Weekend Study-

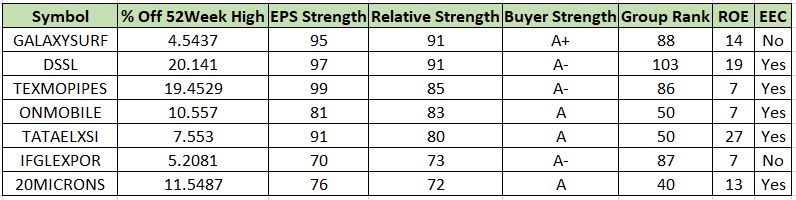

Some good CANSLIM stocks that are setting well with significant compression in volatility & volume.

More from Ravi Sharma

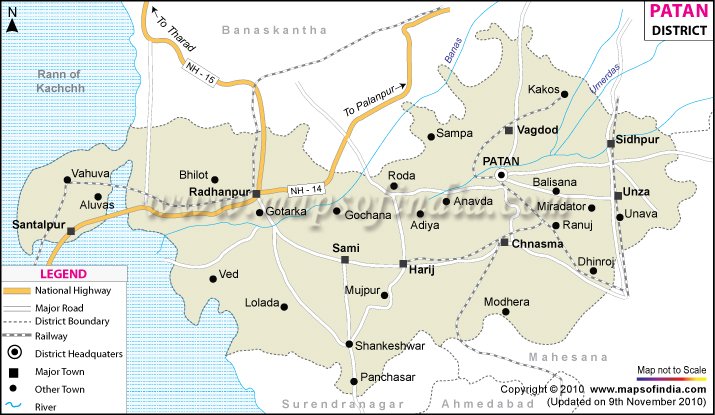

1) 50 WMA > 100 WMA > 150 WMA > 200 WMA

2) Price is within 25% range of its 52-Week High and above 30% or more from its 52-Week Low.

Just one question , how do u differentiate stage 2 from 1 , apart from volume , what else do u look ?

— Priyanshu (@Priyans48107837) August 6, 2021

1) Volatility, Volume & daily range compression scanner

2) Punch-Drunk-Love

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

Sir, How do u find a set up - Do you track chart of each stock daily ? Or do u have filters , that lead you to a number of stocks , after which you scan them.

— AKASH GUPTA (@lockdownmurti) August 25, 2021

I have made some minor tweakings to this timing model since this tweet but it still will give you an idea and primer 👇

Trading 101 with SmallCap Index

— Ravi Sharma (@StocksNerd) August 20, 2019

1. Swing trades when bullish divergence in MACD-H forms

2. Breakout trades if Index closes above 22-Day high

3. Pullback/Pocket Pivot trades if Index consolidates constructively while13-EMA>22-EMA

4. Sell, go cash if Index breaches 10-Day low, NQA pic.twitter.com/u8VjXrU0Re

Signs are all over the place, you just needed to read them. https://t.co/17bwpa1psj

#TATAPOWER is consolidating nicely around 50 & 10-DMA.

— Ravi Sharma (@StocksNerd) April 1, 2022

3 Pocket Pivot days in the last couple of weeks are signaling the interest of buyers.

4 months long base.

Steady growth in Earnings & Sales in the last 3 quarters.

