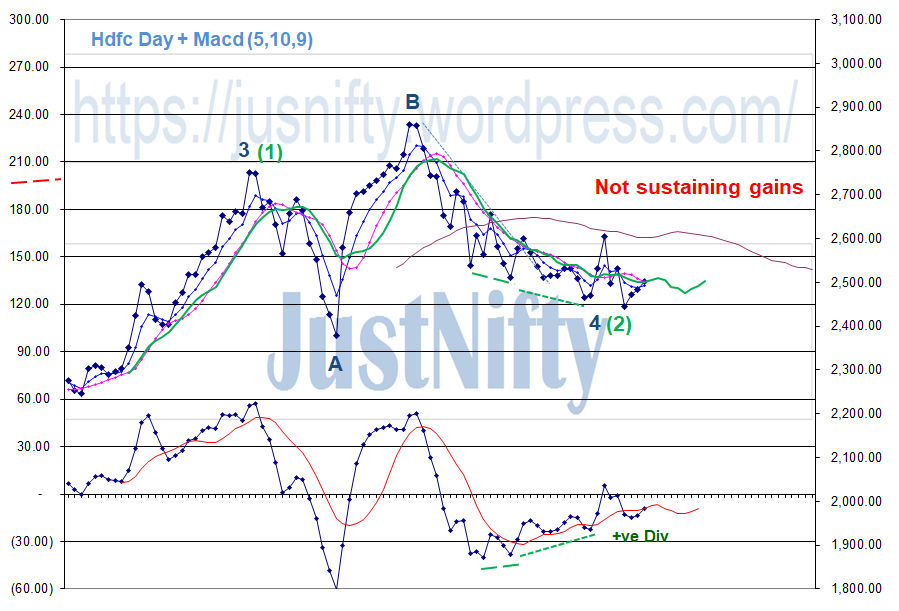

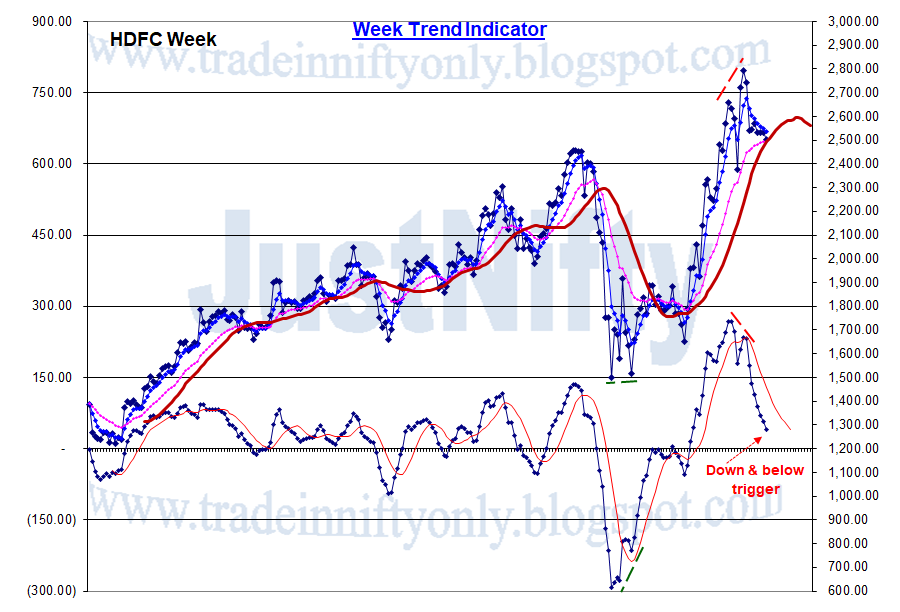

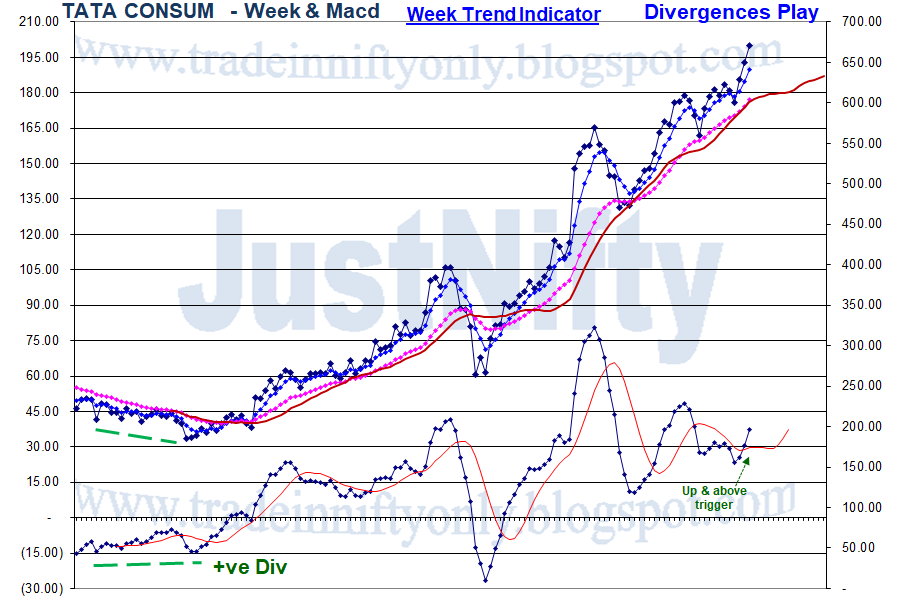

Lesson from "Trend Indicator, MACD"

For traders & Investors, it suggests inherent bias:

+ve when up & above trigger & every fall gets bought into.

-ve when down & below trigger & every rise gets sold into.

Keep in mind always, your success rate would continue to climb higher🙏

More from Van Ilango (JustNifty)

A big rerating underway for #McDowell based on price action.

Holding 660 & 680, poised for big run in the days, weeks & months ahead.

Volume goes with rises

Holding 660 & 680, poised for big run in the days, weeks & months ahead.

Volume goes with rises

Thank you.\U0001f64f

— Van Ilango (JustNifty) (@JustNifty) August 18, 2021

A fresh input for you. #McDowell

A major triangle break out in the coming months.

Presently poised to move out of recent consolidation pic.twitter.com/J15F06ODUq

You May Also Like

On the occasion of youtube 20k and Twitter 70k members

A small tribute/gift to members

Screeners

technical screeners - intraday and positional both

before proceeding - i have helped you , can i ask you so that it can help someone else too

thank you

