This is the type of market that I let others fight for hard pennies while I patiently wait for easy dollars; waiting, stalking and then when the time is right... I POUNCE!!

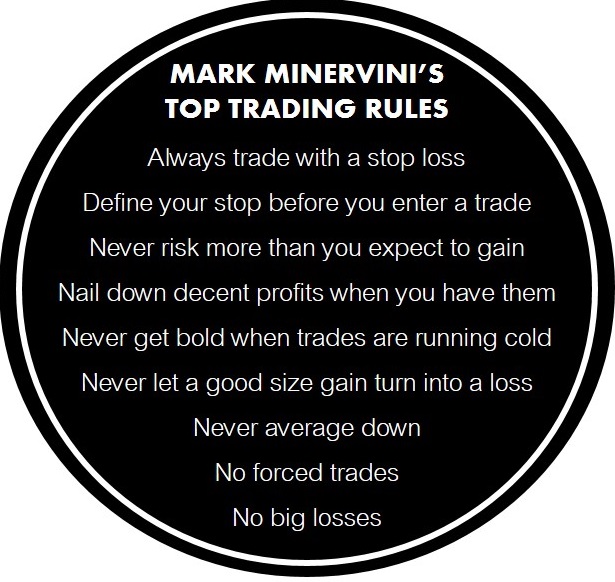

More from Mark Minervini

More from Markminervinilearnings

None of the attributes like discipline, persistence, consistency or hard work are going to do you any good if you are all over the place and haven't first defined your style and committed to mastering it at the expense of being a mediocre jack-of-all trades. #avoidstyledrift.

The word is sacrifice. You are not going to be the best at day trading, swing, value and growth investing. It will be amazing if you can master just one. And you only need one. So pick one and sacrifice the rest! There is no other way unless you want to suck at a bunch of things. https://t.co/QVI68eaNHQ

— Mark Minervini (@markminervini) April 14, 2021

You May Also Like

Tip from the Monkey

Pangolins, September 2019 and PLA are the key to this mystery

Stay Tuned!

1. Yang

2. A jacobin capuchin dangling a flagellin pangolin on a javelin while playing a mandolin and strangling a mannequin on a paladin's palanquin, said Saladin

More to come tomorrow!

3. Yigang Tong

https://t.co/CYtqYorhzH

Archived: https://t.co/ncz5ruwE2W

4. YT Interview

Some bats & pangolins carry viruses related with SARS-CoV-2, found in SE Asia and in Yunnan, & the pangolins carrying SARS-CoV-2 related viruses were smuggled from SE Asia, so there is a possibility that SARS-CoV-2 were coming from

Pangolins, September 2019 and PLA are the key to this mystery

Stay Tuned!

1. Yang

Meet Yang Ruifu, CCP's biological weapons expert https://t.co/JjB9TLEO95 via @Gnews202064

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) October 11, 2020

Interesting expose of China's top bioweapons expert who oversaw fake pangolin research

Paper 1: https://t.co/TrXESKLYmJ

Paper 2:https://t.co/9LSJTNCn3l

Pangolinhttps://t.co/2FUAzWyOcv pic.twitter.com/I2QMXgnkBJ

2. A jacobin capuchin dangling a flagellin pangolin on a javelin while playing a mandolin and strangling a mannequin on a paladin's palanquin, said Saladin

More to come tomorrow!

3. Yigang Tong

https://t.co/CYtqYorhzH

Archived: https://t.co/ncz5ruwE2W

4. YT Interview

Some bats & pangolins carry viruses related with SARS-CoV-2, found in SE Asia and in Yunnan, & the pangolins carrying SARS-CoV-2 related viruses were smuggled from SE Asia, so there is a possibility that SARS-CoV-2 were coming from