More from itrade(DJ)

More from Optionslearnings

Great video with points helpful for beginners.

Made 4 threads on DJ Sir with the help of @niki_poojary

1. Selecting strikes to trade in with risk management.

2. How he took some aggressive trades.

3. Multiple charts analysis for intraday trading.

4. Trade Setup

https://t.co/Ngoc5bh906 Thank Mahek bhai for making this video basis my set up which i have been following since past 2 yr I\u2019m not promoting this software, neither I 'll gain any referral if anyone subscribes for this software ,Purpose is to share help fellow traders!\U0001f60a

— itrade(DJ) (@ITRADE191) September 5, 2021

Attaching all threads made on DJ Sir. After watching the video you can refer to this tweet for notes about his strategy and learn a few other ideas.

Compiling these together for easy access to his knowledge.

1. Selecting strikes and risk

5. A THREAD on . . . .

— Aditya Todmal (@AdityaTodmal) July 11, 2021

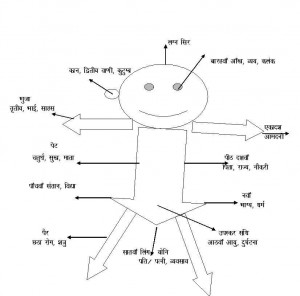

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.https://t.co/YiYYaIReNS

2. Going aggressive with help of data and

6. Thread on how @ITRADE191 made 3 lakhs in 2 days.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

You will need:

1. Pivots

2. Vwap

3. PDL/PDH (Previous day high/low)

4. Advance/Decline Ratio.https://t.co/o9tLOaLpEh

3. Intraday

7. DJ @ITRADE191 multiple chart analysis for INTRADAY TRADING.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm biashttps://t.co/qZQCWOSisa

• Psychological mistakes to avoid

• Iron fly strategy

• Calenders strategy

• 3 great books on trading stocks.

• Various risks and how to manage.

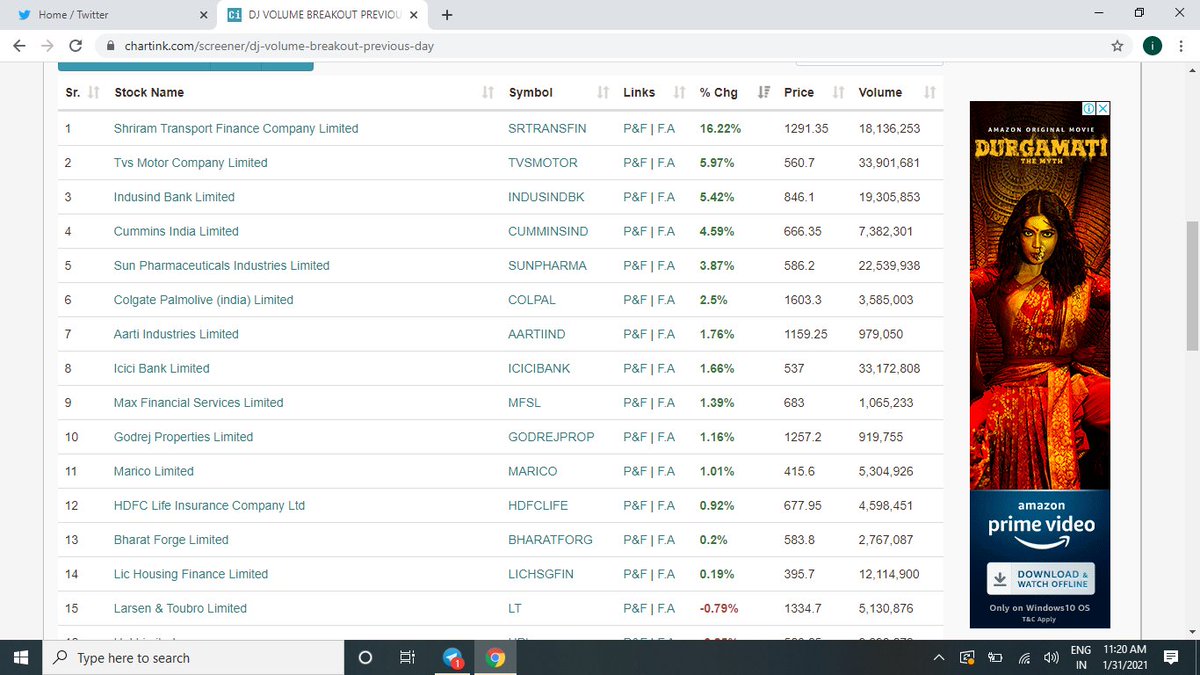

• How breakout stocks behave.

