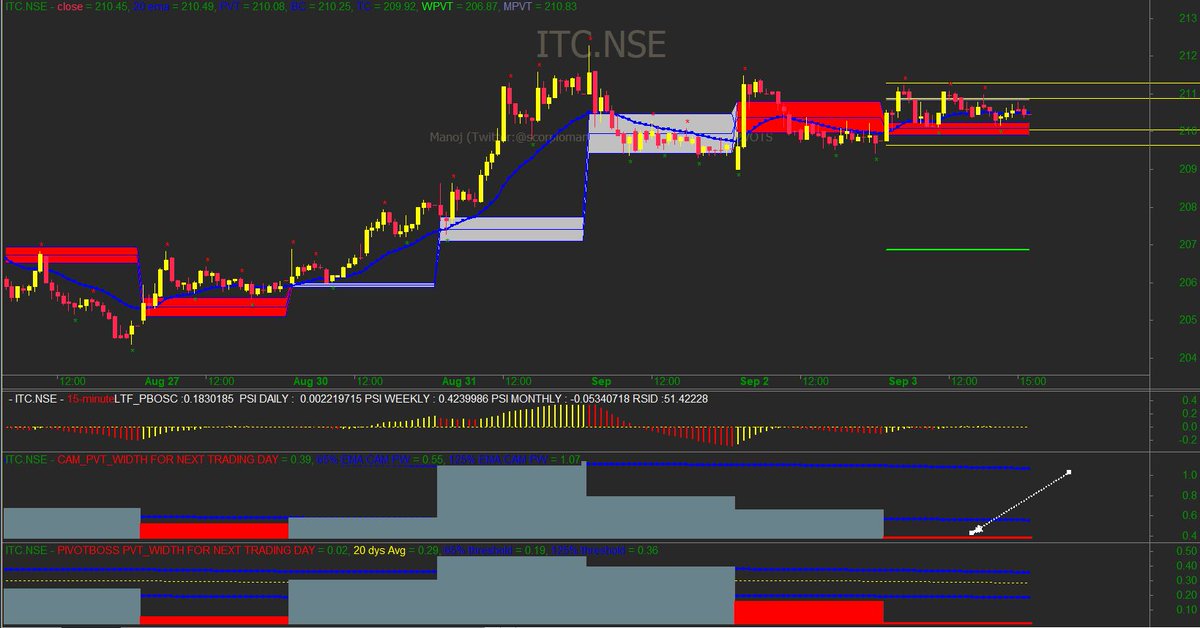

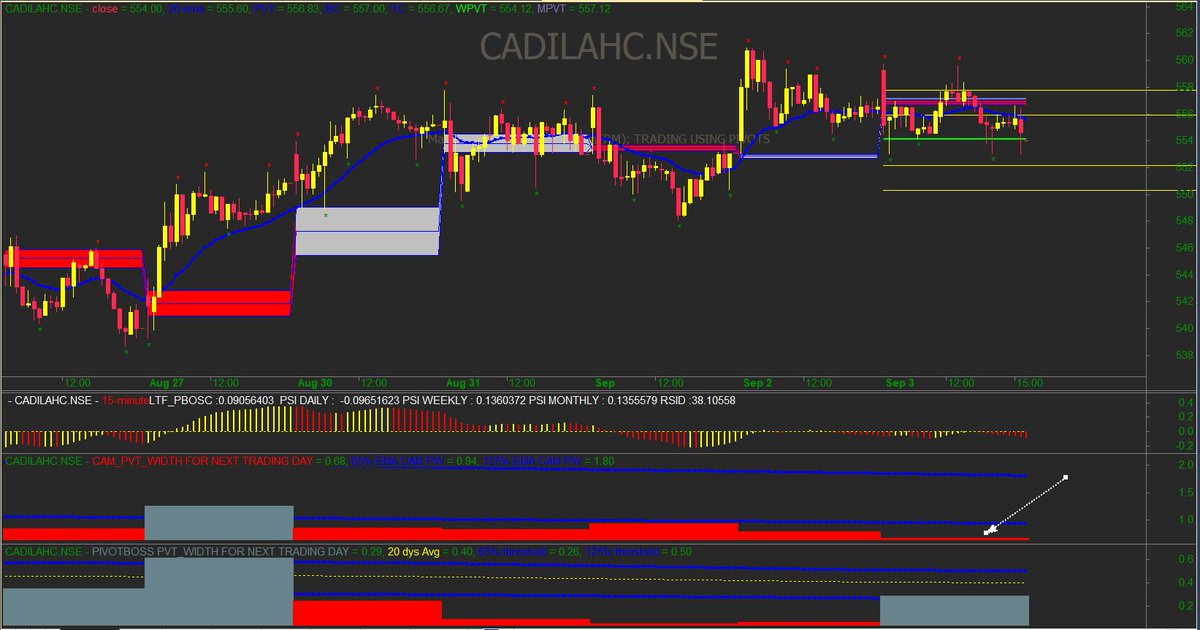

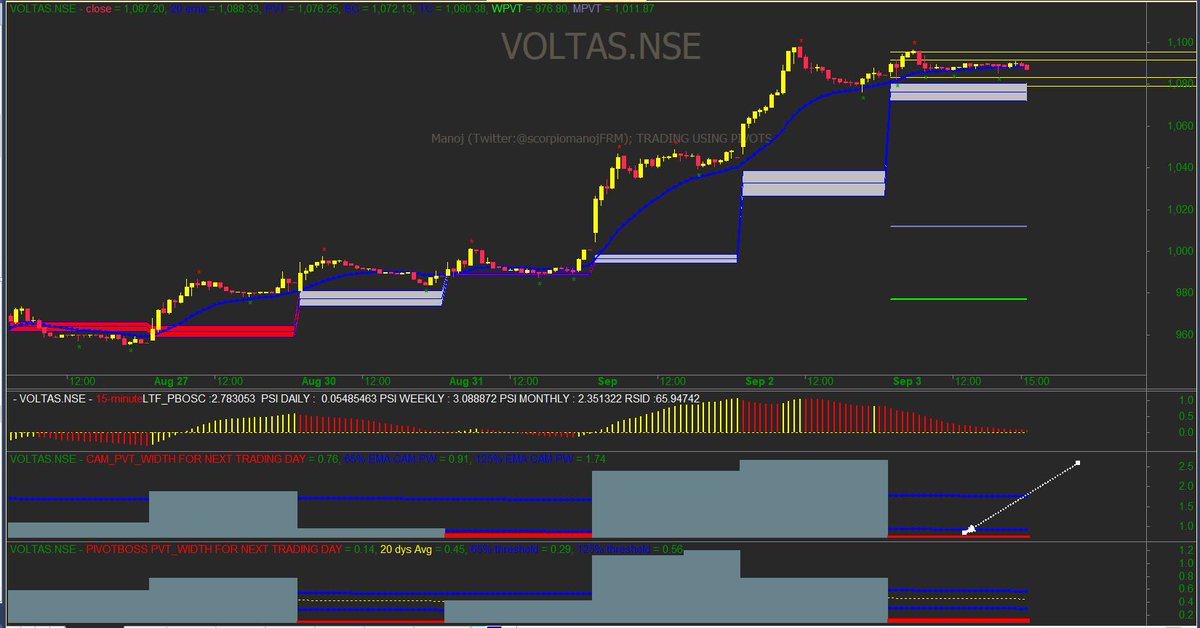

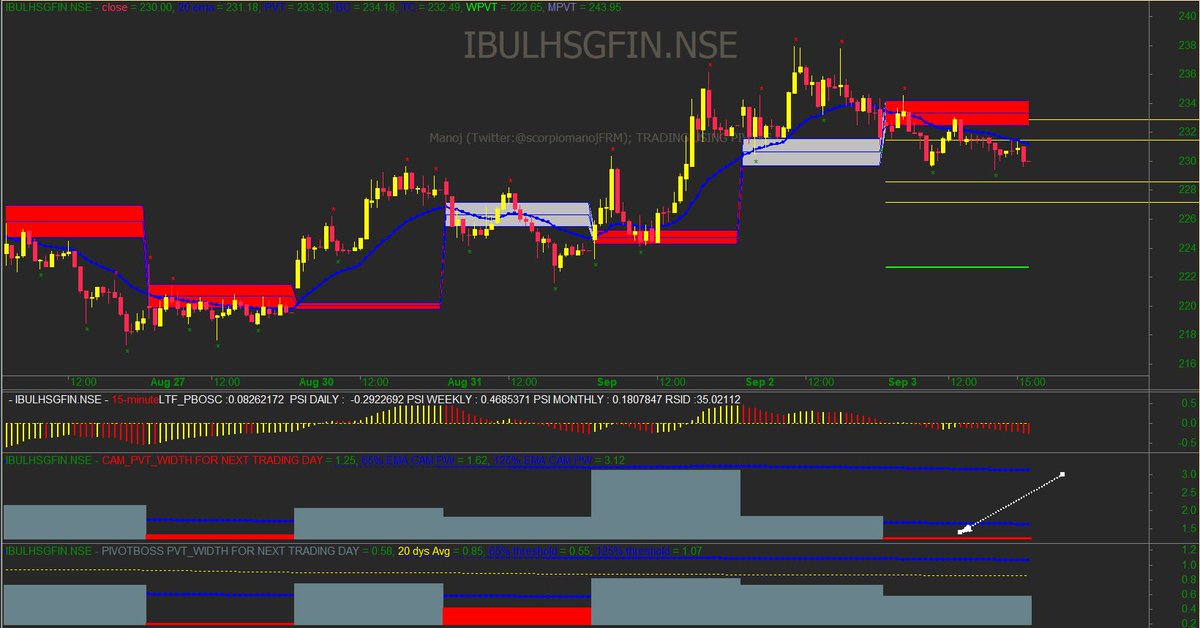

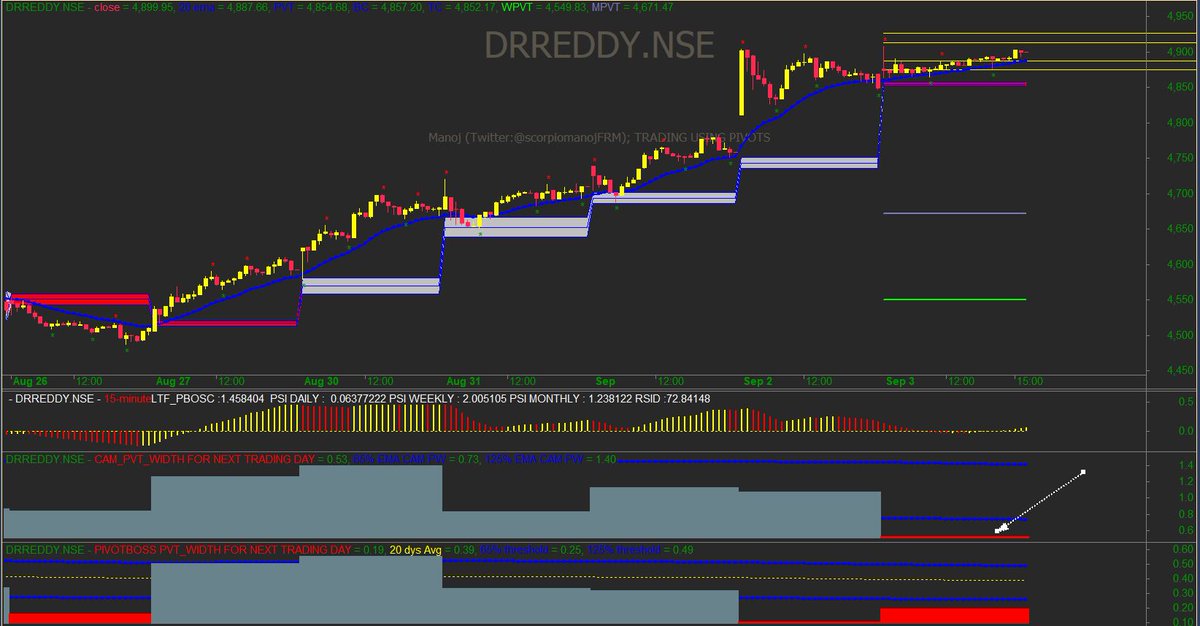

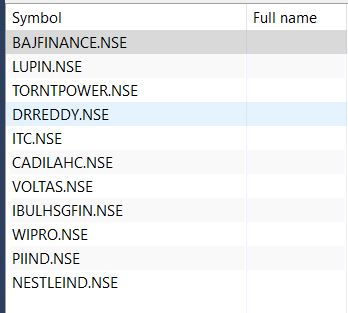

#FnO stocks that could potentially trend tom based on Camarilla squeeze.

Strategy - go long if breaks daily cam r4 or pdh or both. stop at r3 .

go short if breaks down daily cam s4 or pdl or both.

Exit 50% at 1:2 rr and balance trail at cost.

Logic - Contraction Expansion.

More from HMK alias MANOJ

More from Screeners

One of the most successful stock trader with special focus on cash stocks and who has a very creative mind to look out for opportunities in dark times

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

Post that the plight of the

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

Another hack to identify extended move in a stock:

Too many green days!

Read

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K