Do with your own. Don’t pay them.

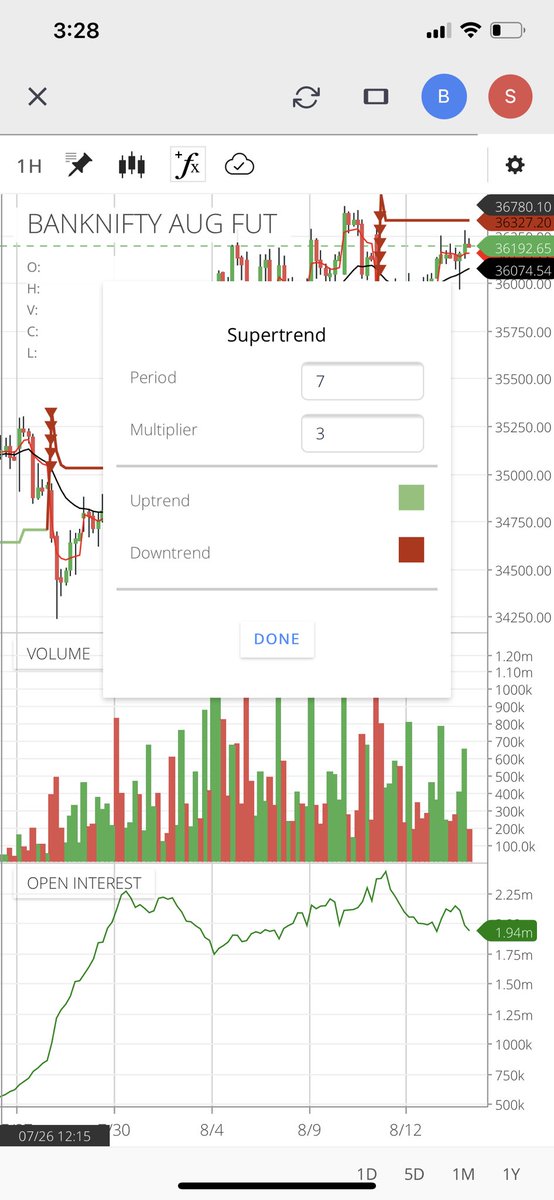

There is a supertrend indicator in zerodha. For swing go with 60 min chart. Check with different numbers in period and multiplier section.

Check success rate of buy and sell signal generated by system. Apply number according to decide buy and sell for swing trade.

More from Mitesh Patel

Few are saying that now a days I am not sharing any knowledgeable tweet.

I already shared in my old tweets and I don’t want to repeat same.

Read my old learning tweets in this PDF collection.

I already shared in my old tweets and I don’t want to repeat same.

Read my old learning tweets in this PDF collection.

Mitesh Bhai's tweets comprises of the live case studies. Study & apply them in your trading system.

— (DJ)itrade capital solution Private Limited. (@ITRADE191) June 25, 2021

Thanks to those who have made the pdfs of Mitesh Bhai's tweets, have merged it in this single pdf.\U0001f607\U0001f60e\U0001f607https://t.co/RLGACDY6sj