Relative Strength: 77

Group Rank: 22 pic.twitter.com/2WFeUGiV1z

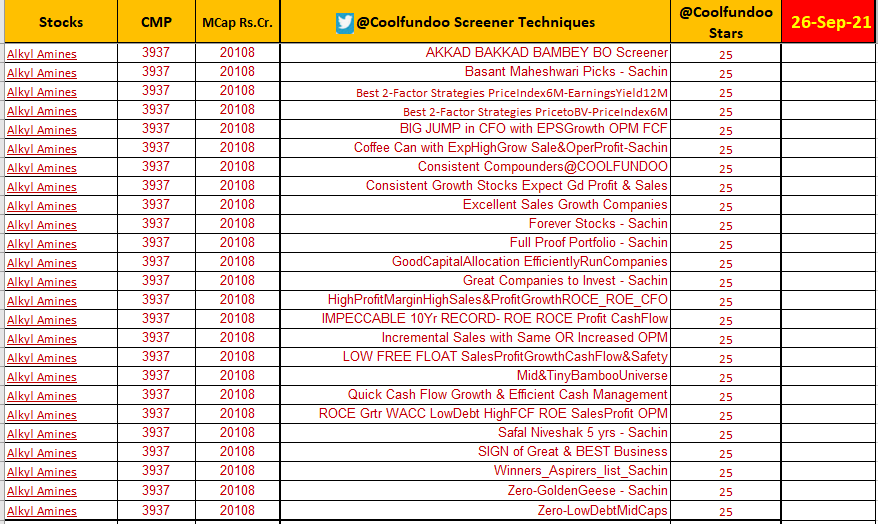

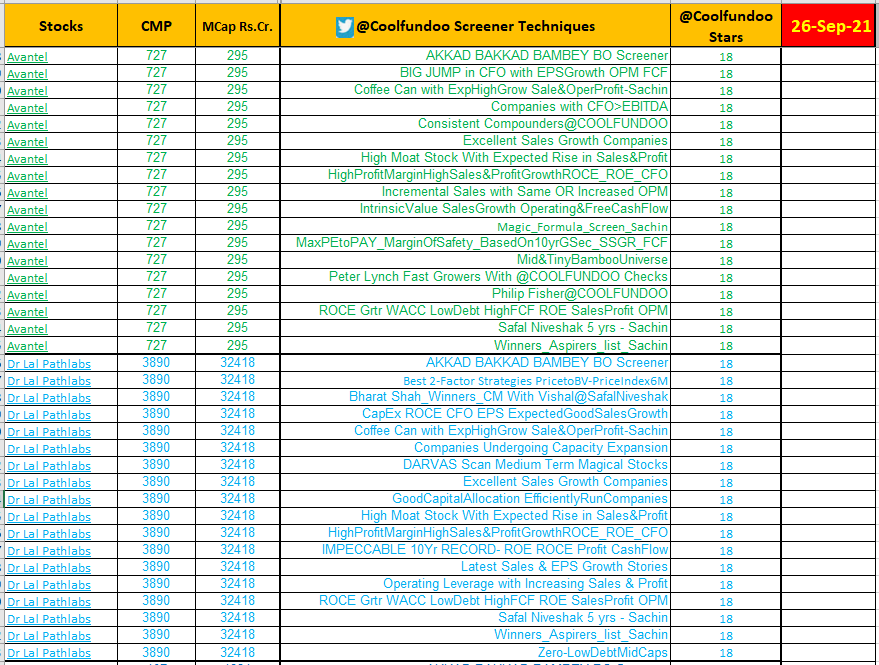

More from Screeners

#bearrun

#BearMarket

Head & Shoulders pattern, double top and bearish RSI divergences fail more often in bull market and generally gives a very good SAR trade. Vice versa is also true for bear market.#bullrun #BullMarket

— Aakash Gangwar (@akashgngwr823) February 9, 2021

You May Also Like

Where to begin?

So our new Secretary of State Anthony Blinken's stepfather, Samuel Pisar, was "longtime lawyer and confidant of...Robert Maxwell," Ghislaine Maxwell's Dad.

"Pisar was one of the last people to speak to Maxwell, by phone, probably an hour before the chairman of Mirror Group Newspapers fell off his luxury yacht the Lady Ghislaine on 5 November, 1991." https://t.co/DAEgchNyTP

OK, so that's just a coincidence. Moving on, Anthony Blinken "attended the prestigious Dalton School in New York City"...wait, what? https://t.co/DnE6AvHmJg

Dalton School...Dalton School...rings a

Oh that's right.

The dad of the U.S. Attorney General under both George W. Bush & Donald Trump, William Barr, was headmaster of the Dalton School.

Donald Barr was also quite a

Donald Barr had a way with words. pic.twitter.com/JdRBwXPhJn

— Rudy Havenstein, listening to Nas all day. (@RudyHavenstein) September 17, 2020

I'm not going to even mention that Blinken's stepdad Sam Pisar's name was in Epstein's "black book."

Lots of names in that book. I mean, for example, Cuomo, Trump, Clinton, Prince Andrew, Bill Cosby, Woody Allen - all in that book, and their reputations are spotless.