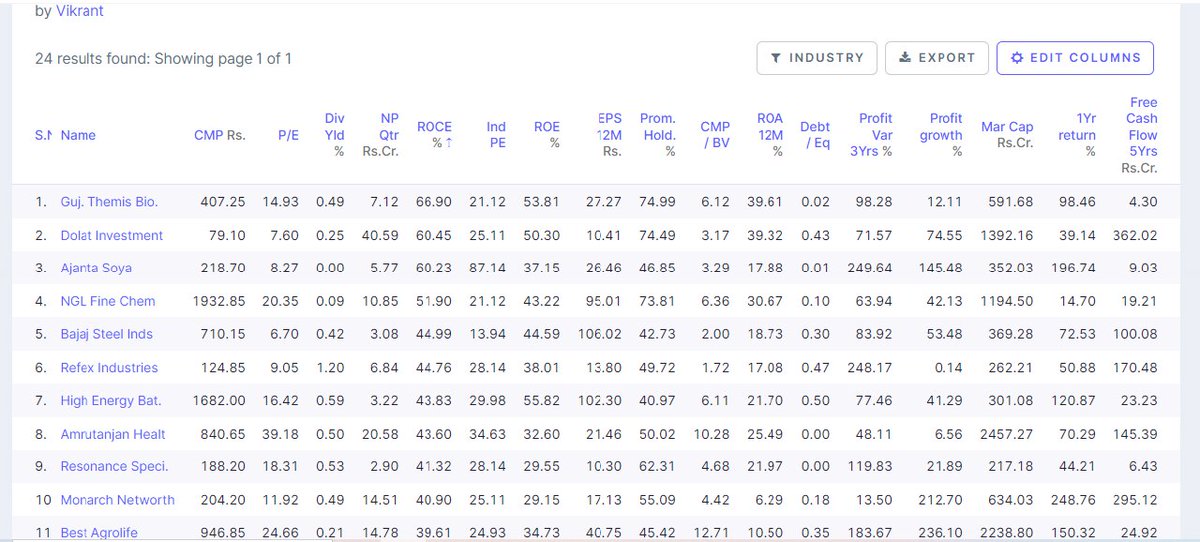

I studied 8⃣ companies which have given multibagger return (8x/10x) in just 5/8 years.

🌠Alkyl amine

🌠Tanla platform

🌠Supreme ind.

🌠HLE glascoat

🌠TATA elxsi

🌠Balaji amines

🌠Abbott india

🌠Bharat rasayan

They all have some common things 👇

For more multibagger characteristics in terms of technical u can check my video 🎥 👇

