Dear Friends,

Here is a video on weekly breakouts. It explains how we pick the stocks for positional based on weekly breakouts.

Step by step guide for weekly BO analysis with scanner details.

https://t.co/fDq74d7s4v

More from SSStockAlerts

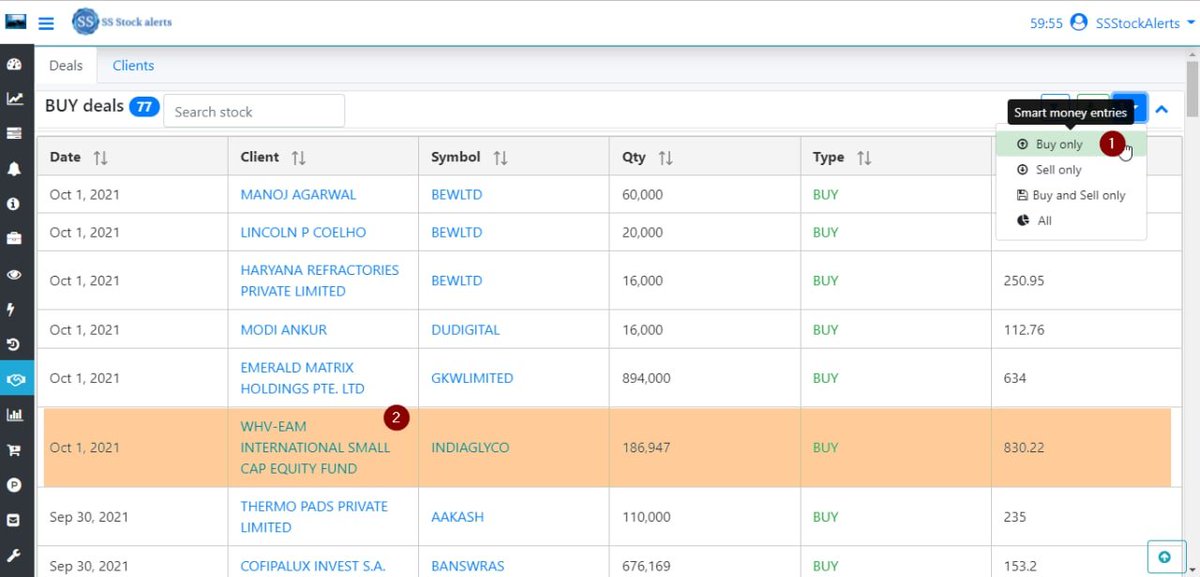

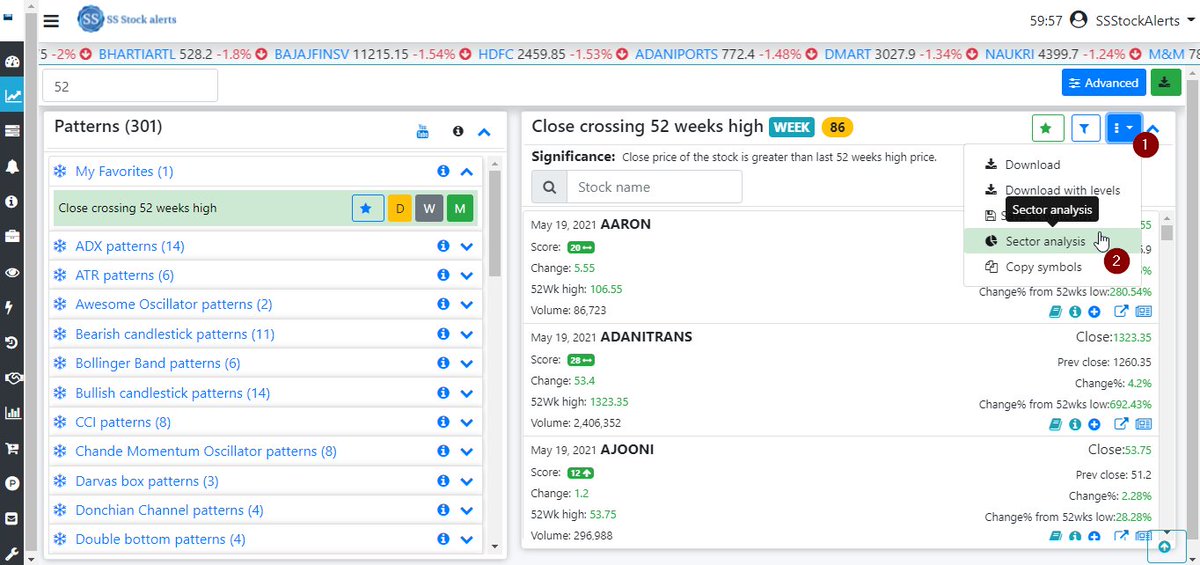

#sssnewfeature

We have implemented sector chart analysis feature and it is available from Scans, Positional and Analysis pages.

Power is given to you. Step ahead with your analysis with leading sectors analysis https://t.co/7rQ5UjCd2J

Dear Friends,

— SSStockAlerts (@ssstockalerts) May 19, 2021

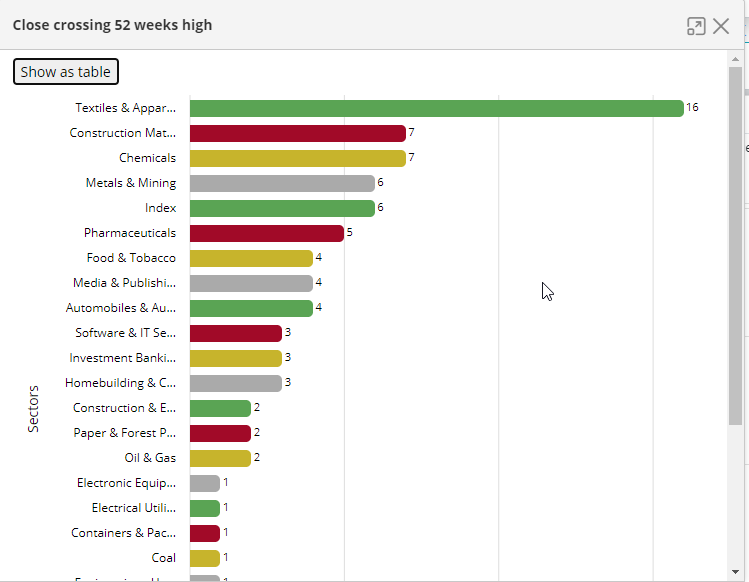

A Sector analysis for scans feature will be added to site.

Eg:- See analysis for 52weeks high breakout, from text tile sector has more breakouts, so concentrate on Textile sector pic.twitter.com/U0cIoEeKDy

- 52 weeks high breakout stocks analysis

- You can see them in tabular format as well and get list of stocks for each sector also.

- Enhanced filter to support these sectors, so you can apply these sectors in filter also.

- Stock rallied to 986 from 789(25%) in just 23days.

- Able to catch the momentum stock near its area of value.

- Find out the stocks which respect which moving average using our AOV analysis and know this type of stocks earlier before bigger move.

#Areaofvalue analysis#CDSL

— SSStockAlerts (@ssstockalerts) May 6, 2021

Buy near 21 SMA support. This stock respects 21 SMA for 84% time. Backtested for last 1 year.

Candle size is getting smaller and volume also less then avg volume.

Any time it can reverse from here.

