#Nifty hrly - Bullish scenario invalid only below 15775. Till then -

- 5.i done as LD at 16793.

- 5.ii done at 16347 and Nifty rises to 17000+

- 5.ii.a or w done at 16347, irregular correction or complex correction may play out for next 5-7 trading sessions.

Buy the dips. https://t.co/l4Iqp7patS

#Nifty hrly - 2.a done and 2.b should ideally be done tomorrow below the previous high.

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) June 6, 2022

With RBI MPC meeting outcome on 8th (I suppose), sets up perfectly for a 3rd wave in major 5th (considering that my counts are right). https://t.co/LXG2SCg3bY pic.twitter.com/Ya2D35VV8F

More from Harsh / 허쉬

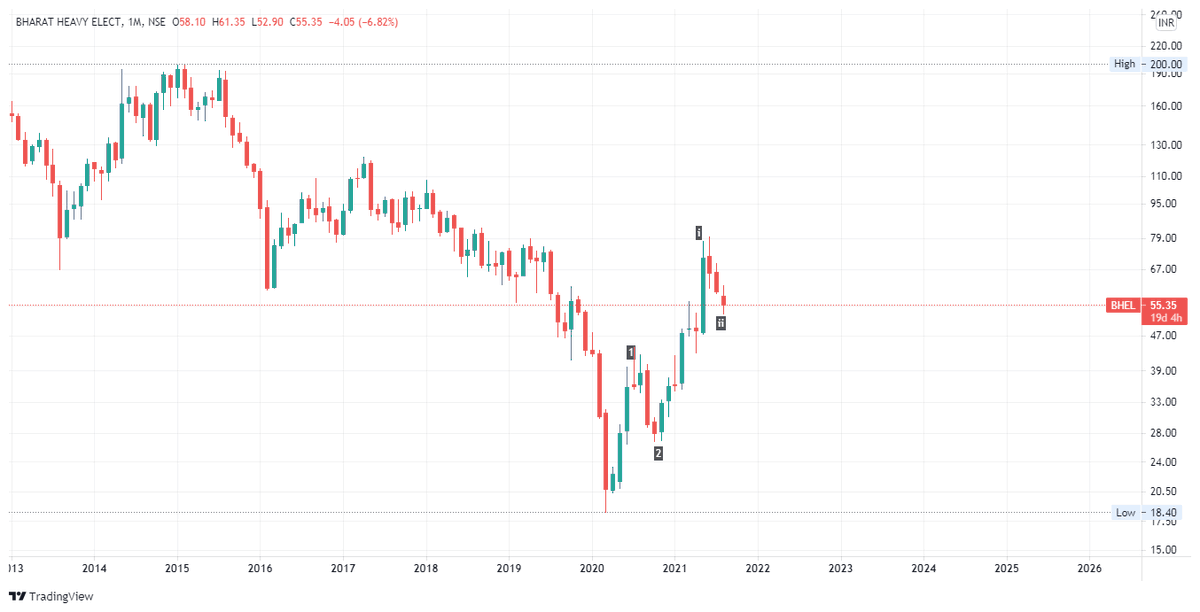

Chart wise labeling for 1,2,i,ii for now - counts invalid if falls further to 38. In that case will take a fresh look.

#Nifty #Elliotwave #Chart https://t.co/2mvKfAs3wA

Holding 29, major wave 2 looks over. Will you believe if I say ATH will come? But let's go step my step - 80-130-200 \U0001f600#Bhel pic.twitter.com/3KPCYeDoDp

— Harsh Mehta (@_Harsh_Mehta_) February 4, 2021

Was looking at #BajajFinance chart once again. I am not able to complete 5 waves yet...hmmm...\U0001f928

— Harsh / \ud5c8\uc26c (@_Harsh_Mehta_) June 17, 2022

As posted earlier, the drop is still 4th (invalidation below 4500).

