“Creative intensity” is the rate at which products or services go stale and new ones must be created. It is the key factor in predicting the future of marketplaces.

On the left, the marketplace model will ultimately go extinct. On the right, it will persist.

A thread 🧵👇

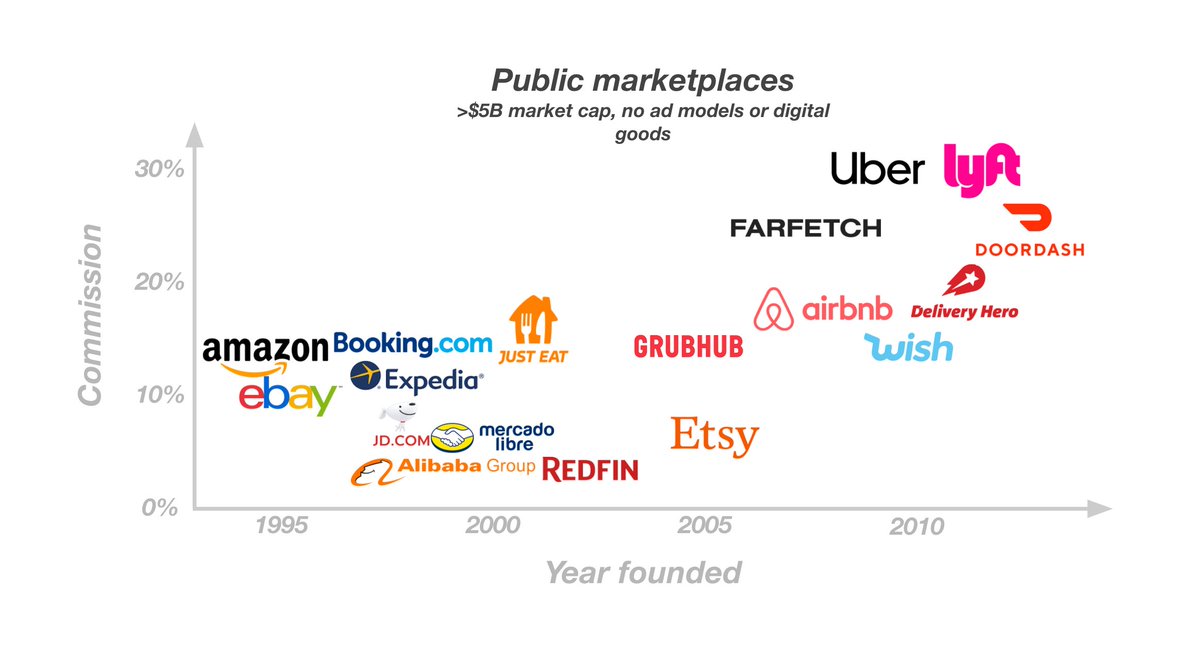

Does that mean that marketplaces are just an intermediary step as an industry transitions from many independent suppliers to consolidated super-suppliers?

