More from JayneshKasliwal

Detailed Study of Stocks that became 5X in past 2 Years

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

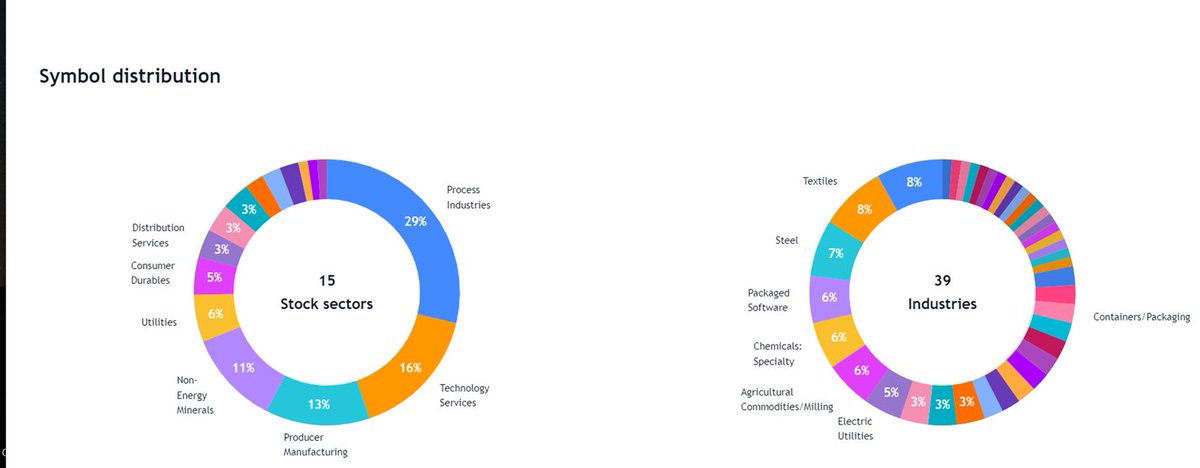

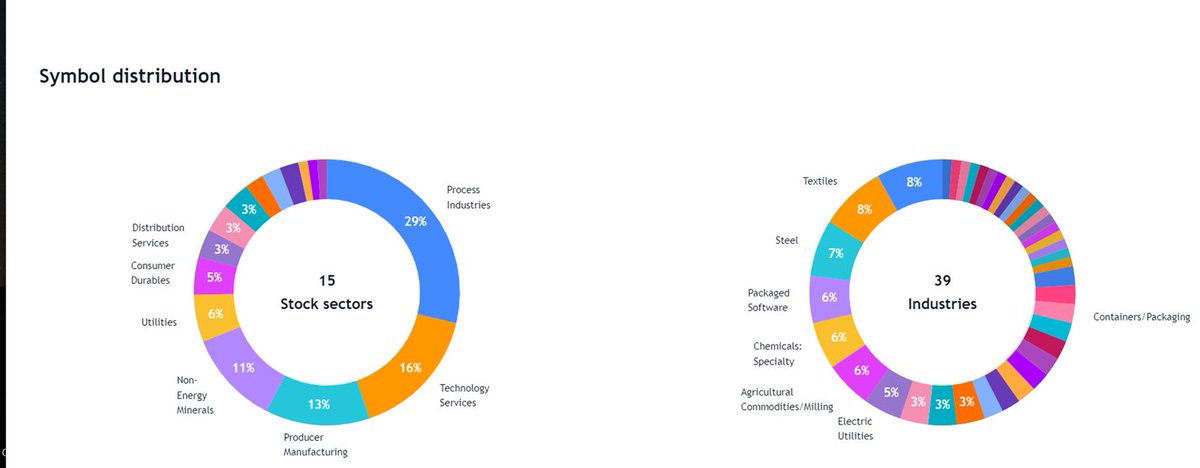

