#3/thread on Angkor wat

Christianity and islam may be the largest religion of today’s world but Sanatan dharm has the largest religious monument in the world in the form of Angkor wat. It is situated in combodia and spread across over 400 acres / 1.6 km².

It was listed as a UNESCO World Heritage Site in 1992, which encouraged an international effort to save the complex.

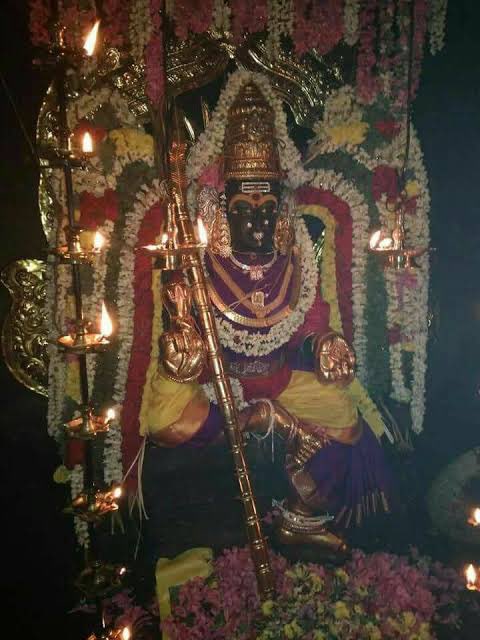

It was originally built as a Hindu temple dedicated to the god Vishnu. In Khmer, the Cambodian language, Angkor means "city" and Wat means "temple grounds".

So Angkor Wat means "Temple City". Its original name was Vrah Vishnuloka or Parama Vishnuloka, meaning the sacred dwelling of Vishnu in Sanskrit.

But, it gradually turned into a Buddhist temple towards the end of the 12th century & is still used for worship today.

Angkor Wat was initially designed and constructed in the first half of the 12th century, during the reign of Suryavarman II, as the king’s state temple and capital city. It was built without the aid of any machinery, as there was no machinery available at that time.

Evidence for these dates comes in part from inscriptions, which are vague, but also from the architectural design and artistic style of the temple and its associated sculptures.

Another aspect is that the five central towers of Angkor Wat symbolize the peaks of Mount Meru,