https://t.co/q3jo9z7iXy

( I run screener based on above queries) 👇👇👇

https://t.co/d7HBEfjkzS

More from Vikrant

Full #volume anlaysis thread 🧵

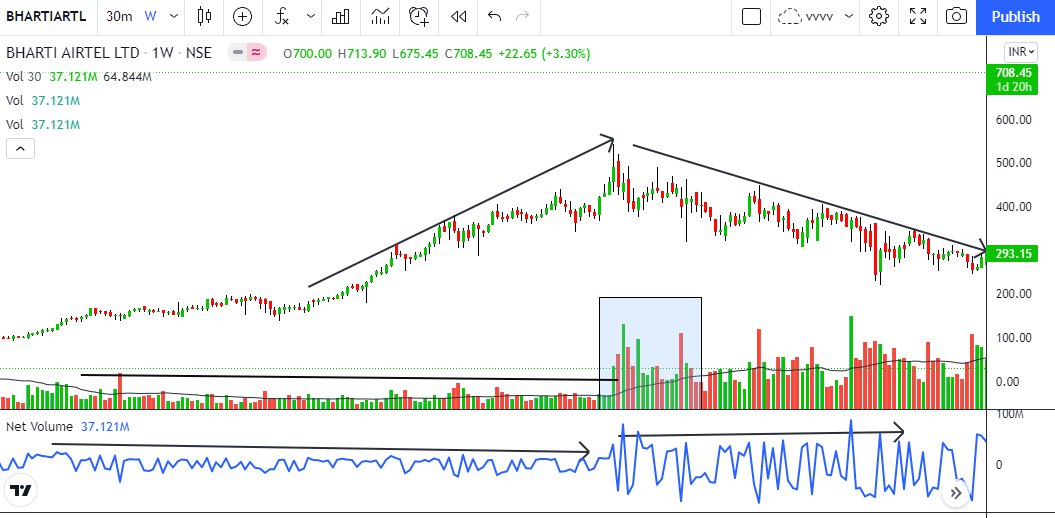

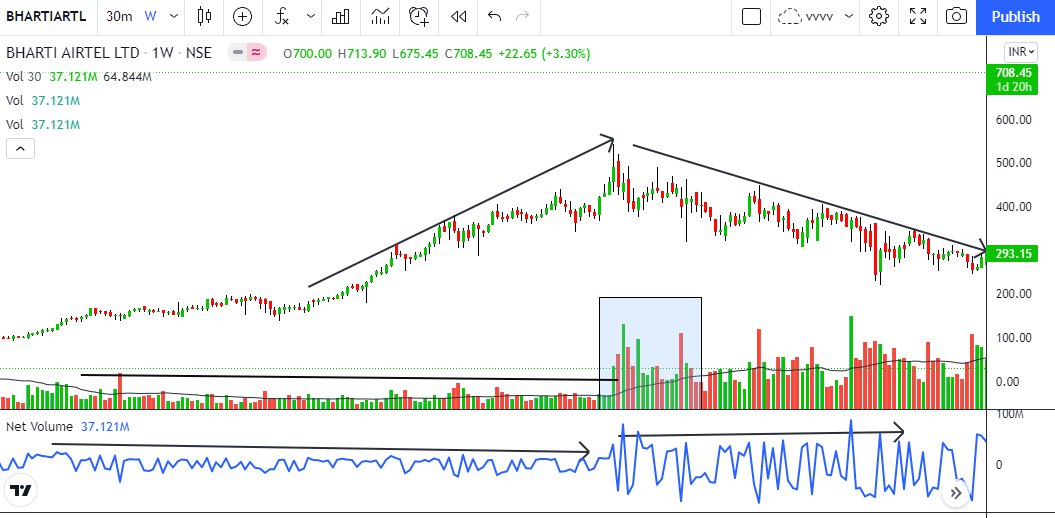

One thing which big player can never hide - VOLUME

Volume price interpretation -

price increases + volume increases = bull 🐂

Price decreases + volume increases = bear 🐻

Price increases + volume decreases = fake upmove) sideways

Price decreases + volume decreases =fake downmove) sideways

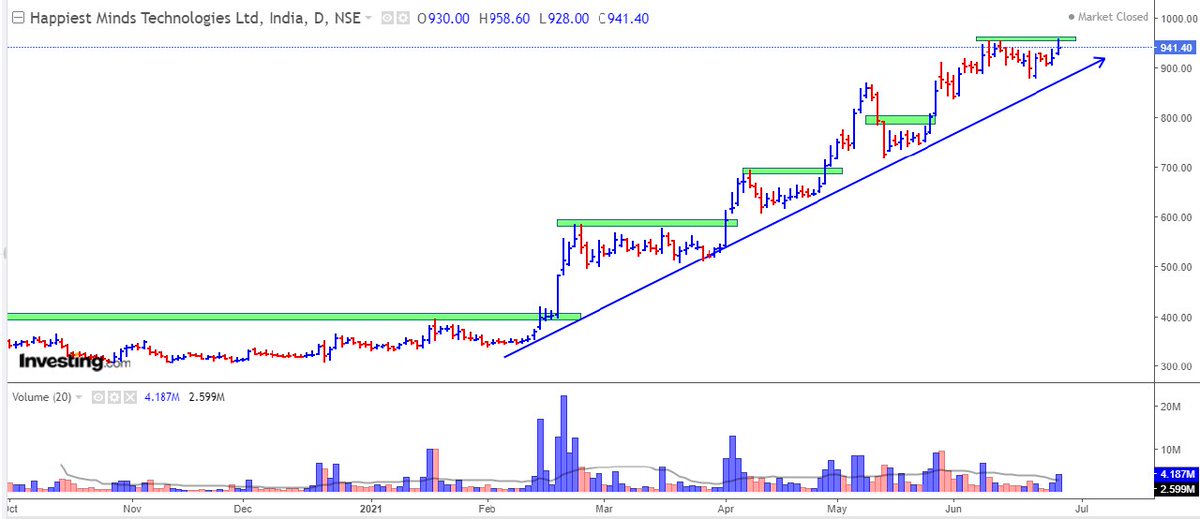

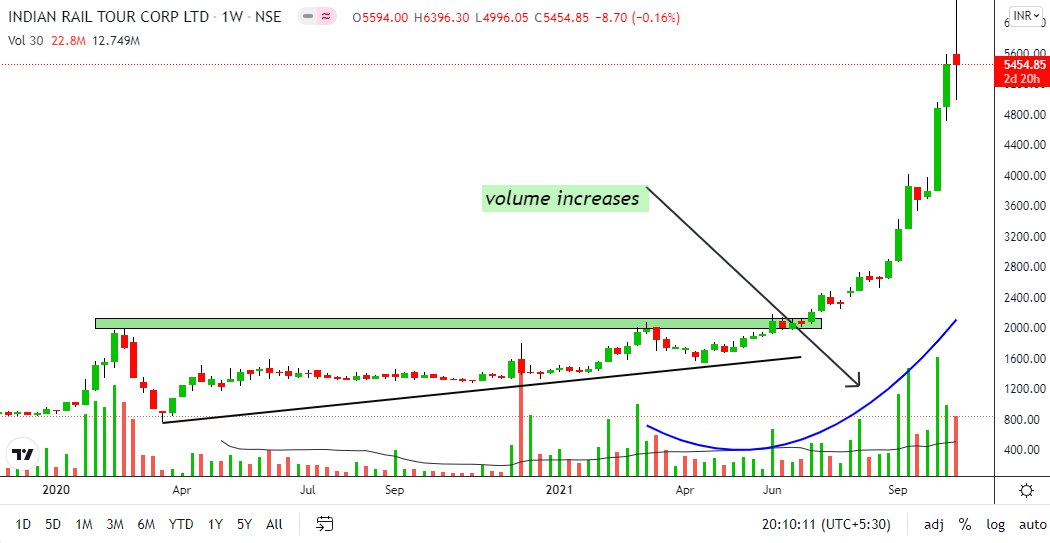

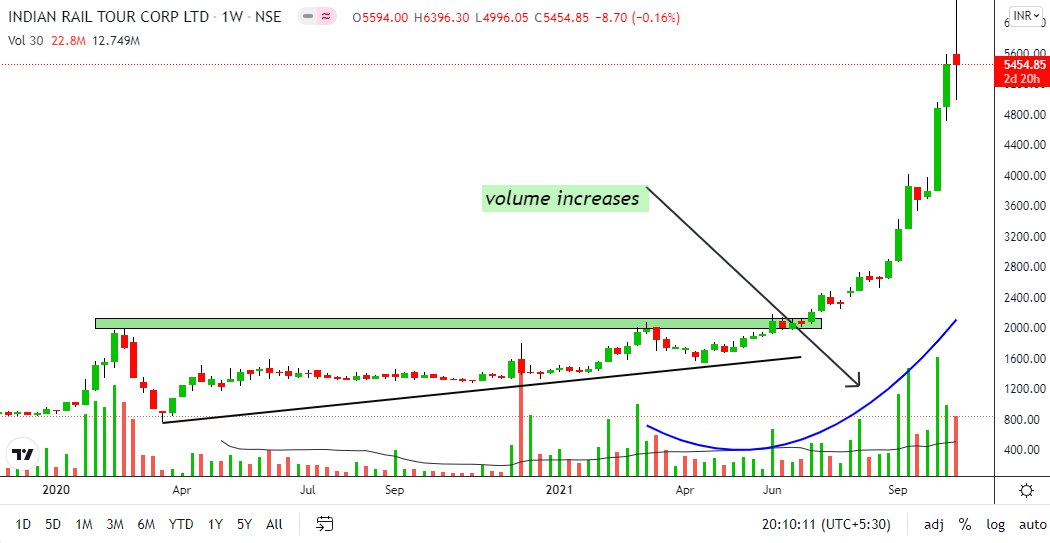

1⃣Always big breakout start with big VOLUME.

The higher the volume +higher the range = higher will be the move.

2⃣ IN the time of consolidation volumes are lower then upmove &.

3️⃣ always trend changing move start with big volume action.

One thing which big player can never hide - VOLUME

preparing mega thread \U0001f9f5 of

— Vikrant (@Trading0secrets) October 18, 2021

#volume analysis .

Key points \U0001f4cd

1\u20e3How should you interpret volume in different time frame?

2\u20e3how do you get that institution or big guys are accumulating ...

The full learning thread \U0001f9f5 about "VOLUME INTERPRETATION "

Stay tuned . \u0964\u0964\u0964\u0964\u0964

Volume price interpretation -

price increases + volume increases = bull 🐂

Price decreases + volume increases = bear 🐻

Price increases + volume decreases = fake upmove) sideways

Price decreases + volume decreases =fake downmove) sideways

1⃣Always big breakout start with big VOLUME.

The higher the volume +higher the range = higher will be the move.

2⃣ IN the time of consolidation volumes are lower then upmove &.

3️⃣ always trend changing move start with big volume action.

