For my investment portfolios as well, the last stop is 200 MA, beyond which i would exit. Last line of support.

For trading portfolios 65 MA, below that it's a risky trade where losses could extend on down side. On 23rd August, last correction, many stocks retested 65 n bouced

More from Dare2Dream

#Indiamart Update : The correction in the stock could be over. Stock holding good supports. Watch for upside momentum as #Unlock plays out. My SL here would be 6650 levels#Dare2Drm pic.twitter.com/JLwujVPcl0

— Dare2Dream (@Dare2Dr10109801) June 13, 2021

#Dare2Drm

Will post charts of next potential movers tomorrow. Interested.#Dare2Drm

— Dare2Dream (@Dare2Dr10109801) July 9, 2021

#HindCopper Stock is coming out of a big consolidation. A move above 147, stock could be headed to 165 (next resistance). If #BseMetals index breaks out, i am expecting levels of 196 again and if that gets taken out, levels of 220. lets see - one step at a time

#Dare2Drm

More from Screeners

A small tribute/gift to members

Screeners

technical screeners - intraday and positional both

before proceeding - i have helped you , can i ask you so that it can help someone else too

thank you

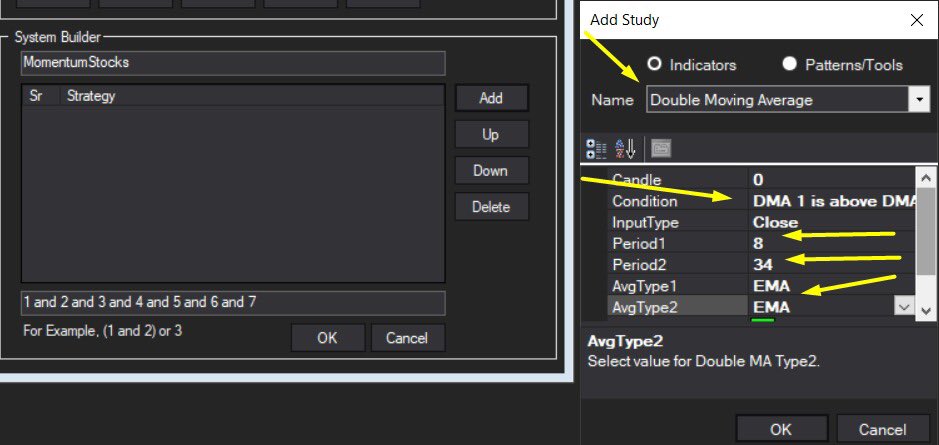

positional one

run - find #stock - draw chart - find levels

1- Stocks closing daily 2% up from 5 days

https://t.co/gTZrYY3Nht

2- Weekly breakout

https://t.co/1f4ahEolYB

3- Breakouts in short term

https://t.co/BI4h0CdgO2

4- Bullish from last 5

intraday screeners

5- 15 minute Stock Breakouts

https://t.co/9eAo82iuNv

6- Intraday Buying seen in the past 15 minutes

https://t.co/XqAJKhLB5G

7- Stocks trading near day's high on 5 min chart with volume BO intraday

https://t.co/flHmm6QXmo

Thank you

You May Also Like

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

Five billionaires share their top lessons on startups, life and entrepreneurship (1/10)

I interviewed 5 billionaires this week

— GREG ISENBERG (@gregisenberg) January 23, 2021

I asked them to share their lessons learned on startups, life and entrepreneurship:

Here's what they told me:

10 competitive advantages that will trump talent (2/10)

To outperform, you need serious competitive advantages.

— Sahil Bloom (@SahilBloom) March 20, 2021

But contrary to what you have been told, most of them don't require talent.

10 competitive advantages that you can start developing today:

Some harsh truths you probably don’t want to hear (3/10)

I\u2019ve gotten a lot of bad advice in my career and I see even more of it here on Twitter.

— Nick Huber (@sweatystartup) January 3, 2021

Time for a stiff drink and some truth you probably dont want to hear.

\U0001f447\U0001f447

10 significant lies you’re told about the world (4/10)

THREAD: 10 significant lies you're told about the world.

— Julian Shapiro (@Julian) January 9, 2021

On startups, writing, and your career: