I did some comparisons on different aspects of how America is doing right now compared to how it was doing at this time four years ago.

I put the links to the sources of information here so you can check for yourself.

1) Unemployment, the Deficit and the Debt

More from TheValuesVoter

Note to Trump supporters asking “why do you keep bringing him up?” Easy answer: he won’t shut his lying pie hole.

This is HOW he lost.

Okay, so here is a more complete rundown of how the last three Presidential Elections went down. And some more mythbusting of Trump's lies about the 2020 Election. https://t.co/3M9c79wHop pic.twitter.com/eRNRKQZzzB

— TheValuesVoter (@TheValuesVoter) May 1, 2021

And this is HOW he lost.

He lost a lot of the white voters, college educated voters and independents who supported him in 2016.

So here, in charts and tables, are the exit polls for the five states that flipped in the 2020 election.

— TheValuesVoter (@TheValuesVoter) May 15, 2021

Arizona - the trend of the state (clearly trending toward the Dems after 2012) and the groups Trump improved/declined with between 2016, when he won and 2020, when he lost. pic.twitter.com/ZxUXyui83R

In 2016, Donald Trump won Independents in every one of the six states that he flipped from blue to red.

In 2020, Donald Trump lost Independents in every one of the five states that Joe Biden flipped from red to blue.

Is it somehow strange that Trump lost the election? No. It would have been much stranger had Trump managed to win the election.

No one as consistently unpopular as him has ever been re-elected. Like ever.

More from Politics

I\u2019m sorry it\u2019s just insane that Democrats are like, \u201cwe won everything and our opening position on relief is $1.9T\u201d and Republicans are like, \u201cwe lost and our opening position is $600B,\u201d and the media will be like, \u201cDemocrats say they want unity but reject this bipartisan deal.\u201d

— Meredith Shiner (@meredithshiner) January 31, 2021

First, party/policy mandates from elections are far from self-executing in our system. Work on mandates from Dahl to Ellis and Kirk on the history of the mandate to mine on its role in post-Nixon politics, to Peterson Grossback and Stimson all emphasize that this link is... 2/

Created deliberately and isn't always persuasive. Others have to convinced that the election meant a particular thing for it to work in a legislative context. I theorized in the immediate period of after the 2020 election that this was part of why Repubs signed on to ...3/

Trump's demonstrably false fraud nonsense - it derailed an emerging mandate news cycle. Winners of elections get what they get - institutional control - but can't expect much beyond that unless the perception of an election mandate takes hold. And it didn't. 4/

Let's turn to the legislation element of this. There's just an asymmetry in terms of passing a relief bill. Republicans are presumably less motivated to get some kind of deal passed. Democrats are more likely to want to do *something.* 5/

