Here is the first tutorial of the course to learn python basics.

Only serious learners are requested to watch. Here my intention is not view count but whoever watch expecting to watch it completely and get some knowledge out of it.

https://t.co/pb0kcJefxK

More from Python

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you’re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

... on the go). You will not be required to install python in your PC but you will be using an amazing python editor, Google Colab Visit https://t.co/EZt0agsdlV

This course is for anyone out there who is confused, frustrated, and just wants this python/finance thing to work!

In Module 1 of this Nano course, we will learn about :

# Using Google Colab

# Importing libraries

# Making a Random Time Series of Black Field Research Stock (fictional)

# Using Google Colab

Intro link is here on YT: https://t.co/MqMSDBaQri

Create a new Notebook at https://t.co/EZt0agsdlV and name it AnythingOfYourChoice.ipynb

You got your notebook ready and now the game is on!

You can add code in these cells and add as many cells as you want

# Importing Libraries

Imports are pretty standard, with a few exceptions.

For the most part, you can import your libraries by running the import.

Type this in the first cell you see. You need not worry about what each of these does, we will understand it later.

==========================

Module 4

In this post, I will attempt to teach you how to write a trading strategy in Equity Segment that runs on your PC and create a Telegram bot that sends you buy/sell signals with Stop Loss.

Nano Course On Python For Trading

— Indian Quant \U0001f1ee\U0001f1f3 (@indian_quant) December 13, 2021

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you\u2019re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

Prerequisite: If you hadn't gone through the earlier modules, I strongly recommend you go through them all. Module 2: https://t.co/pciDOJXyVI

Note:

If you liked my content, you can donate, tip and support me on this link (any amount you prefer)

Nano Course On Python For Trading

— Indian Quant \U0001f1ee\U0001f1f3 (@indian_quant) December 13, 2021

==========================

Module 1

Python makes it very easy to analyze and visualize time series data when you\u2019re a beginner. It's easier when you don't have to install python on your PC (that's why it's a nano course, you'll learn python...

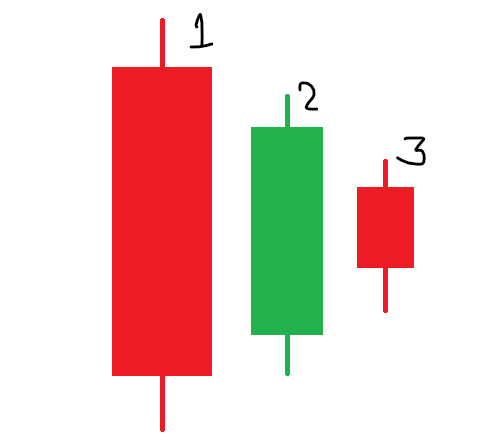

We are going to implement below strategy:

Rules: There should be three candles -> high of candle 1 > high of candle 2 > high of candle 3 and low of candle 1 < low of candle 2 < low of candle 3, where candle 3 is T-1 day, candle 2 is T-2 day and candle 1 is of T-3 Day, T = today.

If on today(day=T), the stock crosses yesterday high(candle 3), then send a buy signal to your telegram handle with candle 3 low as SL.

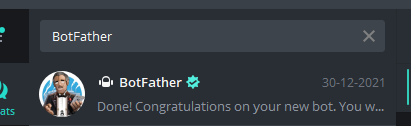

Before we get started with code, let's create a telegram bot using BotFather.

Step 1: Search BotFather in the telegram.

Step 2: type /newbot and then give the name to your bot. Refer to the second image as an example

You May Also Like

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5