2/

If you're below that, you'd be pretty 'safe' from seeing your tax rate(s) increase under his plan.

For those w/ income of $400k or more, he proposed returning the top rate to 39.6% (though whether this is for single filers, joint filers, or both, was never made clear)...

3/

Biden also proposes eliminating the QBI deduction for anyone with income more than $400k (today, non-specified service biz owners may be able to continue to benefit from the deduction if they have sufficient wages or property).

The $400k mark is also the proposed cut off...

4/

for taxpayers who want to do a 1031 exchange. Income higher than that? You wouldn't be able to do one under the plan.

Deductions for high earners would also take a hit under Biden tax plan, as the max benefit would be capped at 28% instead of at the taxpayer's actual rate...

5/

Biden also proposes replaced IRA and 401(k) deductions w/ a flat credit. Would be a big benefit for those w/ more modest incomes, while hurting those with higher incomes.

Would also flip SOP for high earners, making Roth accounts FAR more likely to be the better option...

6/

Child tax credits, dependent care credits would be expanded.

On the capital gains side of the equation, the top rate would equal the ordinary income tax rate for income in excess of $1 million. Big change. 20% to 39.6% (+3.8% in both cases).

The Biden tax plan also...

7/

eliminates the step-up in basis for capital assets and would make death a realization event (basically your assets would be treated as sold upon your death and capital gains taxes would be owed).

Finally, on the estate and gift tax planning side, Biden has proposed...

8/

scaling back the current exemption amounts to historical levels. At various times, he's supported going back to the $5MM pre-TCJA level, while at other times, he's supported going back to a $3.5MM exemption.

In either case, the number of people who'd have to worry about...

9/

the estate tax would dramatically increase (though it would still be a very "1st class problem".

Of course, it's super-important to remember that this is just what Biden proposed. He was elected President though. Not dictator.

Accordingly, Congress still has the biggest...

10/

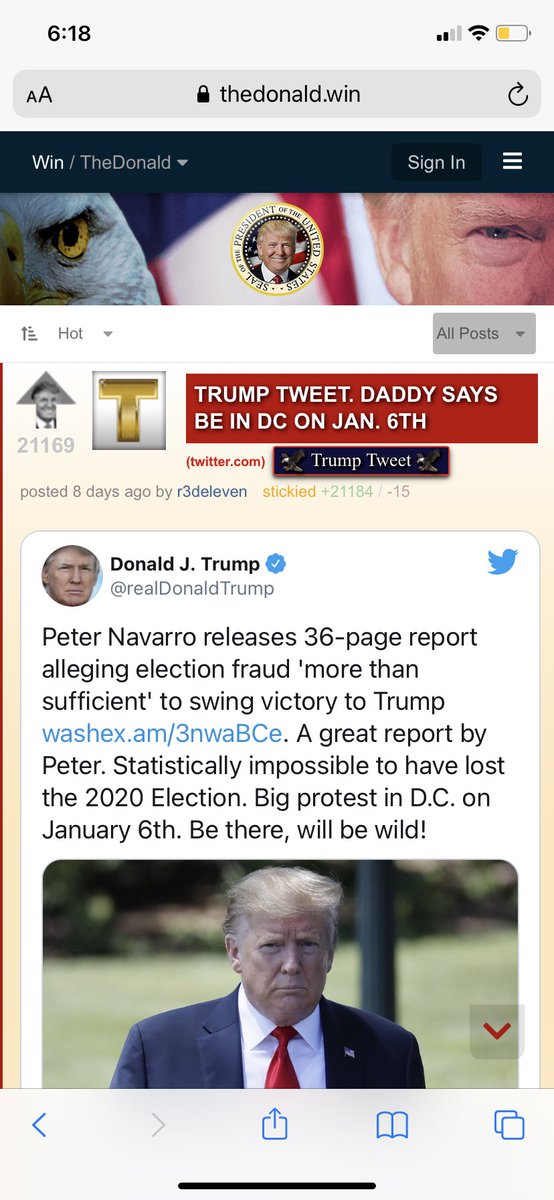

say in what will happen. And while Biden will certainly have a large say in how that legislation will be shaped, he doesn't have to worry about running again in two years... which House Ds will.

And he won't be able to lose a SINGLE D vote in the Senate, which means...

11/

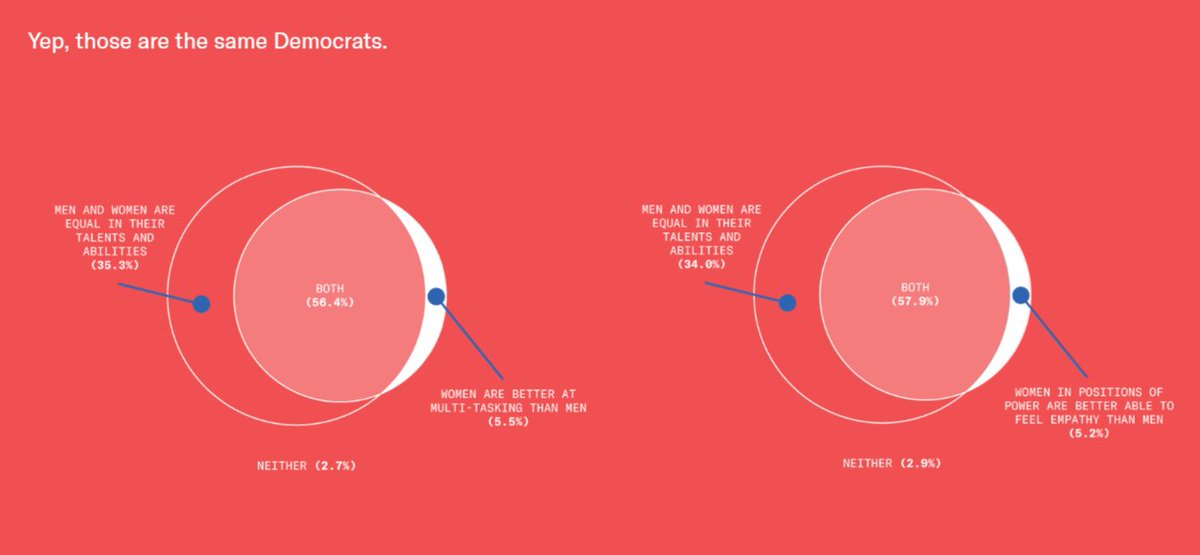

EVERY D Senator has to be on board with the legislation. Purple state Ds will almost certainly balk at ultra-progressive changes.

So what's likely to happen? It's a fool's game to try and handicap DC, but if I HAD to guess, I'd say the most likely outcome is that Dems...

12/

ultimately roll back a lot of the changes made by the TCJA. Doing so - but not going further - gives them a lot of political cover.

Suddenly, it's not really "raising" taxes. It's "just returning them to their previous levels."

So things like returning the top rate to...

13/

39.6% seem reasonable... though perhaps at a different income threshold than proposed.

SALT cap will almost certainly be gone.

Expansion of Child Tax Credit supported by both sides seems very possible.

Doubling of the estate tax exemption likely goes away.

*End👊