The answer is Risk Management.

It's the weekend!

Grab a cup of coffee, in this thread we will explore

1. What is risk management?

2. What is position sizing?

3. How to apply both these concepts to reduce volatility and drawdowns in your portfolio?

Lets dive right in.

The answer is Risk Management.

How Rich You Are

How Respected You Are

How Educated You Are

Improper risk management will blow up your portfolio and most likely bankrupt you.

No luxury houses and cars for him.

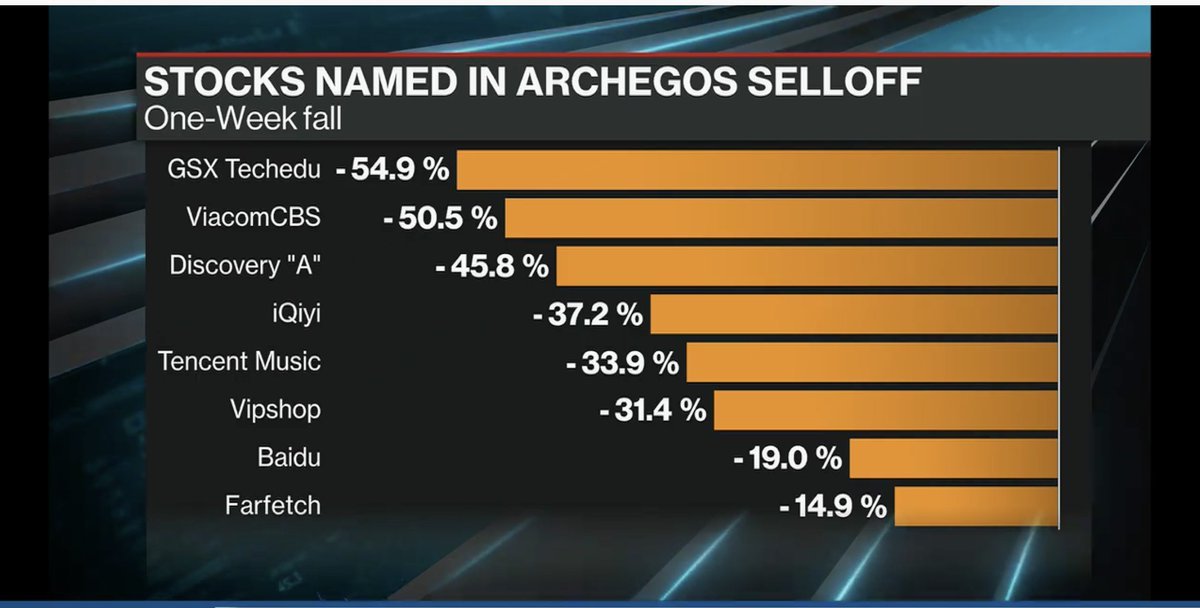

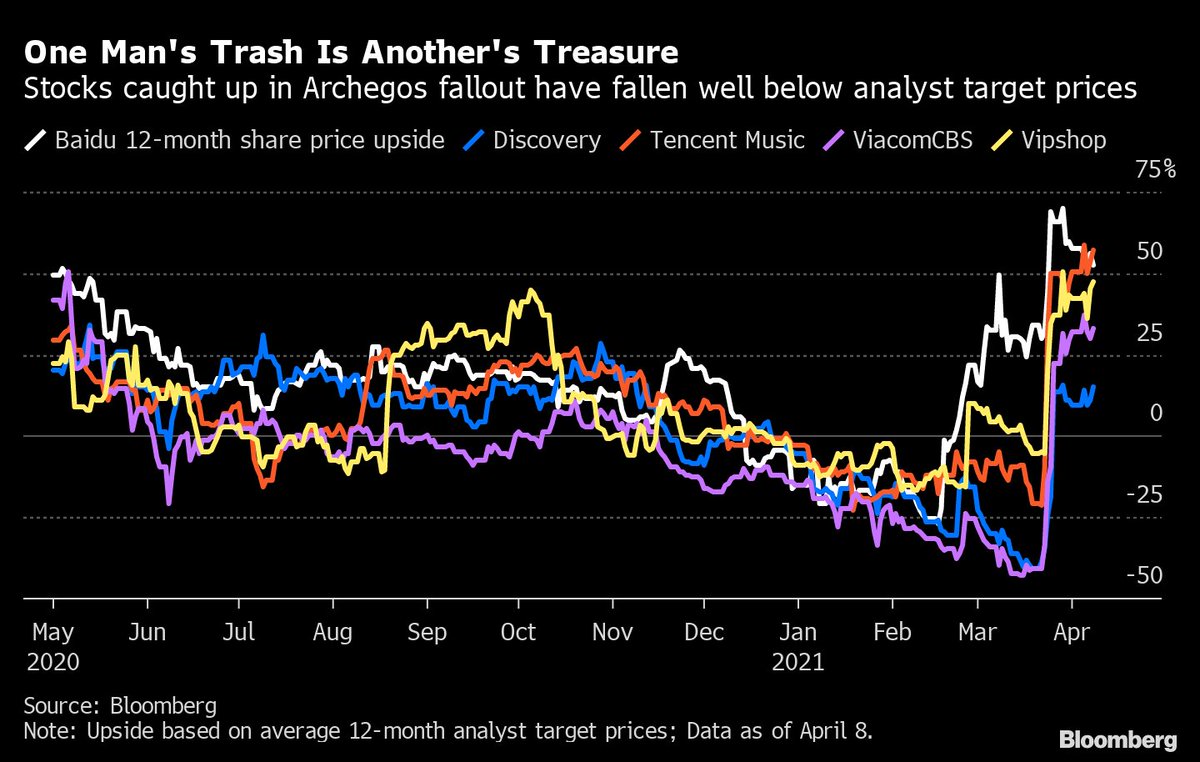

Viacom CBS announces a stock and convertible bond sale after market closes for that day.

Viacom wanted to raise money and for what so ever reason, market didn't like this new stock and bond sale from Viacom.

Cause, Bill Hwang was levered massively. He used a financial instrument called a total return swap (which is a type of OTC derivative) to leverage all his positions.

