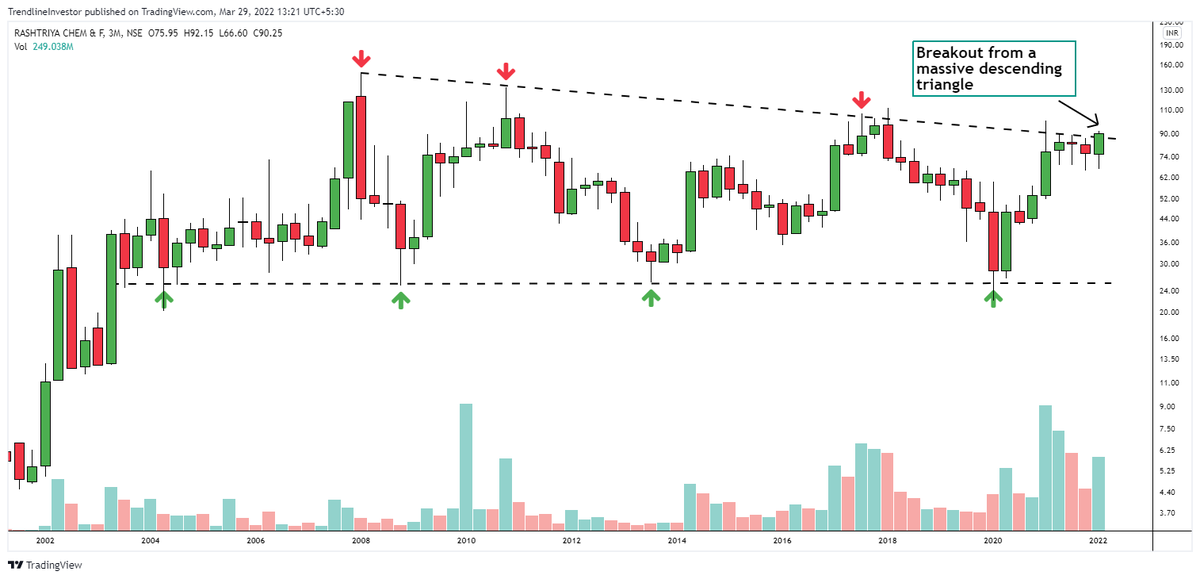

RCF Weekly : Looks good on a pullback to enter

Growth has been fine but overall sector is going good

More from EquiAlpha -MidTerm Momentum🐎🐎

As I said yesterday, I will be sharing the some of my screeners in this thread 🐎

Please note Screener will help you to reach momentum but you need to see chart & further segregate trends manually (1/n)

Do retweet & like so that it reaches maximum people

Screener 1) +ve ADX DMI Breakout to find out where the action is going on a particular day, you can then look onto stocks and find setups and patterns to trade.

Link - https://t.co/fIKlWSloNw

(1/4)

Screener 2) Going one level more deep into ADX where we find up stocks which are already in trend on weekly

1) Weekly ADX >25 indicating the trend is already there

2) +DMI breaking out

3) Stock within 15% of 52w high

4) Stock above 200 SMA

Link-

Screener 3) This is based out of within 20% of ATH Stocks. I have also added few fundamentals to it. You can change variables according to it

Link -

Screener 4) RSI which is a momentum indicator

RSI breaking out can give you names where momentum is picking up and then you can look onto charts for buy points

Link -

Please note Screener will help you to reach momentum but you need to see chart & further segregate trends manually (1/n)

Do retweet & like so that it reaches maximum people

Screener 1) +ve ADX DMI Breakout to find out where the action is going on a particular day, you can then look onto stocks and find setups and patterns to trade.

Link - https://t.co/fIKlWSloNw

(1/4)

Screener 2) Going one level more deep into ADX where we find up stocks which are already in trend on weekly

1) Weekly ADX >25 indicating the trend is already there

2) +DMI breaking out

3) Stock within 15% of 52w high

4) Stock above 200 SMA

Link-

Screener 3) This is based out of within 20% of ATH Stocks. I have also added few fundamentals to it. You can change variables according to it

Link -

Screener 4) RSI which is a momentum indicator

RSI breaking out can give you names where momentum is picking up and then you can look onto charts for buy points

Link -

3 Ways to ride a stock 🐎

(a thread) 🧵

>Do retweet if it adds value as this took a long time for me to make

1) 10/20 Day EMA -

Enter the stock as it comes up back to the 10/20 day EMA and ride it till it drops below or SL hits as explained below

Eg -Nitin Spinners as below

2) Weekly Super trend (Setting 2,7): Whenever trend changes , volatility increases & supertrend measures volatility..That's the logic behind it

Eg - Deepak Nitrite

3) 10 Week MA : Trend following can be done using 10 w MA

Eg - Saregama

Fundamental analysis has to be done for best results as these are to be applied on a growing co + sector movt together ..Eg If you will apply to random co with low RS or low growth..This might be very choppy

Do retweet if make sense so as I can make more of such thread

Join telegram group for stock analysis & daily updates

https://t.co/lJ00OKEVd2

Download equialpha app for free momentum basics course

https://t.co/9N7vFDorC8

Thanks for reading.. Do like

(a thread) 🧵

>Do retweet if it adds value as this took a long time for me to make

1) 10/20 Day EMA -

Enter the stock as it comes up back to the 10/20 day EMA and ride it till it drops below or SL hits as explained below