• Solutions for peak margin.

Psychological mistakes to

Why few traders are going bankrupt after attaining huge success.

— Mitesh Patel (@Mitesh_Engr) September 4, 2021

Could be the following psychology.

During initial days trader is generating huge ROI with less capital.

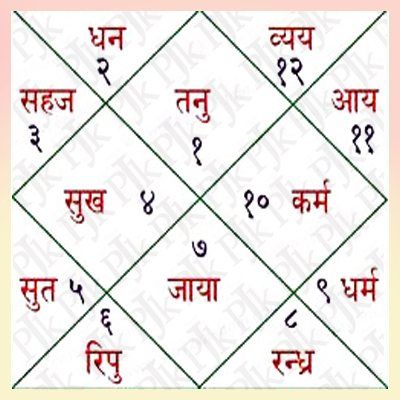

Iron fly strategy

There are many strategies in market \U0001f4c9and it's possible to get monthly 4% return consistently if you master \U0001f4aain one strategy .

— Kavita (@Kavitastocks) September 4, 2021

One of those strategies which I like is Iron Fly\u2708\ufe0f

Few important points on Iron fly stategy

Calenders strategy to give you consistent

Here is the detailed information of about strategy,

— itrade(DJ) (@ITRADE191) September 4, 2021

Entry time : 9.30 - 10

Exit : Upto you

Strategy :

Sell weekly ATM CE & PE at almost equal price

For ex : Sell Nifty 17250 CE at 50 and Nifty 17250 PE at 48 so it will become short straddle

Compounding is

If it takes 15 Long Years (180+ months) to Build the First Crore Rupees, the Second will take a Few Years Lesser. The Third will be Effortless & The Fourth Happens Seamlessly.

— Fundamental Investor \u2122 \U0001f1ee\U0001f1f3 (@FI_InvestIndia) September 5, 2021

This is the Power of Patience, Base Effect & Compounding !!!#FI

He maine kyun likha tha ?? Or call buy kyun nahi kaha tha ?? Kyun sirf put sell kaha Agar maarket up hi jane wala tha to koi bata sakta he ?? https://t.co/w21XemUTLo

— itrade(DJ) (@ITRADE191) May 12, 2021

@SarangSood Sarang bhai according to you what number of vix is ideal for option buyers and what is that for option sellers? And is there any common number which is ideal for both?

— Dhaval bhatt (@Dhavalb55011726) July 14, 2021

You May Also Like

Week 1 highlights: getting shortlisted for YC W2019🤞, acquiring a premium domain💰, meeting Substack's @hamishmckenzie and Stripe CEO @patrickc 🤩

2/ So what is Brew?

brew / bru : / to make (beer, coffee etc.) / verb: begin to develop 🌱

A place for you to enjoy premium content while supporting your favorite creators. Sort of like a ‘Consumer-facing Patreon’ cc @jackconte

(we’re still working on the pitch)

3/ So, why be so transparent? Two words: launch strategy.

jk 😅 a) I loooove doing something consistently for a long period of time b) limited downside and infinite upside (feedback, accountability, reach).

cc @altimor, @pmarca

4/ https://t.co/GOQJ7LjQ2t domain 🍻

It started with a cold email. Guess what? He was using BuyMeACoffee on his blog, and was excited to hear about what we're building next. Within 2w, we signed the deal at @Escrowcom's SF office. You’re a pleasure to work with @MichaelCyger!

5/ @ycombinator's invite for the in-person interview arrived that evening. Quite a day!

Thanks @patio11 for the thoughtful feedback on our YC application, and @gabhubert for your directions on positioning the product — set the tone for our pitch!