Day trading offers many trading opportunities to make quick money.

But if there is no trade opportunity in Nifty/Banknifty, then what to do?

How to shortlist stocks for intraday trading? there are some simple

More from Indrazith Shantharaj

1 - Accuracy

There is no such thing as 90% Accuracy without compromising on other factors (like profit factor, etc)

Fact - A good trading system will have only 35-60% accuracy without compromising other factors.

(1/n)

2 - Profit Factor (PF)

It is similar to risk-reward. It is derived using the below formula:

Profit Factor = Total Profit by winning trades / Total loss by losing trades

Fact - A trading system above 1.2 PF is good if it scores well with other factors.

(2/n)

3 - Maximum Drawdown

The maximum drawdown also plays a vital role psychologically while picking a trading system.

Fact - Maximum Drawdown in any trading system should not exceed 20%. I suggest picking only the techniques which have less than 10% maximum drawdown.

(3/n)

4 - Maximum Consecutive Losers

We all feel bad even if we lose only Rs.1,000 in a trade. Because it is not only about the money, it is emotionally difficult to accept the failure.

Fact - A good trading system will have less than 15 consecutive losing trades.

(4/n)

TRADE LIKE CRAZY

10 Profitable Intraday Trading Systems, which are backtested against 10-years of Banknifty Historical Data!

(n/n)

https://t.co/BuUie17Ish

Nowadays everyday market is opening with big gaps.

Solution?

Shifting to Stocks!