positional one

run - find #stock - draw chart - find levels

1- Stocks closing daily 2% up from 5 days

https://t.co/gTZrYY3Nht

2- Weekly breakout

https://t.co/1f4ahEolYB

3- Breakouts in short term

https://t.co/BI4h0CdgO2

4- Bullish from last 5

intraday screeners

5- 15 minute Stock Breakouts

https://t.co/9eAo82iuNv

6- Intraday Buying seen in the past 15 minutes

https://t.co/XqAJKhLB5G

7- Stocks trading near day's high on 5 min chart with volume BO intraday

https://t.co/flHmm6QXmo

Thank you

A small tribute/gift to members

Screeners

technical screeners - intraday and positional both

before proceeding - i have helped you , can i ask you so that it can help someone else too

thank you

positional one

run - find #stock - draw chart - find levels

1- Stocks closing daily 2% up from 5 days

https://t.co/gTZrYY3Nht

2- Weekly breakout

https://t.co/1f4ahEolYB

3- Breakouts in short term

https://t.co/BI4h0CdgO2

4- Bullish from last 5

intraday screeners

5- 15 minute Stock Breakouts

https://t.co/9eAo82iuNv

6- Intraday Buying seen in the past 15 minutes

https://t.co/XqAJKhLB5G

7- Stocks trading near day's high on 5 min chart with volume BO intraday

https://t.co/flHmm6QXmo

Thank you