You May Also Like

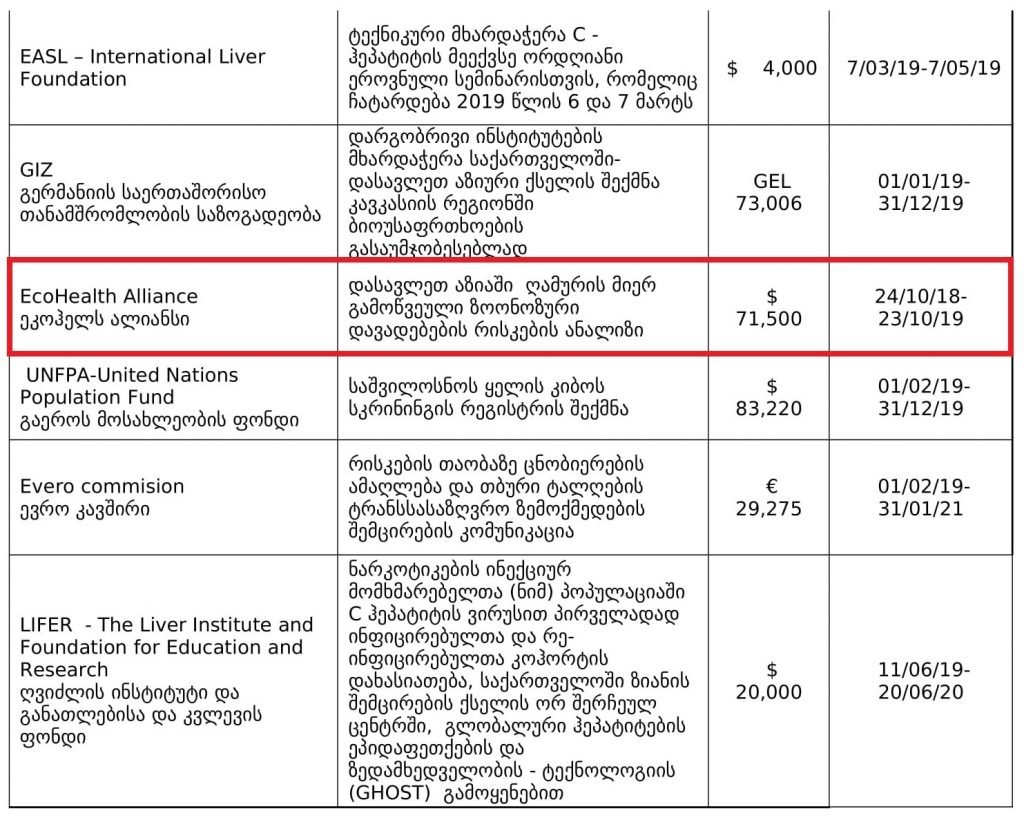

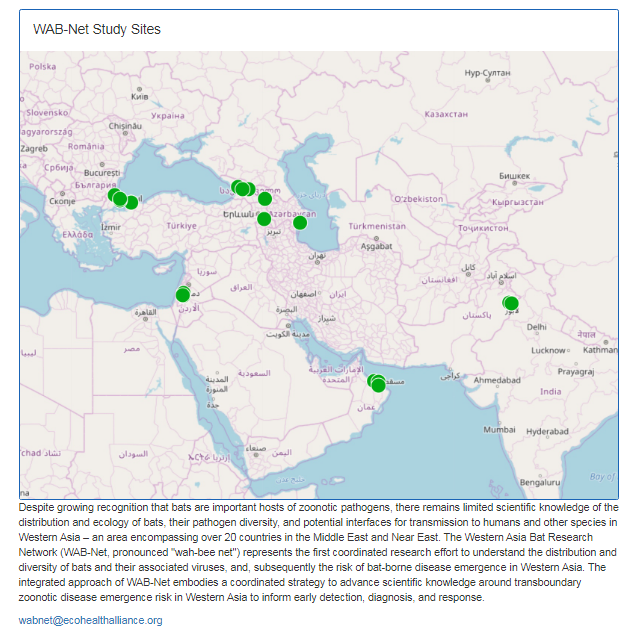

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

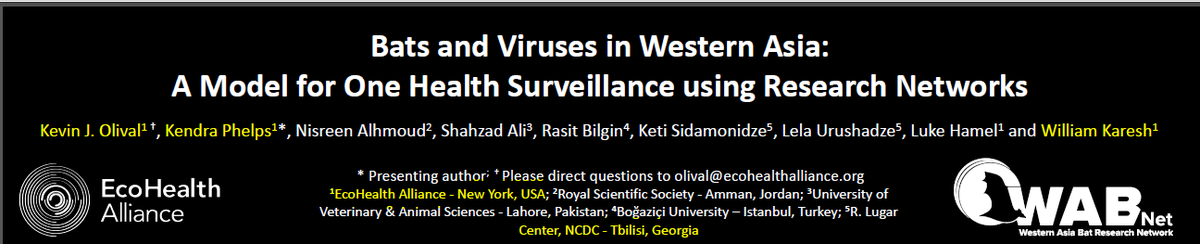

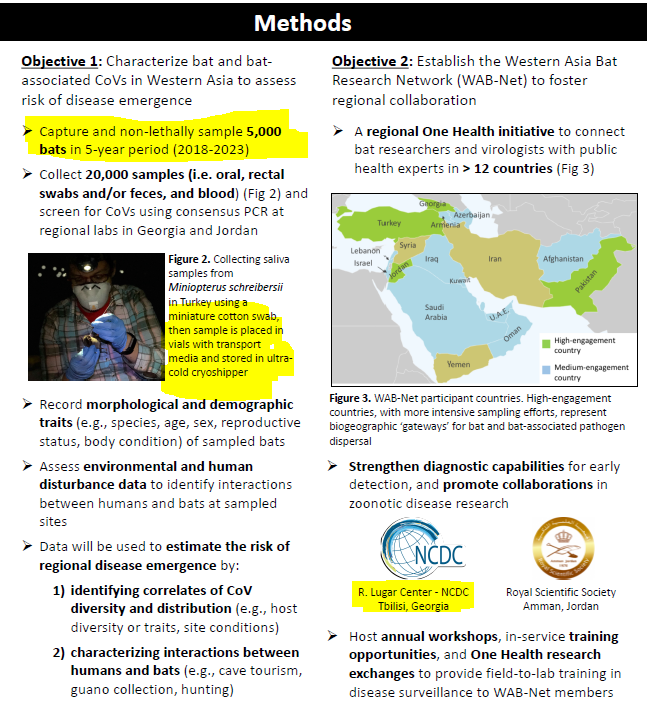

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.