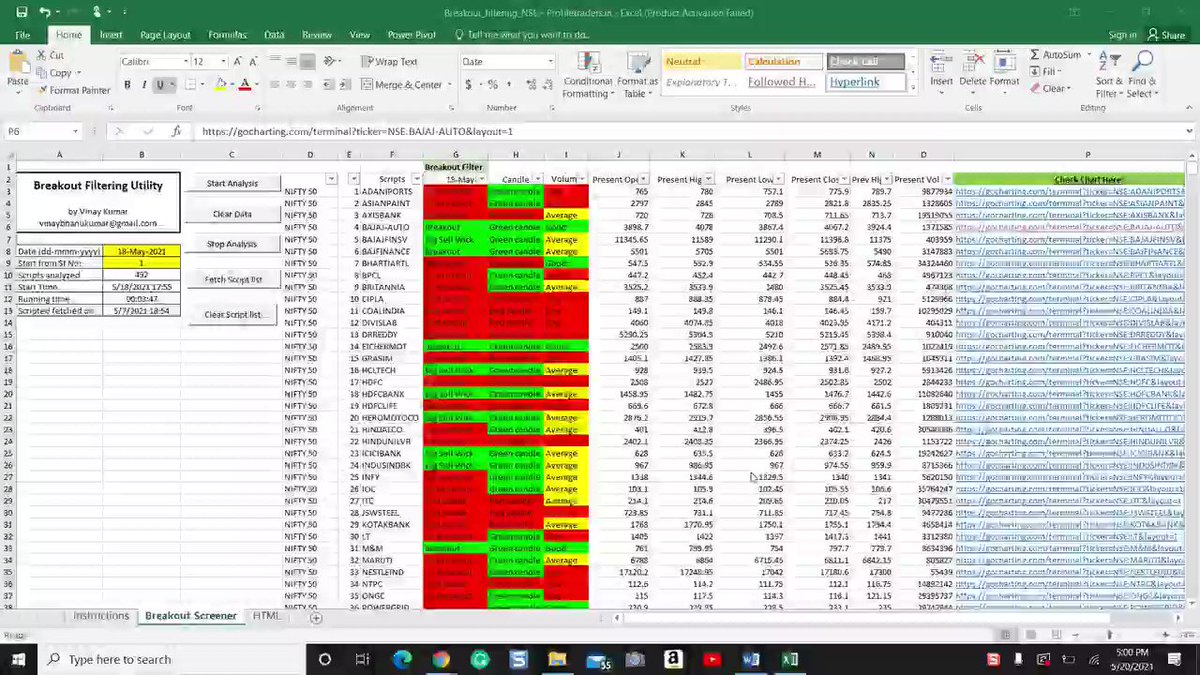

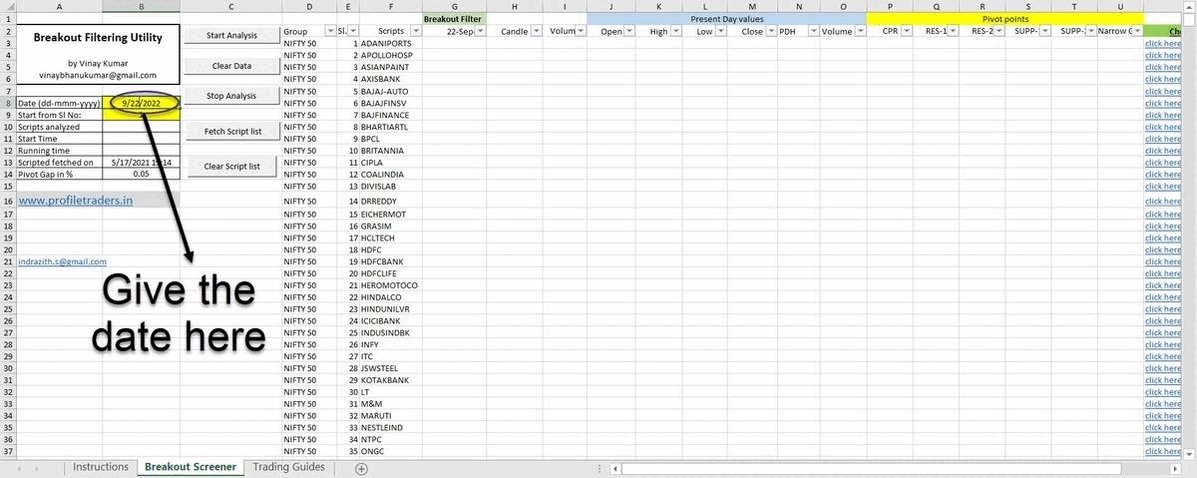

But How to Pick Good Stocks for Tomorrow's Trading?

Presenting 11 FREE Screeners to scan Stocks for the Next Trading Day!

Thread 🧵

(1/N)