Goldman escaped unscathed by this entire mess while Credit Suisse took one the biggest losses in their entire history.

$20 Billion, his life's earnings, all gone, poof, zero, zlich, nada!

Never take on leverage and never invest with borrowed money

Borrowed money is like the grim reaper that is waiting to kill your portfolio at the first instance

If a prodigy like Bill Hwang wasn't able to survive with leverage, why would you?

After paying for the call, he would still be left with ~$10 Billion and live to survive another day.

Be willing to take a loss.

No investment is without risk and knowing the risks in an investment will help you minimize losses if things go south.

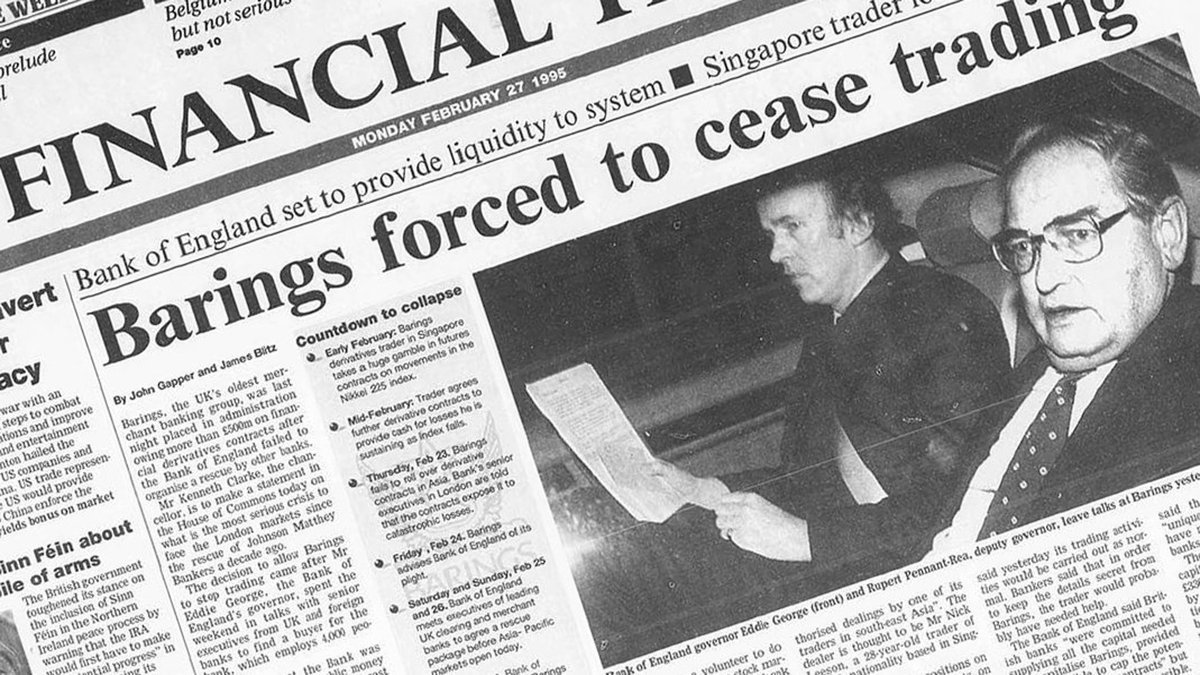

It was founded in 1762 and almost 233 years later in 1995, the Bank would be bought by ING for less than $1.

