Compiling these together for easy access to his knowledge.

DJ SIR THREAD

Great video with points helpful for beginners.

Made 4 threads on DJ Sir with the help of @niki_poojary

1. Selecting strikes to trade in with risk management.

2. How he took some aggressive trades.

3. Multiple charts analysis for intraday trading.

4. Trade Setup

https://t.co/Ngoc5bh906 Thank Mahek bhai for making this video basis my set up which i have been following since past 2 yr I\u2019m not promoting this software, neither I 'll gain any referral if anyone subscribes for this software ,Purpose is to share help fellow traders!\U0001f60a

— itrade(DJ) (@ITRADE191) September 5, 2021

Compiling these together for easy access to his knowledge.

https://t.co/OnFeH6459M

5. A THREAD on . . . .

— Aditya Todmal (@AdityaTodmal) July 11, 2021

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.https://t.co/YiYYaIReNS

https://t.co/iIoFfST4Vy

6. Thread on how @ITRADE191 made 3 lakhs in 2 days.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

You will need:

1. Pivots

2. Vwap

3. PDL/PDH (Previous day high/low)

4. Advance/Decline Ratio.https://t.co/o9tLOaLpEh

https://t.co/rljZ7UxNnU

7. DJ @ITRADE191 multiple chart analysis for INTRADAY TRADING.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm biashttps://t.co/qZQCWOSisa

https://t.co/5RiuuqBdKE

8. @ITRADE191 Sir's set-up.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

Set-up will help in:

\u2022 Capital protection

\u2022 Lower drawdowns

\u2022 Trending days can be captured

Me @AdityaTodmal & @niki_poojary contributed in making this.https://t.co/GX07XOHCsF

More from Aditya Todmal

• Stocks to buy & hold forever

• Companies which will always be in business

• How to 10x money in 10 years?

• Feedback of company employees

• MWPL & F&O ban list explained

• Tradingview free version tricks

Stocks one can buy and hold

8 - Stocks For Buy And Hold Forever:

— Pankaj Parekh (@DhanValue) September 22, 2021

1. Asian Paints

2. Pidilite

3. HUL

4. Colgate

5. Nestle

6. Abbott

7. Honeywell

8. PGHH

NB: ITC is not included here due to its tobacco business.

Discl: Have a check and satisfy yourself before investing.

These companies will always keep running, no matter if recessions come or not.

26% CAGR makes your money 10x in 10

\u26a1\ufe0fIf you are making 26% CAGR then Rs 10,000 invested at 23 has the same value as:

— Soumya Malani (@insharebazaar) September 19, 2021

Investing Rs 1 Lakh at 33

Investing Rs 10 Lakh at 43

At 26% CAGR, your money grows 10 times in 10 years.

Young earners should realize this power and start early.

No amount is too small to start.

Some life

Old Life Lessons:

— R.K. (@ipo_mantra) September 19, 2021

-Mind your Thoughts: If u are Alone

-Mind your Tongue: If u are with Friends

-Mind your Temper: If u are Angry

-Mind your Behavior: if u are in a Group

-Mind your Emotions: If u are in Trouble

-Mind your Ego: If God showers His Blessing

Do u want to add more ?

Found awesome content: ⏬

1. Moneycontrol

2. Bank nifty Strangles/Straddles

3. Learnings

4. Expiry Trading

5. Directional trading

6. Long Term Investing

7. Pivot system

8. DHS pattern

9. Multiple trade management threads/ways.

Moneycontrol article on @sourabhsiso19

@moneycontrolcom did a detailed story on my trading journey.

— Sourabh Sisodiya, CFA (@sourabhsiso19) May 26, 2020

But many couldn\u2019t read it as it needed a pro-subscription.

So here\u2019s a blog on the same :https://t.co/dwN2xieUKd#trading #journey #quant #options #algotrading #markets #OptionsTrading

What Sourabh does and how to trade like him?

Getting many DM\u2019s on how I can learn and trade like you.

— Sourabh Sisodiya, CFA (@sourabhsiso19) January 10, 2020

To be a succesful trader one needs an edge

My edge:

1)focus on selected instruments (Banknifty majorly and few stocks)

2) backtested my strategies historically (for past 10years)

(1)

Why trade multiple systems? ⏬

1. Keeps drawdown at minimum.

2. Strong money management can be applied.

3. Better psychology.

Do I trade only BNF ?

— Sourabh Sisodiya, CFA (@sourabhsiso19) March 4, 2020

Other than BNF intraday , I run few other systems too.

1) Intraday Momentum

2) Positional systems

3) Vol Crush Trade etc

Goal of system trading is to run few non-correlated strategies together so that system drawdown is at the minimum.#trading #systems pic.twitter.com/mS8jFEaLUW

Thread on how options allow you to change your positions in a dynamic manner.