Eg -Nitin Spinners as below

2) Weekly Super trend (Setting 2,7): Whenever trend changes , volatility increases & supertrend measures volatility..That's the logic behind it

Eg - Deepak Nitrite

3) 10 Week MA : Trend following can be done using 10 w MA

Eg - Saregama

Fundamental analysis has to be done for best results as these are to be applied on a growing co + sector movt together ..Eg If you will apply to random co with low RS or low growth..This might be very choppy

Do retweet if make sense so as I can make more of such thread

Join telegram group for stock analysis & daily updates

https://t.co/lJ00OKEVd2

Download equialpha app for free momentum basics course

https://t.co/9N7vFDorC8

Thanks for reading.. Do like

The other way to look at this is that..The stock went below 21 month EA in 2008 & 2020 crash

Something is happening really too bad and worst is yet to come for entire market !!

Something is happening really too bad and worst is yet to come for entire market !!

HDFC bank Monthly Chart :

— EquiAlpha -MidTerm Momentum\U0001f40e\U0001f40e (@equialpha) March 7, 2022

In last 20 years - Only 2 times the stock has gone below 21 month EMA as market. This seems the third time (Monthly close will confirm )

Don't know but something seems off !!

Lets check again on month end pic.twitter.com/9eeVfikdnU

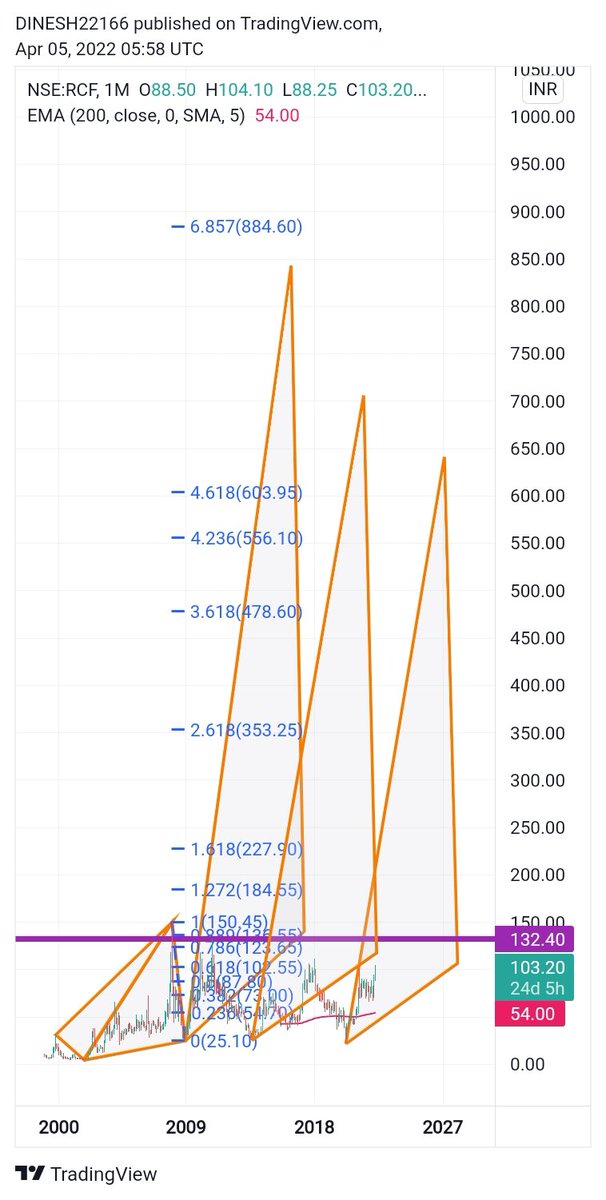

More from Rcf

You May Also Like

1/ Here’s a list of conversational frameworks I’ve picked up that have been helpful.

Please add your own.

2/ The Magic Question: "What would need to be true for you

3/ On evaluating where someone’s head is at regarding a topic they are being wishy-washy about or delaying.

“Gun to the head—what would you decide now?”

“Fast forward 6 months after your sabbatical--how would you decide: what criteria is most important to you?”

4/ Other Q’s re: decisions:

“Putting aside a list of pros/cons, what’s the *one* reason you’re doing this?” “Why is that the most important reason?”

“What’s end-game here?”

“What does success look like in a world where you pick that path?”

5/ When listening, after empathizing, and wanting to help them make their own decisions without imposing your world view:

“What would the best version of yourself do”?

Please add your own.

2/ The Magic Question: "What would need to be true for you

1/\u201cWhat would need to be true for you to\u2026.X\u201d

— Erik Torenberg (@eriktorenberg) December 4, 2018

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody: https://t.co/Yo6jHbSit9

3/ On evaluating where someone’s head is at regarding a topic they are being wishy-washy about or delaying.

“Gun to the head—what would you decide now?”

“Fast forward 6 months after your sabbatical--how would you decide: what criteria is most important to you?”

4/ Other Q’s re: decisions:

“Putting aside a list of pros/cons, what’s the *one* reason you’re doing this?” “Why is that the most important reason?”

“What’s end-game here?”

“What does success look like in a world where you pick that path?”

5/ When listening, after empathizing, and wanting to help them make their own decisions without imposing your world view:

“What would the best version of yourself do”?