Leeson used to bet if the index would go up or down and if it moved in the direction he was betting he would make money.

Instead of stopping there Nick tried to recover these losses by hiding them from the Banks books and taking even larger bets in hopes that they would recover all the losses.

Your task as an investor is to be fully aware of every risk that the investment has.

The probability of some risks maybe higher than others but there is no investment with zero risk.

- They used excessive leverage

- They didn't know how to take a loss

- They threw risk management out the door

- Their positions didn't reflect the proper risk return ratio

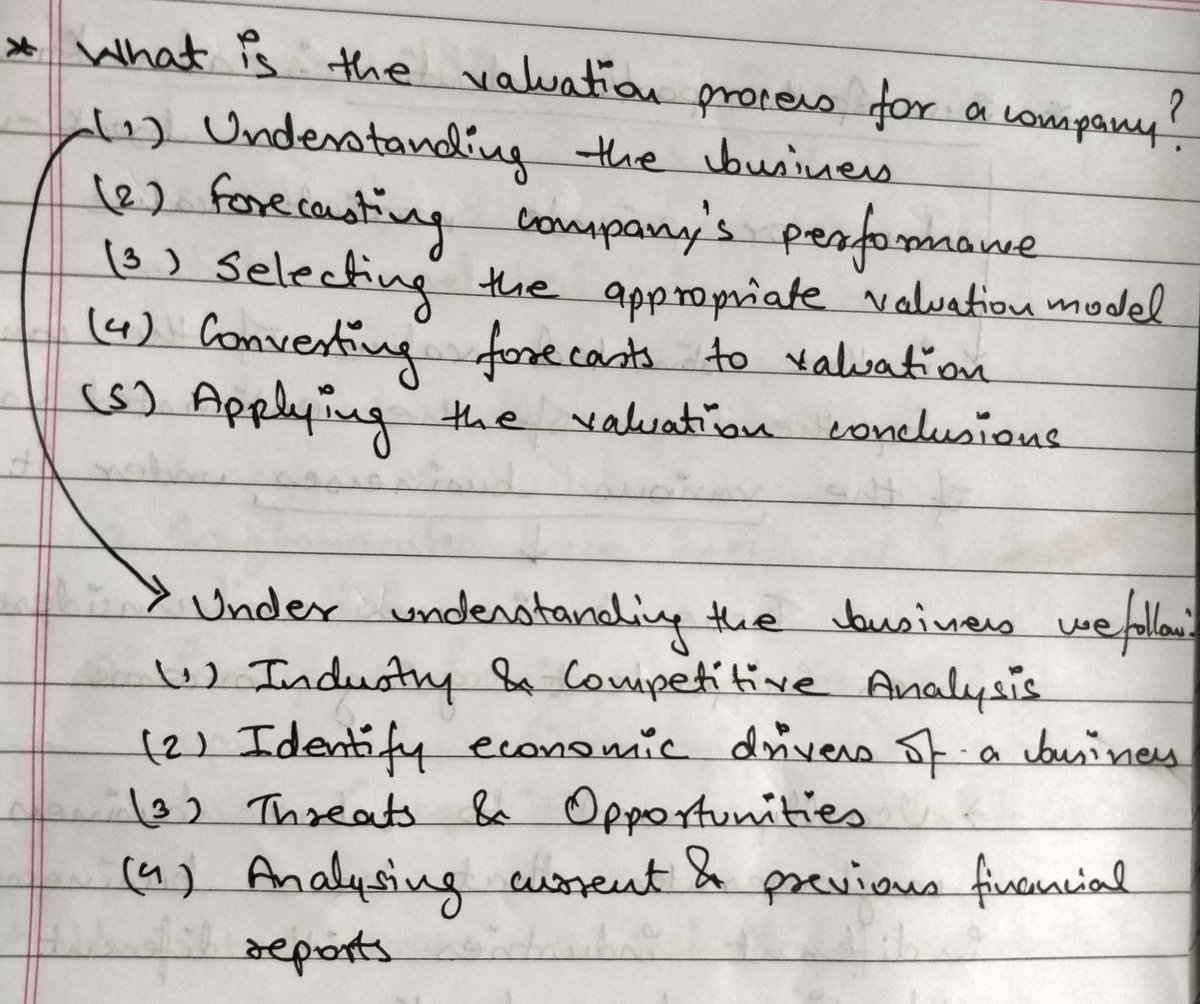

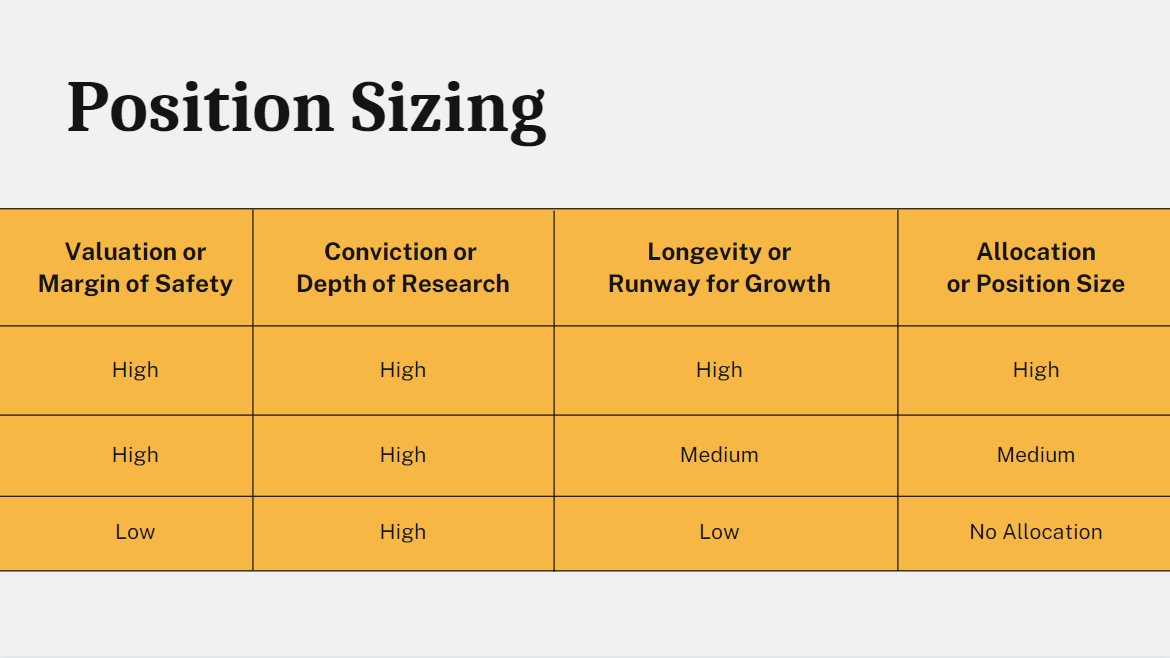

The three factors that I consider are

1. Margin of Safety

2. Depth of Research

3. Longevity of Earnings

If my depth of research and longevity of earnings in a position is high then I will start with a small allocation and allocate big if margin of safety increases.

Diversifying into 50 stocks will not eliminate the risk from your portfolio.

Knowing majority of risks of all 10 stocks you own will certainly help you manage it.

You will get your answer on how much to allocate.

I hope this helped you understand what not to do and how to size positions in your portfolio.

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

https://t.co/az1Rsw05TO

All my Threads so far \U0001f9f5 \U0001f447\U0001f3fc

— Tar \u26a1 (@itsTarH) June 5, 2021

Sign up using the link below to get free 30 days access to it.

https://t.co/NWZOPx8dvW

https://t.co/r7uNYuqjsn

Subscribe for free, if you're interested.

Thank you to the 2000+ of you who already have!

Here is a recent deep dive I wrote on PolicyBazaar.