The cash strategy 👇☢️👇

1⃣ #stock selection process - always choose that stock which are consolidating near all time high.

(Because whenever stock will give all time high breakout then it will easily give 20/30% return in 1/2 months

U can use trading view scanner for that.

2⃣volume analysis - In that consolidating period volume should be high of up move days then down move days. And last 3/4 month volume of accumulation is much higher.

3️⃣ fund diversification - always deploy your capital in 3/4 stocks, not more then that or not less then 3.

And, your 3/4 stocks must be from different different sectors.

4⃣comunding magic - If you hold 10 stocks then if 2 stocks will give 100% return then portfolio impact is 20% only. (here time period is 8/15 months)

If you hold 3 stocks out of them 2 will give 40% then ur portfolio impact is 25%

(Here time period is 1/3 months)

5⃣sectors analysis - always choose that sector stocks which are near support or breakout stage.

If any stocks is out of nifty sector then u can open stock scanner website and check their peer charts. If out of 5 , 3 are strong then u can select that company.

1⃣ #stock selection process - always choose that stock which are consolidating near all time high.

(Because whenever stock will give all time high breakout then it will easily give 20/30% return in 1/2 months

U can use trading view scanner for that.

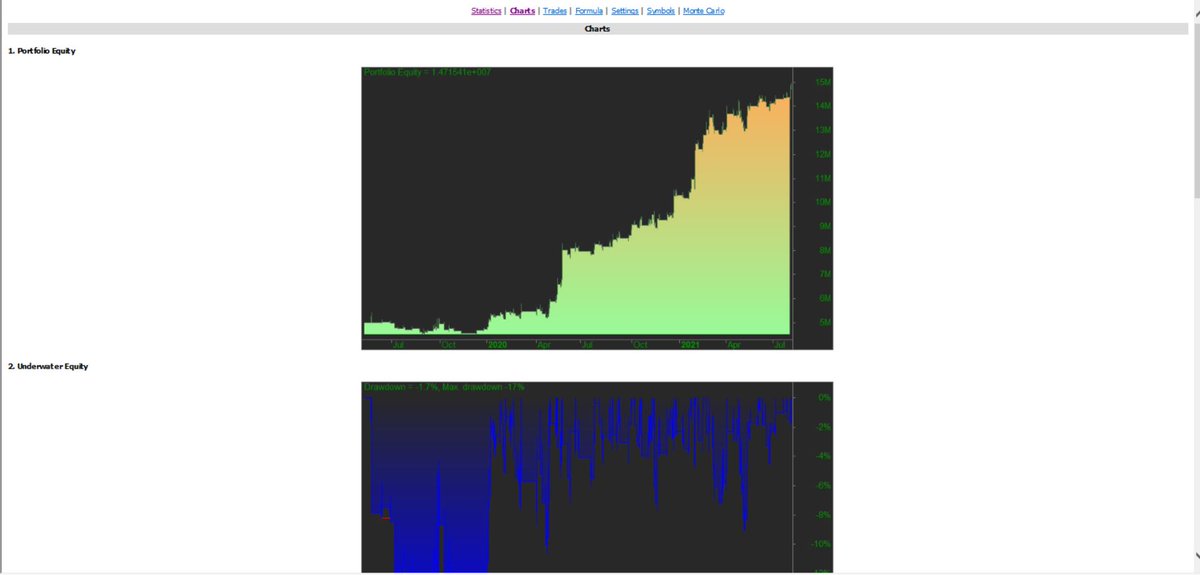

How I turned 7lac account to 33lac in just 1 year only by cash trading.

— Vikrant (@Trading0secrets) October 14, 2021

Soon going to make full thread about my strategy of cash by which this happened.

And for cash hedging I started option selling in different a/c.

How many of u intrested for that thread? \U0001f499\U0001f49b\U0001f499 pic.twitter.com/wIyfE8fwfw

2⃣volume analysis - In that consolidating period volume should be high of up move days then down move days. And last 3/4 month volume of accumulation is much higher.

3️⃣ fund diversification - always deploy your capital in 3/4 stocks, not more then that or not less then 3.

And, your 3/4 stocks must be from different different sectors.

4⃣comunding magic - If you hold 10 stocks then if 2 stocks will give 100% return then portfolio impact is 20% only. (here time period is 8/15 months)

If you hold 3 stocks out of them 2 will give 40% then ur portfolio impact is 25%

(Here time period is 1/3 months)

5⃣sectors analysis - always choose that sector stocks which are near support or breakout stage.

If any stocks is out of nifty sector then u can open stock scanner website and check their peer charts. If out of 5 , 3 are strong then u can select that company.