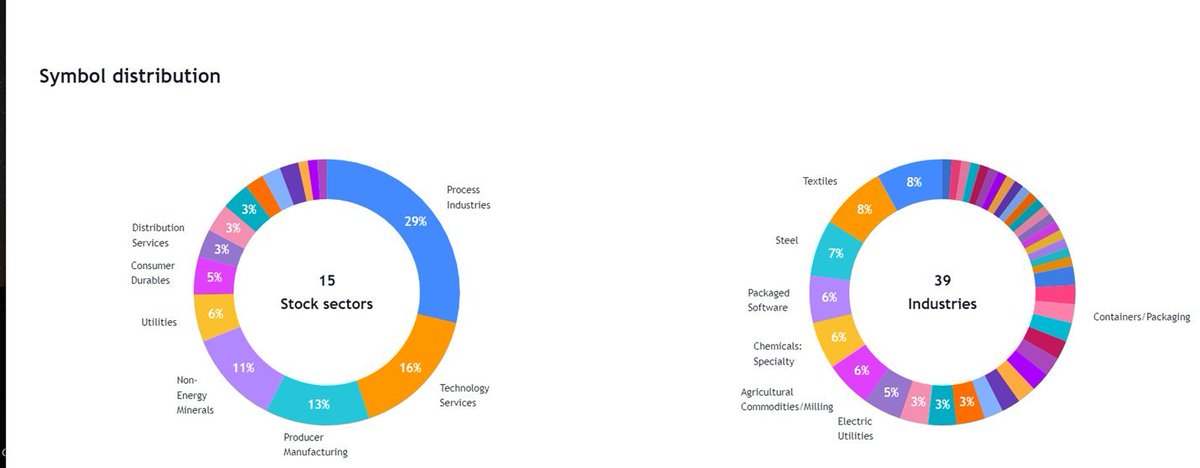

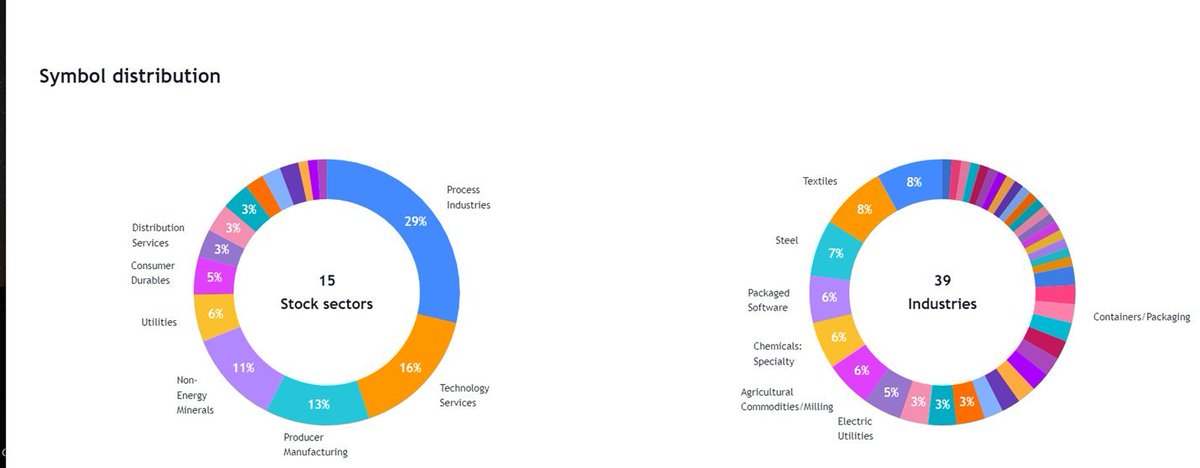

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5

1/n

All stocks had few things in common :

