if i'm being honest i mostly learned from studying and trying to replicate charts from legends like @inversebrah, @LSDinmycoffee and @LomahCrypto

PATTERNS - a thread.

what do dairy products, shampoo and the very first couple all have in common?

the answer is lines, shapes...or rather patterns that traders use to predict where price is going in the future.

if i'm being honest i mostly learned from studying and trying to replicate charts from legends like @inversebrah, @LSDinmycoffee and @LomahCrypto

i've made TONS of mistakes in terms of bad, low effort and flat-out invalid patterns with my charts.

with analysis its very easy to make your charts look they way you *want* them to.

i guess you can have fun staying poor...anyways

there are countless patterns, and if i'm being honest you can almost "create your own" to suit your bias.

but for now, lets focus on three: Adam & Eve, Head & Shoulders and Wedges.

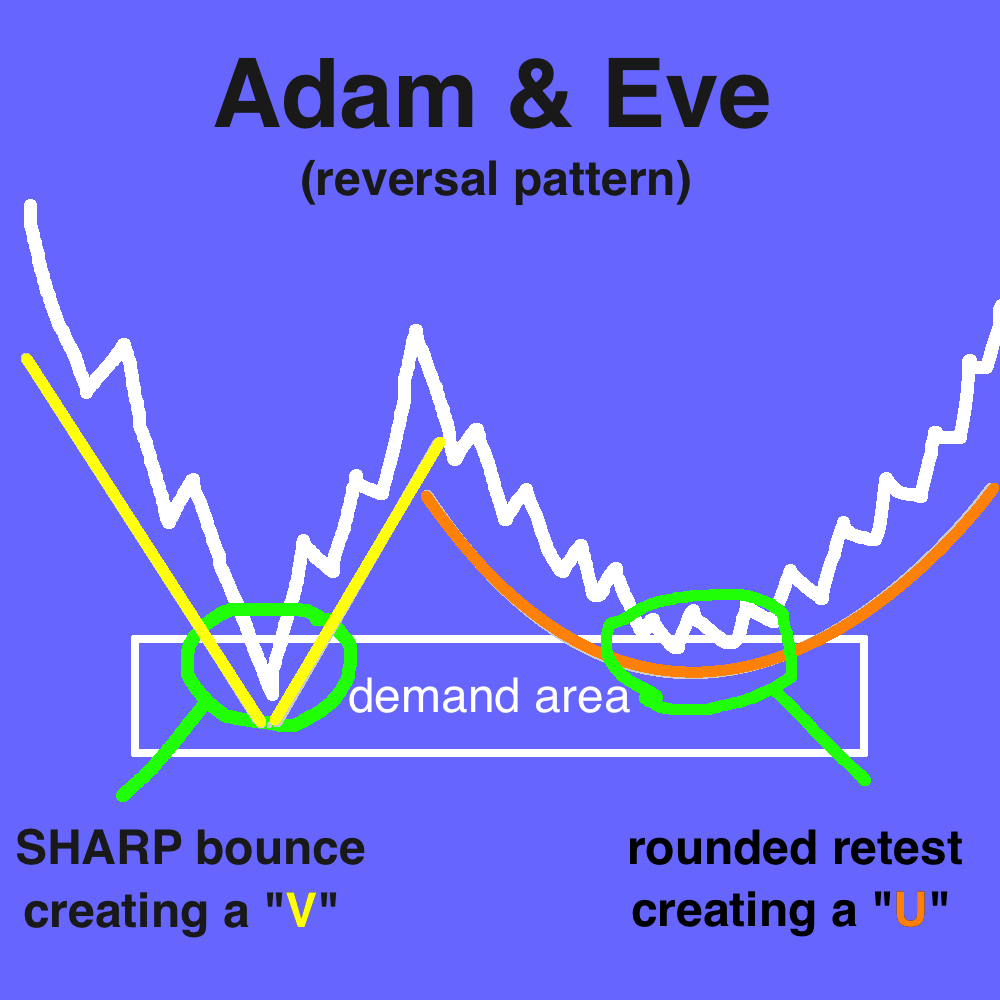

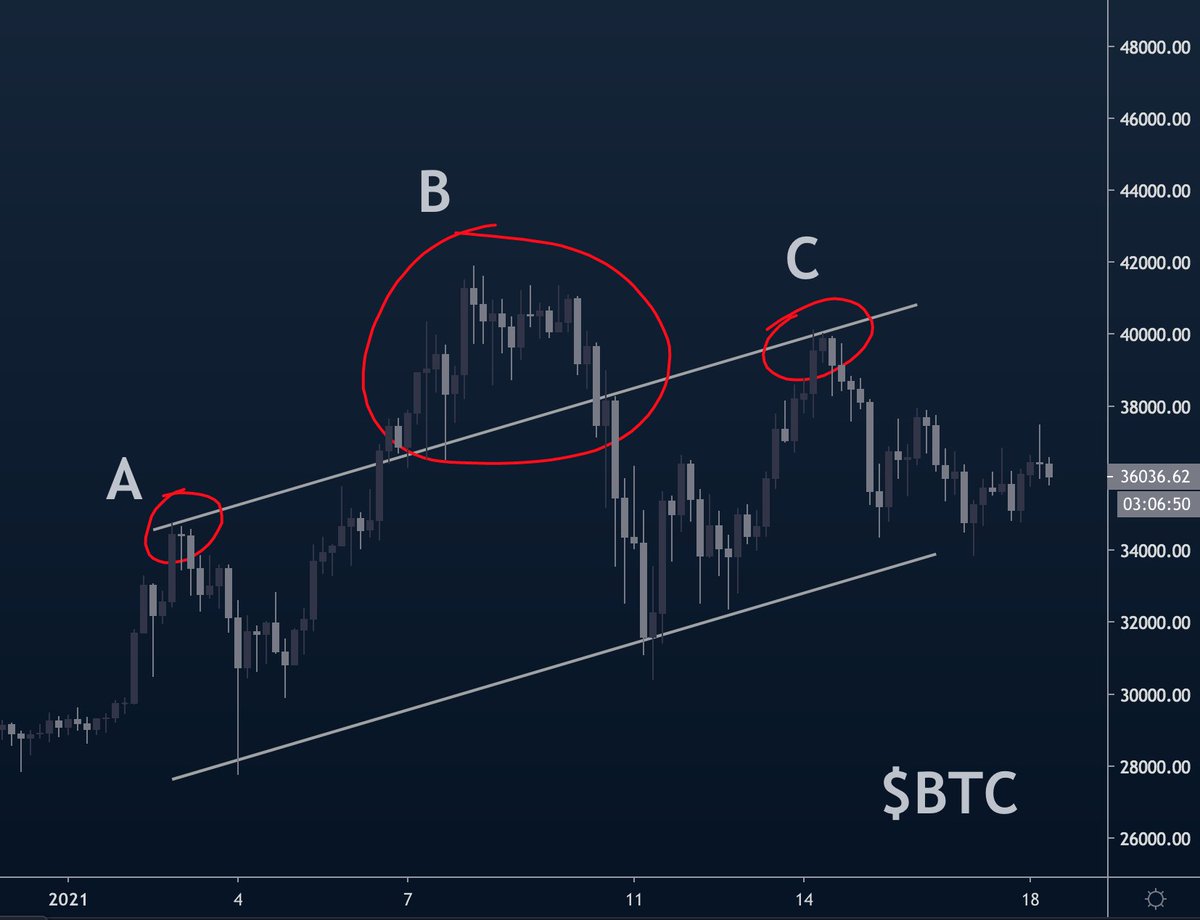

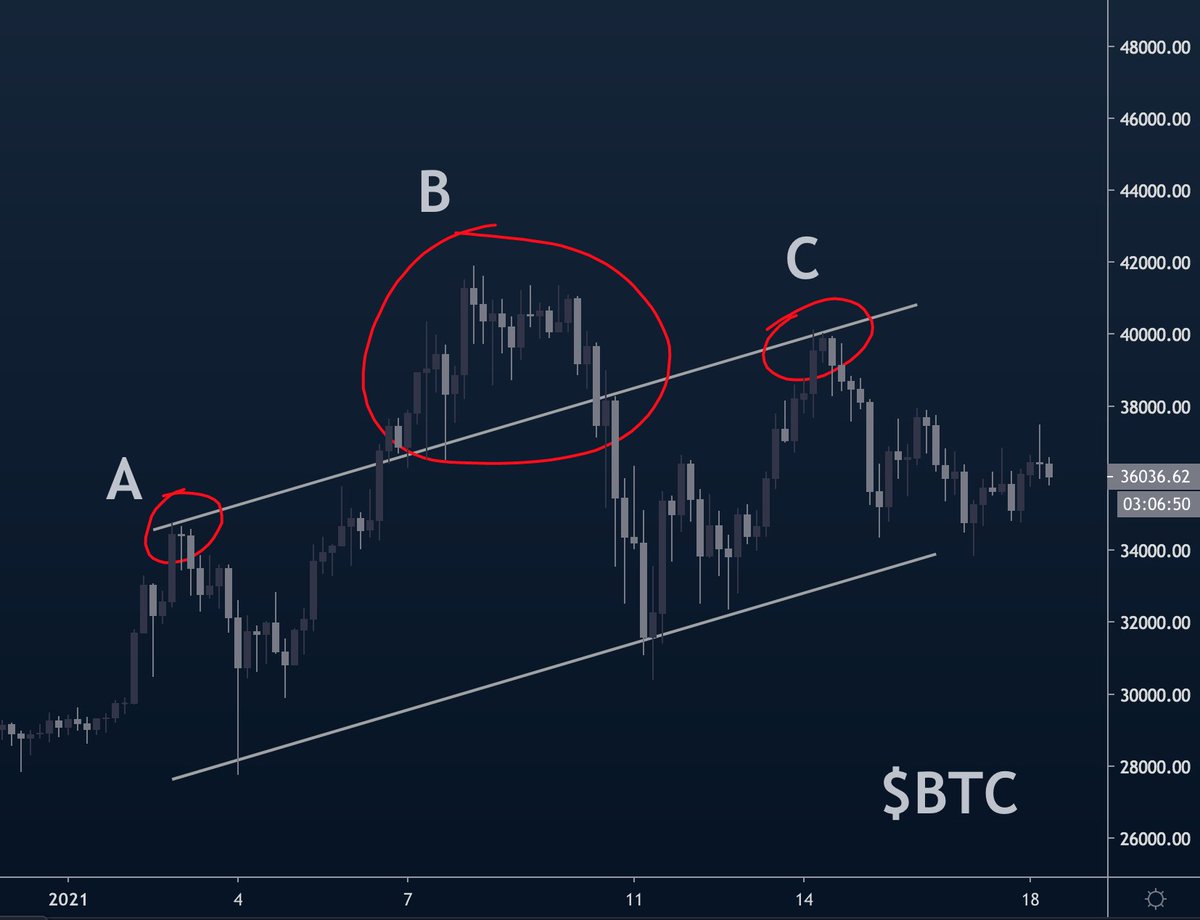

Adam & Eve is a reversal pattern and one of my favorites.

it's basically when you have a sharp reversal at a level, and then have price retest that level in a slower fashion.

price hits demand, bounces sharply, then curves in-and-out of the are it bounced from