More from Screeners

VWAP for intraday Trading Part -2

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

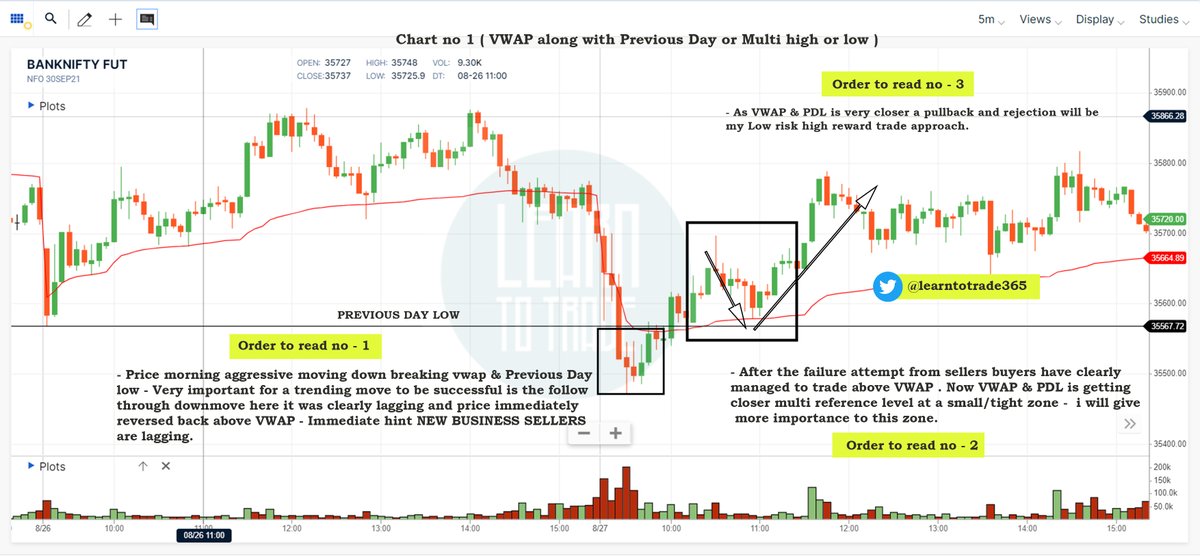

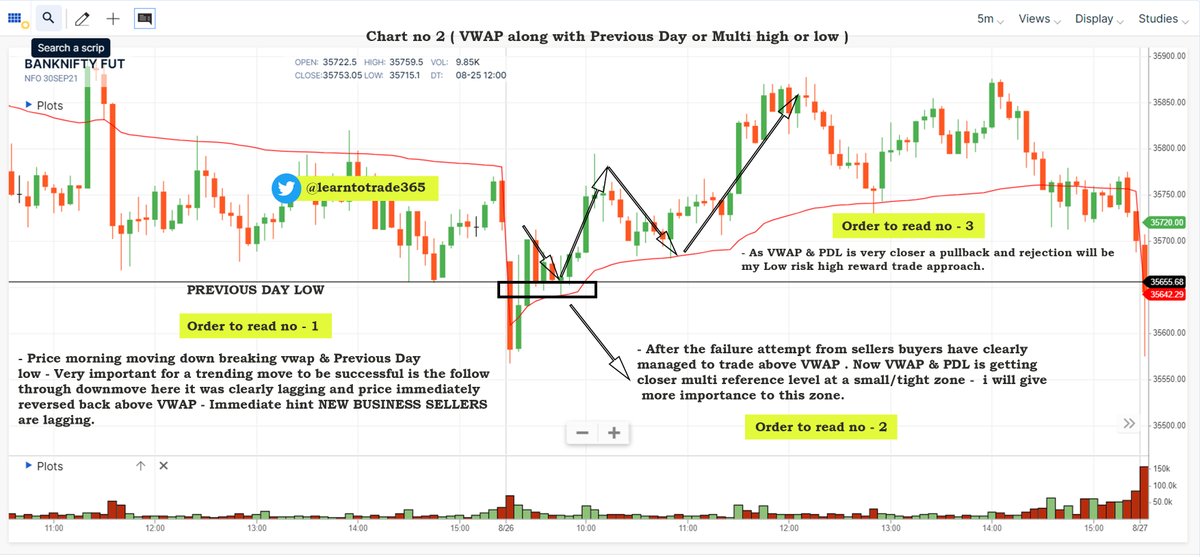

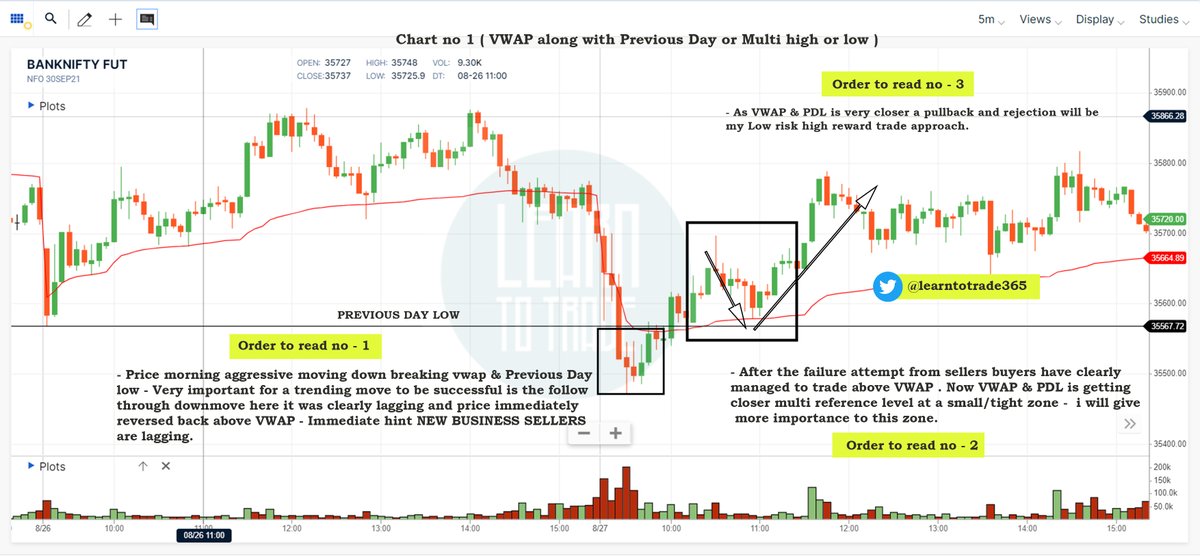

Chart 1

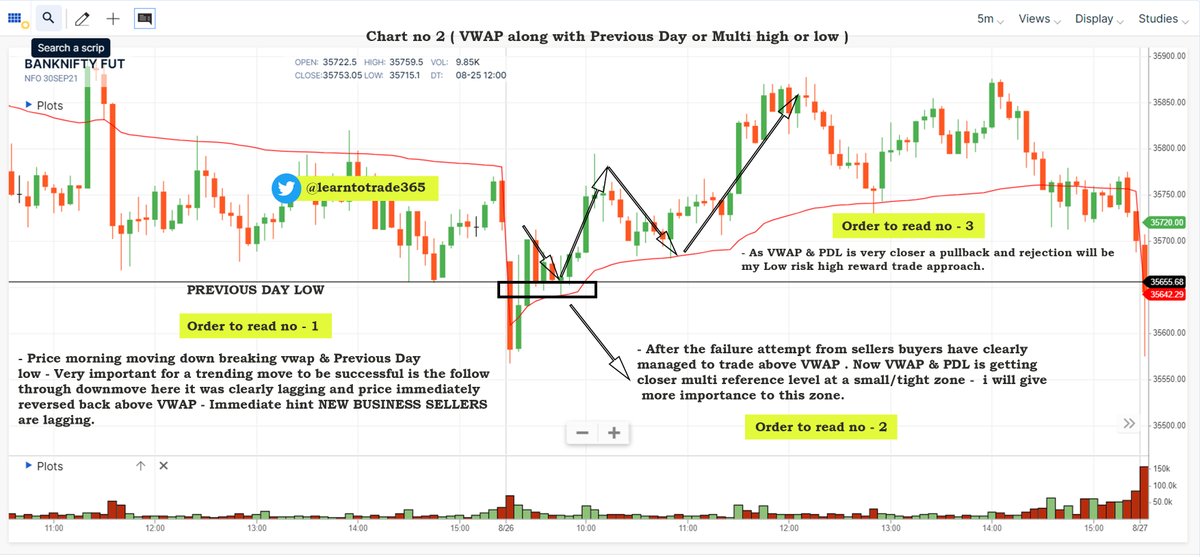

Chart 2

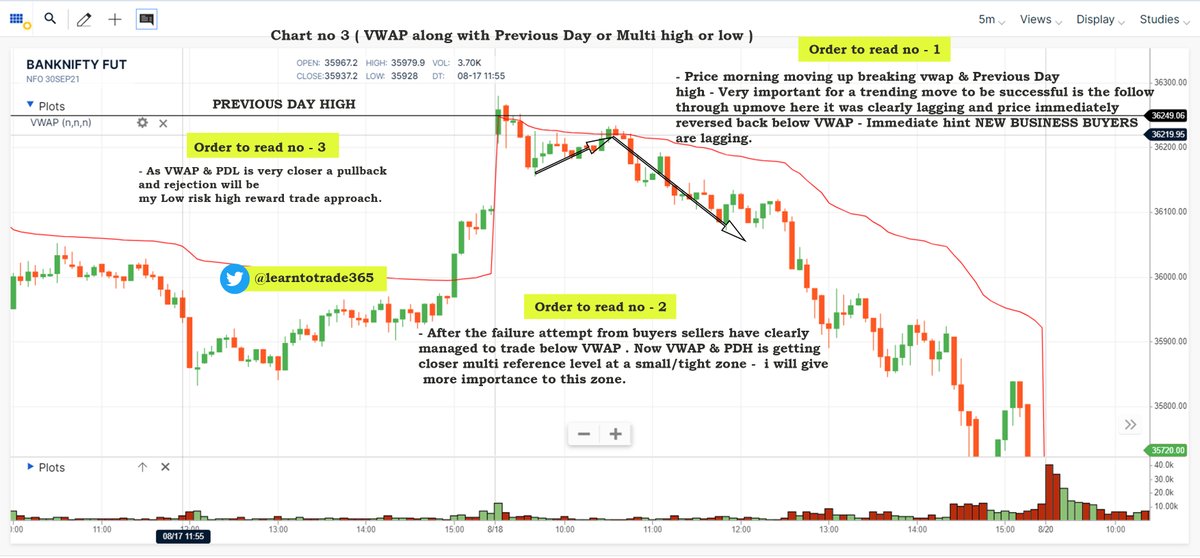

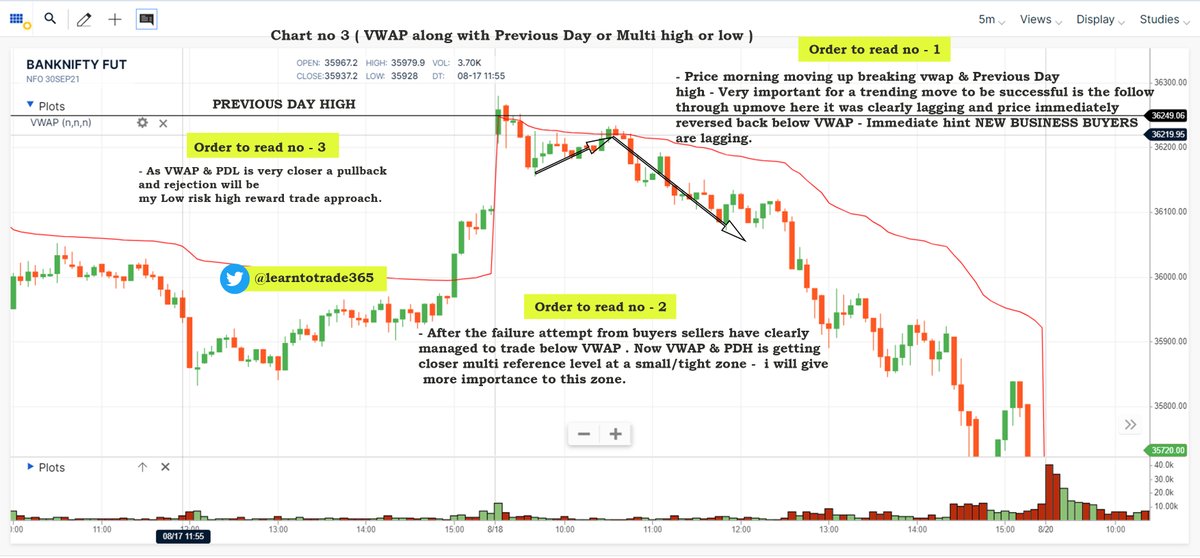

Chart 3

Chart 4

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

Chart 1

Chart 2

Chart 3

Chart 4

I use 4 scanners:

1) Volatility, Volume & daily range compression scanner

2) Punch-Drunk-Love

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

1) Volatility, Volume & daily range compression scanner

2) Punch-Drunk-Love

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

Sir, How do u find a set up - Do you track chart of each stock daily ? Or do u have filters , that lead you to a number of stocks , after which you scan them.

— AKASH GUPTA (@lockdownmurti) August 25, 2021

You May Also Like

Oh my Goodness!!!

I might have a panic attack due to excitement!!

