ULTIMATE GUIDE TO 21 and 200 Moving Average

— JayneshKasliwal (@JayneshKasliwal) November 14, 2021

SUNDAY THREAD \U0001f516

A trend Following System That will Help You Improve Trading immensely.

RETWEET AND SHARE \U0001f504@kuttrapali26 @AmitabhJha3 #stocks #StockMarket

1/n

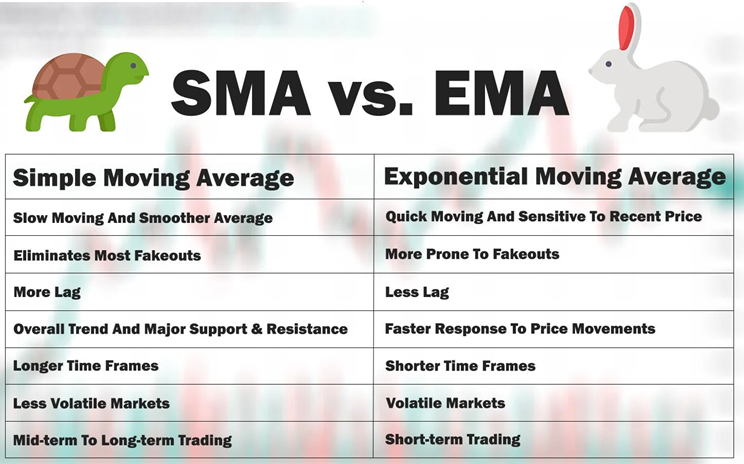

The Ultimate Guide to moving averages !

A mega thread to understand the Use of 21 , 50 and 200 ema.