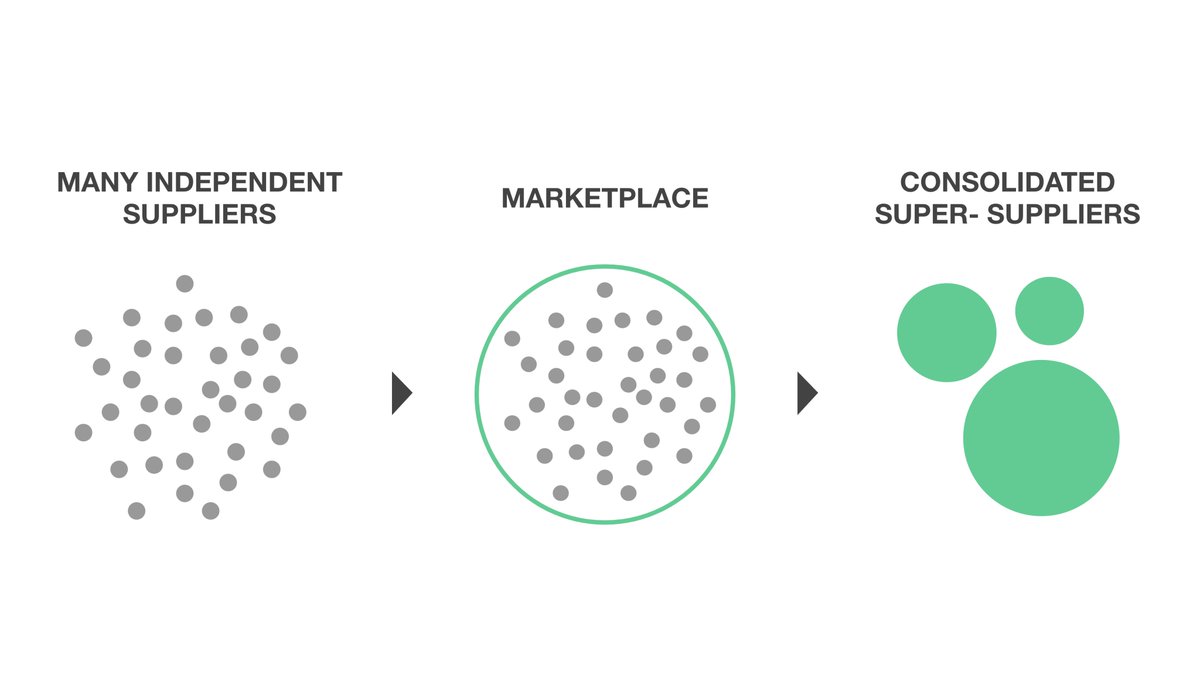

🤝 Coordination: making the product or service legible (categorizing, pricing), matching buyers and sellers, establishing trust

💸 Capital: the full cost and risk of doing business

💡Creativity: figuring out what to sell in the first place

https://t.co/ivo1G133cq

Vertically integrated "super suppliers" do everything. e.g. you can call Clutter a marketplace, but they're really a big, tech-enabled service provider.

When a new marketplace model overtakes an old one, it is usually because they have taken on a new job that their suppliers used to do, and improved the customer experience:

Let's look at a few examples:

eBay left a gap on trust that both GOAT and StockX exploited with their verification programs and money-back guarantees for collector sneakers.

@sarahtavel describes this here:

https://t.co/qqdD1hWTiM

Historically, local services marketplaces made intros and asked buyers/sellers to price the job.

With their Instant Match product, Thumbtack is automating price discovery and letting customer see prices in real time based on preferences, making it easier to hire.

Retailers previously relied on sales reps to help them understand what to buy wholesale.

With access to more data, Faire is able to go a step farther and underwrite the transaction, offering net terms and free returns every time a retailer orders from a new brand.

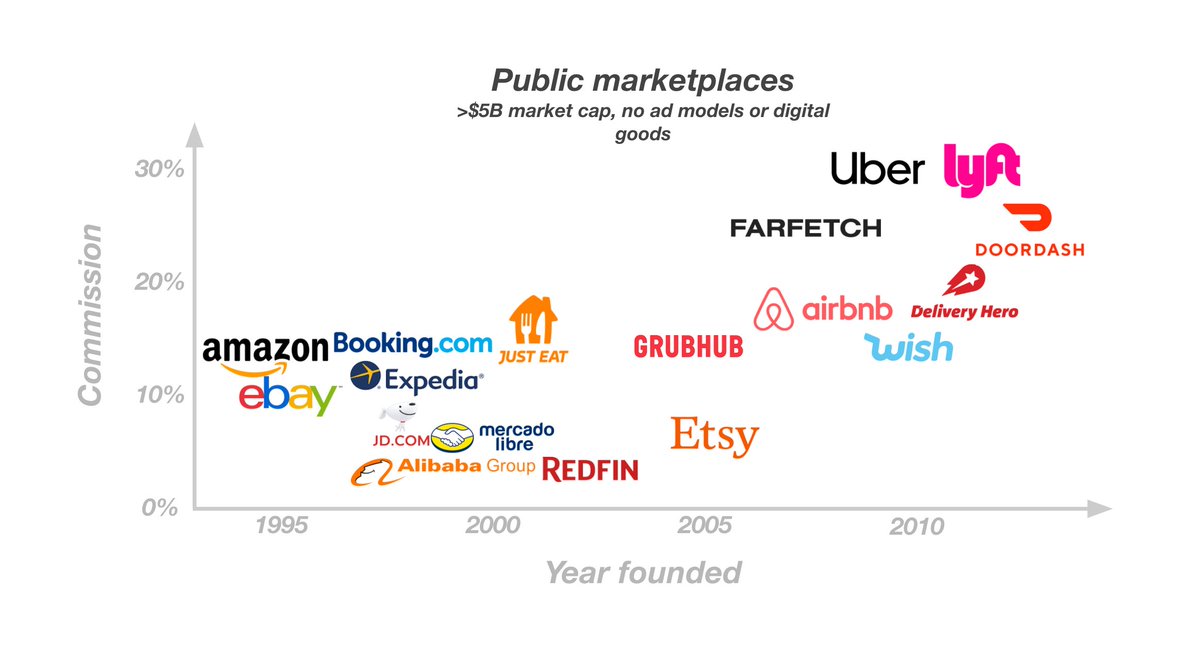

Marketplaces are increasingly reaching farther into the supplier cost structure.

