- If any Index closed exactly at the resistance, you can get a trade on either side on the next day. (2/11)

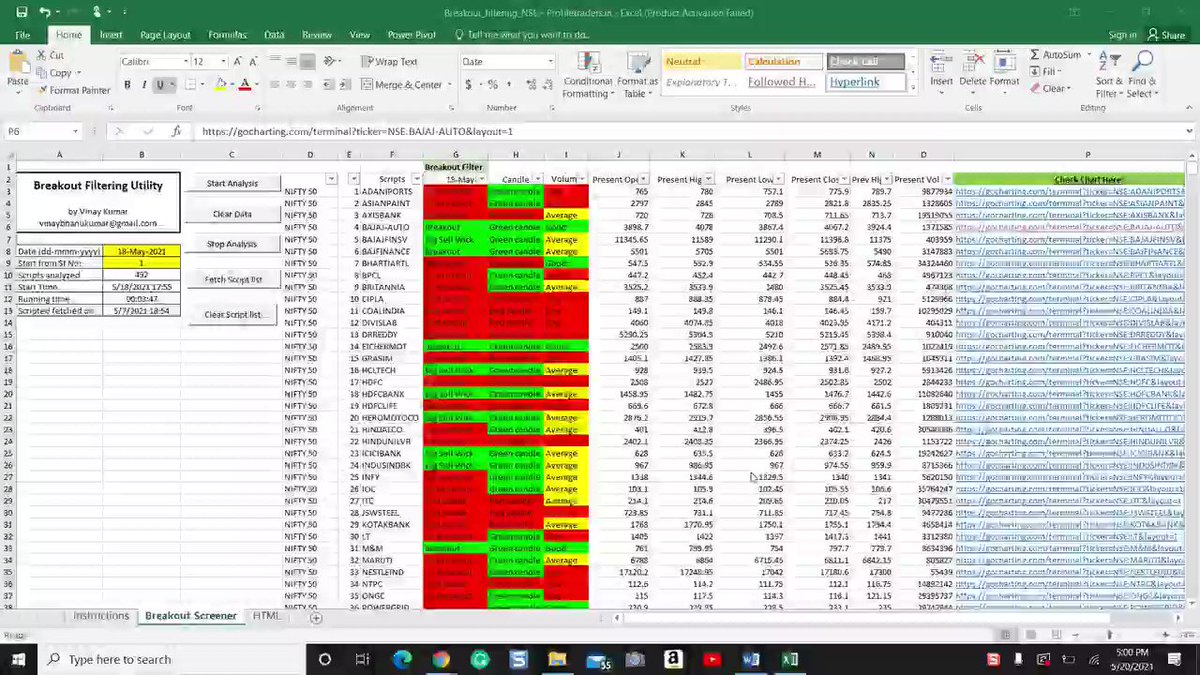

How you can filter stocks for Intraday trades - 🧵

As a kid, we would do homework before school the next day - you have to do homework here too. A specific sector performs on a particular day and studying things a day before will help you spot that particular sector. (1/11)

- If any Index closed exactly at the resistance, you can get a trade on either side on the next day. (2/11)

- If any Index closed exactly at support, you can get a trade on either side the following day.

- If there was a bullish signal at the support.

- If any Index gave a breakout or breakdown and then gave a good closing. (3/11)

Once you spot the Index, look at all the stocks in that particular Index. Pick at least 3-4 stocks from that Index and add them to your watchlist for the next day. It's ideal to check both higher and lower timeframes. (4/11)

- Start with checking the top gainers/losers list. I observe market from 9:15 to 9:45am to check the sectors performing well on that day.(5/11)

More from Sheetal Rijhwani

Read and follow this.. he has aptly explained about various methods to trail.

2. TRAILING METHODS-

— Trader knight (@Traderknight007) December 24, 2020

1. SWING POINT METHOD-

In this method we use the swing points or the HH- HL OR LH-LL points for placing sl,

In this method we trail our sl when the stock make a Higher low after our entry and keep Trailing the sl till it hits. pic.twitter.com/CqzCkLdWmC

Nobody will give you this kind of knowledge in any paid webinar like they gave this in a thread! One more brilliant thread by @ITRADE191 @AdityaTodmal @niki_poojary

In this thread, I'll walk you through my set up, absorb it as much as you can.

— itrade(DJ) (@ITRADE191) June 27, 2021

The instrument that I trade in are Nifty (NF) options

Thanks to @AdityaTodmal @niki_poojary for contributing in making this pic.twitter.com/BrMrGydb1v

More from Screeners

You May Also Like

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K