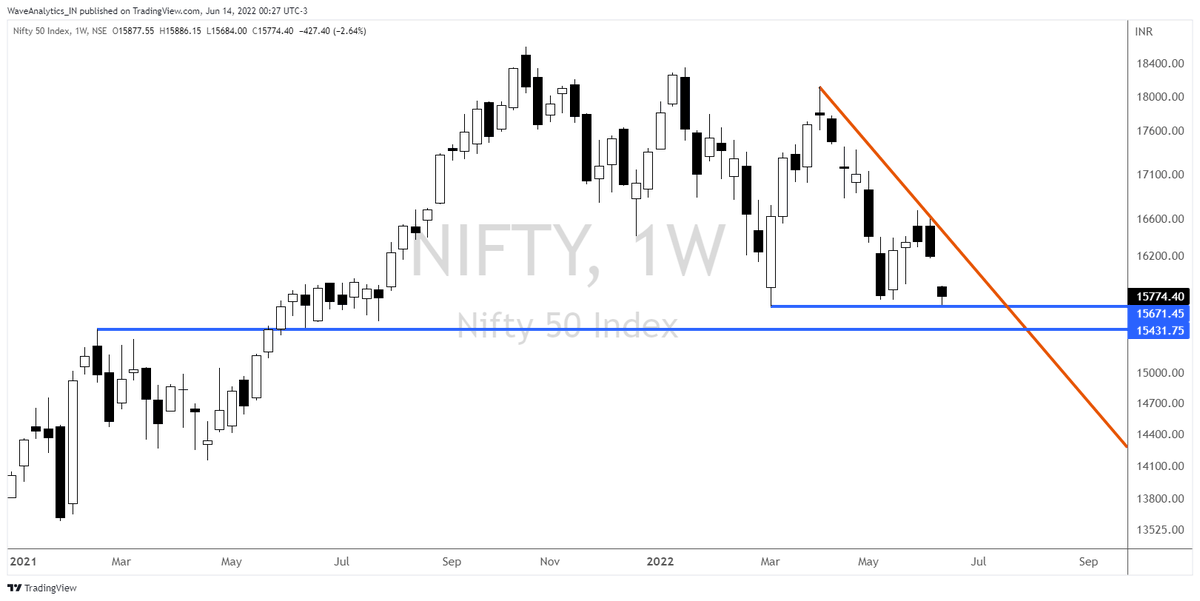

#NIFTY

15 Months to this post. No change in the larger projections.

Long Term Chart of the Year.#NIFTY - Wave 5 (Cycle Degree) Target Zone of 25000-34000 by 2024-2027.

— Piyush Chaudhry (@piyushchaudhry) December 19, 2020

Reassessment on a breach below Blue Trendline. A breach is not a necessary invalidation. Depends on internals.

The dashed path is for representative purpose only. #ElliottWave pic.twitter.com/1xVY4OSr5T

More from Piyush Chaudhry

New All Time High.

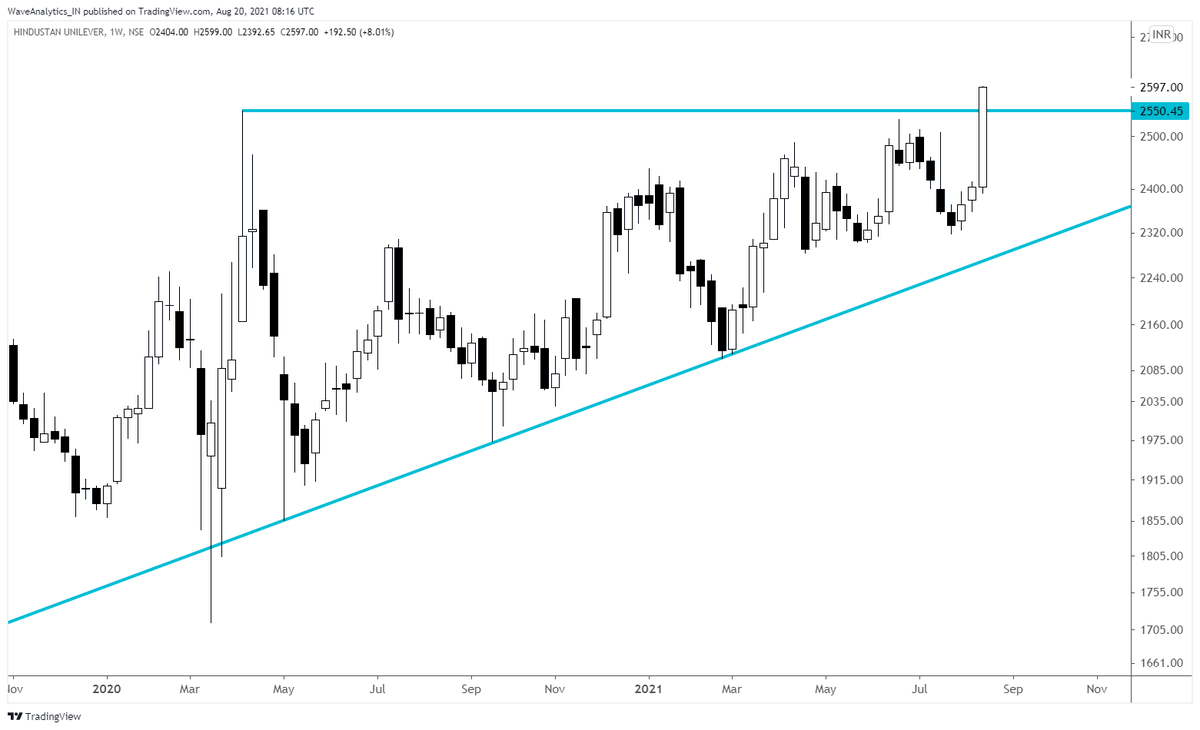

#HINDUNILVR

EW

Long Term Chart of the Month. #HINDUNILVR

— Piyush Chaudhry (@piyushchaudhry) December 9, 2020

Sometime in the next decade I see a fair possibility of stock reaching 7000 odd.

Invalidation below Blue Trendline. #ElliottWave pic.twitter.com/uxQrzt1mbj

as per relative strength

One question that I often get is which of the two: #HINDUNILVR or #ITC would be a better Investment bet. While their individual charts are clear themselves, another approach is ratio chart. IMHO Lever should outperform ITC for several years going forward.https://t.co/3AFqm6FJ1Q pic.twitter.com/rLuIm8xyVw

— Piyush Chaudhry (@piyushchaudhry) December 30, 2020

This is how to differentiate:

• if right shoulder is smaller than left, most likely a continuation H&S

• if right is same or higher than left, and the price is not coming to neckline, most likely CF

sir a doubt does head & shoulders work in down trend ? pic.twitter.com/dytYmbzOfp

— Vega_Greek (@VegaGreek) May 13, 2021