A: price sharp down

B: price sharp up

C: price slow curve into area of demand

and it's that simple

https://t.co/VCvOLmhUH3

final update: adam & eve #BTC pic.twitter.com/yffLKl540C

— \u26a1\ufe0f TUNEZ 2000 \u26a1\ufe0f (@cryptunez) January 14, 2021

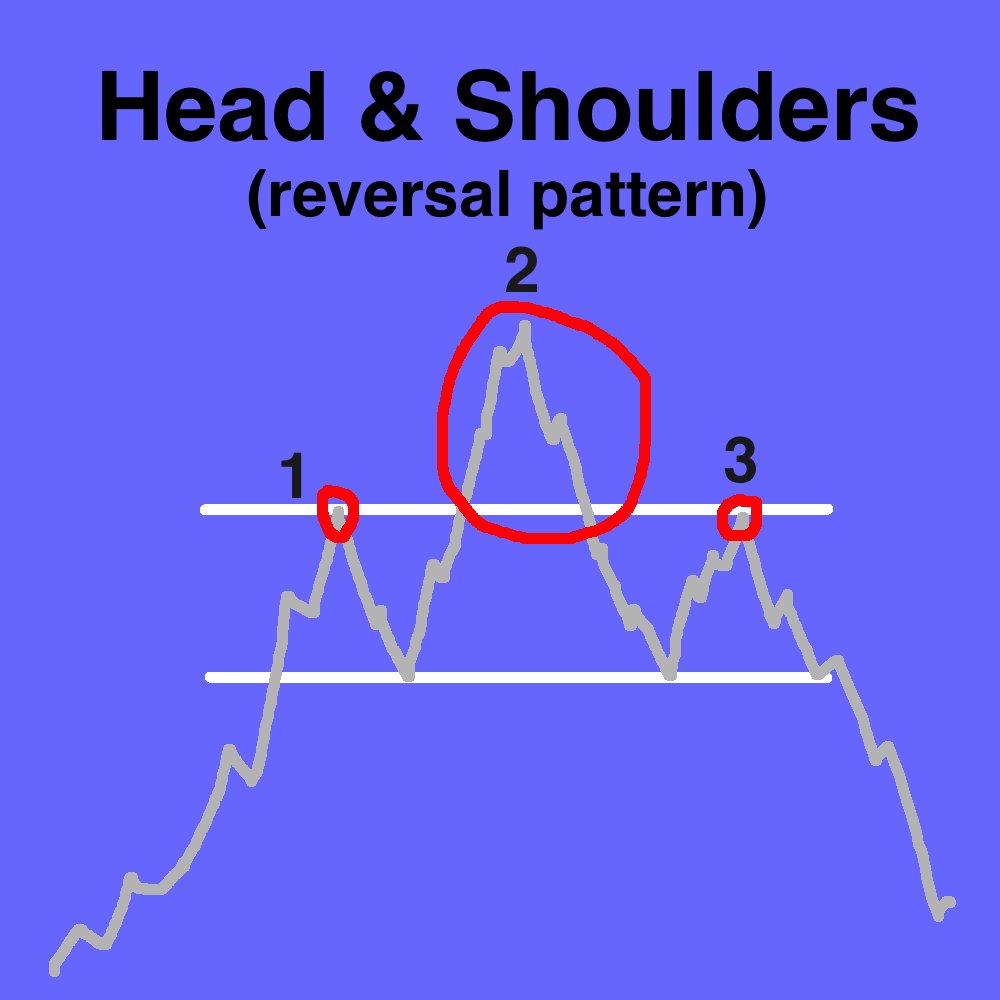

Head & Shoulders is another reversal pattern and a recent CT favorite as bitcoin looks to be printing one of a few timeframes...or is it?

a Head & Shoulders is a pattern that consists of 3 highs with the 1st & 3rd being the same height & lower than the 2nd

1: high

2: higher high

3: lower how (equal to 1st high)

this pattern signifies that the level of 1&3 is a level of supply, and anybody that bought in 2 got faked out and is now trapped.

