Some ofthe biggest breakouts occur after Volatility Contraction, the analogy is that more a spring is pressed, higher it jumps whenever it gets released.

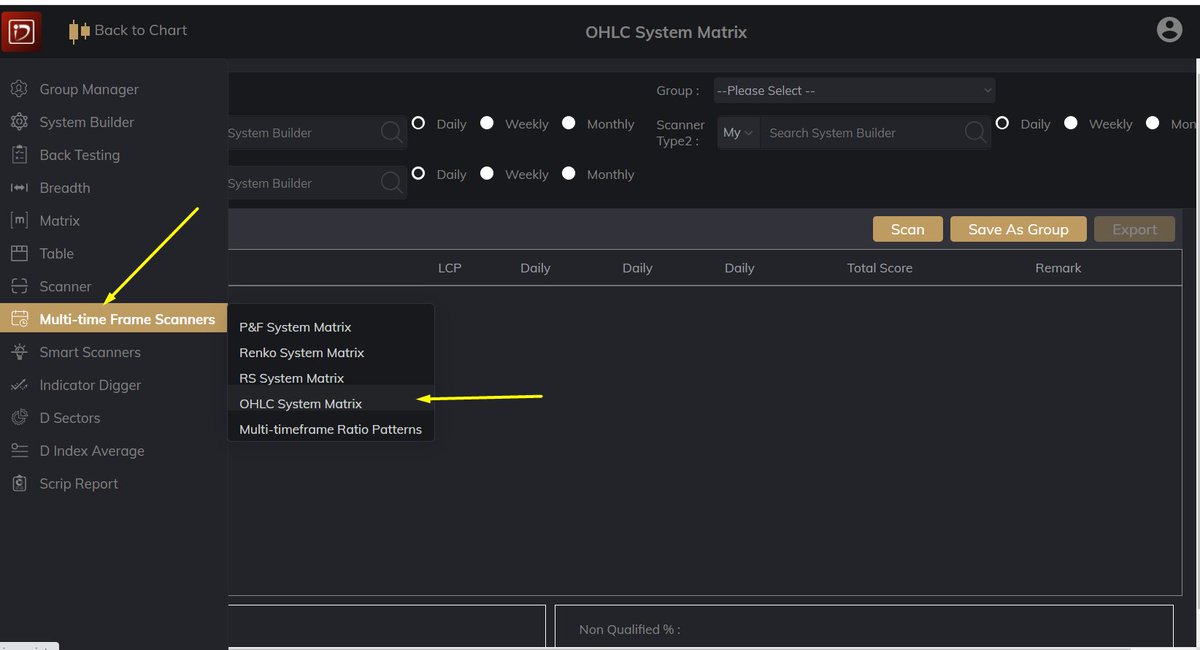

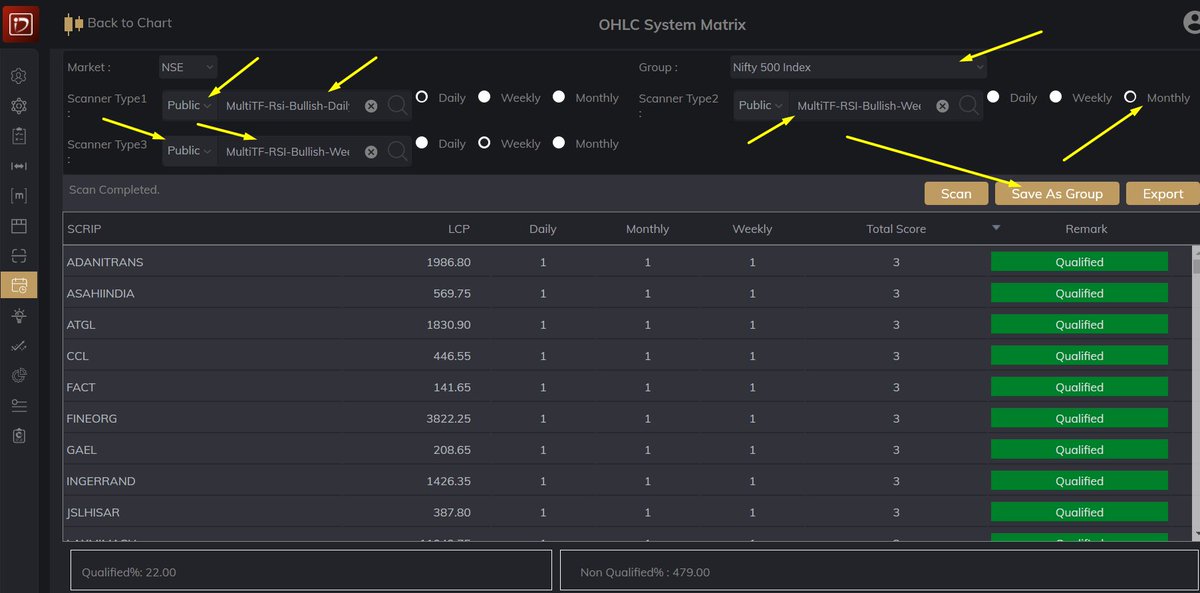

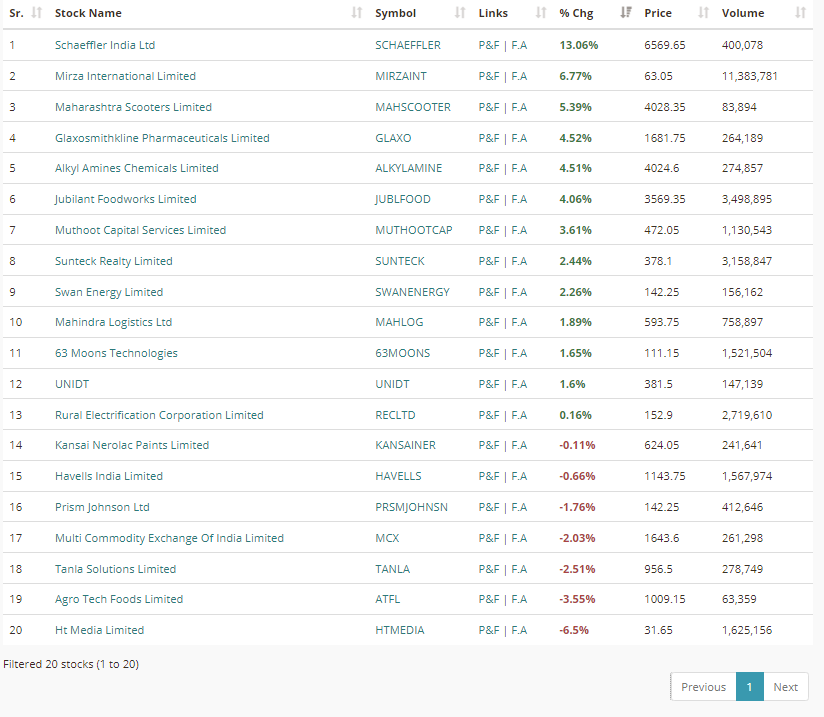

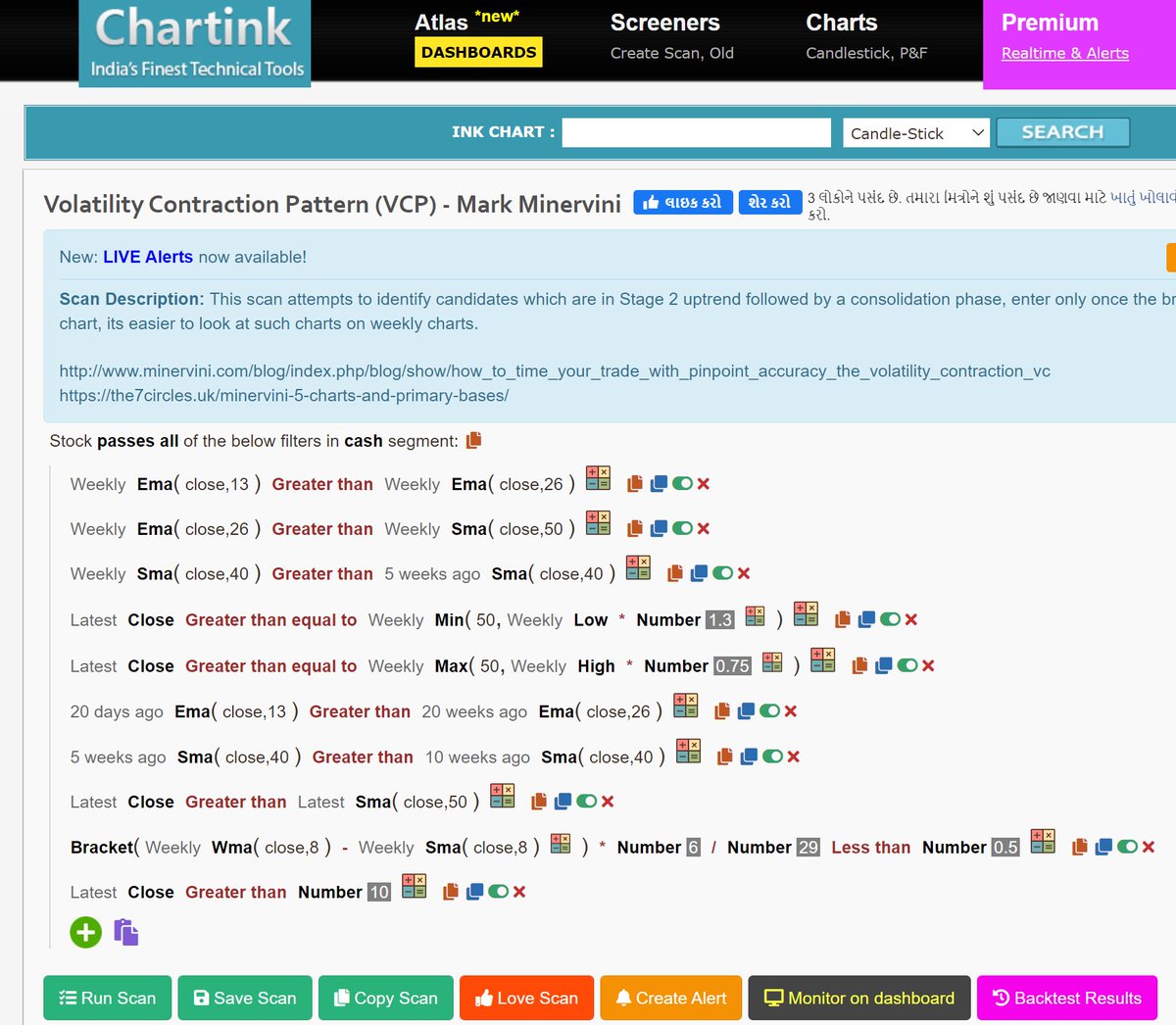

There is a VCP Scanner on chartink (Not mine). This may also be used to find potential Breakouts.

More from Professor

Breakouts in the direction of the general trend

The longer the market is in a range, the stronger the breakout

Stock making higher lows near resistance zone

(lower highs near support zone is a sign of weakness)

Some ofthe biggest breakouts occur after Volatility Contraction, the analogy is that more a spring is pressed, higher it jumps whenever it gets released.

— Professor (@DillikiBiili) October 2, 2021

There is a VCP Scanner on chartink (Not mine). This may also be used to find potential Breakouts. pic.twitter.com/y1lmay7D4e

Lest some charlie jumps to point out, let me make it clear that I haven't invented anything in stock market, all my knowledge of stock market comes from old farts. Just my observation is my own. https://t.co/uHNw8tV4AO