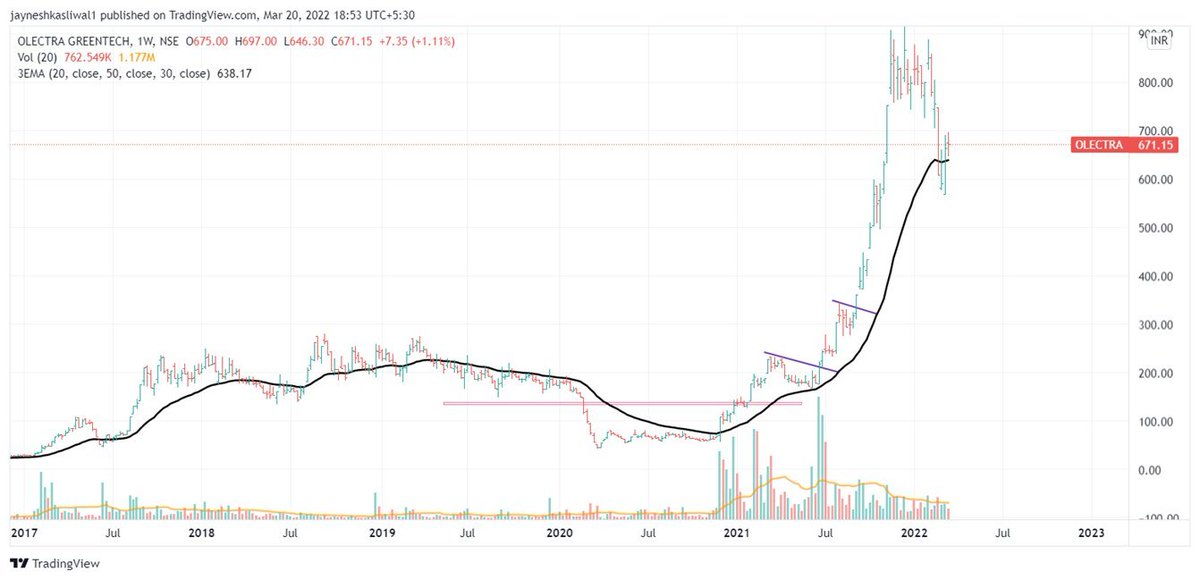

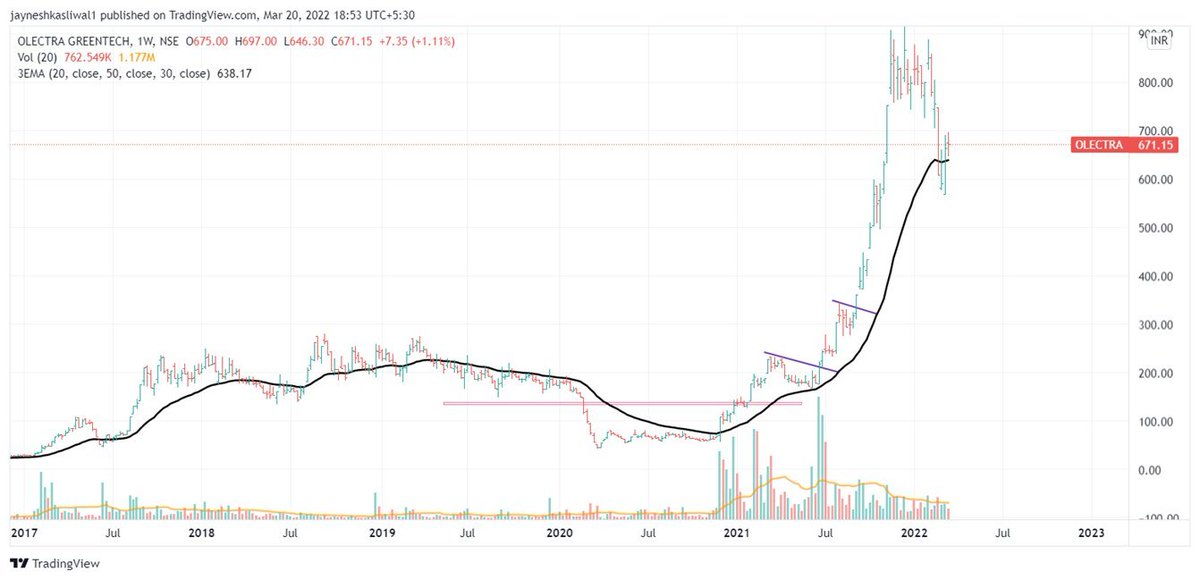

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want to attend a live session on the same !