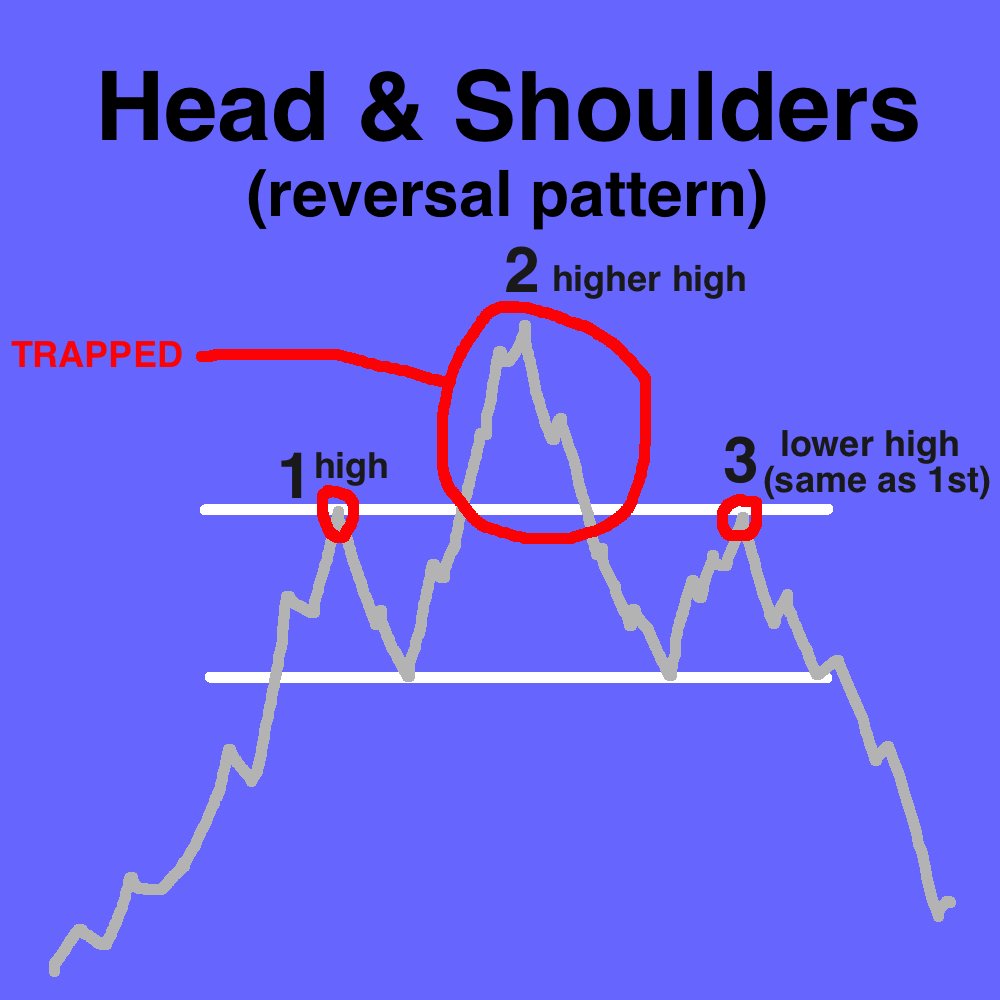

A: high

B: higher high (buys trapped)

C: high (same level as first high)

and it's that simple.

wait...something doesn't look right here...more on this later

now the wedge is powerful and must be respected.

this pattern (of two lines converging) is easily my favorite and most actionable setup.

in fact, i'm hi-jacking my own thread with a triangle masterclass. READ ⬇️ https://t.co/MkpXp9GXGF

TRIANGLE MASTERCLASS - a thread.

— \u26a1\ufe0f TUNEZ 2000 \u26a1\ufe0f (@cryptunez) January 18, 2021

what's the simplest, most effective method of trading a market that trends as hard as cryptocurrencies?

trendlines.

one trendline on its own is strong, but when you put two together you quickly realize just how powerful this simple tool can be. pic.twitter.com/XiHUyn4SOH

well, I think with patterns we can use 2 variables to weight them

1. precision

2. size

okay so this one right here is why/how I think a lot of traders misuse patterns.

it's very easy to let your bias influence a chart, rather than the other way around.

let me add two trendlines to a chart and I can make it look however I'd like.

your analysis can become systematic and consistent.

you start seeing charts for what they are rather than what you want them to be

as we see we have a head & shoulders playing out.

precision - well, if our first and last high are supposed to be the same...and they aren't...then this pattern doesn't seem exactly "valid"

size - medium.

wait a second, is that the god triangle?

precision - seems precise...not forcing it.

size - large

but if we're being honest with ourselves it seems the bullish case is simpler, precise and less "forced"

plus, the pattern is larger. the higher the timeframe with your analysis, the more weight you give to it.

so long as bitcoin is below trendline B, we assume price is compressing

momentum is resetting...if bitcoin breaks above our op cost line we want to be long, if bitcoin breaks below our bias line we want to be short.

we want to long altcoins

https://t.co/wVOlZ82osi

So simple.. #bitcoin \U0001f602 go sideways pls pic.twitter.com/7aNlLLlxRm

— \u03fb \U0001f53a \U0001d524 \U0001d532 \U0001d52f \U0001d51e [\ua729] (@MagUraCrypto) January 17, 2021

it's only if you're able to separate your analysis from your emotions that you'll be able to do this effectively.

same goes for your trading.

for more tips, tricks and tutorials on how i've navigated these markets since 2017 please join my free public telegram channel for more!