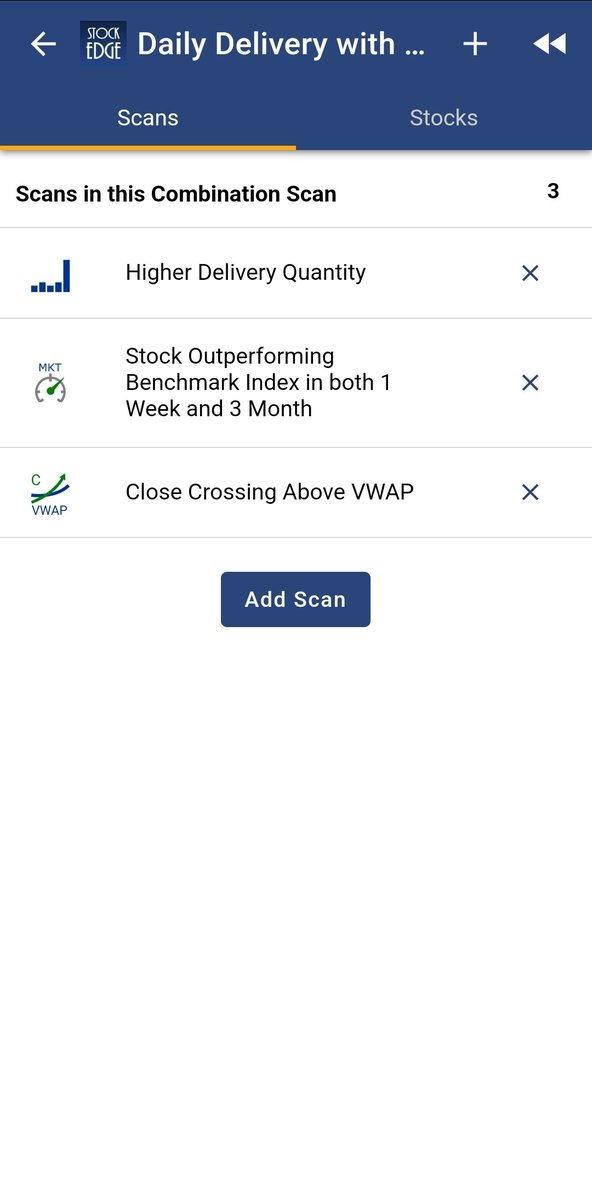

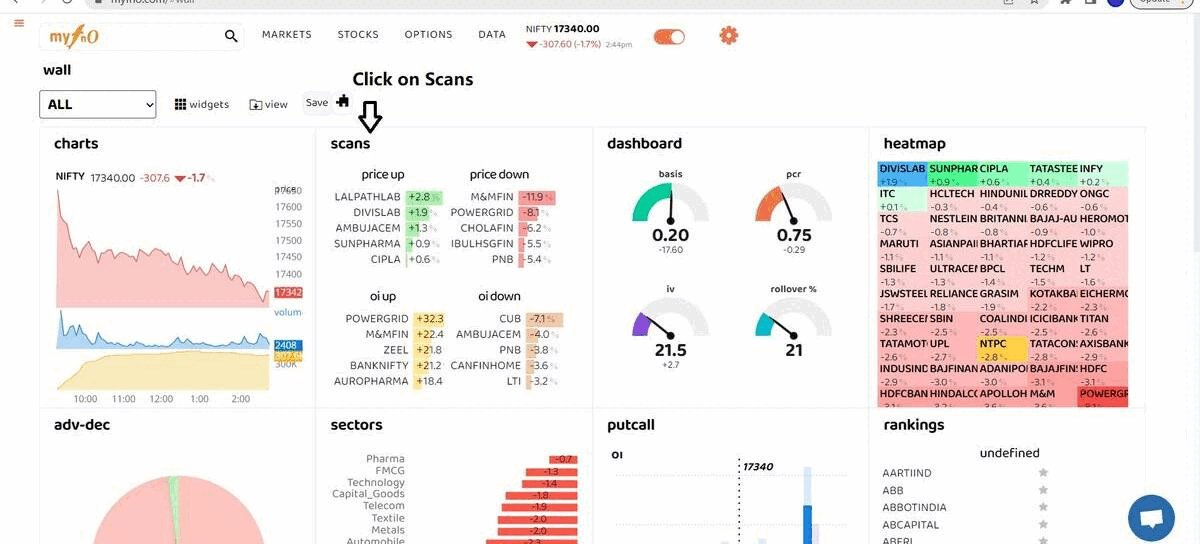

MYFNO - To Know the Stocks Which Received High and Low Open Interest (OI)

https://t.co/FURZDTArKK

(2/N)

Shortlist Bullish Momentum Stocks

This Screener shortlists all the bullish momentum stocks from NSE for the next day's trading (based on price action).

https://t.co/3teN7JLDMs

(3/N)

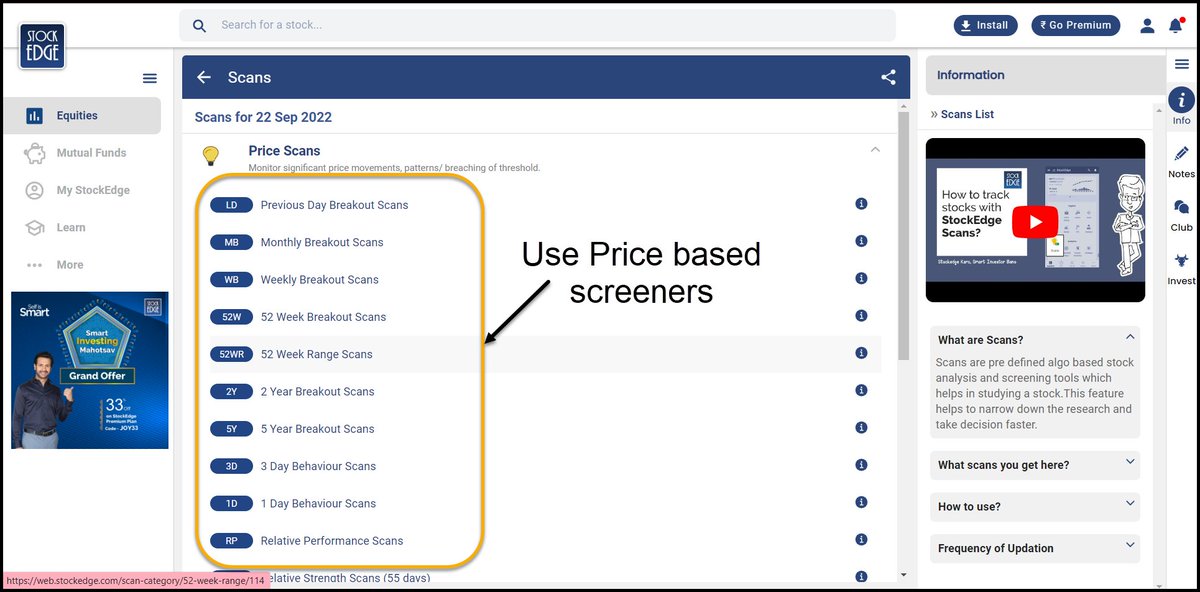

Screeners Based on Price (ex: Previous Day Breakout, Weekly Breakout, Monthly Breakout, etc.)

https://t.co/Y5naQIx967

(4/N)