Read this thread to the end...I just had an epiphany and my mind is blown. Actually, more than blown. More like OBLITERATED! This is the thing! This is the thing that will blow the entire thing out of the water!

Has this man been concealing his true identity?

Is this man a supposed 'dead' Seal Team Six soldier?

Witness protection to be kept safe until the right moment when all will be revealed?!

Who ELSE is alive that may have faked their death/gone into witness protection?

Were "golden tickets" inside the envelopes??

Are these "golden tickets" going to lead to their ultimate undoing?

Review crumbs on the board re: 'gold'.

#SEALTeam6 Trump re-tweeted this.

I might have a panic attack due to excitement!!

Read this thread to the end...I just had an epiphany and my mind is blown. Actually, more than blown. More like OBLITERATED! This is the thing! This is the thing that will blow the entire thing out of the water!

Tik Tok pic.twitter.com/8X3oMxvncP

— Scotty Mar10 (@Allenma15086871) December 29, 2020

Has this man been concealing his true identity?

Is this man a supposed 'dead' Seal Team Six soldier?

Witness protection to be kept safe until the right moment when all will be revealed?!

Who ELSE is alive that may have faked their death/gone into witness protection?

Were "golden tickets" inside the envelopes??

Are these "golden tickets" going to lead to their ultimate undoing?

Review crumbs on the board re: 'gold'.

#SEALTeam6 Trump re-tweeted this.

✨📱 iOS 12.1 📱✨

🗓 Release date: October 30, 2018

📝 New Emojis: 158

https://t.co/bx8XjhiCiB

New in iOS 12.1: 🥰 Smiling Face With 3 Hearts https://t.co/6eajdvueip

New in iOS 12.1: 🥵 Hot Face https://t.co/jhTv1elltB

New in iOS 12.1: 🥶 Cold Face https://t.co/EIjyl6yZrF

New in iOS 12.1: 🥳 Partying Face https://t.co/p8FDNEQ3LJ

🗓 Release date: October 30, 2018

📝 New Emojis: 158

https://t.co/bx8XjhiCiB

New in iOS 12.1: 🥰 Smiling Face With 3 Hearts https://t.co/6eajdvueip

New in iOS 12.1: 🥵 Hot Face https://t.co/jhTv1elltB

New in iOS 12.1: 🥶 Cold Face https://t.co/EIjyl6yZrF

New in iOS 12.1: 🥳 Partying Face https://t.co/p8FDNEQ3LJ