More from Learner Vivek Bajaj

1. https://t.co/bPnddzO9NR is India's largest repository of interviews conducted by me, of real market participants.

2. https://t.co/QvERyyhWaE has A2Z of learning related to Trading.

1/n

3. https://t.co/f4yiFFxQ2p for learning basics of Options Trading

4. https://t.co/u56DYdqQAC for comprehensive text modules on Finance in simple school level language

5. https://t.co/dKr2tfcKI1 for practical value added learnings

2/n

6. @mystockedge , simple and effective research tool for serious market participants who want to do-it-on-their-own

7. https://t.co/PgELBirufd for useful market insights.

And more coming soon.

3/n

We have done fair bit of work in democratising financial education and financial data plus analytics in India by making them affordable and effective. Our Free initiatives are powerful and extremely value adding for:

Beginners

Traders

Investors

4/n

N/n

Premium offerings are meant for next level workings. You should checkout all the advance work we are doing in both @elearnmarkets and @mystockedge to make sure that your financial market journey takes the right path of wealth creation.

Follow both the handles for details.

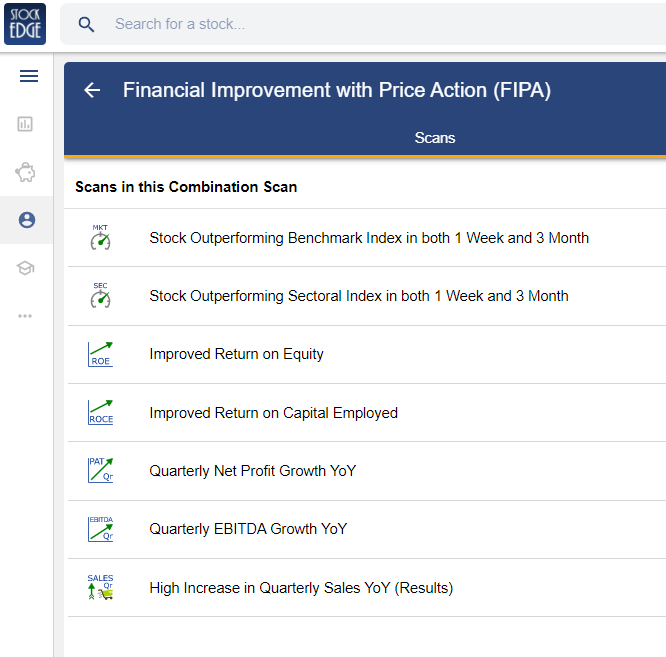