see you in there 😎

https://t.co/DFOPJPdZKd

More from Religion

You May Also Like

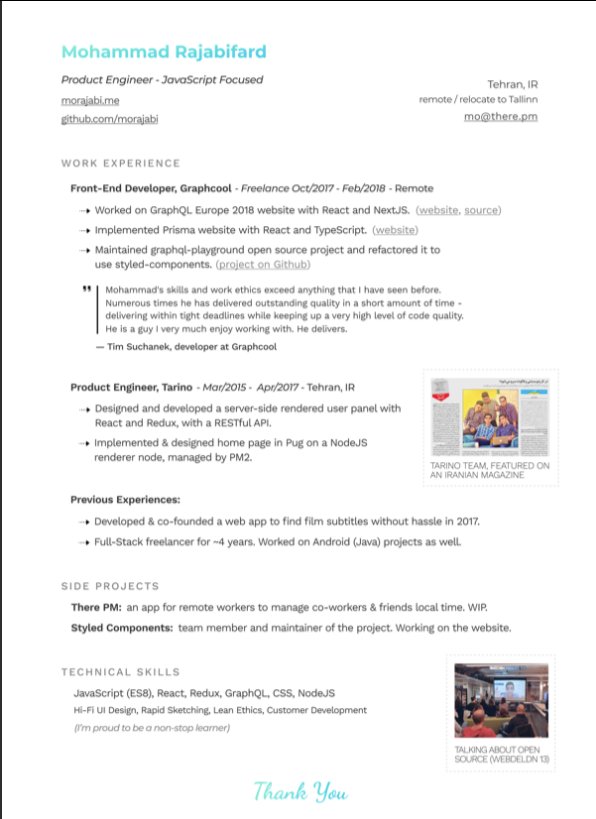

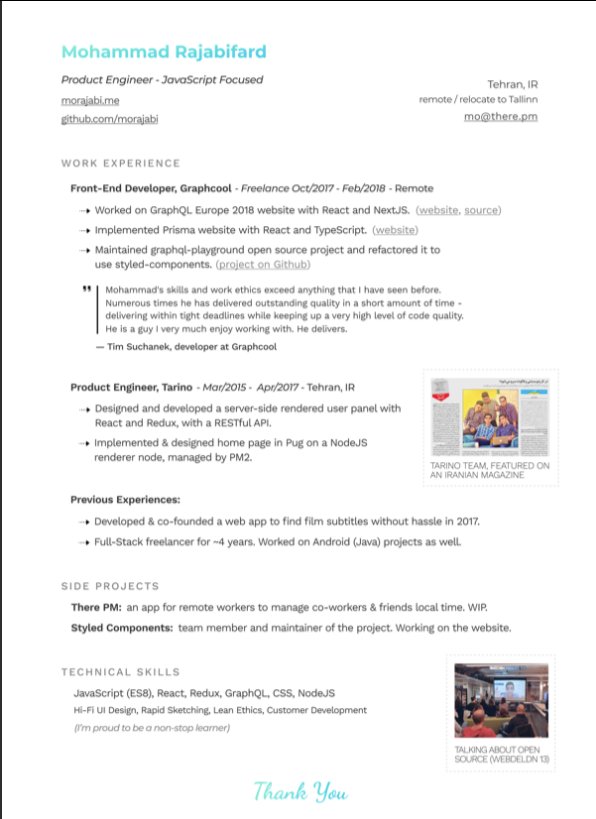

👨💻 Last resume I sent to a startup one year ago, sharing with you to get ideas:

- Forget what you don't have, make your strength bold

- Pick one work experience and explain what you did in detail w/ bullet points

- Write it towards the role you apply

- Give social proof

/thread

"But I got no work experience..."

Make a open source lib, make a small side project for yourself, do freelance work, ask friends to work with them, no friends? Find friends on Github, and Twitter.

Bonus points:

- Show you care about the company: I used the company's brand font and gradient for in the resume for my name and "Thank You" note.

- Don't list 15 things and libraries you worked with, pick the most related ones to the role you're applying.

-🙅♂️"copy cover letter"

"I got no firends, no work"

One practical way is to reach out to conferences and offer to make their website for free. But make sure to do it good. You'll get:

- a project for portfolio

- new friends

- work experience

- learnt new stuff

- new thing for Twitter bio

If you don't even have the skills yet, why not try your chance for @LambdaSchool? No? @freeCodeCamp. Still not? Pick something from here and learn https://t.co/7NPS1zbLTi

You'll feel very overwhelmed, no escape, just acknowledge it and keep pushing.

- Forget what you don't have, make your strength bold

- Pick one work experience and explain what you did in detail w/ bullet points

- Write it towards the role you apply

- Give social proof

/thread

"But I got no work experience..."

Make a open source lib, make a small side project for yourself, do freelance work, ask friends to work with them, no friends? Find friends on Github, and Twitter.

Bonus points:

- Show you care about the company: I used the company's brand font and gradient for in the resume for my name and "Thank You" note.

- Don't list 15 things and libraries you worked with, pick the most related ones to the role you're applying.

-🙅♂️"copy cover letter"

"I got no firends, no work"

One practical way is to reach out to conferences and offer to make their website for free. But make sure to do it good. You'll get:

- a project for portfolio

- new friends

- work experience

- learnt new stuff

- new thing for Twitter bio

If you don't even have the skills yet, why not try your chance for @LambdaSchool? No? @freeCodeCamp. Still not? Pick something from here and learn https://t.co/7NPS1zbLTi

You'll feel very overwhelmed, no escape, just acknowledge it and keep pushing.