#NiftyIT index on daily TF - nearing the resistance area. A nice bullish rejection from 34 EMA last week. This is why I generally love trading with 34 EMA.

@shivaji_1983 @blisstrades @pradytrader1 @ameethvorra @ChartingG @sortingthings @rvgandhi

More from DTBhat

#TataPower on daily charts - a breakout above 126 will be very interesting. It is bullish on higher boxsizes and has given a reversal after a pullback on lower boxsize. Price charts and RS charts self-explanatory pic.twitter.com/9ulYjvBVza

— DTBhat (@dtbhat) July 12, 2021

More from Screeners

The 3 most important rules which I follow in spotting a major trend reversal laid out in this stock, 'as it is'.

1. Trend reversal

2. Price patterns

3. Indicator confirmation

Perfect TA chart.

All boxes ticked !!

Do comment, like and share !!!

#DRREDDY https://t.co/4JGg71GenE

Today at 2 pm:

— Kunal Bothra (@kbbothra) July 5, 2022

I will bring to you one of the SUPER FINEST TECHNICAL CHART setup on a largecap name.

Agar yeh nahi chal paya toh kuch nahi chal paayega\u2026

Retweeet tsunami has to come for this one\u2026 #stock #breakout #technical

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

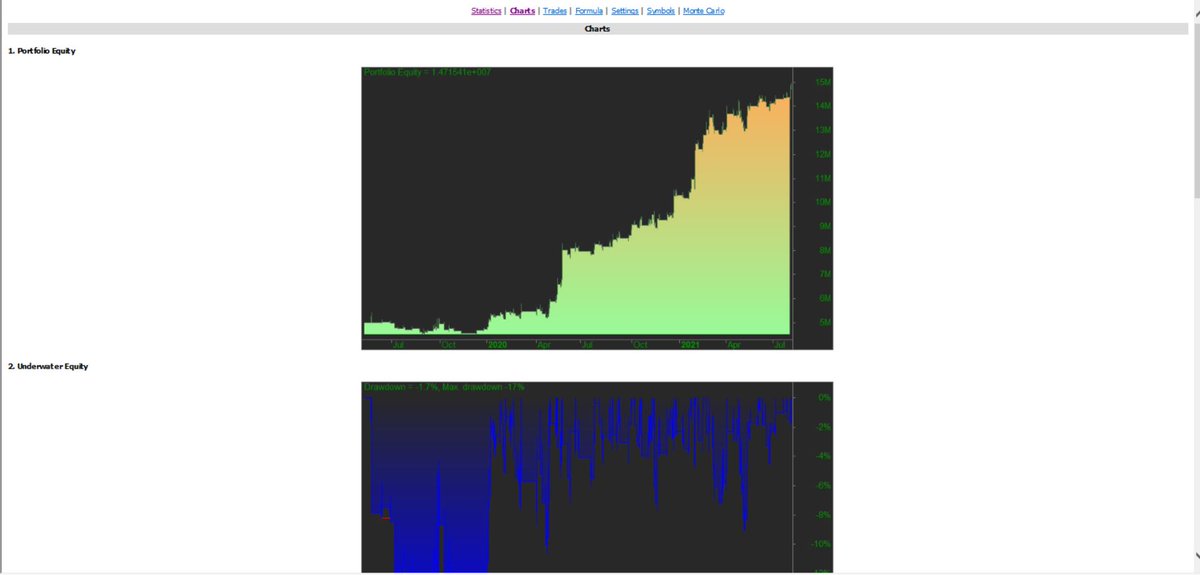

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5