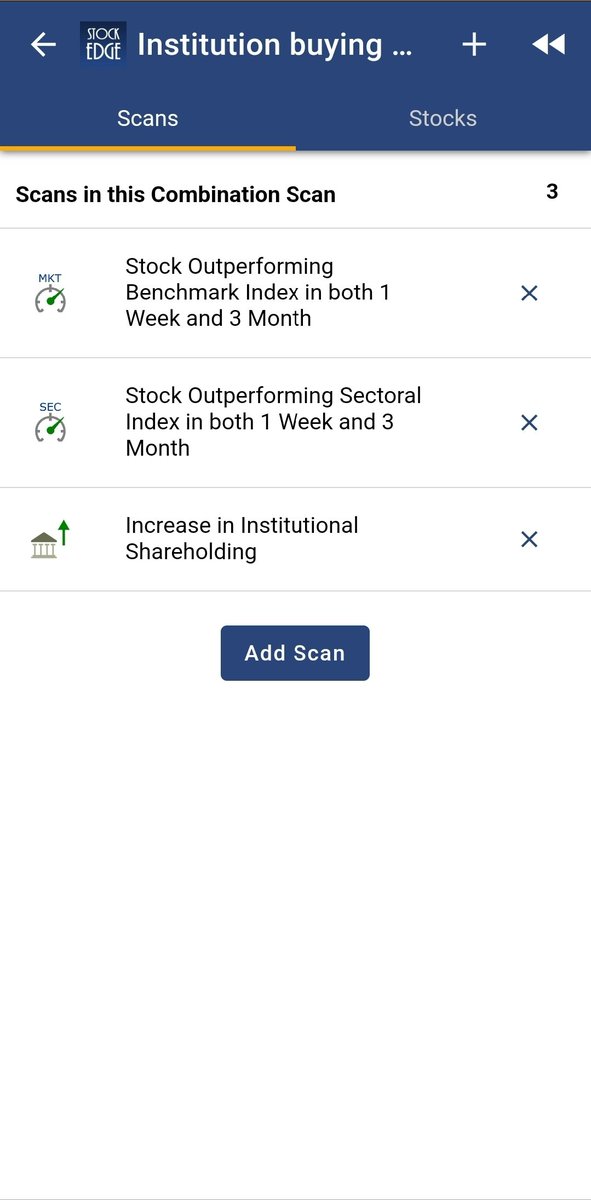

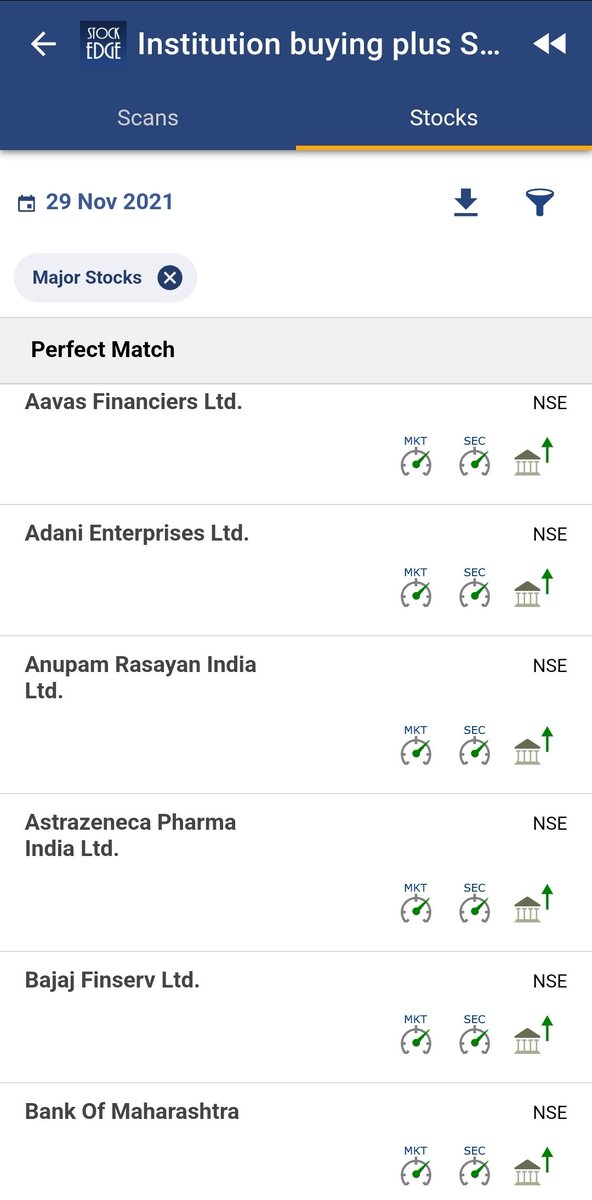

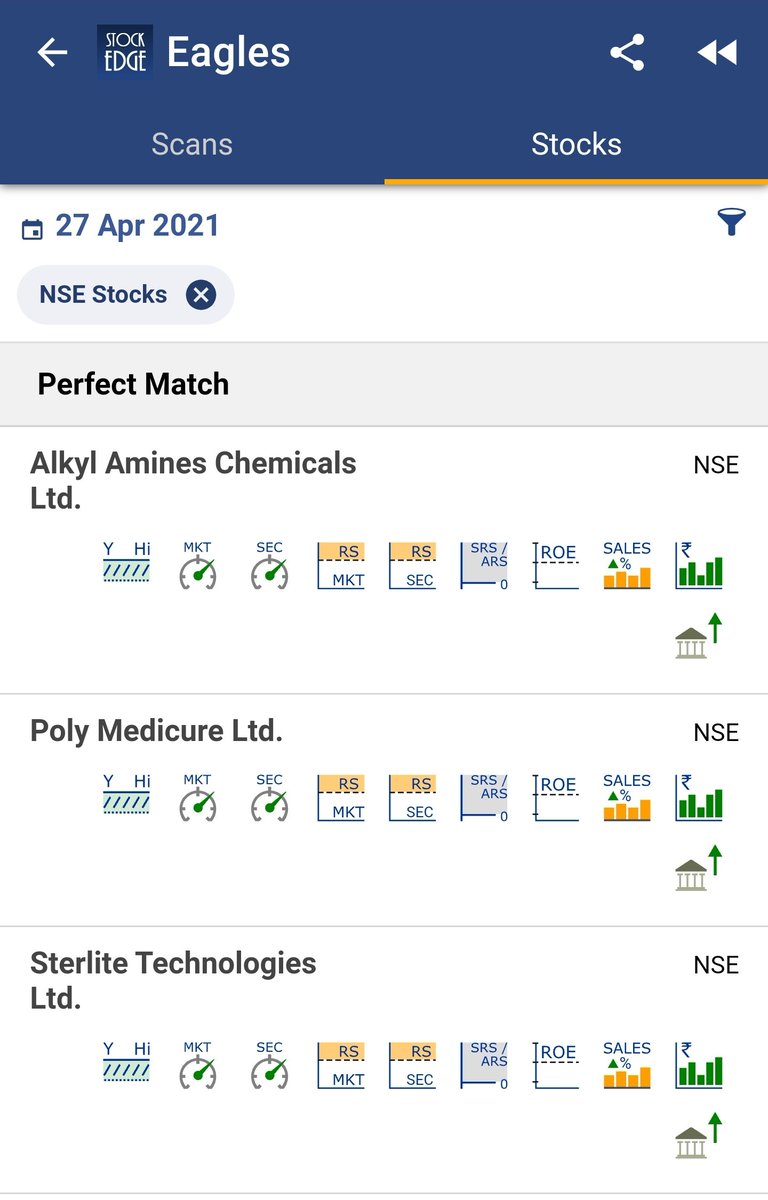

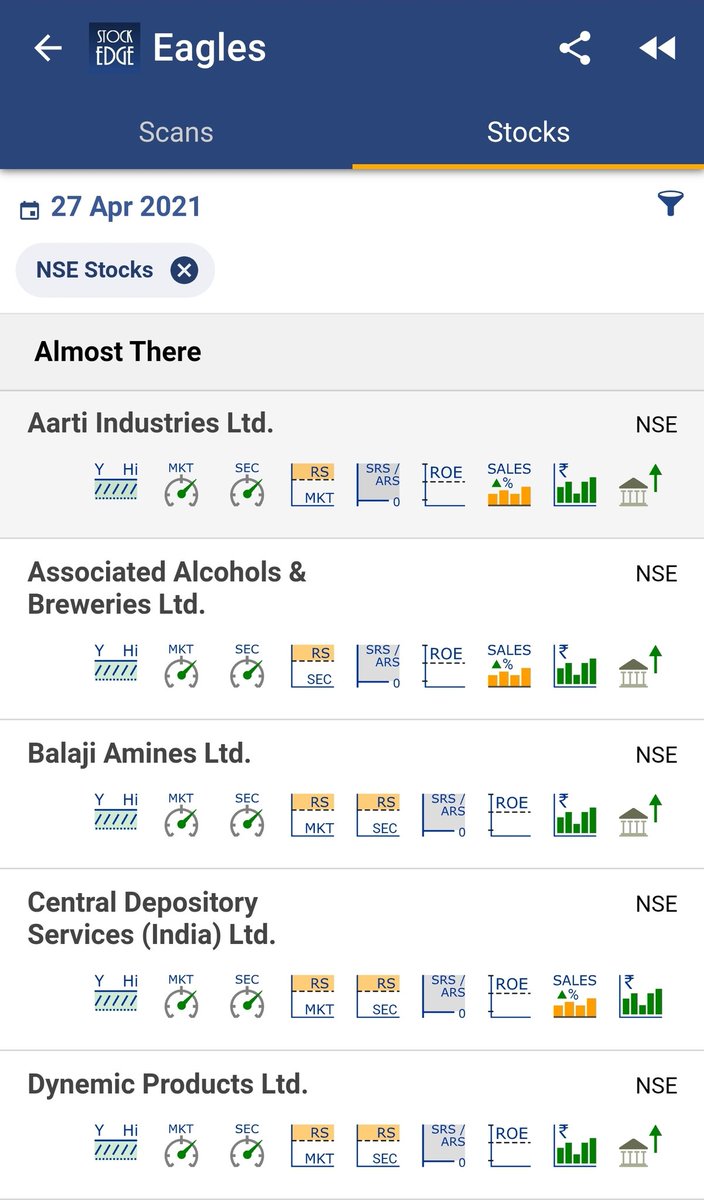

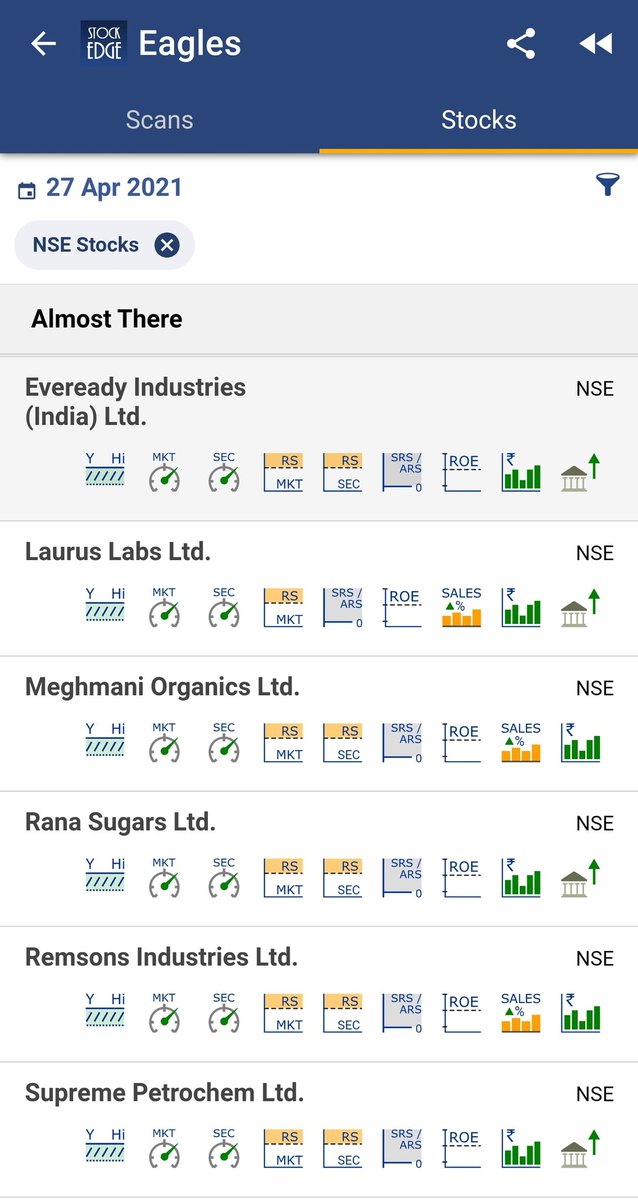

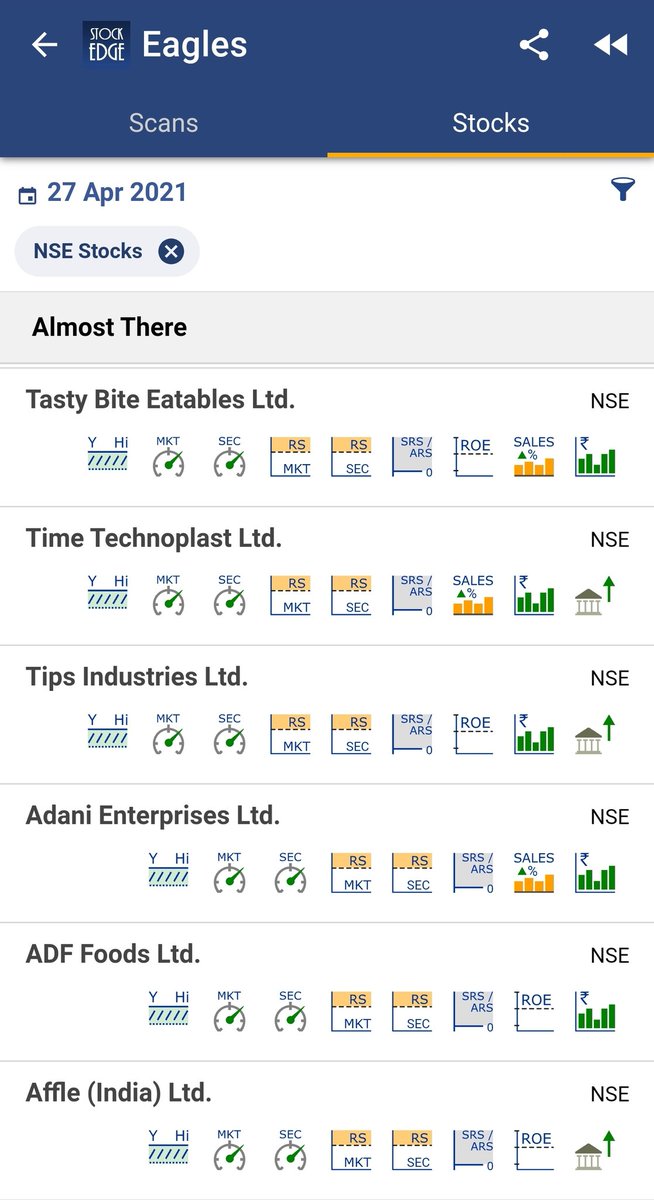

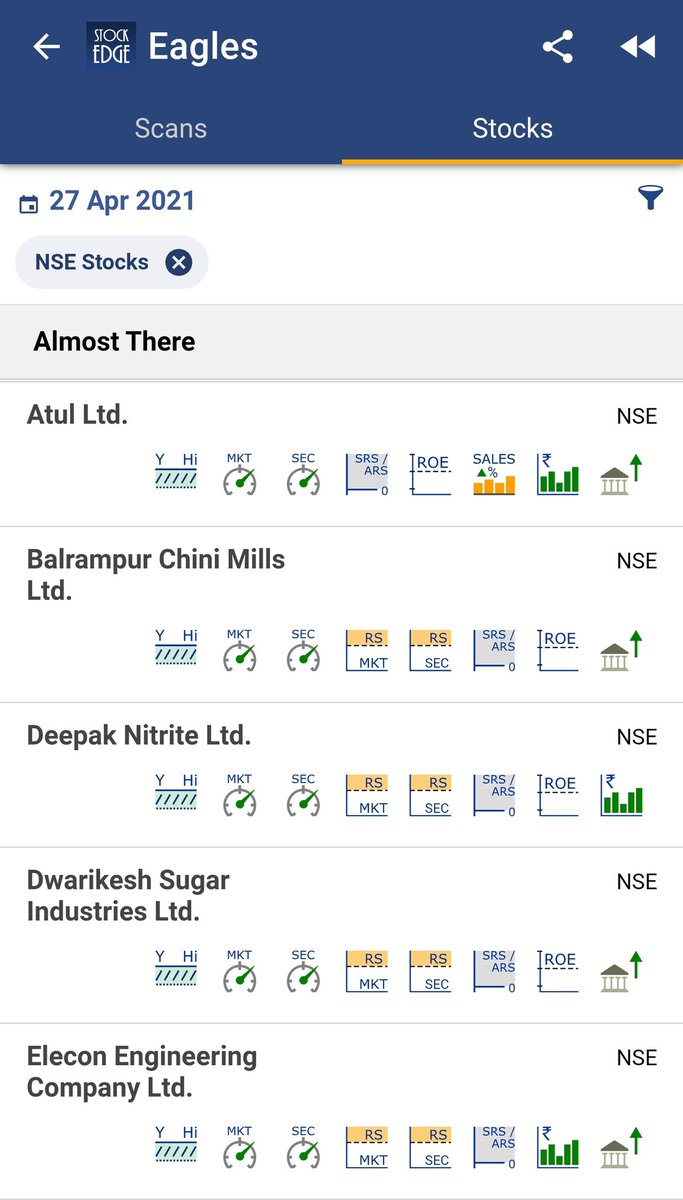

The stocks that are outperforming the market, have their own strength and are capable of flying above all other stocks far higher.

This thread is the list of Eagle Stocks from my Combo scan using @mystockedge

If you like the list retweet for benefit of others.

https://t.co/k4mbQCM638

https://t.co/BQKa0e4tS3

https://t.co/r0OQQaNRhS

https://t.co/LYCH6vDV0g

Wish to build a multi-year, resilient equity #portfolio? On #TheMoneyShow today, @vivbajaj, Co-founder of StockEdge & elearnmarkets shared set a of valuation metrics that can guide your right stock selection strategy@alexandermats pic.twitter.com/qMbNqxHG0M

— ET NOW (@ETNOWlive) January 13, 2022

More from Screeners

A small thread.

PART 1 - https://t.co/ooxepHpYKL

Traders show your support by like & retweet to benefit all

@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @RajarshitaS @Puretechnicals9 @AnandableAnand @Anshi_________ @ca_mehtaravi

