1. Multi-timeframe Technical Analysis

2. Option Chain Data

Also, 3 strategies to deploy for:

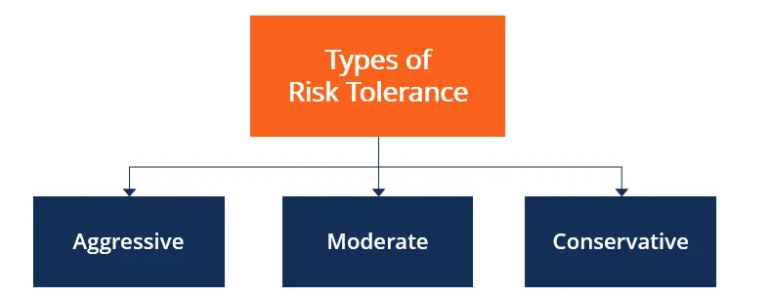

1. Aggressive Traders (1.85%)

2. Moderate Risk Traders (1.2%)

3. Low-Risk Traders (0.75%)

Some important quotes by Jesse Livermore... pic.twitter.com/UklL86oTvb

— Mark Minervini (@markminervini) June 16, 2021

The big turning point in my trading came when I made a decision and vowed to NEVER EVER let a loss exceed 8%. During the next 5 years I averaged 220% per year for a total compounded return of 33,500%. It's been 28 years since and I have never broken that discipline not even once!

— Mark Minervini (@markminervini) April 26, 2021

A few key decisions early in my trading career and my financial life completely changed for the better in just a few years.

— Mark Minervini (@markminervini) June 13, 2021

1. No big losses

2. No averaging down

3. No chasing extended stocks

4. No giving back decent profits

5. Always get odds on my money

Only losers discourage dreamers. Only those who never achieved big things discourage those attempting to achieve big things. Only those who think small discourage those who think big. Never believe discourages. The have no credibility! Believe winners. Believe in YOU! \U0001f447 pic.twitter.com/JdAhRy3lRJ

— Mark Minervini (@markminervini) June 14, 2021

— Harsh (@HarshAsserts) September 11, 2020

When trading,moods will want to influence ur decisions

— Banknifty Addict (Gaurav) (@BankniftyA) December 29, 2019

How to minimize:

-Have a backtested plan/system

-Know yourself(emotion and panic levels)

So trade size is important to keep ur emotions in check

-dont focus too much on pnl

-have a back up plan ready

& last stay positive!!

Backtest the complete expiry and practice again and again till u develop conviction

— Banknifty Addict (Gaurav) (@BankniftyA) November 5, 2020

Support and resistance levels based on technical charts on various time frames.

— Banknifty Addict (Gaurav) (@BankniftyA) December 19, 2019

Breaking any of the above, leads to a direction

and then only directional play.

A THREAD ON OPTIONS SYNTHETICS, LONG READ:

— Aditya Todmal (@AdityaTodmal) August 16, 2020

With synthetics you can increase your returns as the margin requirements/costs are less. Everyone wanting to become a top trader needs to know this and get their concepts cleared because many people don't know what they're doing

(1/11)

Best FREE website for FNO Heatmap - ICICI DIRECThttps://t.co/honvUA9lmx

— Aditya Todmal (@AdityaTodmal) January 24, 2021

Advantages:

1. Quantitative Analysis in one place

2. Easy to find stocks where action taking place

3. Find the exact price levels at which OI is being added.

(1/5) pic.twitter.com/Pvk8i8EfIT

PER ORDER Vs PER LOT brokerage

— Aditya Todmal (@AdityaTodmal) May 23, 2021

Which one is better?

Read the thread to know why one is clearly better than the other.

A THREAD ...

The best YouTuber I have ever seen from the trading industry.

— Aditya Todmal (@AdityaTodmal) January 23, 2021

Power of Stocks - Subhasish Pani

Guys do go over his daily analysis videos to become better.

1. Superb logics

2. Great Risk Reward

3. Consistency

4. Prepared for all scenarioshttps://t.co/I5wGmwIYUq