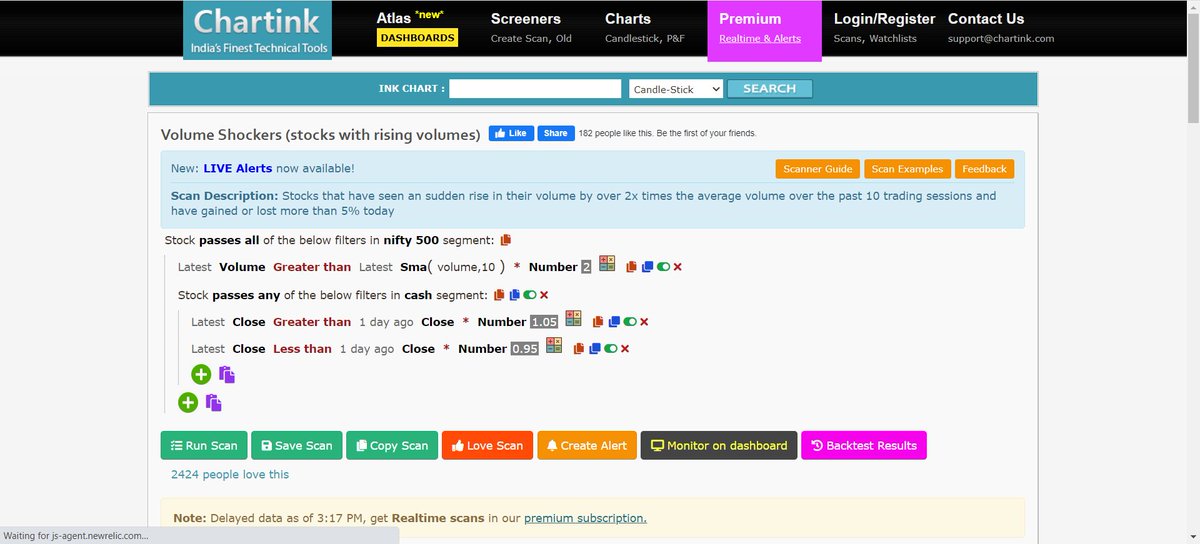

Volume Shockers - Stocks that received a huge volume

https://t.co/u9LTY5Yiir

(5/N)

More from Screeners

Do Share the above tweet 👆

These are going to be very simple yet effective pure price action based scanners, no fancy indicators nothing - hope you liked it.

https://t.co/JU0MJIbpRV

52 Week High

One of the classic scanners very you will get strong stocks to Bet on.

https://t.co/V69th0jwBr

Hourly Breakout

This scanner will give you short term bet breakouts like hourly or 2Hr breakout

Volume shocker

Volume spurt in a stock with massive X times

What does it mean?

7 tweets that will teach you about its basics (and much more):🧵

Collaborated with @niki_poojary

1/ What is CPR?

The basics of CPR, how it's calculated, and TC and BC in CPR.

User: @ZerodhaVarsity.

One can also gauge the trend whether bullish or bearish.

Explained in very simple words

@ZerodhaVarsity 2/ What are the Uses of CPR?

User: @YMehta_

A thread that provides examples along with the concept.

Also includes an Intraday Trading Setup on 5 min

#CPR is an indicator which is used for #Intraday in Stock Market.

— Yash Mehta (@YMehta_) November 19, 2021

This learning thread would be on

"\U0001d650\U0001d668\U0001d65a\U0001d668 \U0001d664\U0001d65b \U0001d63e\U0001d64b\U0001d64d"

Like\u2764\ufe0f& Retweet\U0001f501for wider reach and for more such learning thread in the future.

Also, an investment strategy is shared using CPR in the end.

1/24

@ZerodhaVarsity @YMehta_ 3/ How to analyze trends with CPR?

User: @cprbykgs

How to interpret CPR based on the candles forming either above or below the daily and weekly CPR.

He is the most famous guy when it comes to CPR, so go through his Twitter and Youtube

CPR indicator trend analysis:

— Gomathi Shankar (@cprbykgs) January 25, 2022

Candles below daily & weekly CPR \U0001f43b

Candles above daily CPR but below weekly CPR early confirmation of \U0001f402

Candles above daily + weekly CPR strong confirmation of \U0001f402

Isn\u2019t it simple?#cprbykgs #cprindicator #nifty #banknifty

@ZerodhaVarsity @YMehta_ @cprbykgs 4/ Interpreting longer timeframes with CPR

User: @cprbykgs

Trend Reversals with CPR when the trend is bullish and it enters the daily CPR

#banknifty

— Gomathi Shankar (@cprbykgs) July 9, 2021

Candles above monthly CPR- Bullish

Candles above weekly CPR- Bullish

Now, whenever candles enter daily CPR range it indicates weakness of current trend & early signs of trend reversal.

So, wait for the candles to exit the daily CPR range then take the trade. (1/4) pic.twitter.com/7vaaLMCrV8