1/ Basic knowledge of Technicals:

Option buying is about capturing the momentum, hence sound knowledge of technical analysis is required.

Without any knowledge, if one is buying an option purely because he/she feels market will rise/fall is equivalent to buying lottery tickets.

2/ Technical Analysis knowledge:

The analysis could involve usage of pure price action or indicators or a mix of both to capture momentum.

Getting the direction right is very crucial, however along with the direction the timing is equally important.

3/ Basics of CE & PE:

Option holders can buy or sell a security at a predetermined price using contingent financial derivatives called options.

In return for such access, option purchasers charge a small amount referred to as a premium to such sellers.

4/ Why CE & PE options are purchased:

CE is an abbrevation for Call Option and PE for Put option.

The CE buyer benefits every time the price of the underlying goes up.

Polar opposite is the PE option, as a PE option buyer benefits every time the price of the underlying falls.

5/ Knowledge of Greeks:

One can make money in options without knowing in depth about greeks.

However one needs to be aware about an important greek viz. Theta.

Option loses its value as time moves closer to its maturity.

6/ Option is a wasting asset:

An option’s time value decays as expiration approaches, and options buyers don’t want to watch their purchased options decline in value, potentially expiring worthless if the stock/index finishes below the strike price (in case of a CE option).

7/ When to buy CE or PE option: Set -up 1:

After a consolidation, the stock/index usually breaks the consolidation, if it breaks on the upside an option buyer usually buys a CE option and vice versa for PE option.

8/ When to buy a CE option: Set -up 2: BTST

Whenever the market (mainly indices) closes at day high one can opt for buying a CE option.

Conversely whenever the market closes at day low, one can opt for buying a PE option.

9/ When to buy a PE option: Set -up 2: STBT

Conversely whenever the market closes at day low, one can opt for buying a PE option.

10/ Which instrument to choose?

Chose a particular index which usually has strong momentum eg. Banknifty over Nifty.

If you are interested in stocks look for high beta stocks or screen stocks that is soon going to come out of a consolidation, and always opt for liquid counters.

11/ Finer aspects to be taken care of:

Look for option buying near expiration as most of the time value is already eroded, so one can get it at a cheaper price.

Also look for opportunites in lower VIX.

Intraday players can further choose a specific time window e.g. 1 hour post market opening and last hour before closing.

Intraday players can also opt for option buying only on weekly expiries especially when the VIX is low, as any momentum would get maginified.

12/ What should be minimum R/R criteria:

Always work with a minimum target of 1:3 R/R in option buying.

13/ Buying options comes with huge risk:

To make profits in option buying one has to time the momentum.

In case the expected monvement doesn't work out the premium melts and the option buyer ends up in a loss.

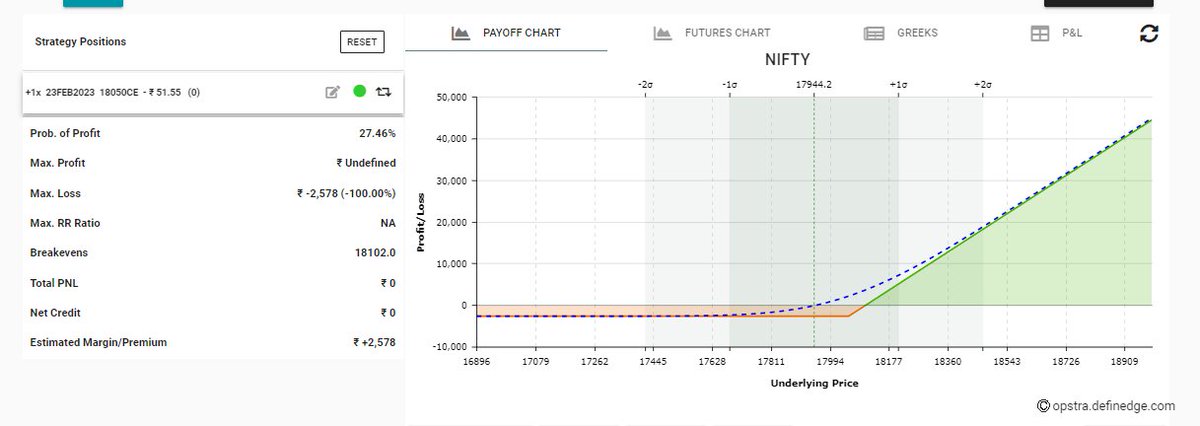

Check in case of naked CE option buying the max risk is Rs. 2578

14/ In case of naked PE option buying the max risk is Rs. 3250

15/ Spreads vs. naked option buying:

One can opt for spreads instead of naked buying where the losses are lower.

But with limited risk this comes with limited return.

Spreads are also considered as "defined risk" trades where both the profit & loss are capped.

For times when the expected move is not as pronounced, a spread may be a better fit depending on environment and other factors.

16/ Bull Call Spread:

This strategy consists of one long call with a near strike price and one short call with a farther strike price of the same underlying stock and the same expiration date.

A bull call spread is established for a net debit.

17/ Bear Put Spread:

This strategy consists of buying one put and selling another put at a lower strike.

This is to offset a part of the upfront cost.

This strategy requires a net cash outlay or net debit at the outset.

18/ Defined risk in spreads:

In the above eg. of naked CE buying the max risk was Rs. 2578 the moment we switch to Bull CE spread the max risk reduces by 50% to Rs. 1250.

So for people who are in the learning phase, its better to opt for spreads as the risk involved is lower.

19/ Position Sizing:

Sizing is the key, never go all in, define your risk in terms of percentage of your total capital or in absolute terms and stick to the same.

20/ Final Thoughts:

Before taking the plunge, always backtest your strategy for atleast 3months and forward test it with small quantity, to learn the nuances of the set up.

Scaling up should be done only when you are consistenly profitable.

We are finally on Youtube!!

We have a free Youtube Channel where we cover our analysis of the markets.

Checkout using this link:

https://t.co/5AyQC6MuyC

If you enjoyed this thread here's another one:

https://t.co/Bt6ejYc3GP

We also have a free telegram channel.

Link to join:

https://t.co/GpDL0dXbzS

That's a wrap!

If you enjoyed this thread:

1. Follow us

@Adityatodmal &

@niki_poojary for more threads on Price action, Option Selling & Trading growth.

We've got you covered.

2. RT the first Tweet to share it with your audience.

I appreciate it!