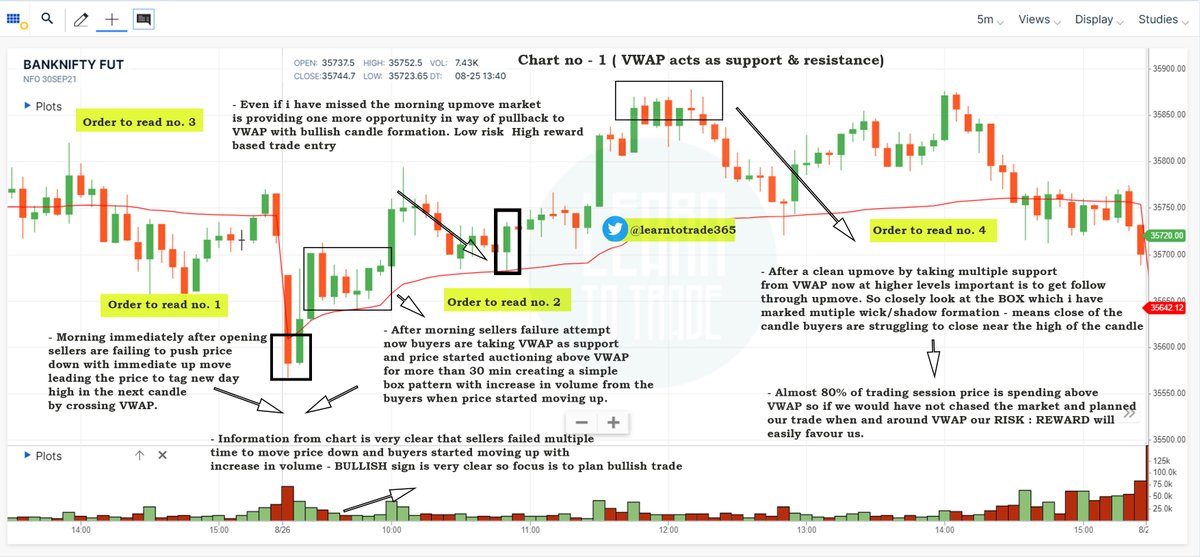

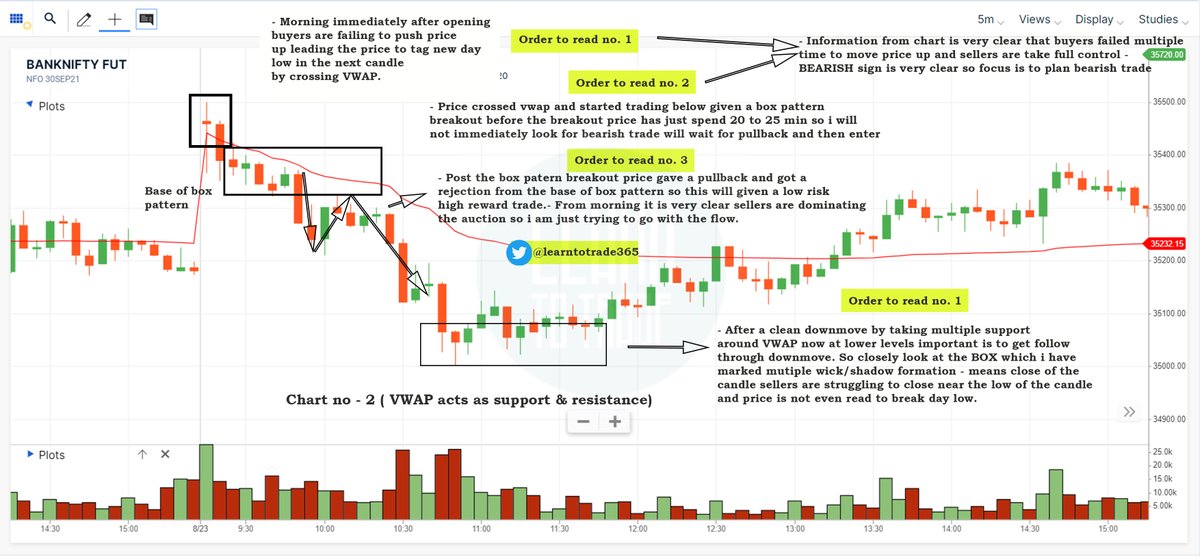

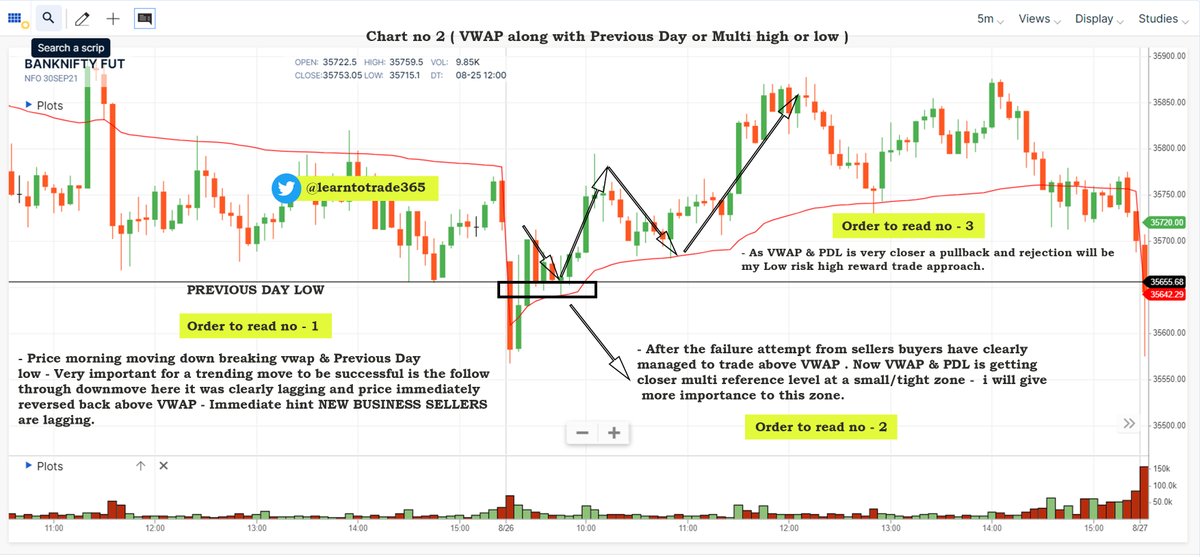

VWAP for intraday Trading Part -1

— Learn to Trade (@learntotrade365) August 28, 2021

A small thread PART -2 will be released tomorrow

Traders show your support by like & retweet to benefit all@Mitesh_Engr @ITRADE191 @ProdigalTrader @nakulvibhor @ArjunB9591 @CAPratik_INDIAN @RajarshitaS @Stockstudy8 @vivbajaj @Prakashplutus pic.twitter.com/y8bwisM4hB

Chart 1

Chart 2

Chart 3

Chart 4

You May Also Like

Covering one of the most unique set ups: Extended moves & Reversal plays

Time for a 🧵 to learn the above from @iManasArora

What qualifies for an extended move?

30-40% move in just 5-6 days is one example of extended move

How Manas used this info to book

The stock exploded & went up as much as 63% from my price.

— Manas Arora (@iManasArora) June 22, 2020

Closed my position entirely today!#BroTip pic.twitter.com/CRbQh3kvMM

Post that the plight of the

What an extended (away from averages) move looks like!!

— Manas Arora (@iManasArora) June 24, 2020

If you don't learn to sell into strength, be ready to give away the majority of your gains.#GLENMARK pic.twitter.com/5DsRTUaGO2

Example 2: Booking profits when the stock is extended from 10WMA

10WMA =

#HIKAL

— Manas Arora (@iManasArora) July 2, 2021

Closed remaining at 560

Reason: It is 40+% from 10wma. Super extended

Total revenue: 11R * 0.25 (size) = 2.75% on portfolio

Trade closed pic.twitter.com/YDDvhz8swT

Another hack to identify extended move in a stock:

Too many green days!