And target still remains open for 10K+ https://t.co/DozJzNhuuI pic.twitter.com/jPRaEQoPH3

More from Niftylongterm

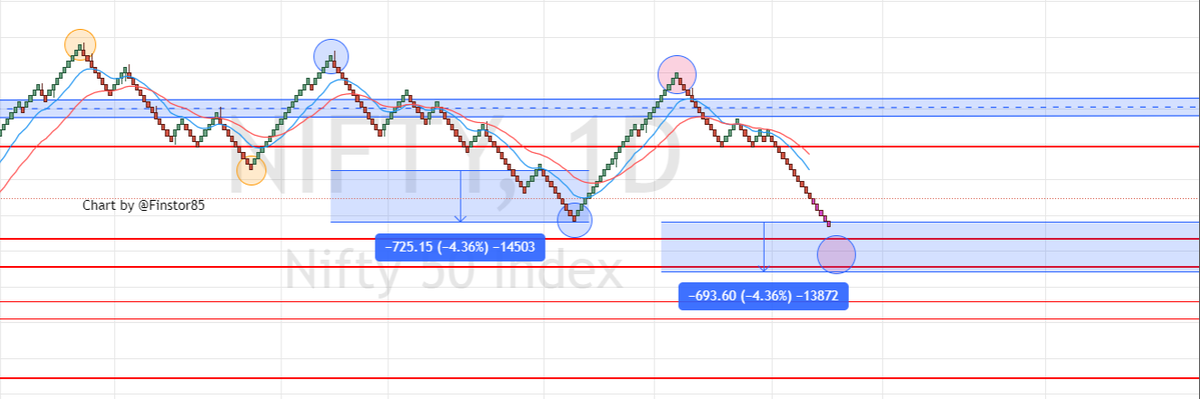

If we are to continue LH-LL setup & break 16666 on daily we will finally complete this drag near 15214. I am not bearish. In fact, this should give amazing opportunity to buy. Until then 16666-17300 continue to provide L-H range for traders. pic.twitter.com/tfIq00VJmZ

— Ameya (@Finstor85) May 2, 2022

You May Also Like

Do Share the above tweet 👆

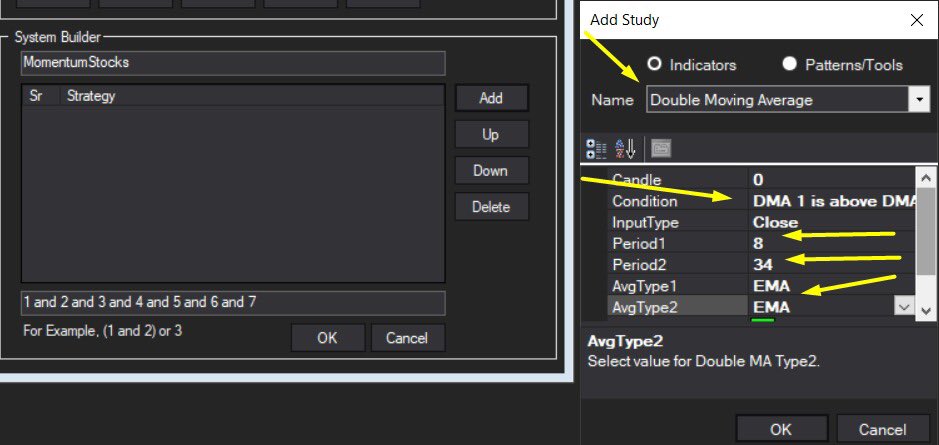

These are going to be very simple yet effective pure price action based scanners, no fancy indicators nothing - hope you liked it.

https://t.co/JU0MJIbpRV

52 Week High

One of the classic scanners very you will get strong stocks to Bet on.

https://t.co/V69th0jwBr

Hourly Breakout

This scanner will give you short term bet breakouts like hourly or 2Hr breakout

Volume shocker

Volume spurt in a stock with massive X times

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Here are the setups from @Pathik_Trader Sir first.

1. Open Drive (Intraday Setup explained)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Bactesting results of Open Drive

Already explained strategy of #opendrive

— Pathik (@Pathik_Trader) May 27, 2020

Backtested results in 30 stocks and nifty, banknifty.

Success ratio : approx 40-45%

RR average 1:2

Entry as per strategy

Stoploss = Open level

Exit 3:15 PM Or SL

39 months 14 months -ve, 25 +ve

Yearly all 4 years +ve performance. pic.twitter.com/nGqhzMKGVy

2. Two Price Action setups to get good long side trade for intraday.

1. PDC Acts as Support

2. PDH Acts as

So today we will discuss two more price action setups to get good long side trade for intraday.

— Pathik (@Pathik_Trader) June 20, 2020

1. PDC Acts as Support

2. PDH Acts as Support

Example of PDC/PDH Setup given

#nifty

— Pathik (@Pathik_Trader) June 23, 2020

This is how it created long setup by taking support at PDC.

hopefully shared setup on last weekend helped. pic.twitter.com/2mduSUpMn5