Options Thread

— Sourabh Sisodiya, CFA (@sourabhsiso19) December 7, 2019

How options allows to change and adjust view dynamically.

Let\u2019s understand with a live example.

Example : Nifty is at 11921 and you are bullish on Nifty.

1) Buy Naked 11900 CE(call) at 167

Breakeven : 12068

Max Loss : Rs 12555

Max Profit : Unlimited pic.twitter.com/TXMhh5HWsd

Here are the best resources.

A thread 🧵👇

Collaborated with @niki_poojary

1. Best book of knowledge for a beginner?

Zerodha Varsity from @Nithin0dha's team is the best book for a newcomer to read and increase his basic knowledge about options, especially for the Indian markets.

Link:

2. Best Youtube channel on Options Trading?

The @tastytrade financial network. It's a foreign channel that focuses mostly on selling options.

They teach all strategies for free with their backtests.

Big on Straddle/Strangles selling.

Links:

3. Top Indian YouTube Channel for Options?

Power of Stocks - Subhasish Pani

What you'll learn:

1. How to form a trading plan.

2. How to scale an account with risk-reward in option selling.

3. Technical analysis logics you can use daily.

15

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

4. What are the preconditions to start option Selling:

You should know technical Analysis basics like:

- Support/Resistance

- Chart Patterns

- Candle Patterns

- Dow Theory (HH, LL)

This will help you start taking high-probability trades.

More from Optionslearnings

If we buy hedges, Margin will reduce & ROI increases.

More strategies will be shared going forward.

All u need is execute with Discipline & sticking with system when in DD.

(1/n) https://t.co/3KH9v0tgsb

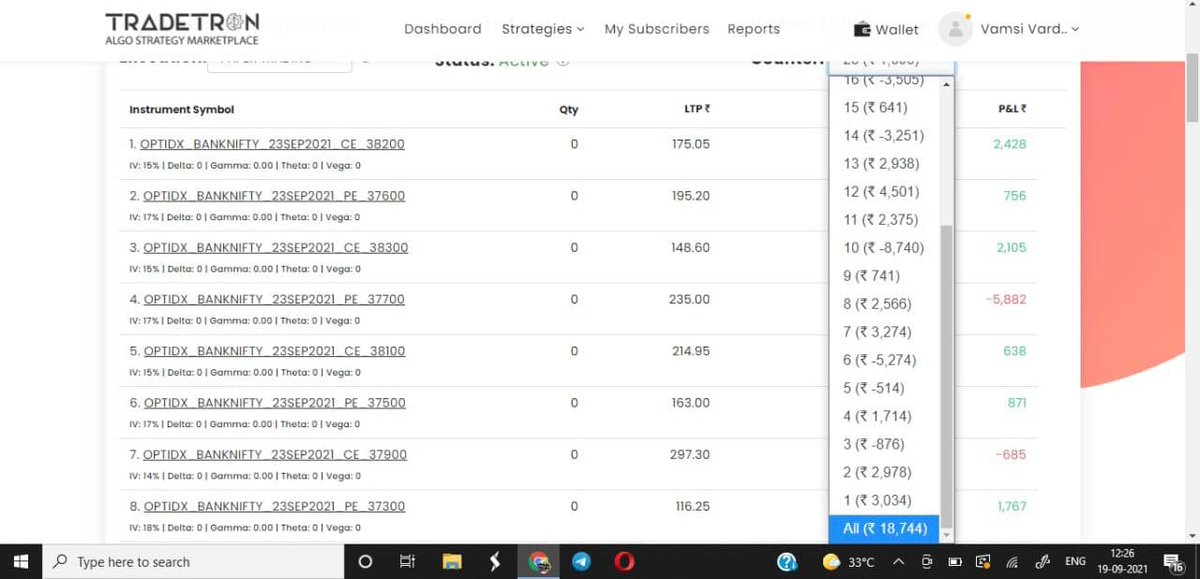

A simple INTRADAY strategy with decent BACKTEST report of more than 3-5% returns on Monthly basis.

— OptionSeller(Vardhan) (@CaVardhanCa) August 15, 2021

Will be sharing live report on daily basis for a month.

& will conduct FREE webinar to discuss about the results in coming weeks.

Sharing all rules below.

(1/n) https://t.co/VMlxNtX90s pic.twitter.com/cJaa9axRss

to learn more about Algo Trading (in both directional & non directional) , you can visit my Telegram channel especially created for Algo Strategies.