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUM32b5

1/n

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

2/n

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

3/n

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

𝟱 𝗧𝗿𝗮𝗱𝗶𝗻𝗴𝘃𝗶𝗲𝘄 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿𝘀 𝗮𝗹𝗹 𝗧𝗿𝗮𝗱𝗲𝗿𝘀 𝘀𝗵𝗼𝘂𝗹𝗱 𝗸𝗻𝗼𝘄 𝗮𝗯𝗼𝘂𝘁:

𝗣𝗮𝗿𝘁 𝟮

🧵 Thread 🧵

Retweet And I will Link a 36 Page PDF

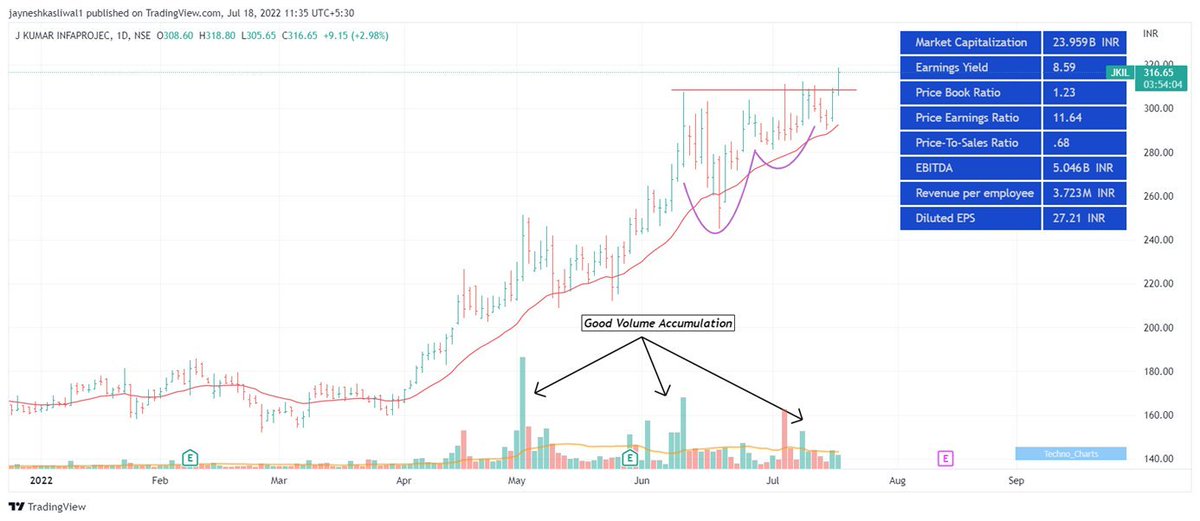

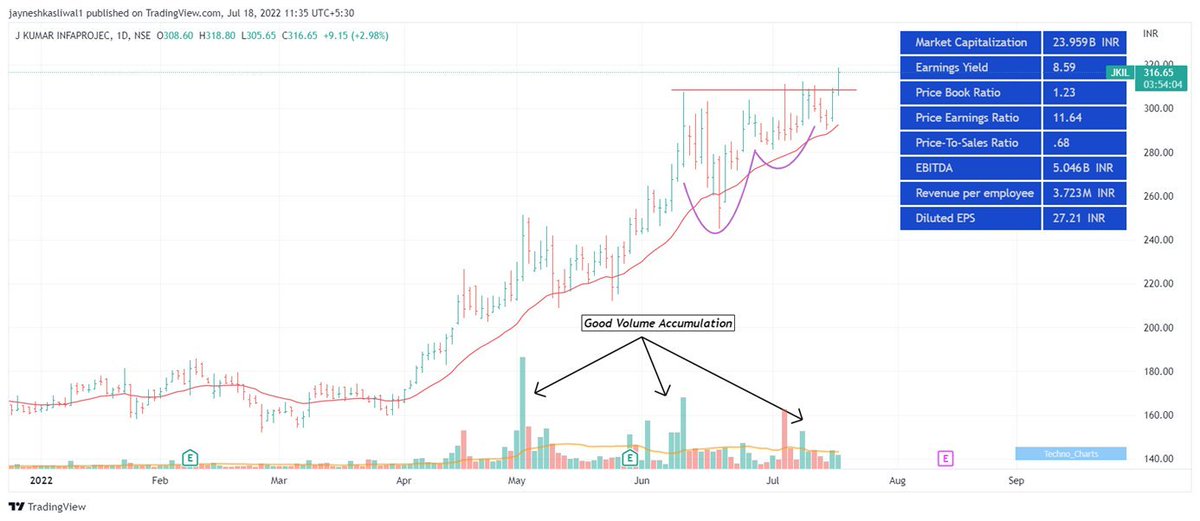

𝟭. 𝗔𝗱𝗱 𝗙𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹𝘀 𝗼𝗻 𝗰𝗵𝗮𝗿𝘁

🔸 Link:

https://t.co/zG165Xa3JB

🔸 Click on the above link -> Add to Favourites -> Add on Chart from favourites and start using it !