https://t.co/w14k2xE0fQ

More from Tar ⚡

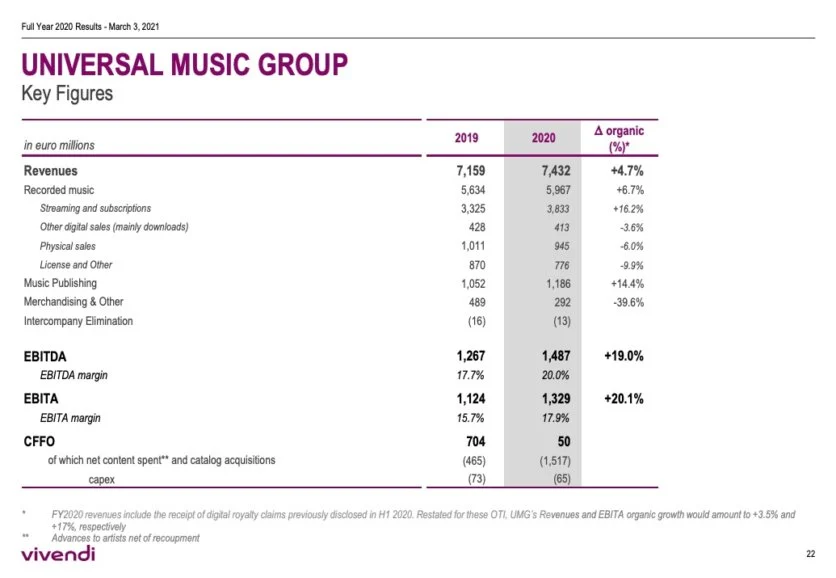

A business like Universal which controls more than 1/3rd of all published music globally is selling for less than 6x FY20 Sales.

Why are Indian businesses like Saregama / Tips selling for 11x, 20x their sales?

If I include all of the revenue generated by entire firm, its selling for ~4.5x FY20 Sales

Universal Listing Market Cap ~ 40 Billion USD

FY 20 Revenues ~ 8.87 B USD or 7.4B EUR

Catalogue of Music includes every international artist you can possibly name

Either Universal is grossly undervalued or Saregama/Tips are grossly overvalued.

https://t.co/aHzWSYtcUt

Homework for all the interested participants here:

— Intrinsic Compounding (@soicfinance) June 27, 2021

Q1.Why 20% and not 50%+ Margins for UMG

Q2. Differences in dynamics between Western&Indian cos?

Q3. Trends in West vs Trends in India in the industry.

Research and find the answers. My job is done \U0001f601\U0001f64f

https://t.co/v0EMoCuYKX

If you see the ebitda of universal music its low 20% compared to our saregama 30% or tips 50%. So when you compare earnings saregama is 40x and tips is 30x and universal music is 30x. Also these type of companies are less( low or no capex with excellent and growinh cashflows)

— Srikanth V (@mynameisnani75) June 27, 2021

More from Itsthlearnings

The One with the Cash Flow Explained

It's the weekend!

— Tar \u26a1 (@itsTarH) May 15, 2021

Grab a cup of coffee, in this thread I will explain

1. What a cash flow statement is?

2. What does it tell you about a business?

3. How to analyze one?

Examples included various Indian companies.

Let's dive right in. pic.twitter.com/c8tNP26Z8K

The One with Free Cash Flow Explained

Its the weekend!

— Tar \u26a1 (@itsTarH) May 22, 2021

Grab a cup of coffee, in this thread I will explain

1. What is Capex?\U0001f4b0

2. What is Free Cash Flow? \U0001f4b8

3. What does Cash Flow from Investing and Cash Flow from Financing tells us? \U0001f4a1

Examples includes some famous companies.

Lets dive right in. pic.twitter.com/HDJgUvE8f8

The One with Mutual Funds

Its the weekend!

— Tar \u26a1 (@itsTarH) May 29, 2021

Grab a cup of coffee, in this thread I will explain

1. How to select a Mutual Fund?

2. Common and costly mistakes people make while choosing a Mutual Fund

3. Some tools and tips to help you while selecting a fund

Lets dive right in. pic.twitter.com/teelsojtn9

The One on Laurus Labs

Laurus Labs : A Visual Story

— Tar \u26a1 (@itsTarH) May 30, 2021

I am a Data Science / Machine Learning developer by profession and data along with finance are my two areas of competence.

I realize how powerful combining both of them can be, so here is a visual analysis for Laurus Labs.

You May Also Like

As someone\u2019s who\u2019s read the book, this review strikes me as tremendously unfair. It mostly faults Adler for not writing the book the reviewer wishes he had! https://t.co/pqpt5Ziivj

— Teresa M. Bejan (@tmbejan) January 12, 2021

The meat of the criticism is that the history Adler gives is insufficiently critical. Adler describes a few figures who had a great influence on how the modern US university was formed. It's certainly critical: it focuses on the social Darwinism of these figures. 2/x

Other insinuations and suggestions in the review seem wildly off the mark, distorted, or inappropriate-- for example, that the book is clickbaity (it is scholarly) or conservative (hardly) or connected to the events at the Capitol (give me a break). 3/x

The core question: in what sense is classics inherently racist? Classics is old. On Adler's account, it begins in ancient Rome and is revived in the Renaissance. Slavery (Christiansen's primary concern) is also very old. Let's say classics is an education for slaveowners. 4/x

It's worth remembering that literacy itself is elite throughout most of this history. Literacy is, then, also the education of slaveowners. We can honor oral and musical traditions without denying that literacy is, generally, good. 5/x