I have been asked a lot about how to determine the direction of the broader market.

I have made some minor tweakings to this timing model since this tweet but it still will give you an idea and primer 👇

Trading 101 with SmallCap Index

— Ravi Sharma (@StocksNerd) August 20, 2019

1. Swing trades when bullish divergence in MACD-H forms

2. Breakout trades if Index closes above 22-Day high

3. Pullback/Pocket Pivot trades if Index consolidates constructively while13-EMA>22-EMA

4. Sell, go cash if Index breaches 10-Day low, NQA pic.twitter.com/u8VjXrU0Re

More from Ravi Sharma

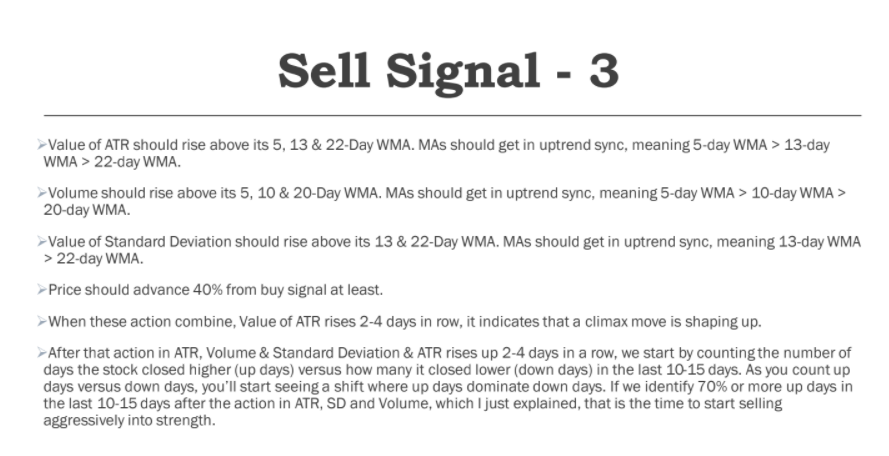

Since market cap of IRCTC is good, I reduced the move rule from 40% to 30% in this case. https://t.co/qzL5rgmtg8

Just a small doubt . I sold Yesterday thinking it was a climax 6% move . How did you decide to sell today ?

— Volatility and Volume Trader (@VolVolatTrader) September 7, 2021

Any rules where you sell positions . Just to learn

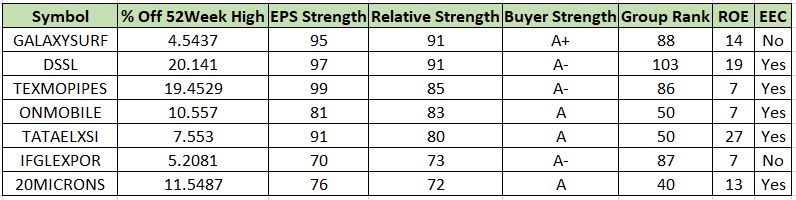

While buying breakouts, your odds will improve a lot when you prefer the following:

1. Strong Relative Strength.

2. Tight price range on low Volume and a pattern which is easy on eyes. https://t.co/CprKpAfgtj

#BAJAJFINSV

— Ravi Sharma (@StocksNerd) August 14, 2021

Setting up in a tight base. Volume has been drying up.

Waiting for the breakout. pic.twitter.com/KWoGZAwkLO

For my trading strategy, 13-day & 22-day EMAs are more suitable.

If SmallCap dips below these MAs & they get into the bearish sync, I get cautious & reduce my position size.

Sir as you follow the smallcap index,do you take full positions when it\u2019s trading below its key moving averages or wait for some confirmation? pic.twitter.com/ph6HTJ9rbD

— Dhanesh Gianani (@dhanesh500) November 30, 2021

More from Screeners

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

You May Also Like

Some random interesting tidbits:

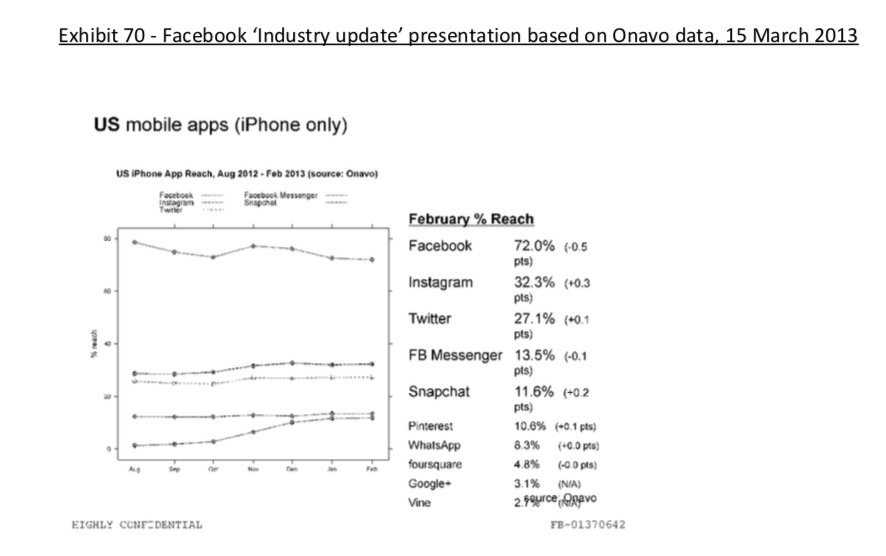

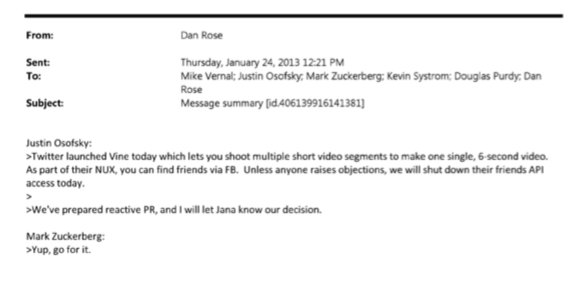

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

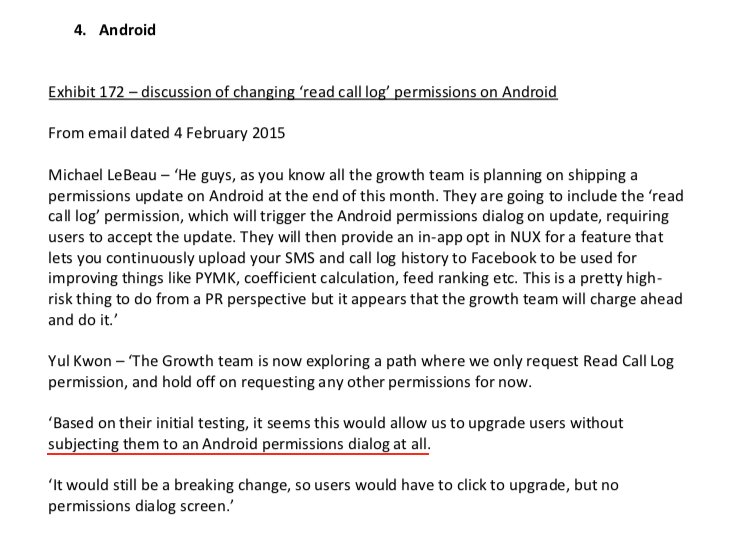

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x