#FREETIP

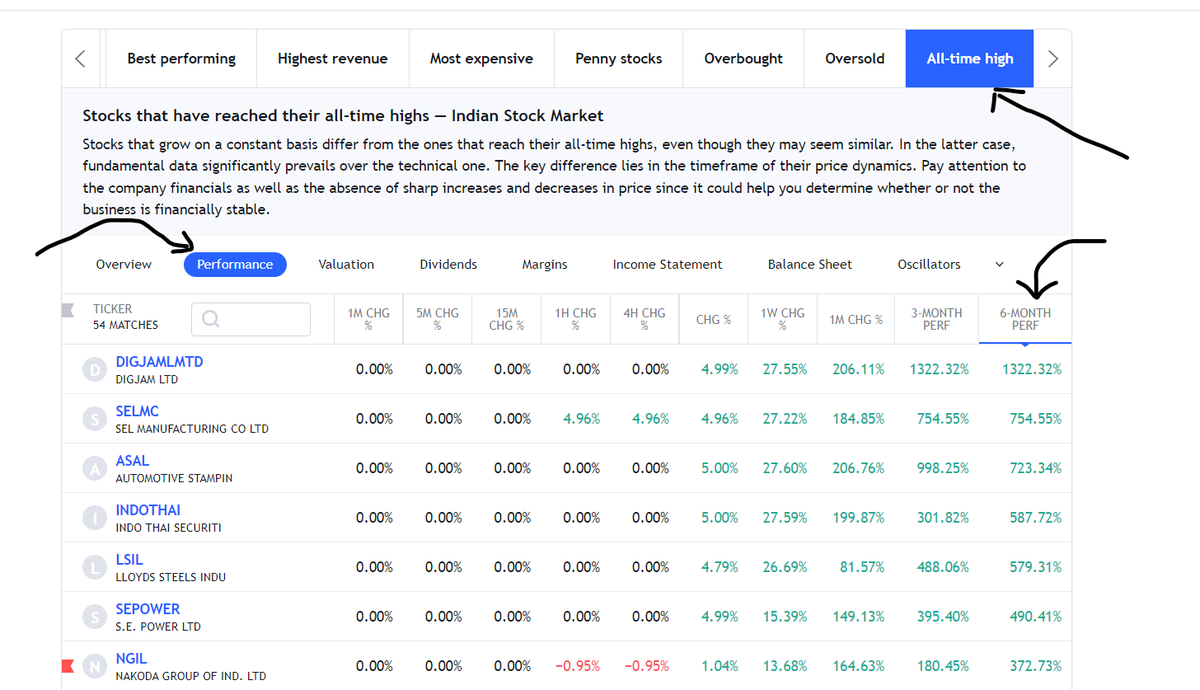

When you are looking at ATH stocks for further research for possible entry, one important thing to note is to concentrate the stocks that has gone up atleast 100% over the last 6 months. This show that there is an evidence of strength. Ignore those below 100% returns.

More from ScorpioManoj

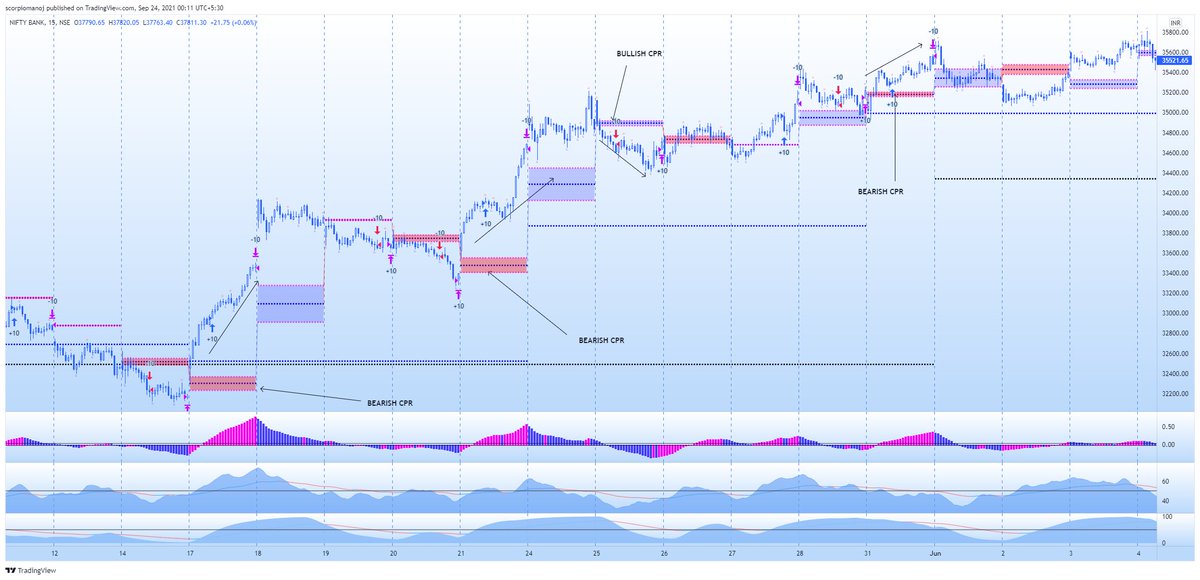

#CHALET 239 . 11% up. Power of Stan Weinstein strategy.

#CHALET

— ScorpioManoj (@scorpiomanojFRM) September 26, 2021

217

A Stan Weinstein strategy scan output.

Stock possibly trying to break to Stage 2 if moves above 220. Huge volume seen in previous week with a strong candle.

30wk MA started sloping upwards and RS sloping upwards.

Fundamentals not good. But huge instnl holdings. pic.twitter.com/PsjwoWbNFJ

More from Screeners

Oil, copper and other commodities came under heavy selling pressure today and that's a good thing because it's mounting evidence that inflation may be peaking.

Positive signs on inflation include fertilizer prices peaking and trending downward. Used Car prices are also down (which led inflation). The recent price break on the $XLE - which emerged almost to the day the market topped, could be an indication that we are close to a low. pic.twitter.com/2MtcKjjmAz

— Mark Minervini (@markminervini) June 23, 2022