By taking on responsibility for delivery, Doordash improved the customer experience and expanded the restaurants they could bring onto the marketplace relative to Grubhub.

This is the process of suppliers envisioning new products and services to sell.

There are zero examples of marketplace figuring how to do this.

Even private label programs like Amazon Basics are just copying the "real" creators on the marketplace.

Why is this?

Big companies are pretty good at solving capital and coordination problems, but terrible at innovation.

They're going to get worse at this as they scale, not better.

They are optimization problems which benefit from more data and better ability to parse it, and we all know how that is going.

As @peteflint has noted, this means marketplaces will increasingly become fintechs and provide financing, banking, and insurance.

https://t.co/jIfXMAVQck

It's one of the reasons @benthompson said Doordash was "playing on hard mode"

https://t.co/HOCa08yutd

HomeAdvisor didn’t try to vertically integrate their moving category until Clutter did it.

(1) Marketplaces figure out how to take these costs in-house themselves; or

(2) They integrate with a 3rd party, like Doordash white label logistics or Stripe Capital, which is essentially "Risk as a Service"

https://t.co/z41meCPtHz

Mundane though it sounds, access to capital is the primary bottleneck that limits the growth and expansion of most small businesses.

— Patrick Collison (@patrickc) December 1, 2020

So we built Capital for platforms: https://t.co/3BvZhCz9Bo. Help *your* customers grow faster by using our lending infrastructure. pic.twitter.com/z7xxfM9GFD

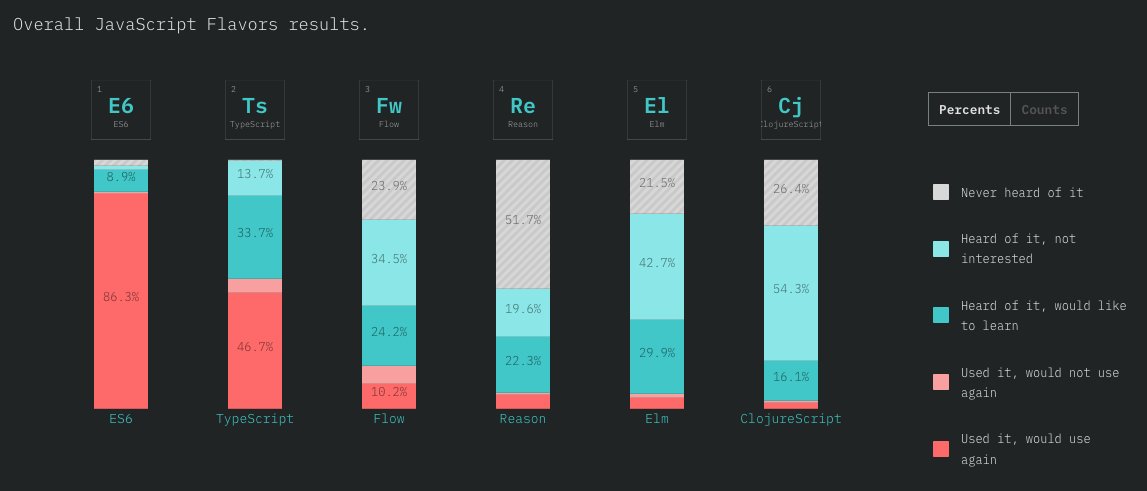

Some industries have high creative intensity (media, art, new consumer products).

Some have low creative intensity (transportation, services, goods re-sale).

In ride sharing, as soon as full autonomy arrives the industry will flip to super-suppliers that handle the end-to-end customer experience, not marketplaces.

In video games, Steam's $5B+ indie game marketplace will be able to co-exist alongside the large game studios in the long term. No centralized company will figure out how to generate the diversity of creative expression required on their own.

https://t.co/HNz4Esqufa

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020