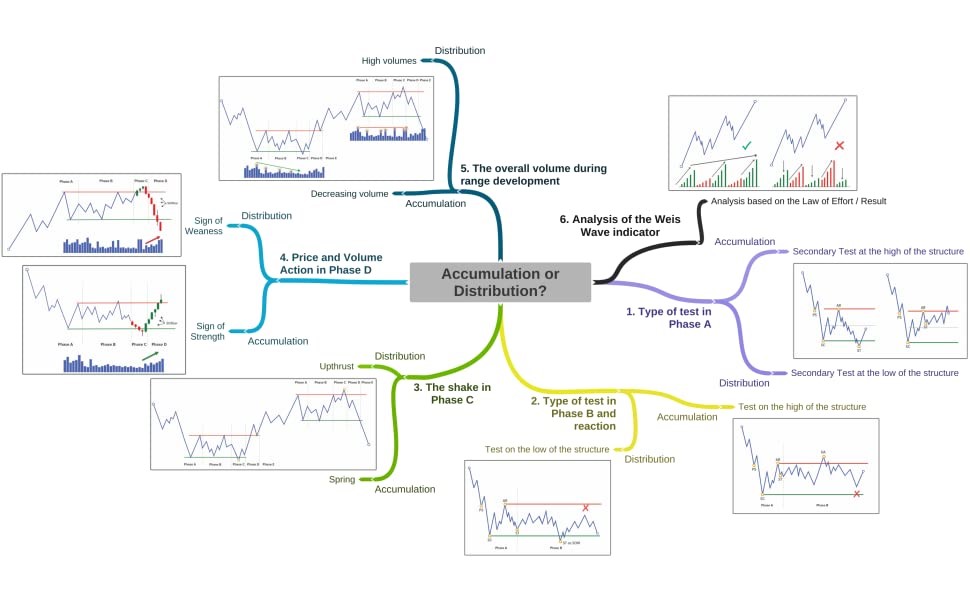

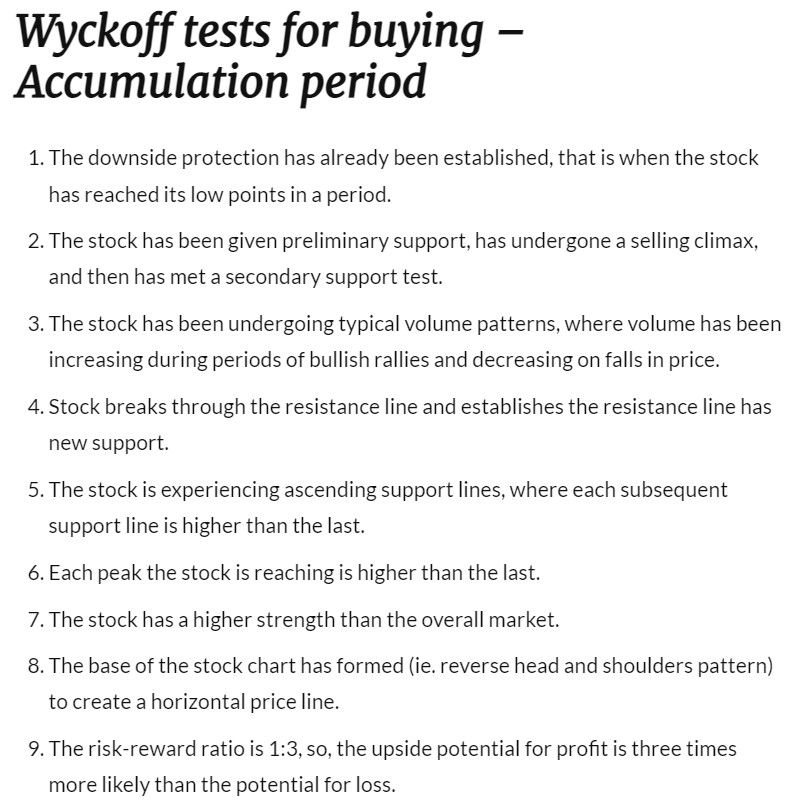

Plz advice how to identify accumulation and distribution phase...... to me Both looks same

— VIVEK VAID (@bobvaid) February 12, 2022

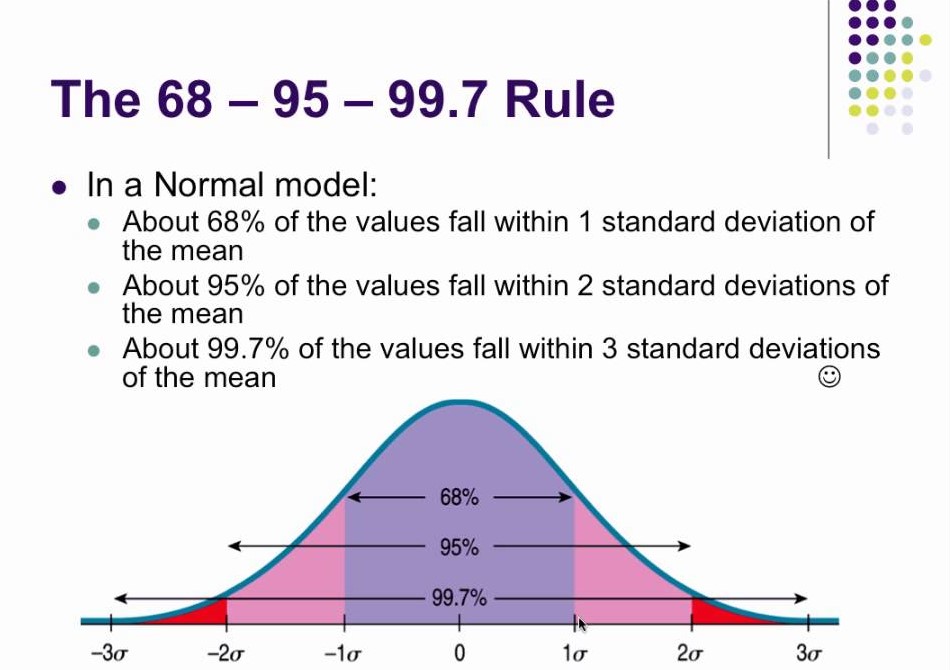

As per Normal Distribution 68% of the time movement is with 1% SD Limits.