2/20

You can add financials from many fundamental criteria's like

🔸 Cashflows

🔸 Income Statements

🔸 Balance sheets

🔸 PE,PB ratios

🔸 Marketcapitlization

🔸 Statistics

3/20

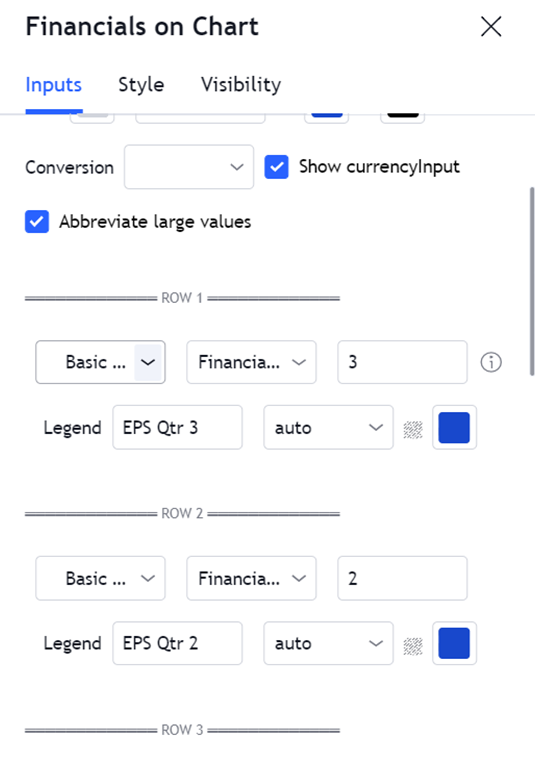

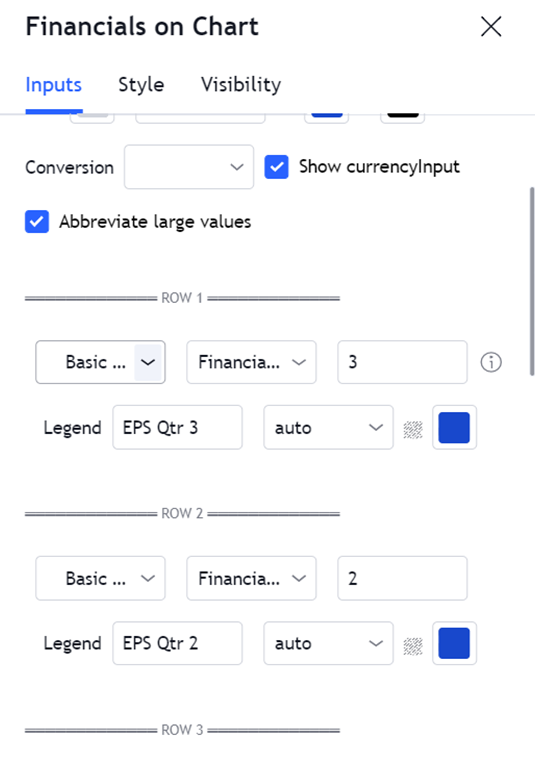

How to change Settings:

🔸 There are 8 columns you can basically select any financial you want

🔸 You can select quarterly or Yearly values and can also write

🔸 The names of the financiaLS Example : EPS Qtr3

🔸 You can Change colours , font size

4/20

𝟮. 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗥𝗮𝘁𝗶𝗻𝗴𝘀

You cannot track each and every indicator like ( 𝗠𝗼𝘃𝗶𝗻𝗴 𝗔𝘃𝗴𝘀 , 𝗥𝗦𝗜 , 𝗠𝗔𝗖𝗗 ) etc , you can use plot this custom strategy to understand whether the trend is positive or negative of those indicators

5/20

𝗣𝗮𝗿𝘁 𝟮

🧵 Thread 🧵

Retweet And I will Link a 36 Page PDF

𝟭. 𝗔𝗱𝗱 𝗙𝘂𝗻𝗱𝗮𝗺𝗲𝗻𝘁𝗮𝗹𝘀 𝗼𝗻 𝗰𝗵𝗮𝗿𝘁

🔸 Link:

https://t.co/zG165Xa3JB

🔸 Click on the above link -> Add to Favourites -> Add on Chart from favourites and start using it !