Help/Supporthttps://t.co/rRCfjf3KIi pic.twitter.com/KGyyAAQ1tV

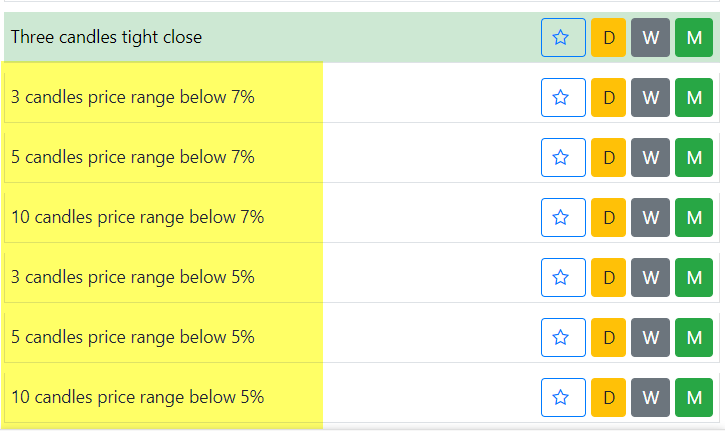

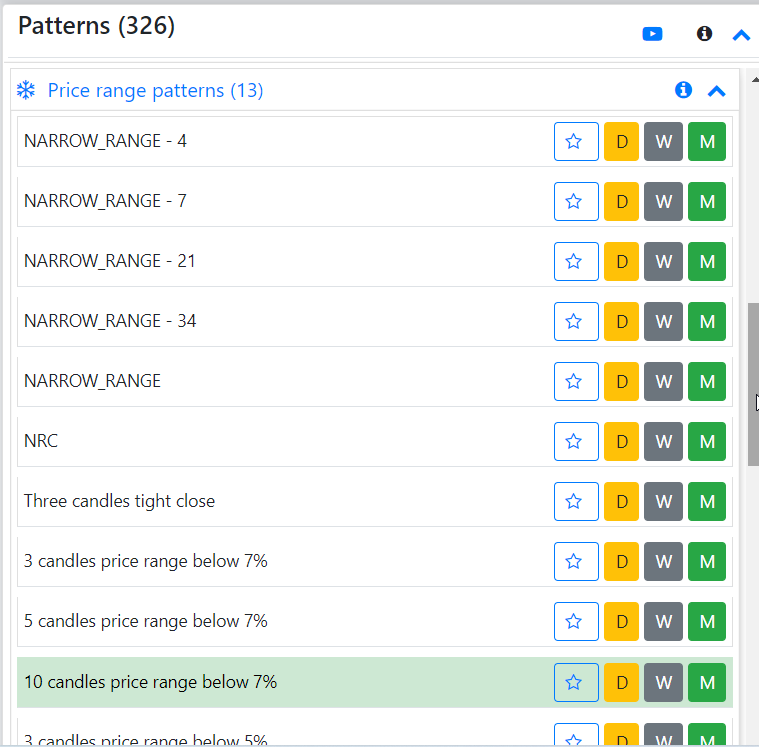

#Sssnewfeature

We have implemented the Price range scans to identify which are in the tight price range for the last few days. Use these scans along with the other scans like the Mark Minervini pattern(High momentum).

@krishchess @Techtrades365

1/n

- These scans can help to find out the stocks whose range is < 5% or 7%.

1. 3 candles price range below 7%

2. 5 candles price range below 7%

3. 10 candles price range below 7%

4. 3 candles price range below 5%

5. 5 candles price range below 5%

6. 10 candles price range below 5%

Why range is important?

When you enter into a trade, for setting up a stop loss if we get the stocks within the 7% price range then we can keep our sl with less than 7%.

- As per Mark Minervini, don't keep the SL with more than 8%.

https://t.co/RkaOwvfBaq

Scans => price range

More from Screeners

1) Volatility, Volume & daily range compression scanner

2) Punch-Drunk-Love

3) GE Ratio - to track fundamentally strong stocks

4) Recently created one to track Power Play setups.

I get around 150-200 stocks daily & choose the ones with the most potential.

Sir, How do u find a set up - Do you track chart of each stock daily ? Or do u have filters , that lead you to a number of stocks , after which you scan them.

— AKASH GUPTA (@lockdownmurti) August 25, 2021

You May Also Like

make products.

"If only someone would tell me how I can get a startup to notice me."

Make Products.

"I guess it's impossible and I'll never break into the industry."

MAKE PRODUCTS.

Courtesy of @edbrisson's wonderful thread on breaking into comics – https://t.co/TgNblNSCBj – here is why the same applies to Product Management, too.

"I really want to break into comics"

— Ed Brisson (@edbrisson) December 4, 2018

make comics.

"If only someone would tell me how I can get an editor to notice me."

Make Comics.

"I guess it's impossible and I'll never break into the industry."

MAKE COMICS.

There is no better way of learning the craft of product, or proving your potential to employers, than just doing it.

You do not need anybody's permission. We don't have diplomas, nor doctorates. We can barely agree on a single standard of what a Product Manager is supposed to do.

But – there is at least one blindingly obvious industry consensus – a Product Manager makes Products.

And they don't need to be kept at the exact right temperature, given endless resource, or carefully protected in order to do this.

They find their own way.