4 Effective uses of Exponential Moving Averages !

Retweet and Share 🔄

#stockmarkets #nifty

@kuttrapali26 @caniravkaria

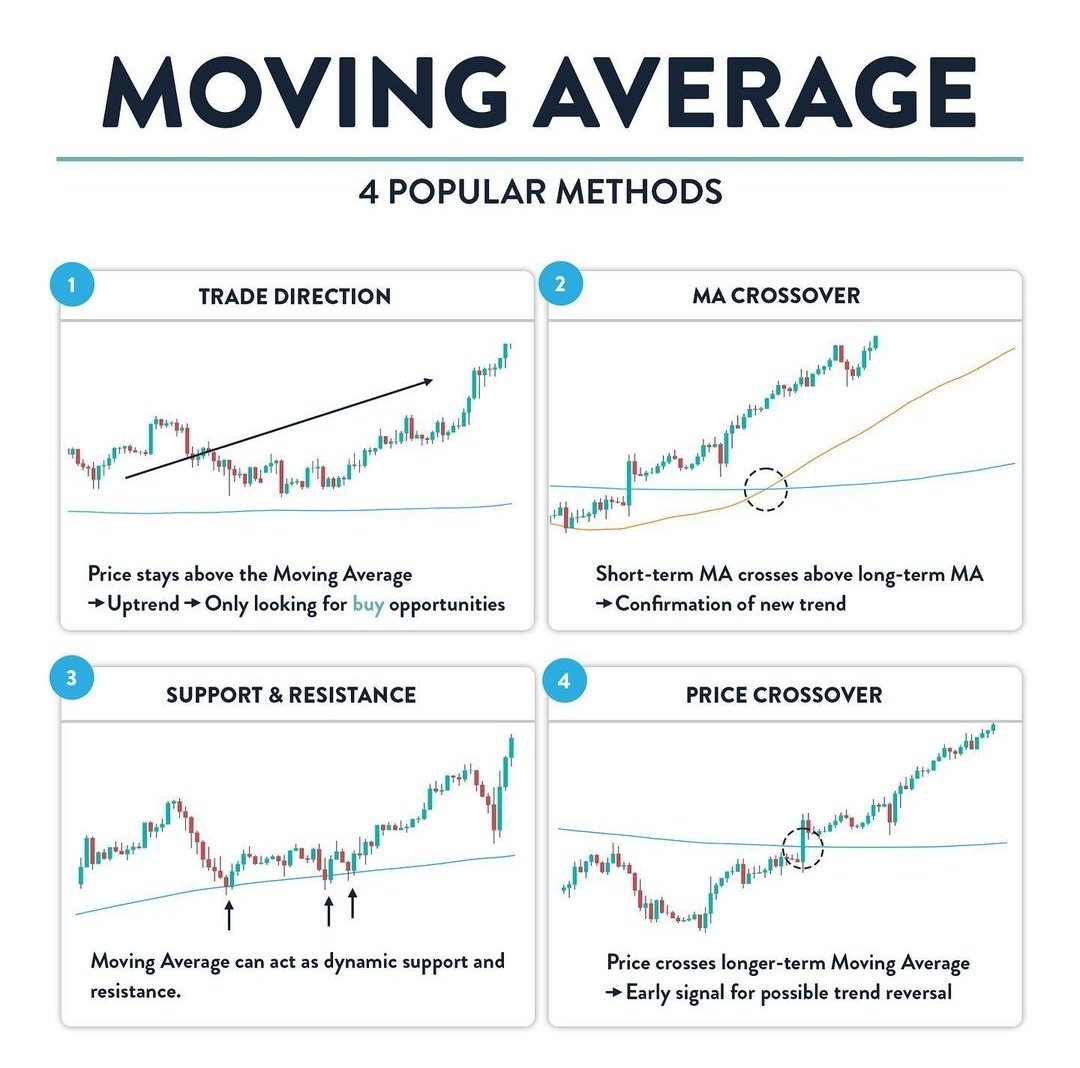

1. Identifying the direction of trend

2. MA crossover

3. Dynamic Support and Resistance

4. Price Crossing above Key EMAs

Note : In chart 21 ema is red , 50 ema is green and 200 ema is black

2/n

The 21 ema will tell us the Short term trend of a stock , while the 200 ema will tell us the long term trend of a stocks

Any EMA that is sloping

:upwards trend is BULLISH

:sideways trend is NEUTRAL

:downwards trend is BEARISH

4/n

When Moving averages turn flat means the stock is in consolidation and is in sideways zone .

Generally this occurs after an uptrend or downtrend and may lead to continuation of previous trend .

This is generally no trading zone for swing traders

5/n

2. Whenever ema is sloping downwards its called dowtrend

3. Whenever ema is sideways its called consolidation

⏫Buy in uptrend

⏬Sell in downtrend

Whenever stocks move too away from ema it is extended and pullsback

6/n

1. Whenever the 21 ema crosses 50 ema from down to up short term trend changes from bearish to bullish and vice versa.

2. The 21 Should be above 50 ema for uptrend and below 50 ema for downtrend

Ex:

7/n

Crossover shouldnt be traded solely as it can lead to multiple signals of buy and sell ,always use confirmation of volume , price etc to take trade .

During consolidation you will get many signals and hence its not advised to use during sideways trend

8/n

50 cutting 200 from down : Golden Cross

50 cuttinf 200 from up : Death Cross

The Long term trend changes when DEATH CROSS happens and its one of the most dangerous situations

Price falls raidly after the Death Cross

9/n

1. 21 ema Dynamic support for trending stocks in short term

2. 50 ema dynamic support for mid term

3. 200 ema dynamic support for long term

Examples Explained !

10/n

200 EMA : THE LONG TERM TREND

1. When a stock price crosses its 200-day moving average, it is a technical signal that a reversal has occurred.

11/n

4. One may consider investing in stocks if the stock is below 200 ema only if he is confirmed about the fundamentals of the stock

5. Some may not agree with this and its ok!

12/n

1. If you use 200 ema on weekly timeframe you can be in a trend for a very long time

2.The sell signs will be given late as we are using weekly timeframe

@rohanshah619 @Puretechnicals9

13/n

https://t.co/T09LUm1HsI

My telegram Free Group

https://t.co/b4N4oPAto9

More from JayneshKasliwal

𝗡𝗶𝗳𝘁𝘆-𝗕𝗮𝗻𝗸𝗻𝗶𝗳𝘁𝘆 𝗢𝗽𝘁𝗶𝗼𝗻 𝗕𝘂𝘆𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝘆

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

You May Also Like

THREAD PART 1.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.

On Sunday 21st June, 14 year old Noah Donohoe left his home to meet his friends at Cave Hill Belfast to study for school. #RememberMyNoah💙

He was on his black Apollo mountain bike, fully dressed, wearing a helmet and carrying a backpack containing his laptop and 2 books with his name on them. He also had his mobile phone with him.

On the 27th of June. Noah's naked body was sadly discovered 950m inside a storm drain, between access points. This storm drain was accessible through an area completely unfamiliar to him, behind houses at Northwood Road. https://t.co/bpz3Rmc0wq

"Noah's body was found by specially trained police officers between two drain access points within a section of the tunnel running under the Translink access road," said Mr McCrisken."

Noah's bike was also found near a house, behind a car, in the same area. It had been there for more than 24 hours before a member of public who lived in the street said she read reports of a missing child and checked the bike and phoned the police.