2/20

You can add financials from many fundamental criteria's like

🔸 Cashflows

🔸 Income Statements

🔸 Balance sheets

🔸 PE,PB ratios

🔸 Marketcapitlization

🔸 Statistics

3/20

How to change Settings:

🔸 There are 8 columns you can basically select any financial you want

🔸 You can select quarterly or Yearly values and can also write

🔸 The names of the financiaLS Example : EPS Qtr3

🔸 You can Change colours , font size

4/20

𝟮. 𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗥𝗮𝘁𝗶𝗻𝗴𝘀

You cannot track each and every indicator like ( 𝗠𝗼𝘃𝗶𝗻𝗴 𝗔𝘃𝗴𝘀 , 𝗥𝗦𝗜 , 𝗠𝗔𝗖𝗗 ) etc , you can use plot this custom strategy to understand whether the trend is positive or negative of those indicators

5/20

Detailed Study of Stocks that became 5X in past 2 Years

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want a PDF

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUMlbpd

( As on 30th March 2022)

[1/n]

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

[2/n]

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

[3/n]

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

A Mega Thread🧵

Concepts :

Relative Strength

Stage Analysis

Retweet and Comment If you want a PDF

We have Got around 86 Stocks that became 5X in 2 years

These Belonged to various sectors and Groups

Excel Link for List of Stocks

https://t.co/jESOUMlbpd

( As on 30th March 2022)

[1/n]

All stocks had few things in common :

Stocks doubled Before entering into Stage 2 Uptrend

52 week RS was positive in stage 2

90% stocks even gave all time high breakout after Stage 2

60 Stocks had market cap less than 1000 Cr

Examples : OLECTRA , PGEL

[2/n]

So What is Relative Strength ?

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

[3/n]

How to Apply ?

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 52 period

Use Weekly Chart

4/n

More from Learnings

Should you add more in Equity or redeem right now?

A thread 🧵to guide retail on why & what should they do at these historic market highs.

Do ‘re-tweet’ and help us educate more retail investors (1/n)

#investing #StockMarket

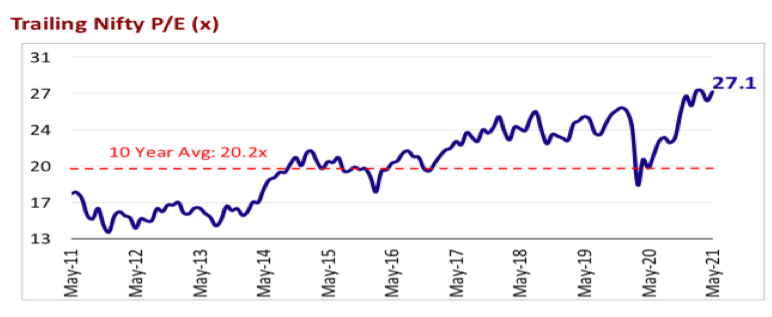

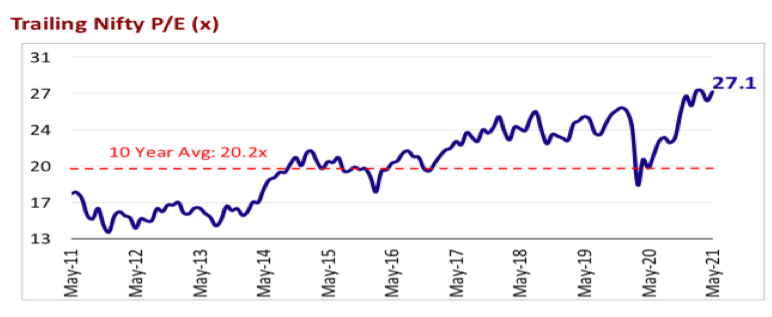

Some investors feel that markets are trading at a PE of 27 vs 10 years historical average of 20 and a market-cap to GDP of 105 vs historical average of 79 and hence markets look expensive (2/n)