Read

When you see 15 green weeks in a row, that's the end of the move. *Extended*

— Manas Arora (@iManasArora) August 26, 2019

Simple price action analysis.#Seamecltd https://t.co/gR9xzgeb9K

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody:

Next level tactic when closing a sale, candidate, or investment:

— Erik Torenberg (@eriktorenberg) February 27, 2018

Ask: \u201cWhat needs to be true for you to be all in?\u201d

You'll usually get an explicit answer that you might not get otherwise. It also holds them accountable once the thing they need becomes true.

2/ First, “X” could be lots of things. Examples: What would need to be true for you to

- “Feel it's in our best interest for me to be CMO"

- “Feel that we’re in a good place as a company”

- “Feel that we’re on the same page”

- “Feel that we both got what we wanted from this deal

3/ Normally, we aren’t that direct. Example from startup/VC land:

Founders leave VC meetings thinking that every VC will invest, but they rarely do.

Worse over, the founders don’t know what they need to do in order to be fundable.

4/ So why should you ask the magic Q?

To get clarity.

You want to know where you stand, and what it takes to get what you want in a way that also gets them what they want.

It also holds them (mentally) accountable once the thing they need becomes true.

5/ Staying in the context of soliciting investors, the question is “what would need to be true for you to want to invest (or partner with us on this journey, etc)?”

Multiple responses to this question are likely to deliver a positive result.