Will be updating Daily Performance of our Algos in below

THREAD: Playbook on option selling to grow your knowledge & P/L account

Collaborated with @AdityaTodmal

1. Basics of Option selling

• The A,B,C,D one should be aware of before taking a plunge into option selling

THREAD: 14 of the best resources/topics for anyone who wants to start option selling as a career. \U0001f9f5

— Aditya Todmal (@AdityaTodmal) March 13, 2022

Collaborated with @niki_poojary

2. @Mitesh_Engr Sir's process for positional option selling

A Thread on the Boss himself @Mitesh_Engr

— Aditya Todmal (@AdityaTodmal) July 4, 2021

Mitesh Sir's Positional Option Selling 101:

\u2022 How to find direction

\u2022 Which options to sell

\u2022 How to deploy capital

\u2022 Exit criteria

\u2022 What ROI he targets weekly

\u2022 What % risk he takes

Done with the help of @niki_poojary pic.twitter.com/tcTKV02oO2

3. How @Mitesh_Engr sells options on an

Catch me if you can @Mitesh_Engr

— Nikita Poojary (@niki_poojary) July 17, 2021

Time for a\U0001f9f5

Mitesh Sir's EXPIRY Option Selling 101:

\u2022 What to look for?

\u2022 Strike Selection & Ratios

\u2022 SL mgmt

\u2022 Avoiding freezes

\u2022 Monthy Expiry

\u2022 Event days

\u2022 How he would have traded last expiry?

In collaboration with @AdityaTodmal pic.twitter.com/9uN2vQQ4hc

4. Transcript of @Mitesh_Engr Sir's “F&O Pe Charcha - Diary Of An Option

Time for a Thread\U0001f9f5On yesterday\u2019s \u201cF&O Pe Charcha - Diary Of An Option Seller\u201d with @Mitesh_Engr by @Paytm Money

— Nikita Poojary (@niki_poojary) August 1, 2021

14 "must-try" trading strategies you can start using today: 🧵

Collaborated with @niki_poojary

We'll break these into portions of:

1. Intraday Trading Techniques

2. Positional Trading Techniques

3. Indicator Applications

1/ 6 Intraday Strategies 🧵

How to Filter Stocks for Intraday

How you can filter stocks for Intraday trades - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) August 15, 2021

As a kid, we would do homework before school the next day - you have to do homework here too. A specific sector performs on a particular day and studying things a day before will help you spot that particular sector. (1/11)

2/ Intraday BNF strangle based on OI data. 🧵

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

3/ A few setups to make intraday trading easy.

A few setups/strategies that can make your intraday trading easy. I follow them personally:

— Sheetal Rijhwani (@RijhwaniSheetal) September 12, 2021

Add these stocks in your watchlist for next few days -

-If a stock closed exactly at resistance with good volumes or it has been consolidating near resistance for a long time. (1/10)

You May Also Like

RT-PCR corona (test) scam

Symptomatic people are tested for one and only one respiratory virus. This means that other acute respiratory infections are reclassified as

4/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

...indication, first of all that testing for a (single) respiratory virus is done outside of surveillance systems or need for specific therapy, but even so the lack of consideration of Ct, symptoms and clinical findings when interpreting its result. https://t.co/gHH6kwRdZG

2/12

It is tested exquisitely with a hypersensitive non-specific RT-PCR test / Ct >35 (>30 is nonsense, >35 is madness), without considering Ct and clinical context. This means that more acute respiratory infections are reclassified as

6/10

— Dr. Thomas Binder, MD (@Thomas_Binder) October 22, 2020

The neither validated nor standardised hypersensitive RT-PCR test / Ct 35-45 for SARS-CoV-2 is abused to mislabel (also) other diseases, especially influenza, as COVID-19.https://t.co/AkFIfTCTkS

3/12

The Drosten RT-PCR test is fabricated in a way that each country and laboratory perform it differently at too high Ct and that the high rate of false positives increases massively due to cross-reaction with other (corona) viruses in the "flu

External peer review of the RTPCR test to detect SARS-CoV-2 reveals 10 major scientific flaws at the molecular and methodological level: consequences for false positive results.https://t.co/mbNY8bdw1p pic.twitter.com/OQBD4grMth

— Dr. Thomas Binder, MD (@Thomas_Binder) November 29, 2020

4/12

Even asymptomatic, previously called healthy, people are tested (en masse) in this way, although there is no epidemiologically relevant asymptomatic transmission. This means that even healthy people are declared as COVID

Thread web\u2b06\ufe0f\u2b07\ufe0f

— Dr. Thomas Binder, MD (@Thomas_Binder) December 16, 2020

The fabrication of the "asymptomatic (super) spreader" is the coronation of the total nons(ci)ense in the belief system of #CoronasWitnesses.

Asymptomatic transmission 0.7%; 95% CI 0%-4.9% - could well be 0%!https://t.co/VeZTzxXfvT

5/12

Deaths within 28 days after a positive RT-PCR test from whatever cause are designated as deaths WITH COVID. This means that other causes of death are reclassified as

8/8

— Dr. Thomas Binder, MD (@Thomas_Binder) March 24, 2020

By the way, who the f*** created this obviously (almost) worldwide definition of #CoronaDeath?

This is not only medical malpractice, this is utterly insane!https://t.co/FFsTx4L2mw

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.