But, in such crazy liquidity driven markets, prices can move much ahead of the fundamentals & suddenly we start hearing commentaries of how the market is pricing in the earnings of FY 22 & 23 to justify the rally

If you r new to fundamentals, 👇 can help

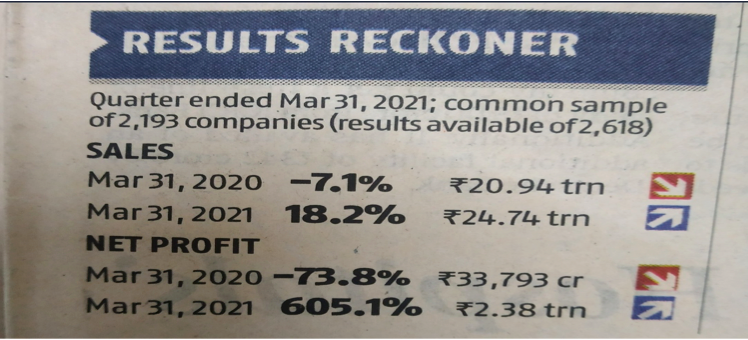

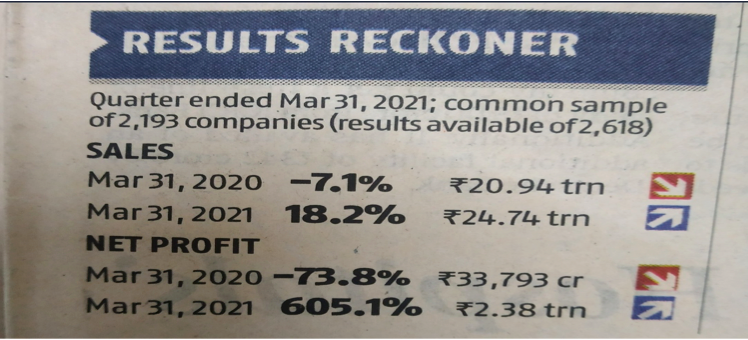

Results for Q4 have come out very well but that is also because of the lower base effect of the last year.

Over the last many years, markets have corrected 10-15% each calendar year. Can it happen this year as well? Can very much and that can be a great entry point. Why? (4/n)

There are a lot of over hangs in the near term,

-Crude going up

-$ index moving up

-Inflation moving up

-COVID uncertainties

All of the above are –ve for markets & liquidity on the other side driving markets up, its impossible to judge the near term movement of the markets (5/n)

A thread 🧵to guide retail on why & what should they do at these historic market highs.

Do ‘re-tweet’ and help us educate more retail investors (1/n)

#investing #StockMarket

Some investors feel that markets are trading at a PE of 27 vs 10 years historical average of 20 and a market-cap to GDP of 105 vs historical average of 79 and hence markets look expensive (2/n)

But, in such crazy liquidity driven markets, prices can move much ahead of the fundamentals & suddenly we start hearing commentaries of how the market is pricing in the earnings of FY 22 & 23 to justify the rally

If you r new to fundamentals, 👇 can help

Market PE at 40 and yet the market is not falling, why? Getting asked this question multiple times. Here's a thread covering \u2018very basic\u2019 premier on valuation for my retail investor friends.

— Kirtan A Shah (@KirtanShahCFP) January 14, 2021

Do hit the \u2018re-tweet\u2019 and help us educate more investors (1/n) pic.twitter.com/8oCkBmmOXY

Results for Q4 have come out very well but that is also because of the lower base effect of the last year.

Over the last many years, markets have corrected 10-15% each calendar year. Can it happen this year as well? Can very much and that can be a great entry point. Why? (4/n)

There are a lot of over hangs in the near term,

-Crude going up

-$ index moving up

-Inflation moving up

-COVID uncertainties

All of the above are –ve for markets & liquidity on the other side driving markets up, its impossible to judge the near term movement of the markets (5/n)