A lot of websites provide you with data for trading.

However, I liked the free website of Icici Direct the most.

Here is a breakdown of what it can do: 🧵

Collaborated with @niki_poojary

Advantages:

1. Quantitative Analysis in one place

2. Easy to find stocks where action taking place

3. Find the exact price levels at which OI is being added.

You can check out this free website by clicking on this

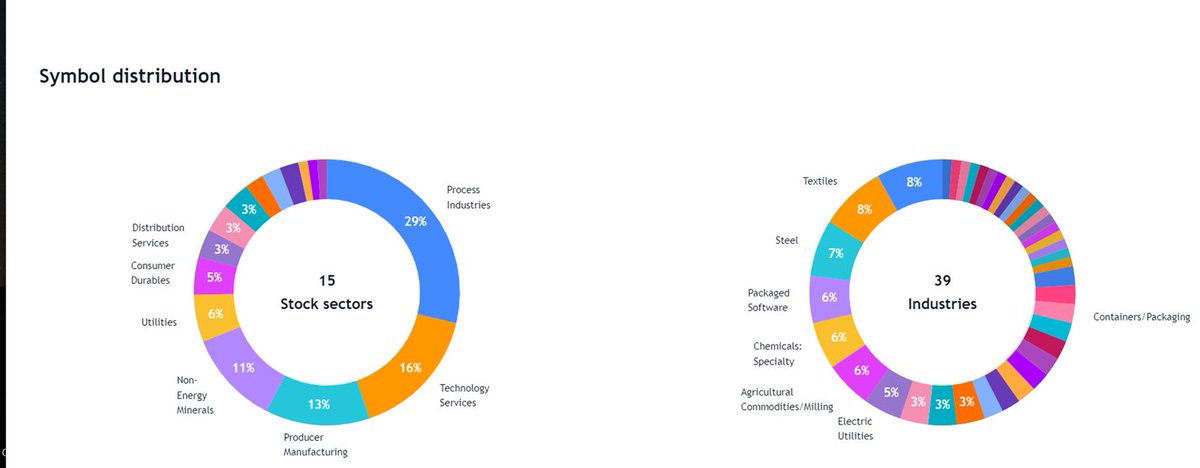

Where is the action taking place?

For eg, Nifty Heatmap Can easily scan for:

- Long Build up = Price Up and OI up

- Long Unwinding = Price Down and OI down

- Short Buildup = Price Down and OI up

- Short Covering = Price Up and OI down

Price levels of OI being added:

• Check 15 mins Built-up in any stock

• Can find Intraday Bullish and bearish trend

• Eg of IBUL who was down 5% on Friday. Short Built-up had started in the morning itself.

• Shows the quantities which are being traded in those intervals.

Time Intervals:

• There are 25, time intervals available every day.

• If a stock has to go up or down a lot it will be heavily dominated in these time intervals.

• IBUL had 10 times short built up on Friday. -5.79 %

• ITC had 14 long built-ups on Friday. +2.6%.