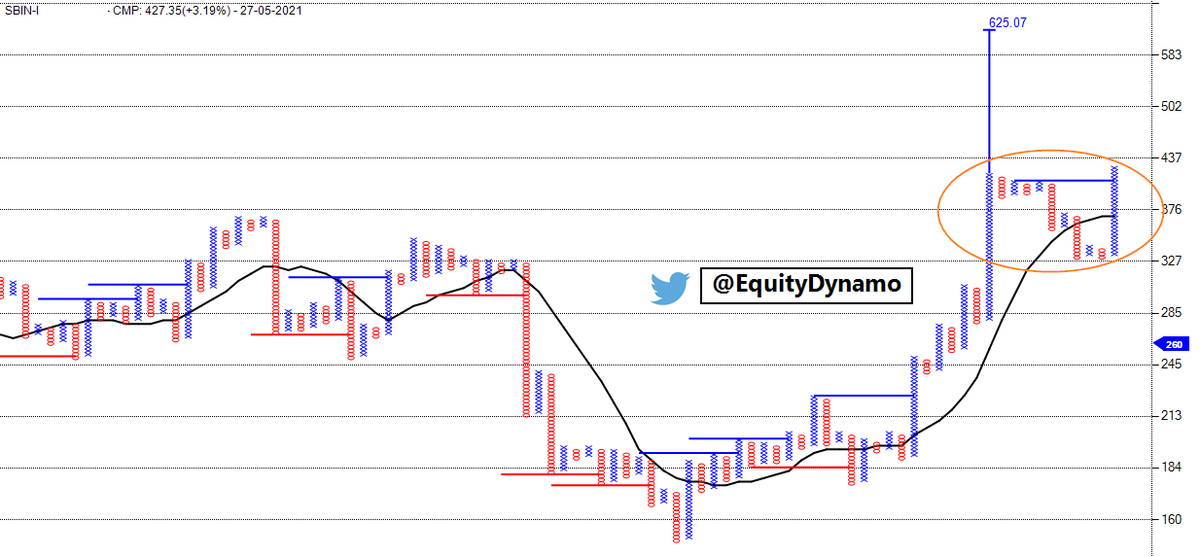

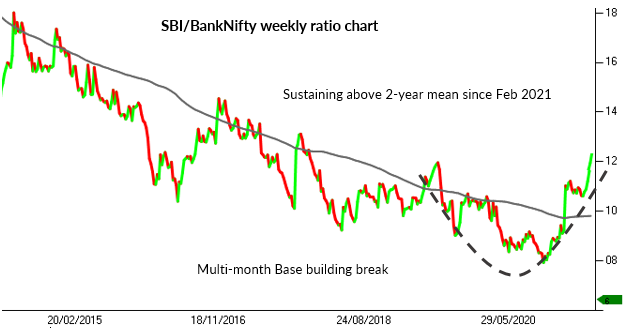

When SBI starts outshining #banknifty, pay attention. Ratio of SBI vs BankNifty shows a multi-month base break, further outperformance is expected from #SBIN #nifty50 Ratio is sustaining abve 2-yr mean since Feb 2021. Such strength has not been at display since 2015

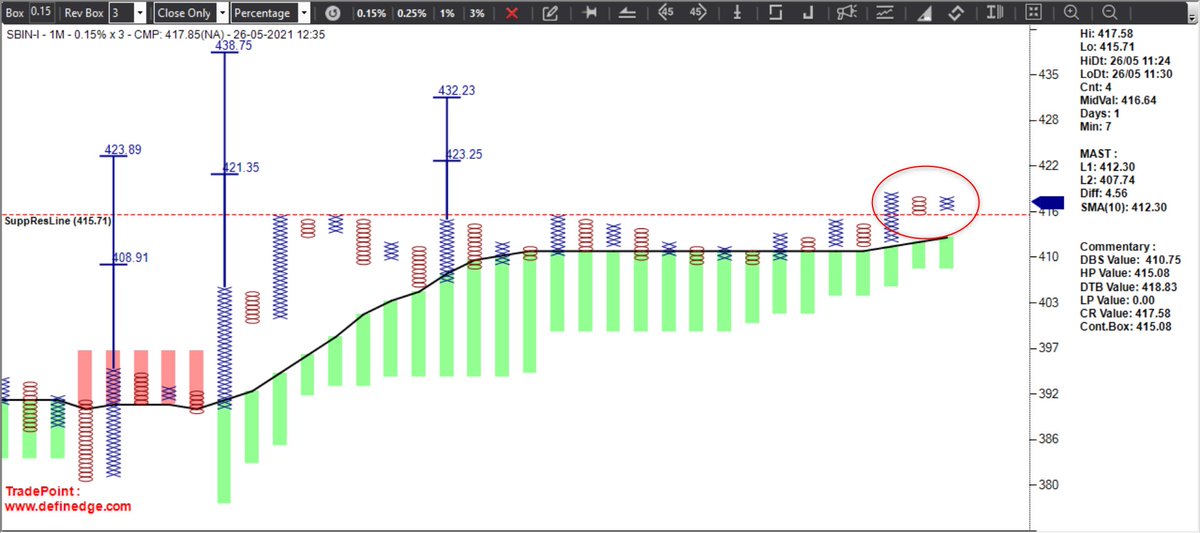

More from Sbin

@rohanshah619 Looks excellent. Reversal from primary trendline as well

#FnOstock #SBIN has completed a 9 month time correction towards the primary trend line & is all set to head higher from here.

— Trendline Investor (@dmdsplyinvestor) July 11, 2022

This could also be a #SIP stock considering it broke out from a decade long consolidation in Feb'21.

Might continue to outperform #Nifty & #Banknifty pic.twitter.com/mYk4exvOn7

You May Also Like

So friends here is the thread on the recommended pathway for new entrants in the stock market.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d