For 95% pf the times movement is within 2% SD limits.

And its only 0.3% of the times that movement exceeds 3 SD.

Since 95% covers a lot of ground that's why 2SD is considered to be a a safe range for most events.

The farther we move from the average, chances of occurrence go down. This is what Taleb sahab calls Tail risk, because it lies in the tail of the standard distribution curve.

Normal distribution occurs everywhere. See this

The Galton Machine shows order from randomness. Each ball bounces left or right at random, 12 times, but together where they fall can be predicted - the normal distribution. This one made by: https://t.co/oI9wOGq7nG pic.twitter.com/VQtVu66OSE

— Tom Stafford (@tomstafford) April 19, 2018

Bollinger Band, which is a very popular indicator has a setting of 2SD. Because its expected that 95% of the time moves will be confined to 2SD limits.

When we say that price is at upper/lower Bollinger band, we are saying that it has reached 2 SD limits and likely to reverse.

Now coming to current scenario, open Nifty daily chart and apply two bollinger Bands on it.

First with default setting and in second change settings to 3 standard deviation.

Crossing 3 SD boundary means that Nifty is now in very rare territory where it has been only 0.3%

More from Screeners

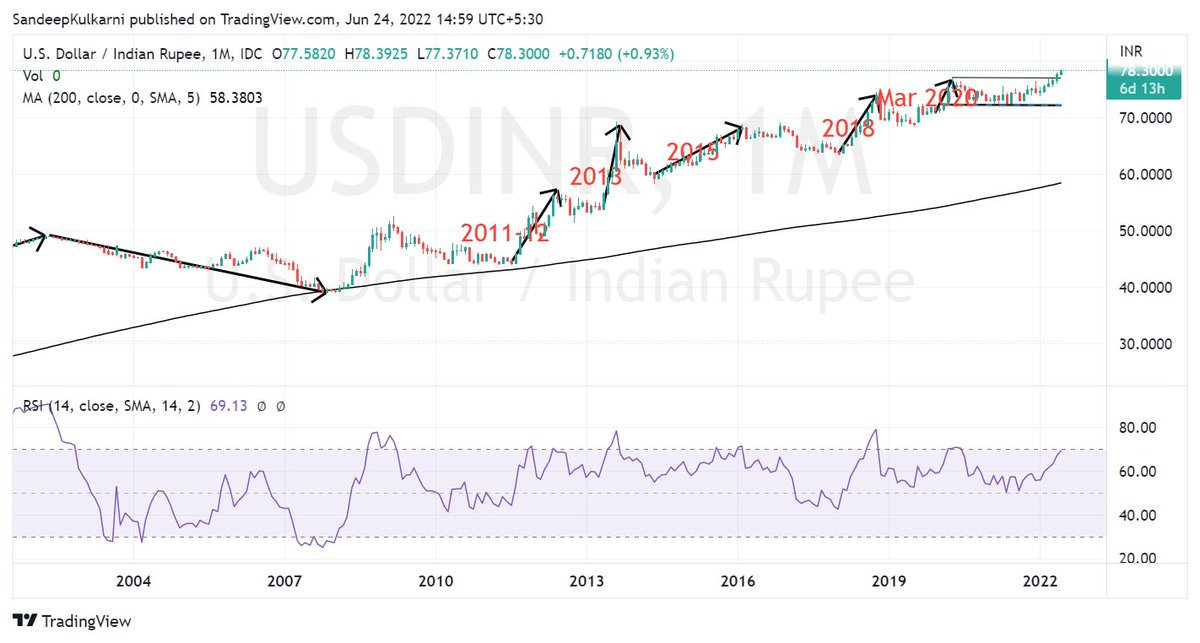

BTW Nifty Metal has inverse correlation with USDINR. https://t.co/X6cqVcYF3V

We know how our stock market has weathered the FII selling.

— Sandeep Kulkarni (@moneyworks4u_fa) June 10, 2022

But the equally big story is how Rupee has weathered $50bn+ outflows since Oct 2021. Hats off to RBI Governor Das & his team for having the vision of building huge reserves in his tenure. pic.twitter.com/CVuF9dM361